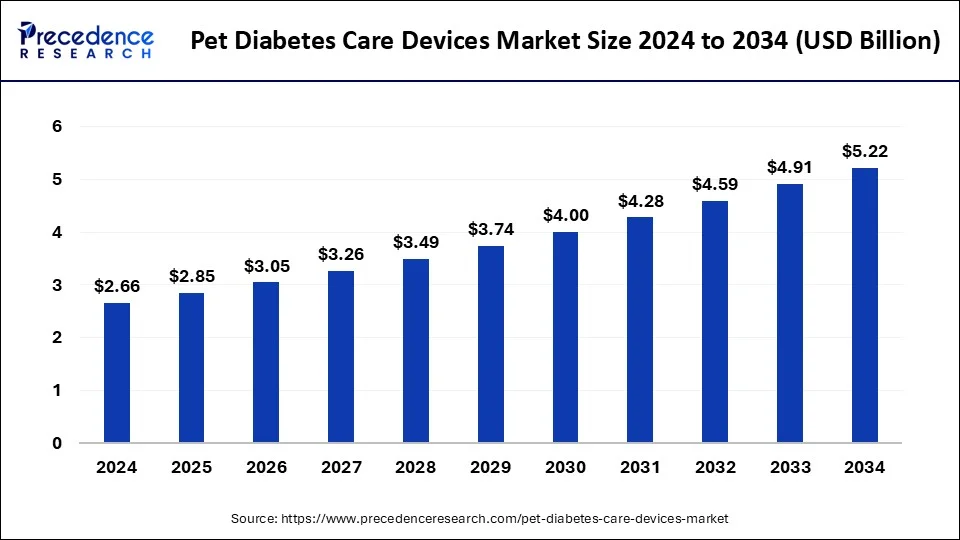

The global pet diabetes care devices market size is anticipated to surpass around USD 4.91 billion by 2033 from USD 2.48 billion in 2023, growing at a CAGR of 7.05% from 2024 to 2033.

The pet diabetes care devices market is witnessing steady growth due to the rising prevalence of diabetes mellitus in companion animals, particularly dogs and cats. Diabetes in pets, like in humans, requires careful management to maintain blood glucose levels within a healthy range and prevent complications. As awareness about pet health increases and veterinary diagnostics and treatments advance, the demand for specialized devices for diabetes management in pets is expected to rise.

Key Points

- North America held the largest market share of 37% in 2023.

- The Asia-Pacific region is observed to witness the fastest rate of expansion during the forecast period.

- By device, the insulin delivery devices segment has contributed more than 93% of the market share in 2023.

- By animal, the dogs segment led the market with the major market share of 55% in 2023.

- By end-users, the veterinary hospitals segment has recorded more than 42% of the market share in 2023.

Growth Factors:

Several factors are contributing to the growth of the pet diabetes care devices market. Firstly, there has been a surge in pet ownership globally, leading to increased spending on pet healthcare products and services. As pets become integral members of families, pet owners are increasingly willing to invest in their well-being, including the management of chronic conditions such as diabetes.

Moreover, advancements in veterinary medicine, including improved diagnostic techniques and treatment options for diabetes in pets, have bolstered the demand for specialized devices. Veterinary clinics and hospitals are investing in state-of-the-art equipment for diabetes monitoring, insulin administration, and glucose testing, driving market growth.

Additionally, the growing awareness about pet health and the importance of early diagnosis and treatment of diabetes is fueling demand for diabetes care devices among pet owners. Veterinary professionals are also playing a crucial role in educating pet owners about diabetes management, thereby increasing the adoption of diabetes care devices in the market.

Furthermore, technological innovations in pet diabetes care devices, such as continuous glucose monitoring systems (CGMS), insulin pumps, and blood glucose meters, are improving the accuracy, convenience, and effectiveness of diabetes management in pets. These advanced devices offer real-time monitoring of blood glucose levels, automated insulin delivery, and data analysis capabilities, enhancing the quality of care for diabetic pets.

