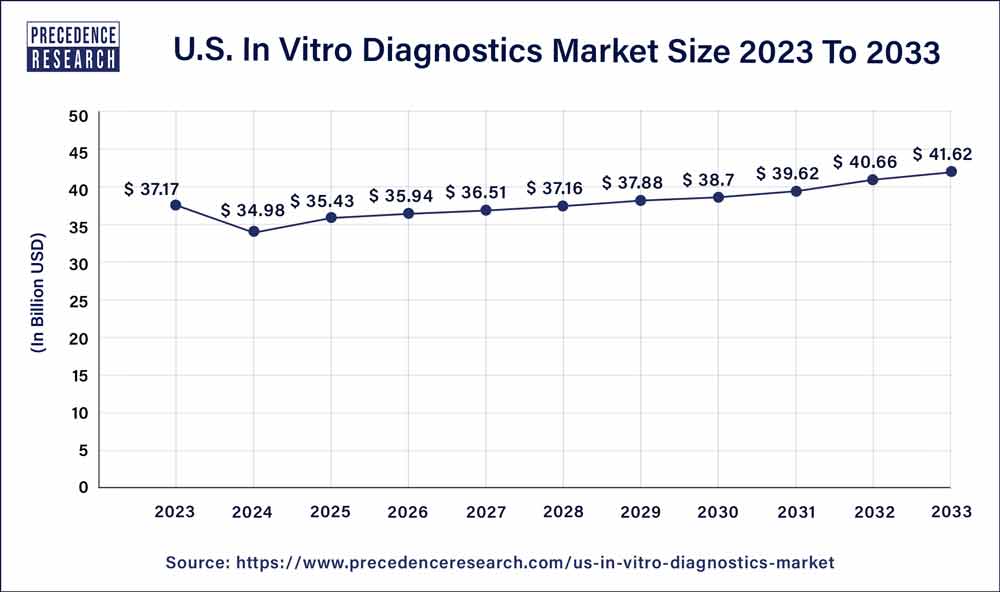

The U.S. in vitro diagnostics market size is anticipated to hit around USD 41.62 billion by 2033 from USD 37.17 billion in 2023, at a CAGR of 2% from 2024 to 2033.

Key Takeaways

- By product, the reagents segment dominated the market with the largest share of 67% in 2023.

- By test location, the point-of-care segment dominated the market in 2023.

- By technology, the Immunoassay segment is expected to dominate the market during the forecast period.

- By application, the infectious diseases segment led the market with the largest share in 2023.

- By application, the oncology segment is expected witness the fastest rate of growth during the forecast period of 2024-2033.

- By end user, the hospital segment held the dominating share of the market in 2023.

Recent Developments

- In November 2023, to create molecular tests for decentralized in vitro diagnostic (IVD) applications, Illumina, a leader in DNA sequencing and array-based technologies, and Veracyte, a top genomic diagnostics business, have partnered for several years. The partnership is centered on using Illumina’s NextSeq 550Dx equipment to develop Veracyte’s Percepta Nasal Swab test and Prosigna Breast Cancer Assay.

- In March 2023, Eli Lilly & Company and Roche announced their partnership to promote the development of Roche’s Elecsys Amyloid Plasma Panel (EAPP). A novel blood test called the EAPP promises to help diagnose Alzheimer’s disease early.

- In April 2023, to enhance health outcomes worldwide, Oxford Nanopore Technologies and bioMérieux SA, a pioneer in the in vitro diagnostics industry, announced that they have joined forces to investigate specific prospects to introduce nanopore sequencing to the infectious disease diagnostics market.

U.S. In Vitro Diagnostics Market Companies

- Alere, Inc.

- Beckman Coulter

- BD

- Bio-Rad laboratories

- Danaher

- Abbott Laboratories

- Thermo Fisher Scientific Inc.

- bioMérieux, Inc

- Quest Diagnostics

- Illumina, Inc.

Segments Covered in the Report

By Product

- Reagents

- Instruments

- Services

By Test Location

- Point of Care

- Home Care

- Others

By Technology

- Immunoassay

- Instruments

- Reagents

- Services

- Hematology

- Instruments

- Reagents

- Services

- Clinical Chemistry

- Instruments

- Reagents

- Services

- Molecular Diagnostics

- Instruments

- Reagents

- Services

- Coagulation

- Instruments

- Reagents

- Services

- Microbiology

- Instruments

- Reagents

- Services

- Others

- Instruments

- Reagents

- Services

By Application

- Diabetes

- Cardiology

- Nephrology

- Infectious Disease

- Oncology

- Drug Testing

- Autoimmune Diseases

- Others

By End User

- Standalone Laboratories

- Hospitals

- Academic & Medical Schools

- Point-of-Care

- Others

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

- Photodynamic Therapy Market Size to Rake USD 8.42 Bn by 2033 - February 5, 2024

- Image Recognition Market Size to Attain USD 166.01 Bn by 2033 - February 5, 2024

- Hydrogen Storage Tanks and Transportation Market Report 2033 - February 5, 2024