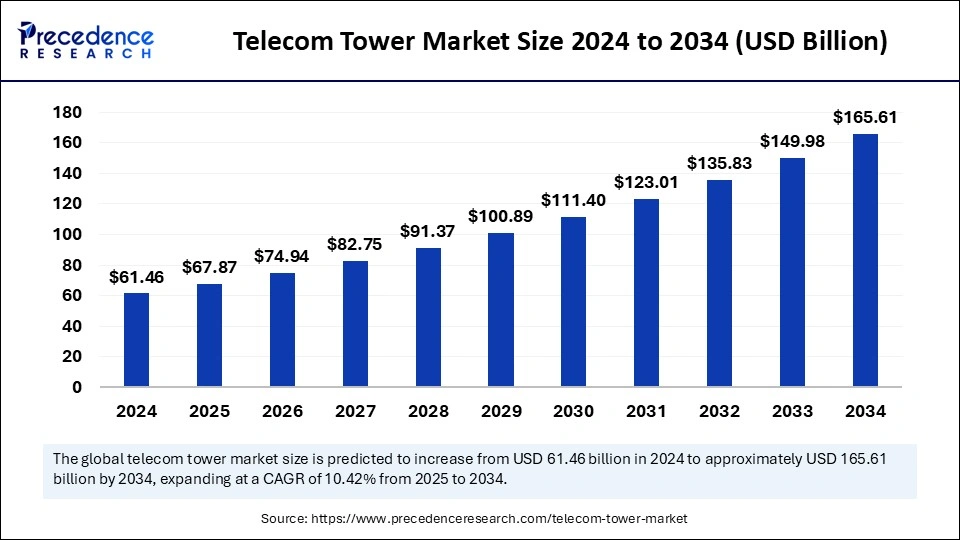

The global telecom tower market size is estimated to attain around USD 165.61 billion by 2034, increasing from USD 61.46 billion in 2024, with a CAGR of 10.42%.

Get a Free Sample Copy of the Report@ https://www.precedenceresearch.com/sample/5832

Telecom Tower Market Key Points

-

Asia Pacific dominated with a 45% market share in 2024.

-

North America is on track to grow the fastest through the forecast period.

-

Shared infrastructure deployment led the segment with 68% share.

-

Owned deployment is likely to experience the highest growth rate ahead.

-

Lattice towers were the most utilized tower type in 2024.

-

Monopole towers are forecasted to expand rapidly in the near future.

-

Ground-based setups led installation types in 2024.

-

Rooftop installations are projected to grow at a record pace.

-

Communication-related towers held the largest application share.

-

Radar-based applications are expected to rise swiftly in market adoption.

How Is AI Revolutionizing the Telecom Tower Industry?

Artificial Intelligence is transforming the telecom tower market by enabling smarter infrastructure management and operational efficiency. AI-driven predictive maintenance systems are helping tower operators identify equipment failures before they occur, reducing downtime and maintenance costs.

These systems monitor data from sensors installed on towers to detect abnormalities in temperature, vibration, or power usage, allowing for proactive servicing. AI also optimizes energy consumption at telecom sites, particularly for off-grid towers, by managing the use of renewable sources like solar panels and batteries more efficiently.

Additionally, AI supports improved network planning and expansion by analyzing vast datasets including geographic, demographic, and usage patterns to determine the best tower locations. It enhances customer experience by optimizing signal strength, reducing latency, and ensuring seamless connectivity in high-demand areas.

As 5G continues to roll out globally, AI plays a crucial role in managing complex networks and allocating bandwidth dynamically to meet increasing data demands. Overall, AI empowers telecom tower companies to reduce costs, improve reliability, and enhance network performance.

Growth Factors of Telecom Tower Market

Increasing Demand for High-Speed Connectivity and 5G Expansion

The global rollout of 5G networks requires a denser network of towers and small cells to ensure seamless connectivity and low latency. This has led to significant investments in new tower installations and upgrades, especially in regions like Asia Pacific and North America.

Rising Mobile Data Consumption

With the surge in mobile data usage driven by online services, streaming, and hybrid work models, telecom companies are expanding their tower networks to meet the growing demand for enhanced network capacity.

Infrastructure Sharing and Cost Efficiency

Telecom operators increasingly share infrastructure to reduce costs and accelerate network expansion. This trend is particularly prominent in regions with high infrastructure costs, such as Africa.

Government Initiatives and Digital Transformation

Governments worldwide are promoting digitalization and investing in telecommunications infrastructure. Initiatives like smart city projects and rural connectivity programs further stimulate demand for telecom towers.

Technological Advancements and Sustainability

Advances such as AI-enabled predictive maintenance and smart power management improve operational efficiency and reduce environmental impact. The adoption of renewable energy sources and sustainable practices is also growing in the telecom tower sector.

