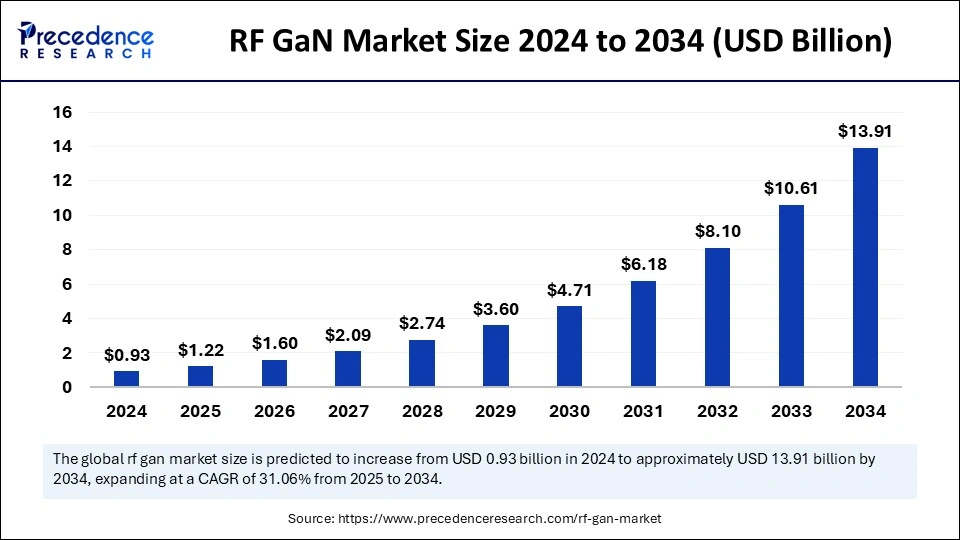

The global RF GaN market size surpassed USD 0.93 billion in 2024 and is projected to cross around USD 13.91 billion by 2034 with a CAGR of 31.06% from 2025 to 2034.

Get a Free Sample Copy of the Report@ https://www.precedenceresearch.com/sample/5799

RF GaN Market Key Highlights

-

Asia Pacific captured the largest portion of the RF GaN market in 2024, with a 43% share.

-

North America is set to achieve notable growth through the forecast period.

-

GaN-on-Si technology led the market by material type in 2024.

-

GaN-on-SiC technology is projected to grow significantly over the next few years.

-

The military segment was the top application segment in 2024.

-

RF energy applications are expected to expand considerably in the forecasted timeframe.

Role of AI in the RF GaN Market

Artificial Intelligence is becoming a transformative force in the RF GaN market, contributing to innovation, performance optimization, and manufacturing efficiency across multiple stages of the value chain.

1. Design Optimization

AI enables the development of more efficient and compact RF GaN devices by analyzing vast datasets to simulate and optimize circuit designs. This reduces design cycles and enhances performance parameters like power density, thermal stability, and linearity.

2. Predictive Maintenance and Quality Control

In RF GaN manufacturing, AI-powered systems monitor production lines in real time. Through data analytics and machine learning, they can predict potential equipment failures, minimize downtime, and ensure consistent device quality.

3. Material Analysis and Enhancement

AI tools are used to model and predict the behavior of GaN materials under different frequencies and temperature conditions. This accelerates the discovery of enhanced substrates and compound structures for better reliability and efficiency.

4. Smart Network Deployment

In telecommunications, especially 5G and emerging 6G, AI helps deploy and manage RF GaN-based systems more effectively. It assists in beamforming, network optimization, and signal integrity management, increasing the performance of high-frequency GaN components in base stations.

5. Defense and Radar Systems

For military applications where RF GaN is crucial, AI supports smarter radar detection, signal processing, and electronic warfare strategies by leveraging real-time analytics for more accurate and agile decision-making.

6. Market Forecasting and Demand Planning

AI-driven analytics help manufacturers and suppliers in demand forecasting, inventory planning, and pricing strategies by analyzing trends, customer behavior, and geopolitical influences on semiconductor supply chains.

RF GaN Market Key Highlights

Artificial Intelligence is playing an increasingly pivotal role in shaping the RF GaN market by enabling smarter design, manufacturing, and deployment of RF components. One of the most significant applications of AI lies in design optimization. Using advanced simulation tools and machine learning algorithms, engineers can analyze large datasets to create more compact and efficient RF GaN circuits. This helps improve performance attributes such as power density, linearity, and thermal management while shortening development timelines.

In manufacturing, AI supports predictive maintenance and quality control. AI-enabled systems monitor production lines in real time and detect anomalies or inefficiencies that might affect product quality. These systems can predict potential equipment failures or deviations, helping manufacturers reduce downtime, improve yield, and maintain consistent quality standards. AI also assists in analyzing the physical and chemical properties of GaN materials, aiding in the discovery and testing of new material compositions that offer enhanced reliability and efficiency.

AI’s impact is also felt in the deployment of RF GaN technologies, especially within telecommunications and defense sectors. For telecom applications such as 5G and beyond, AI helps optimize network configurations, manage beamforming, and ensure signal integrity, which are critical for high-frequency RF GaN devices. In defense, AI enhances radar and electronic warfare capabilities by enabling smarter signal processing, target recognition, and decision-making under dynamic conditions.

What is RF GaN?

RF GaN refers to the use of gallium nitride (GaN) semiconductors in radio frequency (RF) applications. GaN is a wide bandgap material known for its high electron mobility, thermal conductivity, and power density. These properties make it ideal for high-frequency, high-power applications such as radar systems, satellite communications, 5G infrastructure, and military electronics.

