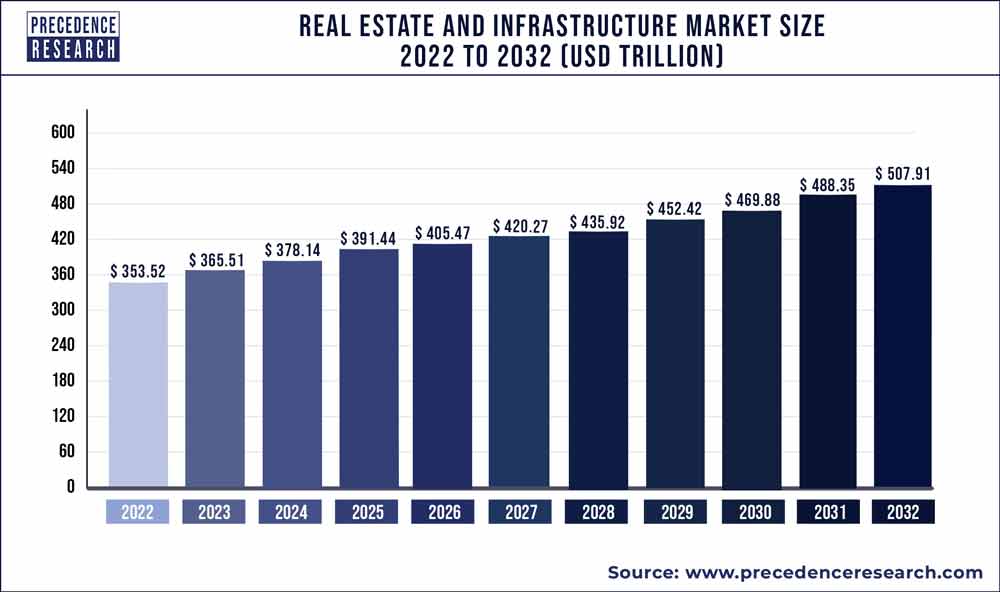

The real estate and infrastructure market size was estimated at USD 365.51 trillion in 2023 and is expected to reach USD 507.91 trillion by 2032, growing at a CAGR of 3.70% from 2023 to 2032.

Key Takeaways

- By property type, the residential segment dominated the real estate market with a market size of USD 285.28 trillion in 2023 and is likely to reach USD 396.48 trillion with a CAGR of 3.7% in 2032.

- By property type, the commercial real estate market is expected to grow with a market value of USD 26.84 trillion in 2023 and is anticipated to reach USD 34.78 trillion with a CAGR of 2.9% in 2032.

- By business type, the buying segment dominated the real estate market with a market size of USD 198.23 trillion in 2023 and is likely to reach USD 264.12 trillion with a CAGR of 3.2% in 2032.

- By business type, the rental segment is expected to grow with a market value of USD 167.28 trillion in 2023 and is anticipated to reach USD 243.80 trillion with a CAGR of 2.9% in 2032.

- By region, North America dominated the real estate and infrastructure market with the largest market size of USD 107.90 trillion in 2023 and forecasted to reach USD 142.16 trillion with a CAGR of 3.1% in 2032. The Europe segment is expected to increase its market size to USD 94.87 trillion in 2023 and is predicted to reach USD 135.45 trillion with a CAGR of 4.0% in 2032.

Growth Factors

The Real Estate and Infrastructure Market is experiencing robust growth driven by several key factors. Urbanization continues to be a primary driver, as more people migrate to cities in search of better opportunities. This influx fuels the demand for both residential and commercial properties. Additionally, the global population’s steady increase contributes to the need for enhanced infrastructure, such as transportation networks, utilities, and smart city solutions. Technological advancements, including the integration of smart building technologies and sustainable construction practices, are reshaping the industry and attracting investment.

