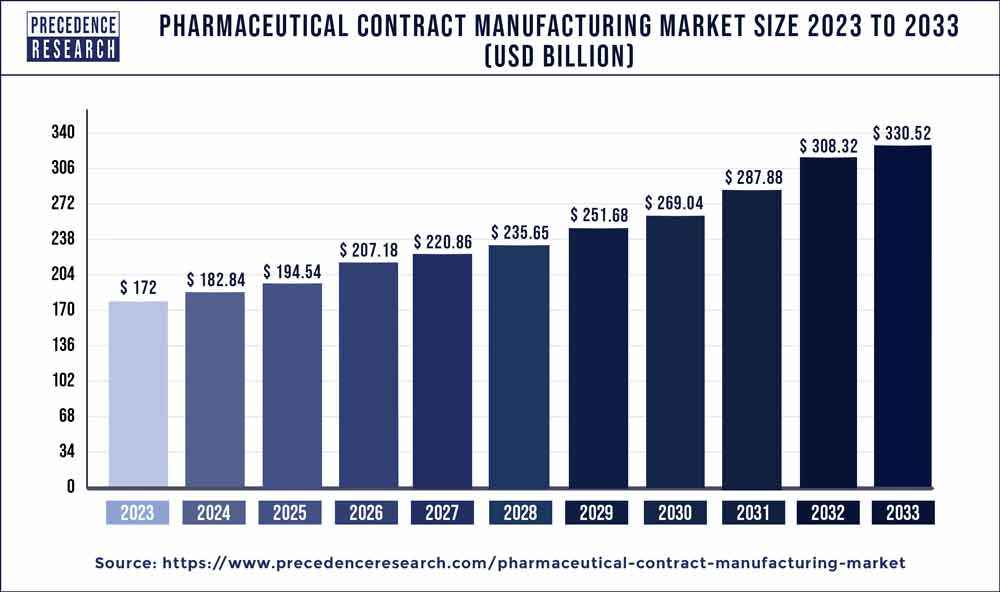

The global pharmaceutical contract manufacturing market size is expected to rake around USD 330.52 billion by 2033, representing a CAGR of 6.80% from 2024 to 2033.

Introduction:

The Pharmaceutical Contract Manufacturing Market has witnessed significant growth in recent years, driven by the increasing complexities in pharmaceutical manufacturing, rising demand for innovative therapies, and the need for cost-effective production processes. Contract manufacturing has emerged as a strategic solution for pharmaceutical companies to streamline their operations, enhance flexibility, and focus on core competencies. This market encompasses a wide range of services, including active pharmaceutical ingredient (API) manufacturing, finished dosage form production, and packaging.

Key Takeaways

- North America contributed 36% of market share in 2023.

- Asia-Pacific is estimated to expand the fastest CAGR between 2024 and 2033.

- By service, the pharmaceutical manufacturing services segment has held the largest market share of 33% in 2023.

- By service, the drug development services segment is anticipated to grow at a remarkable CAGR of 8.9% between 2024 and 2033.

- By end-user, the big pharmaceutical companies segment generated over 42% of revenue share in 2023.

- By end-user, the small & mid-sized pharmaceutical companies segment is expected to expand at the fastest CAGR over the projected period.

Growth Factors

Several factors contribute to the growth of the Pharmaceutical Contract Manufacturing Market. The rising trend of outsourcing in the pharmaceutical industry is a key driver, as companies seek to reduce capital expenditure, minimize time-to-market, and access specialized expertise. Additionally, the growing emphasis on research and development activities, coupled with the need for advanced manufacturing technologies, has led pharmaceutical companies to collaborate with contract manufacturing organizations (CMOs) to leverage their capabilities.

Get a Sample: https://www.precedenceresearch.com/sample/3750

Pharmaceutical Contract Manufacturing Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 6.80% |

| Global Market Size in 2023 | USD 172 Billion |

| Global Market Size by 2033 | USD 330.52 Billion |

| U.S. Market Size in 2023 | USD 43.34 Billion |

| U.S. Market Size by 2033 | USD 84.07 Billion |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Service and By End User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Trends

One prominent trend in the pharmaceutical contract manufacturing sector is the increasing adoption of advanced technologies such as continuous manufacturing and 3D printing. These technologies offer improved efficiency, reduced production costs, and enhanced quality control. Furthermore, the industry is witnessing a shift towards a more collaborative approach between pharmaceutical companies and CMOs, fostering partnerships that go beyond traditional outsourcing models and involve joint development initiatives.

