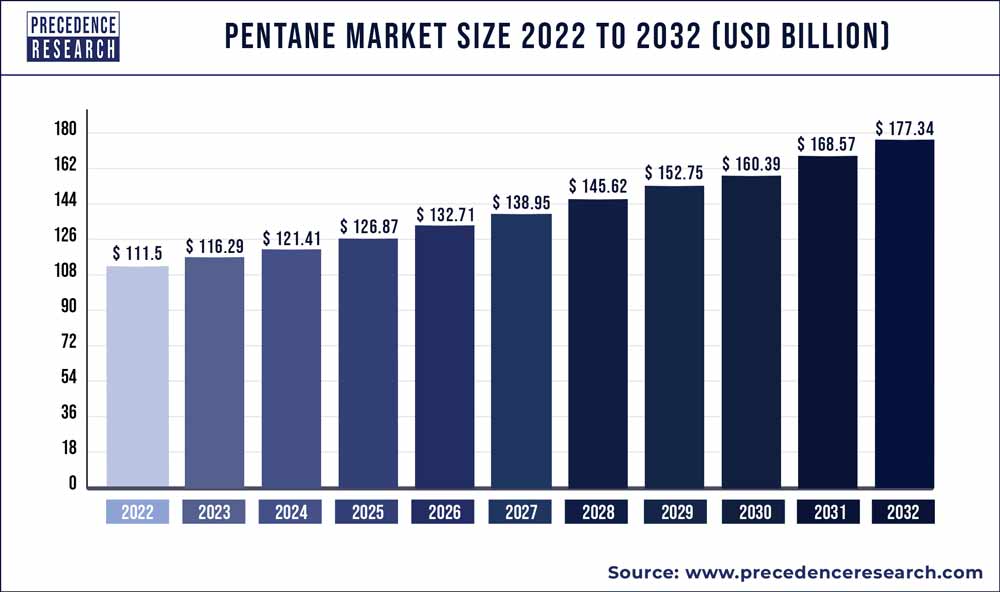

The global pentane market size is expected to hit around USD 177.34 billion by 2032 from USD 116.29 billion in 2023poised to grow at a CAGR of 4.80% during the forecast period from 2023 to 2032.

Key Takeaways

- North America contributed more than 41% of revenue share in 2022.

- Europe is estimated to expand the fastest CAGR between 2023 and 2032.

- By type, the n-Pentane segment has held the largest market share of 43% in 2022.

- By type, the neopentane segment is anticipated to grow at a remarkable CAGR of 5.4% between 2023 and 2032.

- By application, the blowing agent segment generated over 32% of revenue share in 2022.

- By application, the electric cleansing segment is expected to expand at the fastest CAGR over the projected period.

The Pentane market is experiencing a dynamic phase marked by significant growth and evolving trends. Pentane, a hydrocarbon with multiple isomers, plays a pivotal role in various industries, including the production of blowing agents for foam manufacturing, refrigerants, and as a solvent. The market is driven by its versatile applications and the expanding demand across diverse sectors.

Drivers

Several factors contribute to the robust growth of the Pentane market. The increasing demand for foam-blowing agents in the construction and automotive industries is a key driver, fueled by a growing emphasis on energy-efficient and lightweight materials. Additionally, the adoption of Pentane as a refrigerant in response to environmental regulations phasing out ozone-depleting substances further propels market growth. Emerging economies’ industrial expansion and a surge in disposable income also contribute to the escalating demand for Pentane-based products.

Get a Sample: https://www.precedenceresearch.com/sample/3546

Opportunities in the Pentane Market:

The pentane market presents numerous opportunities driven by its versatile applications. One significant avenue lies in the expanding demand for pentane as a blowing agent in the production of foam products. With the global emphasis on sustainable and energy-efficient construction materials, pentane’s role in manufacturing lightweight and insulating foams positions it at the forefront of market growth. Additionally, the automotive industry’s increasing use of pentane as a solvent for adhesives and sealants reflects a growing opportunity, driven by the automotive sector’s perpetual quest for more environmentally friendly and efficient solutions.

