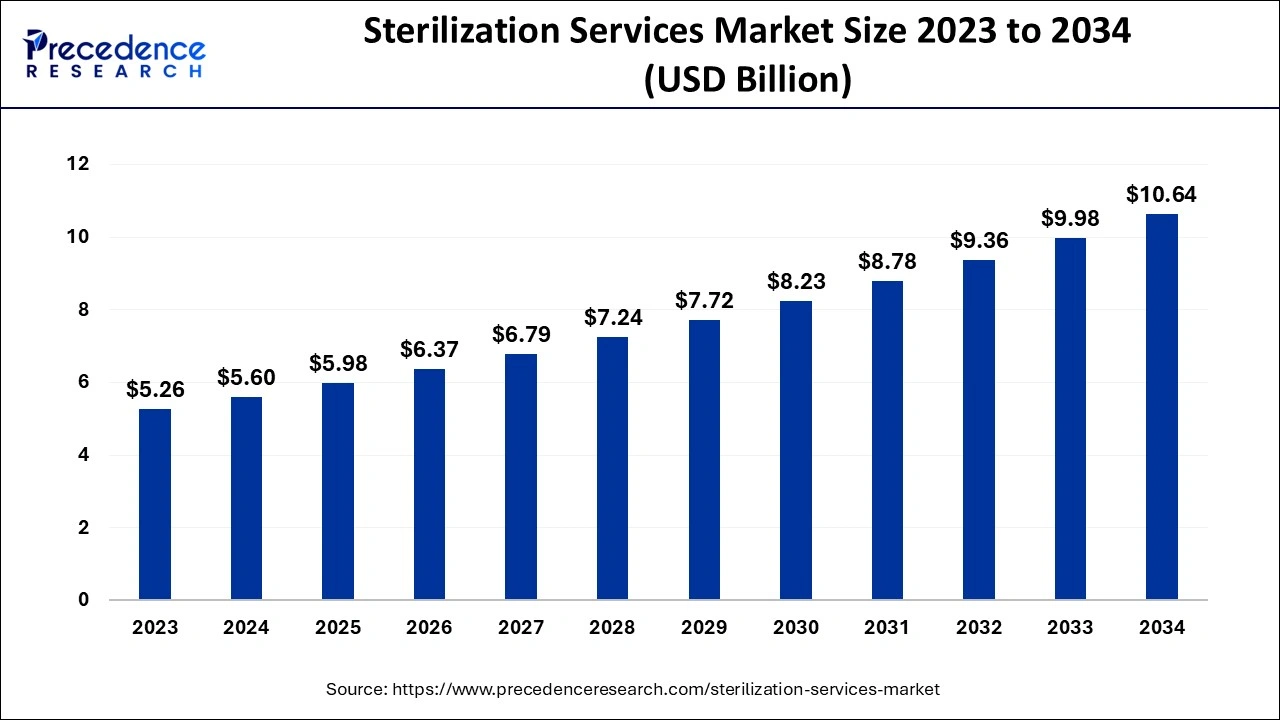

The global Sterilization Services Market size reached USD 5.60 billion in 2024 and is predicted to be worth around USD 10.64 billion by 2034, growing at a CAGR of 6.62% from 2024 to 2034

Key Points

- North America dominated the sterilization services market with the highest market share of 43% in 2023.

- Asia Pacific expects the fastest growth in the market during the forecast period.

- By method, the gas modalities segment accounted for the biggest market share of 37% in 2023.

- By method, the radiation modalities segment is expected to have substantial growth in the market during the predicted period.

- By business type, the contract service sterilization segment contributed the largest market share of 79% in 2023.

- By business type, the sterilization validation services segment is predicted to witness significant growth in the market over the forecast period.

- By mode of delivery, the on-site segment led the sterilization services market in 2023.

- By mode of delivery, the off-site segment expects significant growth in the market during the forecast period.

- By end-user, the healthcare facilities segment dominated the market in 2023.

