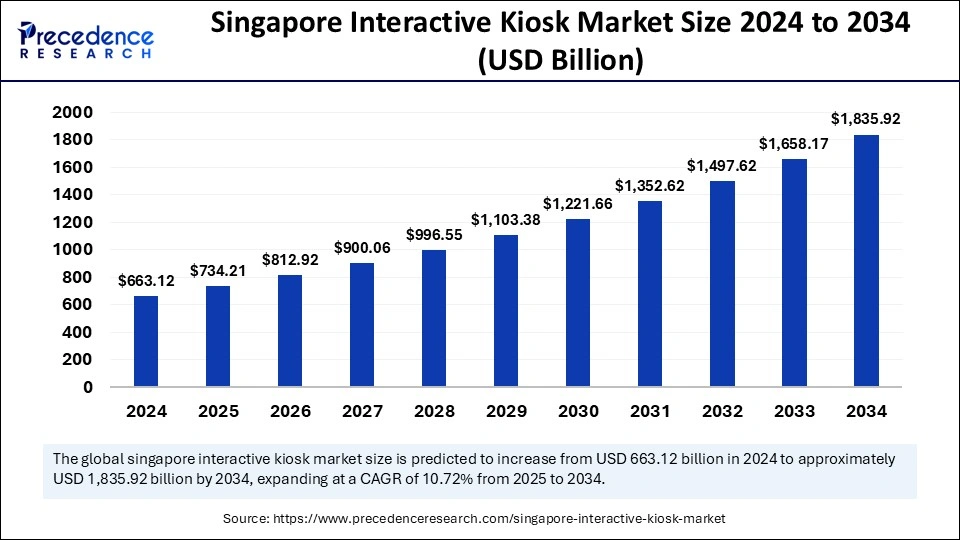

The singapore interactive kiosk market size is estimated to attain around USD 1,835.92 billion by 2034, increasing from USD 663.12 billion in 2024, with a CAGR of 10.72%.

Get a Free Sample Copy of the Report@ https://www.precedenceresearch.com/sample/5828

Singapore Interactive Kiosk Market Key Points

-

By component, the hardware segment held the largest market share in 2024.

-

By component, the software segment is projected to experience the fastest growth during the forecast period.

-

By type, the automated teller machines (ATMs) segment accounted for the highest market share in 2024.

-

By type, the retail self-checkout kiosk segment is expected to register the fastest growth rate over the forecast period.

-

By end use, the BFSI segment secured the largest market share in 2024.

-

By end use, the food & beverage segment is anticipated to witness the most rapid growth during the forecast period.

The Impact of AI on Singapore’s Interactive Kiosk Market

AI plays a crucial role in the Singapore interactive kiosk market by enhancing customer engagement and streamlining operations. Through technologies like natural language processing and voice recognition, AI enables kiosks to offer intuitive, personalized, and multi-lingual interactions that cater to Singapore’s diverse population. This not only improves user experience but also reduces wait times and speeds up transactions, making self-service more efficient and accessible.

Additionally, AI-powered kiosks collect and analyze customer data to provide valuable insights for businesses, allowing for targeted marketing and better inventory management. By automating routine tasks, AI helps reduce operational costs and supports scalability across multiple locations. These benefits are driving strong growth in Singapore’s interactive kiosk market, positioning AI as a key factor in its ongoing expansion and innovation.

Growth Factors of Singapore Interactive Kiosk Market

The growth of the Singapore interactive kiosk market is driven by several key factors. Enhanced customer experience through personalized, efficient, and convenient self-service options is a primary driver, as kiosks reduce waiting times and streamline transactions. The increasing adoption of digital technologies and AI integration—such as voice commands, natural language processing, and real-time data analytics—boosts user engagement and operational efficiency.