Challenges in the Pentane Market:

Despite its promising prospects, the pentane market is not without its challenges. One notable hurdle stems from the volatility of raw material prices, particularly crude oil, which directly impacts the production costs of pentane. Fluctuations in these prices can pose challenges for manufacturers in maintaining stable profit margins. Furthermore, environmental concerns surrounding volatile organic compounds (VOCs) emitted during pentane use present regulatory challenges. Stricter emissions regulations may lead to the need for innovative solutions and alternative products, requiring market players to invest in research and development to stay compliant and sustainable in the long run.

Region Snapshot

Geographically, the Pentane market exhibits a varied landscape influenced by regional industrialization and economic factors. Asia-Pacific stands out as a prominent region, driven by the rapid industrial growth in countries like China and India. North America and Europe follow suit, with a focus on sustainable practices and stringent regulations shaping the market dynamics. As global industries continue to integrate Pentane into their processes, the market’s regional nuances become increasingly vital for stakeholders navigating this dynamic landscape.

Read More: Metaverse in Medical Training Market Size, Trend , Report 2032

Recent Developments

- In July 2021, Haltermann Carless, a trailblazing global provider of premium hydrocarbon solutions for various sectors including mobility, life sciences, industry, and energy, successfully concluded the construction of its state-of-the-art hydrogenation facility located at the Speyer site. This achievement is poised to significantly bolster the cyclopentane and cyclopentane blends industry in Germany.

Pentane Market Players

- ExxonMobil

- Royal Dutch Shell

- Chevron Phillips Chemical Company

- Phillips 66

- LyondellBasell

- Maruzen Petrochemical Co., Ltd.

- Bharat Petroleum Corporation Limited

- LG Chem

- INEOS Group

- JX Nippon Oil & Energy Corporation

- SK Innovation

- Haltermann Carless

- HCS Group

- TOP Solvent Co., Ltd.

- Ganga Rasayanie (P) Ltd.

Segments Covered in the Report

By Type

- n-Pentane

- Isopentane

- Neopentane

By Application

- Blowing agent

- Chemical solvent

- Electronic cleansing

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Table of Content

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology (Premium Insights)

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Pentane Market

5.1. COVID-19 Landscape: Pentane Industry Impact

5.2. COVID 19 – Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Pentane Market, By Type

8.1. Pentane Market Revenue and Volume, by Type, 2023-2032

8.1.1. n-Pentane

8.1.1.1. Market Revenue and Volume Forecast (2020-2032)

8.1.2. Isopentane

8.1.2.1. Market Revenue and Volume Forecast (2020-2032)

8.1.3. Neopentane

8.1.3.1. Market Revenue and Volume Forecast (2020-2032)

Chapter 9. Global Pentane Market, By Application

9.1. Pentane Market Revenue and Volume, by Application, 2023-2032

9.1.1. Blowing agent

9.1.1.1. Market Revenue and Volume Forecast (2020-2032)

9.1.2. Chemical solvent

9.1.2.1. Market Revenue and Volume Forecast (2020-2032)

9.1.3. Electronic cleansing

9.1.3.1. Market Revenue and Volume Forecast (2020-2032)

9.1.4. Others

9.1.4.1. Market Revenue and Volume Forecast (2020-2032)

Chapter 10. Global Pentane Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Volume Forecast, by Type (2020-2032)

10.1.2. Market Revenue and Volume Forecast, by Application (2020-2032)

10.1.3. U.S.

10.1.3.1. Market Revenue and Volume Forecast, by Type (2020-2032)

10.1.3.2. Market Revenue and Volume Forecast, by Application (2020-2032)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Volume Forecast, by Type (2020-2032)