- By end-user, the medical device companies segment expected significant growth in the market during the predicted period.

Sterilization services are crucial for ensuring the safety of medical devices, pharmaceutical products, and food items by eliminating microbial contamination.

Sample:https://www.precedenceresearch.com/sample/5222

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 10.64 Billion |

| Market Size in 2024 | USD 5.60 Billion |

| Market Size in 2025 | USD 5.98 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 6.62% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Method, Business Type,Mode of Delivery,End-Use and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East, & Africa |

Market Drivers

Several key factors are driving market growth. One major driver is the rising number of hospital-acquired infections (HAIs), which increases the demand for effective sterilization to prevent infection. Additionally, growing awareness about hygiene, an increase in surgical procedures, and the adoption of advanced sterilization technologies are also contributing to market expansion. The global shift toward outsourcing sterilization services by medical device manufacturers and hospitals has further boosted the market.

Opportunities

The market presents several opportunities for growth. The increasing focus on healthcare infrastructure in developing regions, particularly Asia-Pacific, offers potential for expansion. Governments’ rising focus on combating healthcare-associated infections and boosting sterilization standards, especially after the COVID-19 pandemic, creates a promising environment for sterilization service providers. Technological advancements, such as new sterilization methods like vaporized hydrogen peroxide, also create avenues for growth

Challenges

Despite its growth, the sterilization services market faces some challenges. The high initial costs of acquiring and maintaining sterilization equipment can be a barrier, particularly for smaller hospitals or businesses. Additionally, certain sterilization methods, such as ethylene oxide, face environmental and health-related concerns, which may hinder their use. Moreover, a shortage of skilled personnel for operating and maintaining advanced sterilization technologies can affect service quality.

Regional Outlook

Regionally, North America dominates the market, driven by high healthcare standards and the growing need for sterilization due to the increasing incidence of HAIs. Europe follows closely, where the demand for sterilization services is also rising due to the growing need for sterilizing medical devices and hospital equipment. The Asia-Pacific region is expected to experience the highest growth due to rapid healthcare infrastructure development, rising medical tourism, and increasing surgical procedure.

Read Also: Amino Acids Market Size to Surpass USD 69.11 Billion by 2034

Sterilization Services Market Companies

- Steris Corporation

- Stryker Corporation

- 3m Company

- Ecolab Inc.

- Sterigenics International LLC

- Cretex Companies

- Noxilizer Inc.

- Beta-Gamma-Service Gmbh & Co. Kg

- Cosmed Group Inc.

- Medline Industries Inc.

- Anderson Products Inc.

- Doyen Medipharm

Recent News

- In May 2024, Crothall Healthcare (Crothall), a leading player in sterile processing and support services, got into a strategic partnership with Ascendco Health (Ascendco), a leading player in healthcare technology for bringing new era instrument tracking and overall sterile processing quality of the healthcare facilities in the world.

Segments Covered in the Report

By Method

- Gas Modalities

- Ethylene Oxide Sterilization

- Hydrogen Peroxide Vapor Sterilization

- Other Gas Modalities

- Radiation Modalities

- Gamma Radiation Sterilization

- X-Ray Sterilization

- Ultraviolet Sterilization

- Electron Beam Sterilization

- Other Radiation Modalities

- Dry Heat Sterilization

- Other Methods

By Business Type

- Contract Sterilization Services

- Sterilization Validation Services

By Mode of Delivery

- On-Site

- Off-Site

By End-Use

- Healthcare Facilities

- Medical Device Companies

- Pharmaceutical And Biotech Companies

- Other End-Users

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

Web:https://www.precedenceresearch.com/

- Freeze-dried food market expected to grow to USD 56.27 billion by 2034 - April 28, 2025

- Aerospace Foam Market Expected to Grow to USD 12.78 Billion by 2034 - April 28, 2025

- Football equipment Market Forecasted to Grow to USD 21.21 Billion by 2034 - April 28, 2025