Key Points

- North America has accounted for more than 35% of the market share in 2023.

- By product, the intermittent catheters segment dominated the market with the largest market share of 58% in 2023.

- By application, the Urinary Incontinence (UI) segment dominated the market with the largest share of 38% in 2023.

- By type, the coated catheters segment led the market in 2023.

- By gender, the women segment led the market in 2023 and promises sustained growth during the forecast period.

- By end-user, the hospitals segment led the market with the largest share in 2023.

Get a Sample: https://www.precedenceresearch.com/sample/3908

Growth Factors

Several factors contribute to the growth of the urinary catheters market. Firstly, the aging population worldwide is a major driver, as elderly individuals are more susceptible to urinary issues such as urinary retention and incontinence. With the elderly population expected to double by 2050, the demand for urinary catheters is projected to increase substantially. Additionally, the rising prevalence of chronic diseases such as diabetes, spinal cord injuries, and multiple sclerosis further fuels the demand for urinary catheters, as these conditions often lead to urinary dysfunction. Technological advancements in catheter design, materials, and coatings have also played a significant role in driving market growth by improving patient comfort, reducing the risk of infection, and enhancing overall safety.

Region:

The urinary catheters market exhibits regional variations influenced by factors such as healthcare infrastructure, reimbursement policies, and the prevalence of urinary disorders. North America and Europe dominate the market, primarily due to well-established healthcare systems, high healthcare expenditure, and a large geriatric population. In Asia-Pacific, the market is driven by rapid urbanization, increasing healthcare spending, and a growing awareness of urinary health issues. Emerging economies in Latin America and the Middle East & Africa are witnessing steady growth in the urinary catheters market, propelled by improving healthcare infrastructure and rising healthcare expenditure.

Urinary Catheters Market Scope

| Report Coverage | Details |

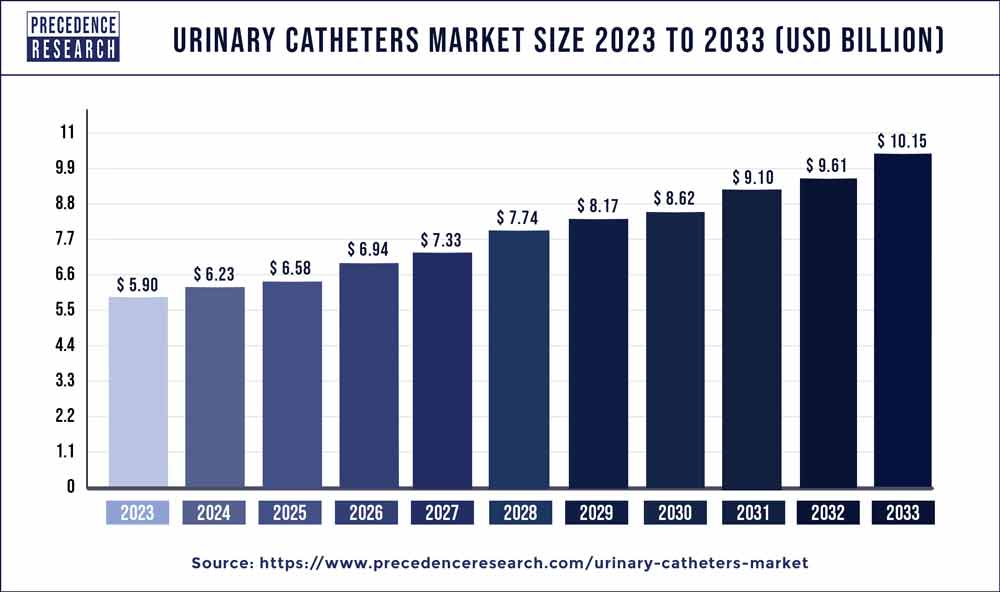

| Growth Rate from 2024 to 2033 | CAGR of 5.57% |

| Global Market Size in 2023 | USD 5.90 Billion |

| Global Market Size by 2033 | USD 10.15 Billion |

| U.S. Market Size in 2023 | USD 1.55 Billion |

| U.S. Market Size by 2033 | USD 2.66 Billion |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Product, By Application, By Type, By Gender, and By End-user |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Urinary Catheters Market Dynamics