Key Market Drivers

-

5G Rollout: The global deployment of 5G networks requires components that can handle higher power and frequency—capabilities where RF GaN excels.

-

Defense and Aerospace: Increasing defense budgets and the growing need for advanced radar and electronic warfare systems boost the demand for RF GaN technology.

-

Satellite Communications: The rise in satellite launches and the demand for high-bandwidth communication fuel the need for RF GaN-based amplifiers and components.

-

High Efficiency and Miniaturization: RF GaN devices offer better energy efficiency and allow for the miniaturization of RF systems, supporting innovation in telecom and IoT.

Applications

-

Telecommunication Infrastructure (especially for 5G base stations)

-

Military Radar and Communications Systems

-

Electronic Warfare and Jamming Systems

-

Satellite and Space Communication

-

RF Energy Applications (like industrial heating, plasma sources, etc.)

Material Types

-

GaN-on-Silicon (GaN-on-Si): Offers cost-effective production and is widely used in commercial applications.

-

GaN-on-Silicon Carbide (GaN-on-SiC): Provides superior thermal and electrical performance, ideal for high-power and high-frequency military and aerospace systems.

Regional Outlook

-

Asia Pacific dominates the RF GaN market, driven by strong manufacturing bases, rapid adoption of 5G, and significant defense investments.

-

North America is expected to witness significant growth due to rising defense spending, technological innovations, and government support for advanced semiconductors.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 13.91 Billion |

| Market Size in 2025 | USD 1.22 Billion |

| Market Size in 2024 | USD 0.93 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 31.06% |

| Dominated Region | Asia Pacific |

| Fastest Growing Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Material Type, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Market Drivers

One of the main drivers of the RF GaN market is the rapid deployment of 5G infrastructure worldwide. RF GaN devices enable higher bandwidth and faster data transmission, making them essential for base stations and other wireless infrastructure. Additionally, increasing investments in defense systems—particularly for advanced radar and electronic warfare technologies—are boosting demand for GaN-based RF devices. The rise in satellite launches and the need for secure, high-frequency communications are further propelling market expansion. Furthermore, RF GaN’s superior performance in high-power applications is driving its adoption in industrial and aerospace sectors.

Market Opportunities

The market presents strong opportunities with the growing demand for lightweight, power-efficient components in aerospace and defense. As global connectivity and space exploration continue to expand, so does the need for high-reliability RF systems in satellite communications. Another significant opportunity lies in the automotive industry, especially with the adoption of radar systems in autonomous and electric vehicles. Moreover, ongoing R&D in GaN-on-diamond and other advanced substrates is expected to enhance performance while reducing heat issues, opening up more use cases. Emerging economies are also expected to create fresh demand for telecom infrastructure, thereby offering new growth prospects for RF GaN.

Market Challenges

Despite the promising outlook, the RF GaN market faces some key challenges. High manufacturing costs remain a primary barrier to widespread adoption, especially in price-sensitive markets. The complexity of GaN-based device fabrication, limited foundry availability, and design integration issues also contribute to market constraints. Additionally, the industry lacks standardization in material quality and performance benchmarking, which can slow down commercialization efforts. Ensuring long-term reliability and meeting rigorous regulatory and safety standards in sectors like aerospace and defense further add to the development challenges.

Regional Insights

Asia Pacific dominated the global RF GaN market in 2024, holding the largest share of approximately 43%. This leadership is attributed to the rapid expansion of 5G networks, robust defense spending, and a strong presence of semiconductor manufacturers in countries like China, South Korea, and Japan. North America is projected to grow at a notable CAGR during the forecast period, driven by advanced defense technologies and increasing demand for GaN in telecom and aerospace applications. Europe also presents growth potential due to its focus on developing next-generation radar and communication systems. Overall, regional investments in infrastructure, defense, and R&D are shaping the global landscape of the RF GaN market.

RF GaN Market Companies

- Fujitsu

- Macom

- United Monolithic Semiconductors (UMS)

- Microchip Technology Inc.

- Wolfspeed

- NXP Semiconductor

- Qorvo, Inc.

- Analog Devices Inc.

- ROHM Semiconductors

- STMicroelectronics NV

- Infenion technologies

Recent Developments

- In January 2025, Guerrilla RF, Inc. introduced the GRF0020D and GRF0030D as the initial members of their new GaN on SiC HEMT power amplifier product series. The GaN HEMT transistors offer 50W of saturated power to clients in wireless infrastructure, military, aerospace as well and industrial heating applications that need integrated bare die for their custom MMICs.

- In June 2024, Tagore Technology introduced the TS8729N and TS8728N series of high-power GaN SPDT switches for broadband applications. The switches deliver superior power handling in addition to outstanding insertion loss to serve L- and S-Band radar and cellular infrastructure.

Segments Covered in the Report

By Material Type

- GaN-on-Si

- GaN-on-SiC

- Other Material Types (GaN-on-GaN, GaN-on-Diamond)

By Application

- Military

- Telecom Infrastructure (Backhaul, RRH, Massive MIMO, Small Cells)

- Satellite Communication

- Wired Broadband

- Commercial Radar and Avionics

- RF Energy

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

Also Read: Construction and Design Software Market

Ready for more? Dive into the full experience on our website@ https://www.precedenceresearch.com/

- Customer Self-service Software Market Size to Attain USD 128.36 Bn by 2034 - April 11, 2025

- Converted Flexible Packaging Market Size to Attain USD 374.06 Bn by 2034 - April 11, 2025

- Scleral Lens Market Size to Soar USD 982.68 Bn by 2034 - April 11, 2025