Key Points

- North America has held a revenue share of around 42.7% in 2023.

- By product, the wearables segment held the largest share of around 76% in 2023. The segment is observed to sustain the dominance throughout the forecast period.

- By application, the insomnia segment dominated the sleep tech devices market with revenue share of 48% in 2023.

- By distribution channel, the sleep centers and fitness centers segment stood as a dominating share of the market in 2023.

Get a Sample: https://www.precedenceresearch.com/sample/3911

Growth Factors

Several factors contribute to the growth of the sleep tech devices market. One of the primary drivers is the growing prevalence of sleep disorders such as insomnia, sleep apnea, and restless leg syndrome. According to the World Health Organization (WHO), approximately one-third of the global population suffers from sleep-related issues. As a result, there is a growing demand for solutions that can help individuals monitor and improve their sleep patterns.

Additionally, the increasing adoption of wearable technology and smart devices has propelled the demand for sleep tech devices. Wearable sleep trackers, in particular, have gained popularity as they provide users with real-time data about their sleep cycles, duration, and quality. Moreover, advancements in sensor technology and data analytics have enhanced the accuracy and effectiveness of these devices, further driving market growth.

Furthermore, rising consumer awareness about the importance of sleep for overall health and performance has fueled the demand for sleep tech devices. Consumers are increasingly seeking ways to optimize their sleep routines to enhance productivity, cognitive function, and overall well-being. As a result, manufacturers are introducing innovative features and functionalities in sleep tech devices to cater to evolving consumer preferences.

Region Snapshot

The demand for sleep tech devices varies across different regions, influenced by factors such as healthcare infrastructure, technological advancements, and consumer awareness. North America dominates the global sleep tech devices market, owing to the high prevalence of sleep disorders and the presence of key market players in the region. The United States, in particular, accounts for a significant share of the market, driven by increasing investments in healthcare technology and rising consumer spending on wellness products.

Europe is also a lucrative market for sleep tech devices, supported by the growing aging population and increasing healthcare expenditure. Countries such as Germany, the United Kingdom, and France are witnessing a surge in demand for sleep monitoring devices and smart mattresses. Moreover, favorable government initiatives aimed at promoting sleep health and well-being are further driving market growth in the region.

Asia Pacific is expected to emerge as a significant market for sleep tech devices in the coming years, fueled by rapid urbanization, changing lifestyle patterns, and increasing disposable income. Countries like China, Japan, and India are witnessing a growing prevalence of sleep disorders due to factors such as work-related stress, irregular sleep schedules, and lifestyle changes. As a result, there is a rising demand for sleep tracking and monitoring devices in the region.

Sleep Tech Devices Market Scope

| Report Coverage | Details |

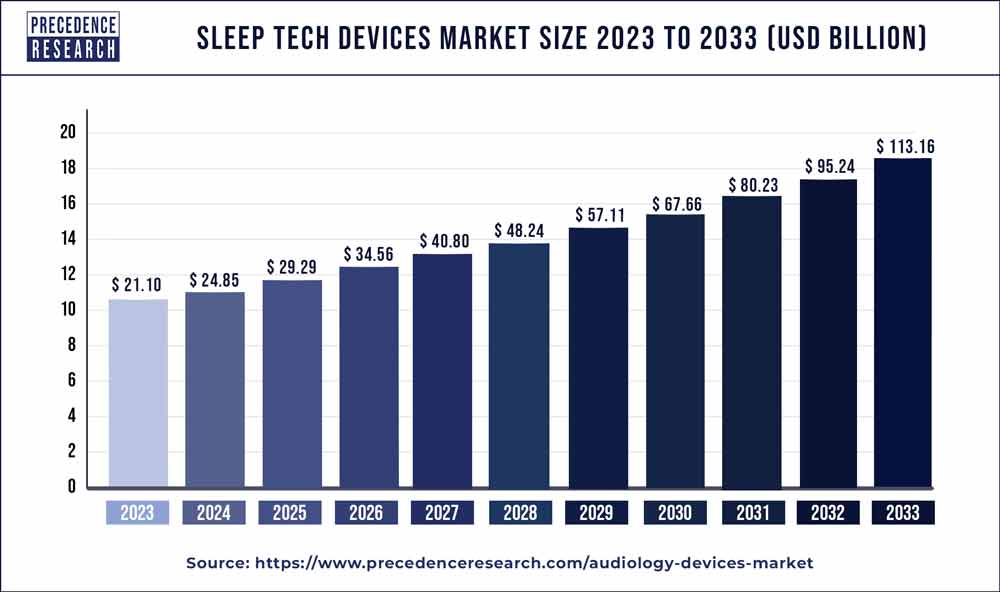

| Growth Rate from 2024 to 2033 | CAGR of 18.23% |

| Global Market Size in 2023 | USD 21.10 Billion |

| Global Market Size by 2033 | USD 113.16 Billion |

| U.S. Market Size in 2023 | USD 8.65 Billion |

| U.S. Market Size by 2033 | USD 38.46 Billion |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Product, By Application, and By Distribution Channel |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Sleep Tech Devices Market Dynamics

Driver

One of the key drivers of the sleep tech devices market is the growing consumer inclination towards proactive health management. With an increasing emphasis on preventive healthcare, consumers are seeking ways to monitor and improve their sleep quality to prevent the onset of chronic conditions such as obesity, diabetes, and cardiovascular diseases. Sleep tech devices offer users actionable insights into their sleep patterns, enabling them to make informed decisions about lifestyle changes and interventions.

Moreover, the integration of artificial intelligence (AI) and machine learning algorithms in sleep tech devices has enhanced their functionality and effectiveness. These advanced algorithms analyze sleep data collected by the devices to provide personalized recommendations for improving sleep quality. For example, AI-powered sleep trackers can identify patterns and trends in sleep behavior, such as sleep disturbances or irregular sleep cycles, and suggest interventions to address underlying issues.