10.1.4.2. Market Revenue and Volume Forecast, by Application (2020-2032)

10.2. Europe

10.2.1. Market Revenue and Volume Forecast, by Type (2020-2032)

10.2.2. Market Revenue and Volume Forecast, by Application (2020-2032)

10.2.3. UK

10.2.3.1. Market Revenue and Volume Forecast, by Type (2020-2032)

10.2.3.2. Market Revenue and Volume Forecast, by Application (2020-2032)

10.2.4. Germany

10.2.4.1. Market Revenue and Volume Forecast, by Type (2020-2032)

10.2.4.2. Market Revenue and Volume Forecast, by Application (2020-2032)

10.2.5. France

10.2.5.1. Market Revenue and Volume Forecast, by Type (2020-2032)

10.2.5.2. Market Revenue and Volume Forecast, by Application (2020-2032)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Volume Forecast, by Type (2020-2032)

10.2.6.2. Market Revenue and Volume Forecast, by Application (2020-2032)

10.3. APAC

10.3.1. Market Revenue and Volume Forecast, by Type (2020-2032)

10.3.2. Market Revenue and Volume Forecast, by Application (2020-2032)

10.3.3. India

10.3.3.1. Market Revenue and Volume Forecast, by Type (2020-2032)

10.3.3.2. Market Revenue and Volume Forecast, by Application (2020-2032)

10.3.4. China

10.3.4.1. Market Revenue and Volume Forecast, by Type (2020-2032)

10.3.4.2. Market Revenue and Volume Forecast, by Application (2020-2032)

10.3.5. Japan

10.3.5.1. Market Revenue and Volume Forecast, by Type (2020-2032)

10.3.5.2. Market Revenue and Volume Forecast, by Application (2020-2032)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Volume Forecast, by Type (2020-2032)

10.3.6.2. Market Revenue and Volume Forecast, by Application (2020-2032)

10.4. MEA

10.4.1. Market Revenue and Volume Forecast, by Type (2020-2032)

10.4.2. Market Revenue and Volume Forecast, by Application (2020-2032)

10.4.3. GCC

10.4.3.1. Market Revenue and Volume Forecast, by Type (2020-2032)

10.4.3.2. Market Revenue and Volume Forecast, by Application (2020-2032)

10.4.4. North Africa

10.4.4.1. Market Revenue and Volume Forecast, by Type (2020-2032)

10.4.4.2. Market Revenue and Volume Forecast, by Application (2020-2032)

10.4.5. South Africa

10.4.5.1. Market Revenue and Volume Forecast, by Type (2020-2032)

10.4.5.2. Market Revenue and Volume Forecast, by Application (2020-2032)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Volume Forecast, by Type (2020-2032)

10.4.6.2. Market Revenue and Volume Forecast, by Application (2020-2032)

10.5. Latin America

10.5.1. Market Revenue and Volume Forecast, by Type (2020-2032)

10.5.2. Market Revenue and Volume Forecast, by Application (2020-2032)

10.5.3. Brazil

10.5.3.1. Market Revenue and Volume Forecast, by Type (2020-2032)

10.5.3.2. Market Revenue and Volume Forecast, by Application (2020-2032)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Volume Forecast, by Type (2020-2032)

10.5.4.2. Market Revenue and Volume Forecast, by Application (2020-2032)

Chapter 11. Company Profiles

11.1. ExxonMobil

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Royal Dutch Shell

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Chevron Phillips Chemical Company

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Phillips 66

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. Recent Initiatives

11.5. LyondellBasell

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Maruzen Petrochemical Co., Ltd.

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Bharat Petroleum Corporation Limited

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. LG Chem

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. INEOS Group

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. JX Nippon Oil & Energy Corporation

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

- Photodynamic Therapy Market Size to Rake USD 8.42 Bn by 2033 - February 5, 2024

- Image Recognition Market Size to Attain USD 166.01 Bn by 2033 - February 5, 2024

- Hydrogen Storage Tanks and Transportation Market Report 2033 - February 5, 2024