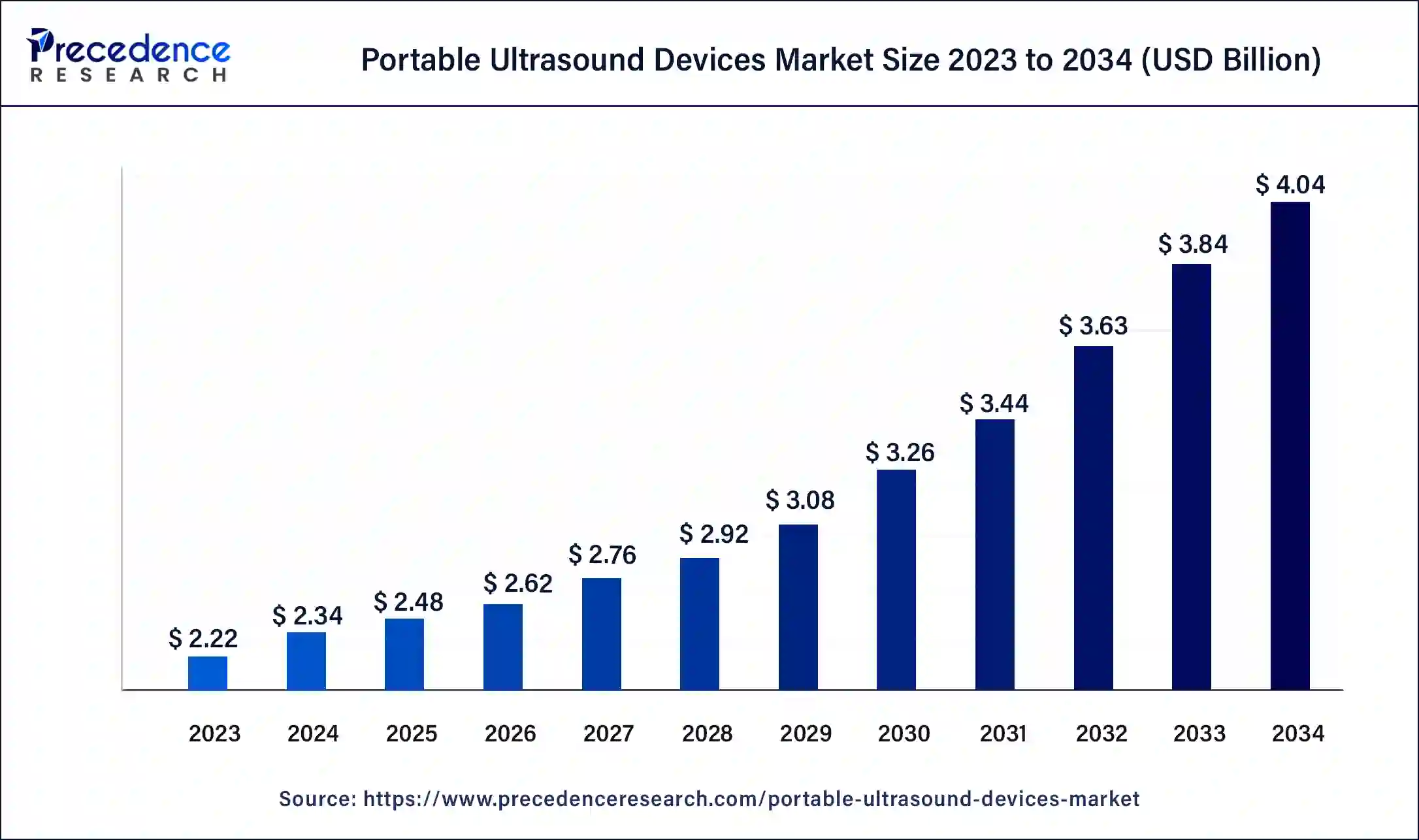

The global portable ultrasound devices market size was calculated at USD 2.22 billion in 2023 and is expected to reach around USD 3.83 billion by 2033, growing at a CAGR of 5.62% from 2024 to 2033.

Key Points

- The North America portable ultrasound devices market size accounted for USD 950 million in 2023 and is expected to attain around USD 1,670 million by 2033, poised to grow at a CAGR of 5.80% between 2024 and 2033.

- North America dominated the market with the largest revenue share of 43% in 2023.

- Asia Pacific is estimated to grow at the fastest CAGR of 6.72% during the forecast period.

- By type, the handheld segment has held the largest revenue share of 56% in 2023.

- By application, the obstetrics/gynecology segment has contributed a major revenue share of 47% in 2023.

- By application, the cardiovascular segment is estimated to expand at a solid CAGR of 7.12% during the forecast period.

- By technology, the Doppler ultrasound segment has generated more than 47% of revenue share in 2023.

- By technology, the 3D and 4D ultrasound segment is projected to grow at a notable CAGR of 8.05% during the forecast period.

- By end-use, the hospitals & clinics segment has held the maximum revenue share of 57% in 2023.

- By end-use, the homecare segment is growing at a CAGR of 7.04% during the forecast period.