Get a Sample: https://www.precedenceresearch.com/sample/3566

Real Estate and Infrastructure Market Scope

| Report Coverage | Details |

| Market Size in 2023 | USD 365.51 Trillion |

| Market Size by 2032 | USD 507.91 Trillion |

| Growth Rate from 2023 to 2032 | CAGR of 3.70% |

| Largest Market | North America |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Segments Covered | By Property Type, By Commercial Property Type, By Specialized Property Type, By Infrastructure Property Type, and By Business Type |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Trends

Several trends are shaping the landscape of the Real Estate and Infrastructure Market. One notable trend is the rise of sustainable and eco-friendly construction practices. With a growing emphasis on environmental consciousness, developers are incorporating green building technologies, energy-efficient designs, and sustainable materials. Another prominent trend is the increased adoption of PropTech (Property Technology), which leverages innovations like virtual reality for property tours, blockchain for transparent transactions, and data analytics for market insights. The flexible workspace trend, accelerated by the rise of remote work, is also influencing the demand for adaptable commercial real estate solutions.

Opportunities:

The Real Estate and Infrastructure Market presents a myriad of opportunities for investors and stakeholders alike. One of the key advantages lies in the potential for substantial returns on investment. As urbanization continues to surge globally, the demand for both residential and commercial properties remains high. Smart investments in strategic locations can yield significant profits. Additionally, the growing emphasis on sustainable and eco-friendly infrastructure opens up avenues for innovative projects that align with environmental goals. Partnerships with government initiatives and public-private collaborations offer a chance to contribute to societal development while reaping financial rewards.

Challenges:

However, navigating the Real Estate and Infrastructure Market comes with its fair share of challenges. Market volatility, influenced by economic shifts and geopolitical factors, can pose a risk to investment stability. Regulatory complexities, varying across regions, demand a thorough understanding of legal frameworks. The lengthy approval processes and bureaucratic hurdles can slow down project timelines, affecting profitability. Furthermore, the industry’s susceptibility to external shocks, such as the recent global health crisis, highlights the importance of risk management strategies. Balancing short-term gains with long-term sustainability is an ongoing challenge in this dynamic and evolving market.

Region Snapshot

The dynamics of the Real Estate and Infrastructure Market vary significantly by region. In emerging economies, rapid urbanization and industrialization often lead to increased demand for new infrastructure projects and affordable housing. In developed regions, the focus may shift towards redevelopment and revitalization projects, with an emphasis on smart infrastructure solutions. Government policies and regulatory frameworks play a crucial role in shaping the market in each region, influencing factors such as land use, zoning, and incentives for sustainable development. Global economic trends, geopolitical stability, and cultural preferences further contribute to the regional nuances within the Real Estate and Infrastructure Market.

Read Also: Industrial Catalysts Market

Recent Developments

- In November 2023, the Dubai Land Department accepted the responsibility of combining the private and government sector resources to revolutionize the real estate future of Dubai. The workshop held by the Dubai Land Department, aided the exchange of experiences, expertise, strategic vision, and ideas to shape the real estate future in Dubai.

- In November 2023, a frequently expanding real estate development, ACUBE Real Estate Development,” shared its plans to expand its operations in the UAE market due to the increasing demand for real estate and larger return on investment.

- In November 2023, Blackfinch Group, a specialist in investment management, launched two new funds: IFSL Blackfinch NextGen Property Securities, and IFSL Blackfinch NextGen Infrastructure. The primary purpose of these funds is to align with worldwide trends such as urbanization, digitalization, and aging demographics.

- In November 2023, Uzbekistan announced its plans for the expansion of its green energy infrastructure. Uzbekistan is about to launch ten wind power plants with a total capacity of 4400 MW by the end of 2027.

Real Estate and Infrastructure Market Players

- Simon Property Group

- CBRE Group

- Cushman and Wakefield PLC

- JLL

- Homie Real Estate

- Houwzer

- American Tower

- RE/Max

- Equity Residential

- Vornado Realty

- BrazilOasis

Segments Covered in the Report:

By Property Type

- Residential

- Commercial

- Industrial

- Specialized

- Infrastructure

By Commercial Property Type

- Offices

- Hospitals

- Retails

- Others

By Specialized Property Type

- Healthcare

- Education

- Leisure

By Infrastructure Property Type

- Energy

- Telecom

- Utilities

- Transportation

By Business Type

- Buy

- Rental

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/

- Photodynamic Therapy Market Size to Rake USD 8.42 Bn by 2033 - February 5, 2024

- Image Recognition Market Size to Attain USD 166.01 Bn by 2033 - February 5, 2024

- Hydrogen Storage Tanks and Transportation Market Report 2033 - February 5, 2024