Opportunities

The market presents several opportunities for both pharmaceutical companies and contract manufacturers. With the rising demand for personalized medicine and biopharmaceuticals, CMOs specializing in these areas are poised for substantial growth. Additionally, the increasing focus on environmental sustainability is creating opportunities for contract manufacturers to develop green and sustainable manufacturing processes, aligning with the broader industry’s commitment to corporate social responsibility.

Restraints

Despite its growth, the Pharmaceutical Contract Manufacturing Market faces certain challenges. Quality control and regulatory compliance remain critical concerns, particularly as pharmaceutical products become more complex. Stringent regulatory requirements in different regions can pose obstacles to seamless global operations. Moreover, the potential risk of intellectual property issues and the need for confidentiality in the contract manufacturing relationship are factors that must be carefully navigated.

Region Insights:

The market exhibits regional variations influenced by factors such as regulatory landscapes, infrastructure, and the presence of key pharmaceutical companies. North America and Europe have historically been prominent regions for pharmaceutical contract manufacturing due to established regulatory frameworks and a concentration of major pharmaceutical players. However, Asia-Pacific is rapidly gaining traction, driven by its cost advantages, skilled workforce, and a growing number of contract manufacturing facilities.

Read Also: U.S. Insulation Market Size to Rake USD 9.76 Bn by 2023

Competitive Landscape:

The competitive landscape of the Pharmaceutical Contract Manufacturing Market is characterized by a mix of global CMOs and smaller, specialized players. Major companies are actively engaging in mergers and acquisitions to expand their service offerings and geographical presence. Contract manufacturers are also investing in state-of-the-art manufacturing facilities and technology upgrades to stay competitive. Key players include [List of Major Companies], each contributing to the market’s dynamism through innovation and strategic collaborations.

Pharmaceutical Contract Manufacturing Market Companies

- Lonza Group

- Catalent, Inc.

- Patheon (Now part of Thermo Fisher Scientific)

- Recipharm AB

- Boehringer Ingelheim

- Dr. Reddy’s Laboratories

- Jubilant Life Sciences

- Fareva

- Vetter Pharma

- Evonik Industries

- WuXi AppTec

- Pfizer CentreOne

- Almac Group

- AbbVie Contract Manufacturing

- Samsung Biologics

Recent Developments

- In September 2022, Lonza Group entered into a partnership with Touchlight, a biotechnology company, to enhance its comprehensive mRNA manufacturing capabilities by incorporating an additional source of DNA.

- In February 2022, Thermo Fisher Scientific collaborated with Moderna, Inc. to facilitate the large-scale production of Moderna’s COVID-19 vaccine, Spikevax, and other experimental mRNA therapies in its development pipeline.

- In January 2023, Catalent played a crucial role in supporting the manufacturing process for Sarepta’s advanced gene therapy candidate, delandistrogene moxeparvovec (SRP-9001), designed to address Duchenne muscular dystrophy.

Segments Covered in the Report

By Service

- Pharmaceutical Manufacturing Services

- Pharmaceutical API Manufacturing Services

- Pharmaceutical FDF Manufacturing Services

- Drug Development Services

- Biologic Manufacturing Services

- Biologic API Manufacturing Services

- Biologic FDF Manufacturing Services

By End User

- Big Pharmaceutical Companies

- Small & Mid-Sized Pharmaceutical Companies

- Generic Pharmaceutical Companies

- Other End Users (Academic Institutes, Small CDMOs, and CROs)

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/

- Intelligent Traffic Management System Market Size, Trends, Report 2034 - July 17, 2024

- Healthcare Finance Solutions Market Size to Grow USD 293.12 Bn by 2034 - July 17, 2024

- Epoxy Composites Market Size to Grow USD 84.99 Bn by 2034 - July 17, 2024