Additionally, rising demand for contactless solutions, government initiatives promoting digital transformation, and labor shortages further accelerate market expansion. Technological advancements in touchscreen and kiosk hardware, along with multi-functional capabilities, also contribute significantly to market growth.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 1,835.92 Billion |

| Market Size in 2025 | USD 734.21 Billion |

| Market Size in 2024 | USD 663.12 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 10.72% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Type, End Use. |

Market Dynamics

Drivers

Key drivers for the market include the growing demand for contactless and efficient self-service solutions, especially in the wake of the COVID-19 pandemic. Businesses are seeking innovative ways to improve customer engagement and streamline operations. The integration of AI, which enables features like voice commands, natural language processing, and real-time data analytics, further accelerates adoption. Additionally, Singapore’s high digital readiness and the push for digital transformation across industries support the market’s expansion.

Opportunities

Significant opportunities exist in leveraging advanced technologies to further personalize and optimize kiosk services. The increasing use of AI and data analytics opens avenues for predictive customer service, dynamic content delivery, and improved accessibility through multi-lingual interfaces. As businesses look to enhance service efficiency and adapt to evolving consumer preferences, the deployment of interactive kiosks in new verticals and applications is expected to rise.

Challenges

Despite strong growth prospects, the market faces challenges in designing user-friendly and reliable kiosk solutions that can withstand heavy usage and require minimal maintenance. Ensuring intuitive interfaces, robust security, and hygiene especially in public settings—remains critical. The pandemic also highlighted vulnerabilities, as sectors like retail and hospitality saw reduced kiosk usage due to decreased foot traffic and shifting consumer behaviors.

Singapore Interactive Kiosk Market Companies

- XIPHIAS Software Technologies Pvt. Ltd.

- AOGO Technologies

- Uniconnect Systems Pte Ltd

- NCR Corporation

- Zebra Technologies Corporation

- KIOSK Information Systems

- Diebold Nixdorf

- Toshiba Commerce Solutions

- Slimline Kiosks

- Advantech Co., Ltd.

- Meridian Kiosks

- Fujitsu Limited

- TouchPoint Solutions

Leader’s Announcements

- In November 2024, ViewQwest, a provider of connectivity and ICT solutions, announced collaboration with Synlan Technology, a subsidiary of iFLYTEK, for developing AI-based solutions such as an AI-driven virtual concierge kiosk for interacting in native languages with non-English-speaking tourists. Jeffery Wang, General Manager of iFLYTEK Openplatform Singapore, said that, “As a newcomer to Singapore and the region, Synlan values a strong regional partner who understands the landscape. Our collaboration with ViewQwest allows us to jointly develop targeted AI solutions for the region’s diverse market segments.”

Recent Developments

- In November 2024, Freshpod inaugurated its first autonomous food kiosk, which offers customizable options and chef-curated bowls at Ascent in Singapore Science Park.

- In June 2024, Etiqa Insurance Singapore, a leading provider of life and general insurance in Singapore, declared the continuance of its prize-winning ‘With You for the Ride’ campaign alongwith the official opening of the Marine Parade station on the Thomas-East Coast Line (TEL). The campaign by Etiqa aims at engaging travellers on the new TEL line with spectacular displays and interactive digital games for winning attractive rewards.

Segments Covered in the Report

By Component

- Hardware

- Display

- Printer

- Others

- Software

- Integration & Deployment

- Managed Services

- Services

- Windows

- Android

- Linux

- Others (iOS, Others)

By Type

- Automated Teller Machines (ATMs)

- Retail Self-Checkout Kiosk

- Self Service Kiosk

- Vending Kiosk

By End Use

- BFSI

- Retail

- Food & Beverage

- Healthcare

- Government

- Travel & Tourism

- Singapore Interactive Kiosk Market Size to Attain USD 1,835.92 Billion by 2034 - April 17, 2025

- Robotic Sensors Market Size to Attain USD 1,716.86 Million by 2034 - April 17, 2025

- Laminated Steel Market Size to Reach USD 2.63 Billion by 2034 - April 17, 2025