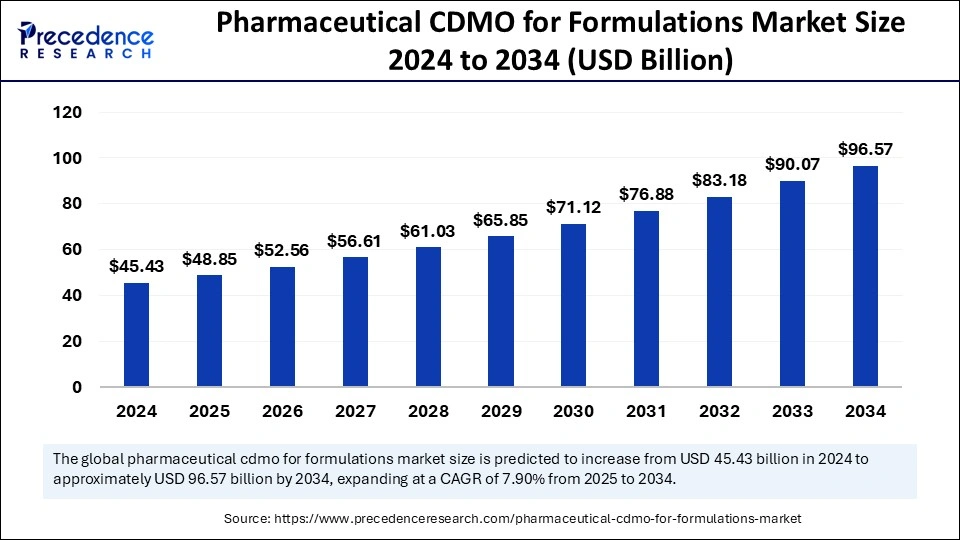

The global pharmaceutical CDMO for formulations market size is predicted to surpass around USD 96.57 billion by 2034, increasing from USD 45.43 billion in 2024, with a CAGR of 7.90%.

Get a Free Sample Copy of the Report@ https://www.precedenceresearch.com/sample/5785

Pharmaceutical CDMO for Formulations Market Key Takeaways

-

Asia Pacific held the largest slice of the market in 2024 with a dominant 42% share.

-

Europe is projected to experience notable growth at a CAGR of 8.40%.

-

Oral solids continue to be the top dosage form, commanding 40% of the market.

-

Injectables are expected to see impressive growth at 8.31% CAGR.

-

Oncology remained the top therapeutic category, representing 23% of the market.

-

Infectious diseases are gaining traction with an 8.02% CAGR outlook.

-

The pharmaceutical companies segment leads the end-user category with a 55% share.

-

Biopharmaceutical firms are on the rise, with forecasted growth at 8.17% CAGR.

Transforming the Future: The Role of AI in the Pharmaceutical CDMO for Formulations Market

Precision Meets Innovation

Artificial Intelligence is revolutionizing how CDMOs approach drug formulation and manufacturing. By leveraging machine learning models and predictive algorithms, AI enables precise formulation design, faster compound screening, and real-time optimization of active pharmaceutical ingredients (APIs). This minimizes trial-and-error, reduces development costs, and accelerates time-to-market — giving pharma companies a competitive edge.

Smart Manufacturing. Smarter Decisions.

From automated quality checks to predictive maintenance, AI-powered systems ensure seamless, high-quality manufacturing with minimal disruptions. AI enhances batch consistency, detects deviations instantly, and streamlines documentation for regulatory compliance. It also empowers CDMOs with advanced forecasting tools, helping them manage supply chains, anticipate demand shifts, and deliver custom solutions at scale.

Pharmaceutical CDMO for Formulations Market Growth Factors

1. Rising Demand for Outsourced Drug Development

Pharmaceutical and biotech companies are increasingly outsourcing formulation and manufacturing processes to CDMOs to reduce costs, accelerate timelines, and focus on core competencies like R&D and marketing. This trend is especially strong among small to mid-sized firms with limited internal infrastructure.

2. Surge in Complex and Personalized Therapies

As the industry shifts toward more complex formulations—including biologics, injectables, and personalized medicines—CDMOs with advanced formulation expertise and adaptable technologies are in high demand. Their ability to manage sophisticated development processes makes them vital partners.

