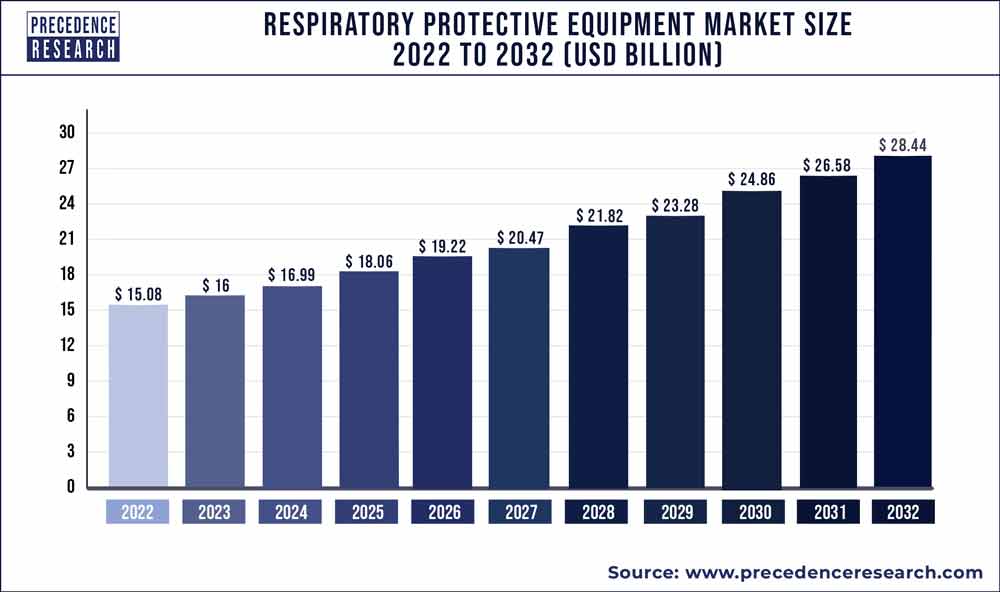

The respiratory protective equipment market size surpassed USD 16 billion in 2023 and is projected to expand to USD 28.44 billion by 2032, at a CAGR of 6.60% from 2023 to 2032.

Key Takeaways

- North America contributed more than 36% of revenue share in 2022.

- Asia-Pacific is estimated to expand the fastest CAGR between 2023 and 2032.

- The air-purifying respirators (APR) segment has held the largest market share of 64% in 2022.

- The supplied air respirators (SARs) segment is anticipated to grow at a remarkable CAGR of 7.8% between 2023 and 2032.

- The healthcare segment generated over 25% of revenue share in 2022.

- The mining segment is expected to expand at the fastest CAGR over the projected period.

The Respiratory Protective Equipment (RPE) market is a critical segment within the broader safety equipment industry. Its primary function is to safeguard individuals against harmful airborne contaminants, ensuring respiratory health and well-being. The market encompasses a diverse range of products designed to address various occupational hazards, ranging from simple masks to advanced respirators.

Growth Factors:

Several factors contribute to the growth of the Respiratory Protective Equipment market. Heightened awareness of occupational safety, stringent regulatory standards, and a growing emphasis on employee health and well-being are significant drivers. Additionally, industries such as healthcare, manufacturing, and construction, where respiratory risks are prevalent, contribute to the expanding demand for RPE.

Get a Sample: https://www.precedenceresearch.com/sample/3624

Region Snapshot

The Respiratory Protective Equipment market exhibits regional variations influenced by industry regulations, economic factors, and the prevalence of respiratory hazards. Developed regions such as North America and Europe have established stringent safety norms, driving a robust market. Meanwhile, the Asia-Pacific region, with its burgeoning industrial sector, presents significant growth potential, fueled by increasing awareness and regulatory measures.

Drivers:

The increasing prevalence of respiratory diseases, exacerbated by environmental factors, is a key driver propelling the Respiratory Protective Equipment market. The ongoing COVID-19 pandemic has further underscored the importance of respiratory protection, leading to a surge in demand for high-quality and specialized RPE. Technological advancements, such as the integration of smart features in respirators, also drive market growth.

Opportunities:

Opportunities within the Respiratory Protective Equipment market lie in the development of innovative and cost-effective solutions. The rise of sustainable and eco-friendly materials in RPE manufacturing presents a promising avenue. Furthermore, expanding market penetration in emerging economies and the customization of products for specific industries offer untapped opportunities for growth.

Challenges:

Despite its growth, the Respiratory Protective Equipment market faces challenges. Price sensitivity among end-users, especially in developing regions, can hinder market expansion. Additionally, the complexity of compliance standards and the need for continuous product innovation pose challenges for manufacturers. Balancing effectiveness with comfort and usability is an ongoing challenge in RPE design.

Respiratory Protective Equipment Market Scope

| Report Coverage | Details |

| Growth Rate from 2023 to 2032 | CAGR of 6.60% |

| Market Size in 2023 | USD 16 Billion |

| Market Size by 2032 | USD 28.44 Billion |

| Largest Market | North America |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Segments Covered | By Product and By End-Use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Read Also: Sludge Treatment Chemicals Market to Earn USD 11.82 Billion in Size By 2032

Recent Developments

- In June 2022, Avon Protection Plc, formerly recognized as Avon Rubber Plc, revealed a new line of EXOSKINTM CBRN gloves and boots designed to serve as respiratory protective equipment for military personnel.

- 3M, in May 2022, declared its intentions to expand its operations in Valley, Nebraska, with a focus on increasing the production of hearing and respiratory protection products.

- Bullard, in August 2021, introduced the SALUS-HC, an air purifying respiratory protective equipment aimed at ensuring the safety of workers in public and healthcare settings.

- In January 2021, MSA Safety Inc. completed the acquisition of Bristol Uniforms, a UK-based company, with the aim of offering firefighters reliable and innovative respiratory protective equipment.

Respiratory Protective Equipment Market Players

- Avon Protection Plc

- 3M

- Bullard

- MSA Safety Inc.

- Honeywell International Inc.

- Ansell Limited

- Alpha Pro Tech

- Gentex Corporation

- Kimberly-Clark Corporation

- Moldex-Metric, Inc.

- Drägerwerk AG & Co. KGaA

- RPB Safety LLC

- uvex group

- Delta Plus Group

- JSP Ltd.

Segments Covered in the Report

By Product

- Air Purifying Respirators (APR)

- Supplied Air Respirators

By End-Use

- Oil & Gas

- Fire services

- Petrochemical/chemical

- Industrial

- Pharmaceuticals

- Construction

- Healthcare

- Mining

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/

- Photodynamic Therapy Market Size to Rake USD 8.42 Bn by 2033 - February 5, 2024

- Image Recognition Market Size to Attain USD 166.01 Bn by 2033 - February 5, 2024

- Hydrogen Storage Tanks and Transportation Market Report 2033 - February 5, 2024