The Smart Infrastructure Market is witnessing exponential growth driven by advancements in technology, increasing urbanization, and the growing need for sustainable infrastructure solutions. Smart infrastructure refers to the integration of various digital technologies into physical infrastructure to enhance efficiency, connectivity, and sustainability. These technologies encompass a wide range of applications, including smart buildings, smart transportation systems, smart energy grids, and smart water management systems. As governments and organizations worldwide prioritize infrastructure development to support economic growth and address environmental challenges, the demand for smart infrastructure solutions is expected to surge significantly.

Key Points

- North America dominated the market with the largest share of 32% in 2023.

- Asia Pacific is observed to expand at the fastest rate during the forecast period.

- By offering, in 2023, the products segment has contributed more than 70% of the market share.

- By offering, the service offering segment is to experience the highest growth rate.

- By type, in 2023, the smart transportation system segment held the largest share of the market.

- By type, the smart waste management segment will experience the fastest growth.

- By end-user, in 2023, the non-residential segment claimed the largest market share of 75%.

- By end-user, the residential segment is observed to experience the fastest expansion during the forecast period.

Growth Factors

Several factors are contributing to the robust growth of the Smart Infrastructure Market. Firstly, rapid urbanization is leading to the development of smart cities, where integrated infrastructure systems play a crucial role in enhancing the quality of life for residents. Smart infrastructure solutions help optimize resource utilization, improve public services, and enhance overall urban planning and management. Additionally, the proliferation of Internet of Things (IoT) devices and sensors is enabling the collection of real-time data, empowering decision-makers to make informed choices and improve operational efficiency across various infrastructure sectors. Moreover, initiatives aimed at reducing carbon emissions and mitigating climate change are driving investments in smart energy and transportation infrastructure, further fueling market growth.

Trends

Several notable trends are shaping the Smart Infrastructure Market. One prominent trend is the convergence of physical and digital infrastructure through the adoption of digital twins. Digital twins are virtual replicas of physical assets that enable predictive maintenance, performance optimization, and simulation of various scenarios. Another significant trend is the rise of artificial intelligence (AI) and machine learning (ML) technologies in optimizing infrastructure operations. AI-powered systems can analyze vast amounts of data to identify patterns, predict failures, and optimize resource allocation in real-time. Additionally, there is a growing emphasis on cybersecurity in smart infrastructure deployments, as interconnected systems become increasingly vulnerable to cyber threats.

Smart Infrastructure Market Scope

| Report Coverage | Details |

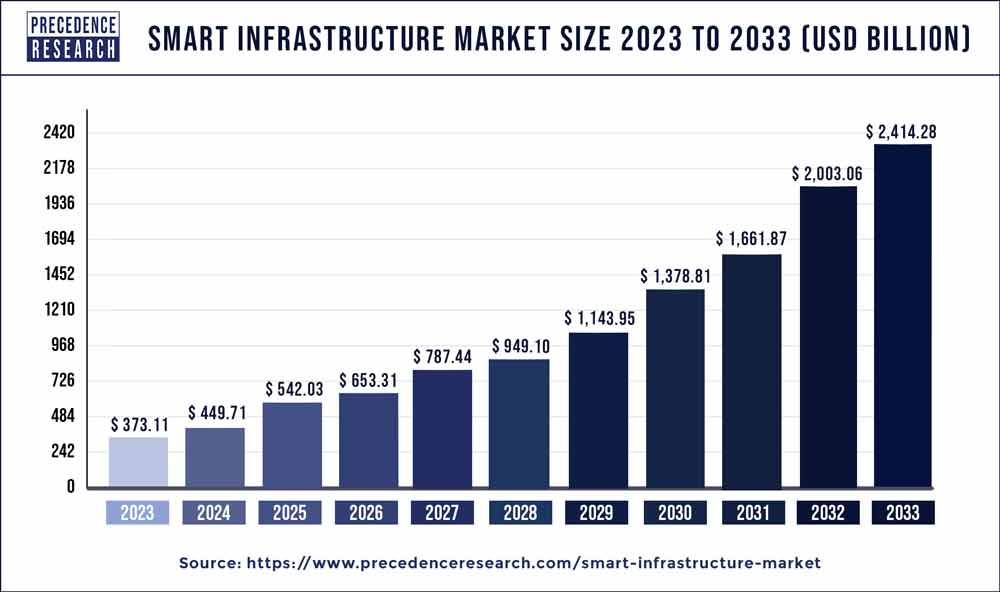

| Growth Rate from 2024 to 2033 | CAGR of 20.53% |

| Global Market Size in 2023 | USD 373.11 Billion |

| Global Market Size by 2033 | USD 2,414.28 Billion |

| U.S. Market Size in 2023 | USD 83.58 Billion |

| U.S. Market Size by 2033 | USD 540.80 Billion |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Offering, By Type, and By End-user |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