3. Expanding Biopharmaceutical Sector

The biopharma boom has significantly boosted the need for CDMOs with capabilities in sterile manufacturing, high-potency drugs, and large molecule formulations. Biopharma companies rely heavily on specialized CDMOs to manage strict regulatory demands and scale-up requirements.

4. Globalization and Market Expansion

Pharmaceutical companies are expanding into emerging markets, increasing the need for regionally compliant formulations. CDMOs with global manufacturing and regulatory capabilities are well-positioned to support localized product development and distribution.

5. Technological Advancements and AI Integration

The adoption of cutting-edge technologies such as AI, machine learning, and digital twins enhances formulation optimization, predictive analytics, and operational efficiency. These innovations help CDMOs offer faster, more accurate, and cost-effective solutions.

6. Stringent Regulatory Standards and Quality Requirements

Meeting the rising regulatory standards for drug quality, safety, and efficacy is challenging. CDMOs that invest in robust quality systems, GMP compliance, and regulatory support become preferred partners for pharmaceutical companies.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 96.57 Billion |

| Market Size in 2025 | USD 48.85 Billion |

| Market Size in 2024 | USD 45.43 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.90% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | Europe |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Dosage Form, Therapeutic Area, End-User, and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

The growing demand for advanced drug formulations, cost-efficiency in outsourcing, and the rising burden of chronic diseases are fueling market growth. Additionally, increasing R&D investments and faster product approvals are encouraging companies to rely more on CDMO partners.

Opportunities

Emerging markets, personalized medicine, and the rising adoption of AI and automation in drug formulation offer promising opportunities. The trend toward biologics and complex injectables is also expanding the need for specialized CDMO services.

Challenges

Stringent regulatory requirements, intellectual property concerns, and manufacturing scalability issues pose significant challenges. Additionally, supply chain complexities and quality control remain ongoing hurdles for market players.

Regional Outlook

Asia Pacific holds the largest market share, driven by strong manufacturing capabilities, low operational costs, and supportive government policies. Europe is expected to show significant growth due to its robust regulatory environment and increasing focus on biosimilars and complex drugs.

Pharmaceutical CDMO for Formulations Market Companies

- Lonza

- Thermo Fisher Scientific, Inc.

- Recipharm AB

- Laboratory Corporation of America Holdings (LabCorp)

- Catalent, Inc.

- WuXi AppTec, Inc.

- Piramal Pharma Solutions

- Siegfried Holding AG

- CordenPharma International

- Cambrex Corporation

- Bushu Pharmaceuticals Ltd.

- Nipro Corporation

- EuroAPI

- Hovione

- Curia

Latest Announcements by Industry Leaders

- In November 2024, John Rim, Samsung Biologics chief executive, stated that the company feels honored to improve its partnership with European pharmaceutical companies to jointly deliver high-quality biopharmaceutical treatment to patients. The strategic global partnerships invest in its technologies and manufacturing capabilities. We aim to provide the highest quality services at every stage and deepen our trusted partnerships.

Recent Developments

- In October 2023, Cambrex Corporation, centered in High Point, North Carolina (U.S.), finished its expansion project worth USD 38 million. The facility improvement delivered cutting-edge analytical laboratories as well as chemical development laboratories, new clinical production suites, and three work centers with 2,000 L reactors for small-scale commercial manufacturing.

Segments Covered in the Report

By Dosage Form

- Oral Solids

- Oral Liquids

- Injectables

- Topicals

- Inhalation Products

- Transdermal And Patches

- Others

By Therapeutic Area

- Oncology

- Cardiology

- Central Nervous System

- Gastroenterology

- Infectious Diseases

- Endocrinology (Diabetes, Hormonal Therapy)

By End User

- Pharmaceutical Companies

- Biopharmaceutical Companies

- Others

By Region

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

Also Read: CRISPR-Based Gene Editing Market

Ready for more? Dive into the full experience on our website@ https://www.precedenceresearch.com/

- Aerospace Foam Market Expected to Grow to USD 12.78 Billion by 2034 - April 28, 2025

- Football equipment Market Forecasted to Grow to USD 21.21 Billion by 2034 - April 28, 2025

- Metal 3D Printing Market Size to Attain USD 87.33 Billion by 2034 - April 25, 2025