Driver:

One of the key drivers of the urinary catheters market is the growing preference for minimally invasive procedures and the increasing adoption of intermittent catheterization techniques. Intermittent catheterization offers several advantages over indwelling catheters, including reduced risk of urinary tract infections (UTIs) and improved patient comfort. Moreover, the shift towards home-based healthcare and self-catheterization has expanded the market for urinary catheters, empowering patients to manage their condition independently and improving their quality of life. Healthcare providers are increasingly recommending intermittent catheterization for patients with neurogenic bladder dysfunction, spinal cord injuries, and other urinary disorders, thereby driving market growth.

Opportunity:

The urinary catheters market presents significant opportunities for innovation and market expansion. There is growing demand for catheters with advanced features such as antimicrobial coatings, hydrophilic surfaces, and integrated drainage systems, which can reduce the risk of catheter-associated infections and improve patient outcomes. Manufacturers are investing in research and development to introduce novel materials and technologies that enhance the performance and safety of urinary catheters. Furthermore, expanding healthcare access in emerging markets, coupled with rising awareness about urinary health issues, creates opportunities for market penetration and growth in regions with previously untapped potential.

Restraint:

Despite the promising growth prospects, the urinary catheters market faces certain challenges and restraints. One of the primary concerns is the risk of catheter-associated urinary tract infections (CAUTIs), which can lead to serious complications and increase healthcare costs. Healthcare providers are increasingly focusing on infection prevention strategies and adopting evidence-based practices to mitigate the risk of CAUTIs. Another restraint is the stringent regulatory requirements governing the manufacturing and marketing of urinary catheters, particularly in developed markets. Compliance with regulatory standards and obtaining necessary approvals can be time-consuming and resource-intensive for manufacturers, affecting product launches and market entry strategies.

Read Also: Outboard Engines Market Size to Surpass USD 18.12 Bn by 2033

Recent Developments

- In January 2023, after a thorough authorization procedure, Bactiguard announced the approval of its first MDR (Medical Device Regulations 2017/745) product. The latex BIP Foley Catheter, an indwelling urinary catheter using Bactiguard’s exclusive infection prevention technology, is the subject of the MDR approval. A thin coating of noble metal alloy affixed to the catheter’s surface serves as the foundation for Bactiguard’s unique technology. The metals have a galvanic effect when they come into contact with fluids, which lowers microbial adhesion—that is, fewer germs stick to the catheter surface. Healthcare-associated infections (HAI) impact one in ten patients globally, with catheter-associated urinary tract infections (CAUTI) accounting for a sizable portion of cases. The incidence of CAUTI is considerably decreased by urinary catheters equipped with Bactiguard technology.

- In December 2022, to minimize urinary tract infections (UTIs) and unintentional Foley catheter extractions, CATHETRIX, a creative creator of urinary (Foley) smart catheter fixation devices, commercially debuted their catheter stabilizer at the Arab Health 2023.

Urinary Catheters Market Companies

- Coloplast

- ConvaTec, Inc.

- Boston Scientific Corp.

- BD (C.R. Bard, Inc.)

- Cook Medical

- Medtronic PLC

- Teleflex, Inc.

- B. Braun Melsungen AG

- Hollister, Inc.

- Medline Industries, Inc.

- J and M Urinary Catheters LLC

Segments Covered in the Report

By Product

- Foley/ Indwelling Catheters

- Intermittent Catheters

- External Catheters

By Application

- Urinary Incontinence

- Benign Prostate Hyperplasia & Prostate Surgeries

- Spinal Cord Injury

- Others

By Type

- Coated Catheters

- Uncoated Catheters

By Gender

- Male

- Female

By End-user

- Clinics

- Hospitals

- Long-Term Care Facilities

- Others

`By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

- Intelligent Traffic Management System Market Size, Trends, Report 2034 - July 17, 2024

- Healthcare Finance Solutions Market Size to Grow USD 293.12 Bn by 2034 - July 17, 2024

- Epoxy Composites Market Size to Grow USD 84.99 Bn by 2034 - July 17, 2024