SWOT Analysis

Strengths:

- Advanced technologies such as IoT, AI, and data analytics are driving innovation and efficiency in smart infrastructure solutions.

- Increasing government initiatives and investments in smart city projects worldwide are creating a conducive environment for market growth.

- Smart infrastructure helps reduce operational costs, improve resource management, and enhance the overall quality of life in urban areas.

Weaknesses:

- High initial investment costs and complex integration processes may pose challenges for widespread adoption, particularly in developing regions.

- Concerns regarding data privacy and cybersecurity vulnerabilities could hinder trust and adoption of smart infrastructure solutions.

- Lack of interoperability standards and compatibility issues among different technologies may impede seamless integration and scalability.

Opportunities:

- Growing awareness of sustainability and environmental concerns is driving demand for smart energy, water, and transportation infrastructure solutions.

- Emerging markets offer significant growth opportunities as governments prioritize infrastructure development to support economic growth and urbanization.

- Technological advancements such as 5G connectivity and edge computing are expanding the capabilities of smart infrastructure solutions, opening new avenues for innovation.

Threats:

- Regulatory challenges and policy uncertainties may slow down the pace of adoption and deployment of smart infrastructure solutions.

- Geopolitical tensions and trade disputes could disrupt the supply chain of critical components and technologies required for smart infrastructure projects.

- Rapid technological obsolescence and the emergence of disruptive technologies pose risks to existing smart infrastructure investments.

Read Also: Non-Alcoholic Beverages Market Size to Attain USD 2,508.66 Bn by 2033

Recent Developments

- In September 2023, Huawei Technologies Co., Ltd. introduced smart infrastructure solutions, including Intelligent DC OptiX, an ultra-broadband solution, and CloudEngine XH, the AI Computing DCN Switch Series. These offerings are designed to assist enterprises in digitizing their business operations.

- In August 2023, Honeywell International Inc. announced its provision of City Suite Software for a smart city project managed by Atlanta BeltLine. The project involves redeveloping 22 miles of railroad in the city. The software is intended to assist smart city developers in presenting data from various locations across the entire area in a unified view.

Competitive Landscape:

The Smart Infrastructure Market is characterized by intense competition among key players, including multinational corporations, startups, and technology giants. Companies are increasingly focusing on strategic partnerships, mergers and acquisitions, and product innovations to gain a competitive edge in the market. Established players are leveraging their expertise in hardware, software, and services to offer end-to-end smart infrastructure solutions tailored to the specific needs of customers. Meanwhile, startups and agile innovators are disrupting traditional business models with niche offerings and disruptive technologies. Key players in the market include Siemens AG, IBM Corporation, Cisco Systems Inc., Schneider Electric SE, and General Electric Company, among others.

Smart Infrastructure Market Companies

- ABB

- Aclara Technologies LLC (Hubbell Incorporated)

- Broadcom, Inc. (VMware)

- Cisco Systems, Inc.

- Dynamic Ratings

- Honeywell International Inc.

- Hewlett Packard Enterprise Development LP

- Huawei Technologies Co., Ltd.

- International Business Machines Corporation

- L&T Technology Services Limited

- Panamax Infotech

- Schneider Electric

- Siemens

- Wipro

- Xylem (Sensus)

Segments Covered in the Report

By Offering

- Products

- Services

By Type

- Smart Transportation System

- Smart Energy Management System

- Smart Safety & Security Systems

- Smart Waste Management Solutions

- Others

By End-user

- Residential

- Non-residential

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

- Intelligent Traffic Management System Market Size, Trends, Report 2034 - July 17, 2024

- Healthcare Finance Solutions Market Size to Grow USD 293.12 Bn by 2034 - July 17, 2024

- Epoxy Composites Market Size to Grow USD 84.99 Bn by 2034 - July 17, 2024