Furthermore, the proliferation of smartphones and mobile applications has expanded the accessibility of sleep tech devices to a broader consumer base. Many sleep tracking apps are available for download on smartphones, allowing users to monitor their sleep patterns without the need for additional hardware. This convenience factor has contributed to the widespread adoption of sleep tech devices among tech-savvy consumers, driving market growth.

Opportunity

The sleep tech devices market presents significant opportunities for innovation and product development. Manufacturers are increasingly focusing on incorporating advanced features such as biometric sensors, sleep staging algorithms, and personalized coaching into their products to differentiate themselves in the competitive landscape. For instance, some smart mattresses now come equipped with sensors that adjust firmness and temperature settings based on the user’s sleep preferences and biometric data.

Moreover, there is a growing trend towards integrating sleep tracking functionality into other wearable devices such as smartwatches and fitness trackers. This convergence of technologies allows users to seamlessly monitor their sleep patterns alongside other health metrics such as heart rate, activity levels, and stress levels. As a result, manufacturers have the opportunity to capitalize on the growing demand for multifunctional health and wellness devices that offer comprehensive insights into overall well-being.

Additionally, partnerships and collaborations between sleep tech companies and healthcare providers present opportunities for expanding market reach and driving adoption among clinical populations. By integrating sleep monitoring solutions into existing healthcare infrastructure, providers can offer patients more comprehensive care and better manage chronic conditions related to sleep disorders. Furthermore, research initiatives aimed at understanding the link between sleep and various health outcomes present opportunities for developing targeted interventions and personalized treatment approaches.

Restraint

Despite the promising growth prospects, the sleep tech devices market faces certain challenges that could impede market growth. One of the primary restraints is the lack of regulatory oversight and standardization in the industry. Unlike medical devices, which are subject to rigorous testing and certification processes, sleep tech devices are often classified as consumer wellness products, leading to variability in product quality and reliability. This lack of regulation can undermine consumer trust and hinder widespread adoption of sleep tech devices, especially among healthcare professionals and clinical settings.

Moreover, privacy and data security concerns pose a significant challenge for sleep tech companies, particularly regarding the collection and handling of sensitive health information. Sleep tracking devices gather detailed data about users’ sleep patterns, which raises concerns about data breaches, unauthorized access, and misuse of personal information. Ensuring robust data protection measures and compliance with privacy regulations is essential for building consumer confidence and mitigating risks associated with data security breaches.

Furthermore, the affordability and accessibility of sleep tech devices remain barriers to adoption, particularly among underserved populations and developing regions. While the market offers a wide range of products at varying price points, premium sleep tracking devices with advanced features may be out of reach for individuals with limited financial resources. Additionally, factors such as smartphone penetration, internet connectivity, and digital literacy can affect the accessibility of sleep tech devices in certain regions, hindering market growth in those areas.

Read Also: Audiology Devices Market Size to Surpass USD 18.71 Bn by 2033

Recent Developments

- In January 2024, the National Sleep Foundation (NSF) created the SleepTech® Network, a new community platform for stakeholders in the sleep technology business. The news comes from the CES® trade exhibition in Las Vegas, which shows the whole technology environment. NSF is located in Booth 8604 in Tech East’s North Hall. The inaugural members of the SleepTech® Network range from high-profile start-ups to Fortune Global 500 representatives, representing key segments such as consumer electronics, digital therapeutics, mobility, consumer home products, and sleep-monitoring AI software. Asleep, Pocket Kado, PureCare, Samsung Health, Variowell, and Waymo are among the companies that participate.

- In December 2022, ASLEEP, a sleep technology firm, announced that it would reveal the blueprint for an individually personalized sleep environment based on its unequaled AI-based sleep monitoring technology at CES 2023. ASLEEP offers a wide range of sleep-related services using AI technology that analyzes sleep phases based on breathing sounds. ASLEEP’s technology can identify sleep phases in any setting by utilizing microphone-equipped devices such as smartphones, smart TVs, and speakers. ASLEEP’s sleep detection technology provides the most accurate results without the need for wearable devices such as smartwatches. It detects REM sleep, non-REM sleep, and wake state with an average 15% higher accuracy than industry-leading smartwatches.

- In January 2023, Earable® Neuroscience conducted a global launch ceremony for its FRENZ™ Brainband at CES 2023. During the occasion, the business talked about the breakthroughs behind the award-winning gadget, its potential to disrupt sleep technology, a special discount pricing, and its 88 Pioneer project. Earable® Neuroscience, a deep tech firm creating scalable, human-centric solutions that improve everyday experiences, had a global launch event for the FRENZ™ Brainband at the 2023 Consumer Electric Show (CES 2023) on Jan 6, revealing the breakthroughs that power the award-winning gadget.

Sleep Tech Devices Market Companies

- Philips

- Fitbit

- Eight Sleep

- Dodow

- Rhythm

- Casper

- Xiaomi

- Oura Health

- Nokia

- Sleepace

Segments Covered in the Report

By Product

- Wearables

- Non-wearables

By Application

- Obstructive Sleep Apnea

- Insomnia

- Narcolepsy

- Others

By Distribution Channel

- Hypermarkets and Supermarkets

- Sleep Centers and Fitness Centers

- Pharmacy and Retail Stores

- E-commerce

- Others

`By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

- Intelligent Traffic Management System Market Size, Trends, Report 2034 - July 17, 2024

- Healthcare Finance Solutions Market Size to Grow USD 293.12 Bn by 2034 - July 17, 2024

- Epoxy Composites Market Size to Grow USD 84.99 Bn by 2034 - July 17, 2024