Get a Sample: https://www.precedenceresearch.com/sample/3970

Region Insights:

The pet diabetes care devices market is witnessing growth across various regions, with North America and Europe leading in terms of market share. In North America, the United States and Canada have a large pet population and well-established veterinary healthcare infrastructure, driving demand for diabetes care devices. The region’s high disposable income levels and pet humanization trends further support market growth.

In Europe, countries like the United Kingdom, Germany, and France are experiencing a growing prevalence of diabetes in pets, leading to increased adoption of diabetes care devices. The presence of leading veterinary device manufacturers and research institutions focused on pet health innovation also contributes to market expansion in the region.

Asia Pacific is emerging as a lucrative market for pet diabetes care devices, driven by rapid urbanization, rising pet ownership, and increasing awareness about pet health. Countries like China, Japan, and Australia have witnessed significant growth in the pet care industry, creating opportunities for diabetes care device manufacturers to tap into this burgeoning market.

Latin America and the Middle East & Africa regions are also experiencing growth in the pet diabetes care devices market, albeit at a slower pace compared to other regions. Factors such as improving economic conditions, urbanization, and a growing focus on pet health and wellness are expected to drive market growth in these regions in the coming years.

Pet Diabetes Care Devices Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 7.05% |

| Global Market Size in 2023 | USD 2.48 Billion |

| Global Market Size by 2033 | USD 4.91 Billion |

| U.S. Market Size in 2023 | USD 640 Million |

| U.S. Market Size by 2033 | USD 1,270 Million |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Device, By Animal, and By End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Pet Diabetes Care Devices Market Dynamics

Drivers:

Several drivers are driving the growth of the pet diabetes care devices market. Firstly, the rising prevalence of diabetes in pets, attributed to factors such as obesity, genetics, and aging, is fueling demand for diabetes management solutions. As the pet population continues to grow and lifestyles become increasingly sedentary, the incidence of diabetes in pets is expected to rise, driving market growth.

Moreover, the increasing awareness about pet health and the benefits of early diagnosis and treatment of diabetes are driving pet owners to invest in diabetes care devices. Veterinary professionals play a crucial role in educating pet owners about diabetes management, thereby boosting the adoption of diabetes care devices in the market.

Furthermore, technological advancements in pet diabetes care devices, such as CGMS, insulin pumps, and smartphone apps for remote monitoring, are enhancing the accuracy, convenience, and effectiveness of diabetes management in pets. These advanced devices offer pet owners and veterinarians real-time insights into blood glucose levels, enabling personalized treatment and improving outcomes for diabetic pets.

Additionally, the growing trend towards pet humanization, wherein pets are increasingly viewed as family members, is driving demand for high-quality healthcare products and services, including diabetes care devices. Pet owners are willing to invest in advanced medical technologies to ensure the health and well-being of their furry companions, thereby driving market growth.

Furthermore, favorable government initiatives and regulations aimed at promoting pet health and welfare, as well as investments in veterinary healthcare infrastructure, are supporting market growth. Veterinary clinics and hospitals are increasingly equipped with advanced diagnostic and treatment capabilities for managing diabetes in pets, driving demand for diabetes care devices.

Opportunities:

The pet diabetes care devices market presents several opportunities for manufacturers, healthcare providers, and pet owners. Firstly, there is a growing demand for innovative and user-friendly diabetes care devices that offer accurate monitoring and management of blood glucose levels in pets. Manufacturers can capitalize on this opportunity by investing in research and development to develop advanced technologies and improve existing diabetes care devices.

Moreover, there is a need for increased awareness and education about diabetes management in pets among pet owners and veterinary professionals. Manufacturers can collaborate with veterinarians and pet advocacy organizations to raise awareness about the importance of regular monitoring, proper nutrition, and medication adherence for diabetic pets, thereby expanding their market reach.

Additionally, there is a growing trend towards personalized medicine in veterinary care, wherein treatments are tailored to individual pets based on their specific needs and medical history. Manufacturers can develop customizable diabetes care devices that offer personalized treatment plans and remote monitoring capabilities, catering to the evolving needs of pet owners and veterinarians.