Edge Computing and IoT Integration

The rise of edge computing and Internet of Things (IoT) technologies requires robust telecom networks, driving demand for additional towers and small cells to support these emerging technologies.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 165.61 Billion |

| Market Size in 2025 | USD 67.87 Billion |

| Market Size in 2024 | USD 61.46 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 10.42% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Deployment Type, Type, Installation, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Market Drivers

One of the primary drivers of the telecom tower market is the widespread rollout of 5G networks, which require denser and more efficient tower infrastructure. The surge in mobile data traffic due to smartphone proliferation and digital content consumption has also necessitated network expansion, driving demand for telecom towers.

Additionally, the adoption of shared infrastructure by telecom operators has reduced capital expenditure and facilitated rapid network deployment. Supportive government policies and initiatives aimed at improving digital connectivity further accelerate market growth.

Opportunities

The telecom tower market presents numerous opportunities, particularly in emerging economies where digital infrastructure is still developing. The expansion of 5G and internet of things (IoT) applications opens avenues for innovative tower solutions, including smart towers and energy-efficient systems.

Moreover, the increasing use of renewable energy sources to power telecom towers offers sustainability benefits and cost savings. There’s also growing potential in rural and underserved regions, where connectivity remains limited, creating a strong demand for new installations.

Challenges

Despite its growth, the market faces several challenges. Regulatory hurdles and zoning issues can delay tower installations, particularly in urban areas with strict land use regulations. High operational and maintenance costs, especially in remote locations, also pose concerns for tower operators.

Furthermore, ensuring security and minimizing environmental impact are ongoing issues that require continuous innovation and investment.

Regional Insights

Asia Pacific dominates the telecom tower market, driven by high population density, rapid urbanization, and strong investments in 5G and broadband infrastructure. Countries like China and India are leading in tower deployments to meet increasing data demand. North America is expected to experience the fastest growth rate, supported by early 5G adoption and technological advancements.

Meanwhile, regions like Latin America and Africa are emerging as promising markets due to improving connectivity needs and supportive government initiatives aimed at bridging the digital divide.

Telecom Tower Market Companies

- American Tower Corporation (U.S.)

- AT&T, Inc.

- Cellnex Telecom S.A. (Spain)

- China Tower Corporation Limited

- Crown Castle

- GTL Infrastructure Limited

- Helios Tower Plc

- IHS Holding Limited

- Indus Towers Limited (Bharti Airtel)

- SBA Communications Corporation

- Telesites S.A.B. de C.V.

- Viom Networks

Latest Announcements by Industry Leaders

- In November 2024, Independent telecom tower companies are set to spend Rs 21,000 crore over fiscal years 2025 and 2026 to enhance rural connectivity and urban network quality. Anand Kulkarni, Director, Crisil Ratings, said, “The industry witnessed robust addition of towers in the past two fiscals to support 4G and 5G services. Nevertheless, the addition of towers will continue as a geographically diversified tower portfolio is critical for telcos to gain competitive coverage.

- In November 2024, France-based Orange Wholesale announced plans to deactivate its 2G network by the end of 2025. The company’s chief minister stated, “As we move towards advanced communication networks, it is essential to phase out legacy systems and adopt modern solutions.”

Recent Developments

- In December 2024, Transcelestial, a Singapore-based telecom service provider, announced plans to test advanced laser communication technology in Northern Australia. With an emphasis on space communications and defense assets, this initiative seeks to improve remote connectivity. By delivering high-speed data transmission without requiring substantial ground-based infrastructure, the technology has the potential to transform connectivity in underserved areas completely.

- In November 2024, Telefonica Germany collaborated with Amazon Web Services to pilot quantum technologies within its mobile network. The initiative focuses on optimizing mobile tower placements and enhancing network security through quantum encryption. This collaboration is part of Telefonica’s broader strategy to explore advanced technologies that could underpin future 6G networks, aiming to improve service delivery and maintain a competitive age in the rapidly evolving telecom landscape.

Segments Covered in the Report

By Deployment Type

- Shared Infrastructure Deployment

- Owned Deployment

By Type

- Lattice Tower

- Guyed Tower

- Monopole Tower

- Stealth Tower

By Installation

- Rooftop

- Ground Based

By Application

- Radio

- Radar

- Communication

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Also Read: Singapore Interactive Kiosk Market

Ready for more? Dive into the full experience on our website@ https://www.precedenceresearch.com/

- Fabric Filter Market Size to Attain USD 7.50 Billion by 2034 - April 24, 2025

- Pilot Training Market Size to Attain USD 31.38 Bn by 2034 - April 24, 2025

- Wearable Smart Baby Monitor Market Size to Gain USD 4.34 Billion by 2034 - April 24, 2025