The portable ultrasound devices market has witnessed significant growth in recent years, fueled by advancements in technology, increasing demand for point-of-care diagnostics, and the rising prevalence of chronic diseases worldwide. Portable ultrasound devices offer convenience, portability, and cost-effectiveness compared to traditional ultrasound machines, driving their adoption across various medical specialties and settings.

Get a Sample: https://www.precedenceresearch.com/sample/4356

Growth Factors:

Several factors contribute to the growth of the portable ultrasound devices market. These include the growing geriatric population, which is more susceptible to chronic diseases requiring diagnostic imaging, as well as the rising demand for minimally invasive diagnostic procedures. Technological advancements such as the development of handheld and wireless ultrasound devices have further expanded the market by enhancing mobility and accessibility.

Region Insights:

The portable ultrasound devices market exhibits significant regional variation. Developed regions such as North America and Europe lead the market due to high healthcare expenditure, advanced healthcare infrastructure, and early adoption of innovative medical technologies. Meanwhile, emerging economies in Asia-Pacific and Latin America are witnessing rapid market growth attributed to increasing healthcare investments, improving healthcare infrastructure, and growing awareness about the benefits of portable ultrasound devices.

Portable Ultrasound Devices Market Scope

| Report Coverage | Details |

| Portable Ultrasound Devices Market Growth Rate | CAGR of 5.62% from 2024 to 2033 |

| Portable Ultrasound Devices Market Size in 2023 | USD 2.22 Billion |

| Portable Ultrasound Devices Market Size in 2024 | USD 2.34 Billion |

| Portable Ultrasound Devices Market Size by 2033 | USD 3.83 Billion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Type, Application, Technology, End-Use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Portable Ultrasound Devices Market Dynamics

Drivers:

Key drivers influencing the portable ultrasound devices market include the growing preference for point-of-care diagnostics, rising healthcare expenditure, and increasing healthcare access in remote and underserved regions. Additionally, advancements in ultrasound technology, such as the integration of artificial intelligence (AI) for image interpretation and enhanced diagnostic accuracy, are driving market growth by improving the efficiency and effectiveness of portable ultrasound devices.

Opportunities:

The market presents several opportunities for growth and innovation. Expansion into emerging markets, development of novel applications for portable ultrasound devices, and strategic collaborations between healthcare providers and technology companies for product development and distribution are key avenues for market players to capitalize on. Moreover, the integration of telemedicine and remote monitoring capabilities into portable ultrasound devices opens new opportunities for decentralized healthcare delivery.

Challenges:

Despite the promising growth prospects, the portable ultrasound devices market faces certain challenges. These include concerns regarding the quality and accuracy of portable ultrasound imaging compared to traditional machines, regulatory hurdles related to product approval and certification, and reimbursement limitations in certain healthcare systems. Moreover, competition from alternative imaging modalities and the high initial cost of portable ultrasound devices pose challenges to market expansion.

Read Also: Blood and Blood Components Market Size, Share, Report by 2033

Portable Ultrasound Devices Market Recent Developments

- In May 2024, Esaote SPA launched a portable ultrasound system named ‘MyLab Omega eXP VET.’ This system will help veterinarians examine animals with a high level of flexibility and accuracy in diagnostic imaging. It also covers animals of all species and ensures high performance, ranging from general imaging and echocardiography to interventional procedures.

- In April 2024, Butterfly announced that the FDA had approved its next-generation handheld point-of-care ultrasound (POCUS) system named iQ3. This new device features a new ergonomic design and delivers high data processing speed for optimized image resolution and accuracy for the detection of various body parts.

- In November 2023, Aco Healthcare launched its new handheld ultrasound system, Apache Neo. This system features microwave-beamforming imaging technology that provides high-resolution medical images and accurate diagnosis to enhance patients’ overall medical experience.

- In September 2023, Mindray Medical International Limited launched the TE Air wireless handheld ultrasound device. This device offers multi-device connectivity and flexible charging options. It also produces high-quality images and ensures accessibility in critical clinical scenarios.

- In August 2023, GE HealthCare launched Vscan Air SL, a wireless handheld ultrasound device designed to accelerate the imaging process during cardiac and vascular problems. This device comes with GE HealthCare’s proprietary XDclear and SignalMax technology to enhance resolution and improve imaging performance.

Portable Ultrasound Devices Market Companies

- General Electric Company

- Siemens

- Clarius Mobile Health

- Koninklijke Philips N.V.

- SAMSUNG

- FUJIFILM Holdings Corporation

- Shenzhen Mindray Bio-medical Electronics Co., Ltd.

- Canon Inc.

- BenQ Corporation

- ESAOTE SPA

- Hitachi

- Butterfly Network

Segments Covered in the Report

By Type

- Laptop-based

- Handheld

By Application

- Obstetrics/Gynecology

- Cardiovascular

- Urology

- Gastric

- Musculoskeletal

- Others

By Technology

- 2D Ultrasound

- 3D & 4D Ultrasound

- Doppler Ultrasound

- High-intensity Focused Ultrasound

By End-Use

- Hospitals & Clinics

- Home Care

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/

- Intelligent Traffic Management System Market Size, Trends, Report 2034 - July 17, 2024

- Healthcare Finance Solutions Market Size to Grow USD 293.12 Bn by 2034 - July 17, 2024

- Epoxy Composites Market Size to Grow USD 84.99 Bn by 2034 - July 17, 2024