Furthermore, there is a significant opportunity for market expansion in emerging markets with a growing pet population and increasing disposable income levels. Manufacturers can tap into these markets by offering affordable and accessible diabetes care devices, adapting their products to local preferences and regulatory requirements, and establishing partnerships with local distributors and veterinary clinics.

Moreover, there is a need for integrated healthcare solutions that combine diabetes care devices with other pet health monitoring technologies, such as activity trackers, nutrition sensors, and telemedicine platforms. Manufacturers can develop holistic pet health management platforms that provide comprehensive insights into a pet’s health status and facilitate proactive healthcare management, thereby enhancing the value proposition of diabetes care devices.

Challenges:

Despite the growth opportunities, the pet diabetes care devices market faces several challenges that need to be addressed. Firstly, there is a lack of standardized guidelines and protocols for diabetes management in pets, leading to variability in treatment approaches and device usage among veterinary professionals. Manufacturers need to collaborate with veterinarians and regulatory authorities to establish standardized protocols and best practices for diabetes care, ensuring the safe and effective use of diabetes care devices.

Moreover, cost considerations remain a significant barrier to adoption for some pet owners, particularly in emerging markets with limited access to affordable healthcare services. Manufacturers need to develop cost-effective diabetes care devices that offer value for money without compromising on quality and performance, thereby expanding market penetration and addressing unmet needs.

Additionally, there is a need for ongoing education and training for pet owners and veterinary professionals on the proper use and maintenance of diabetes care devices. Manufacturers can invest in educational initiatives, such as workshops, webinars, and informational materials, to empower pet owners and veterinarians with the knowledge and skills needed to effectively manage diabetes in pets using diabetes care devices.

Furthermore, regulatory compliance and product safety are paramount concerns in the pet healthcare industry, given the potential risks associated with medical devices. Manufacturers need to ensure that their diabetes care devices comply with regulatory requirements and undergo rigorous testing and quality assurance processes to guarantee safety, reliability, and efficacy.

Read Also: Vibration Sensor Market Size to Rise USD 12.44 Bn by 2033

Recent Developments

- In November 2023, Boehringer Ingelheim got approval for SENVELGO® in Europe. This is the first oral liquid medication available for diabetic cats, and it represents a significant advancement in treating feline diabetes in Europe. SENVELGO® can be given to cats once a day, either mixed with a small amount of food or directly administered into their mouth.

- In May 2023, UBI introduced the Petrackr, a diabetes monitoring device for pets. The product consists of a device and single-use test strips for collecting a small drop of blood sample and a hand-held monitor that can supervise multiple profiles of pets. The device accurately tracks, monitors, and displays the blood glucose levels of pets. The product has distribution partnerships in the United States and Canada.

- In Feb 2023, ALRT, a Singapore-based medical device company, launched GluCurve Pet CGM. It is a continuous monitoring device for diabetic cats and dogs produced in collaboration with Covetrus. It is designed to make diabetes management more effortless.

Pet Diabetes Care Devices Market Companies

- Merck animal health

- Becton

- Fitbark

- TaiDoc

- Dickinson

- Allison Medical

- Henry Schein

- Zoetis

- Ulticare

- Boehringer Ingelheim Vetmedica Inc.

- IDEXX Laboratories

- Johnson & Johnson Services, Inc

- Novo Nordisk

- Eli Lilly and Company

- Vetoquinol S.A.

Segments Covered in the Report

By Device

- Glucose Monitoring Devices

- Insulin Delivery Devices

- Insulin Delivery Pen

- Insulin Delivery Syringes

By Animal

- Dogs

- Cats

- Horses

By End-use

- Veterinary Clinics

- Home Care Settings

- Veterinary Hospitals

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/

- Intelligent Traffic Management System Market Size, Trends, Report 2034 - July 17, 2024

- Healthcare Finance Solutions Market Size to Grow USD 293.12 Bn by 2034 - July 17, 2024

- Epoxy Composites Market Size to Grow USD 84.99 Bn by 2034 - July 17, 2024