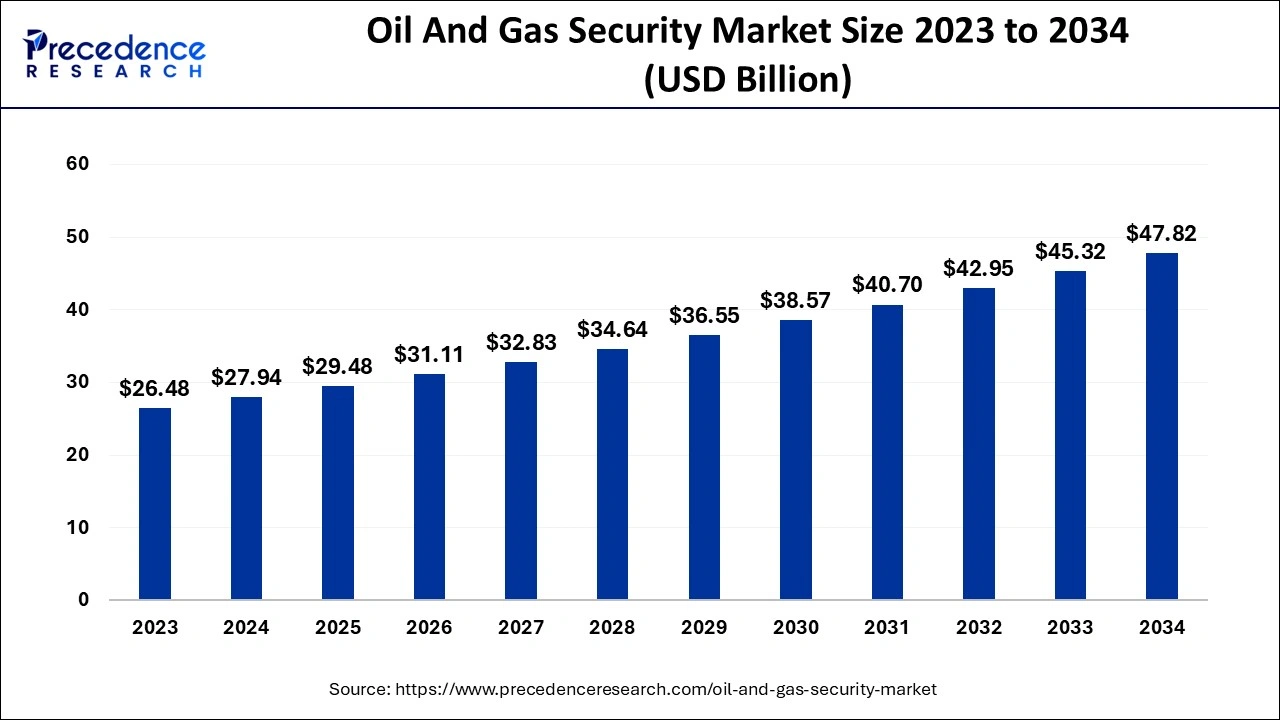

The global oil and gas security market size reached USD 27.94 billion in 2024 and is predicted to be Cross around USD 47.82 billion by 2034, growing at a CAGR of 5.52% from 2024 to 2034

Key Points

- North America dominated the oil and gas security market with the largest market share of 34% in 2023.

- Asia Pacific is expected to witness the fastest growth in the market during the studied period.

- By component, the hardware segment contributed the biggest market share of 52% in 2023.

- By component, the services segment will show significant growth in the market over the forecast period.

- By end use, the oil and gas companies segment generated the highest market share of 36% in 2023.

- By end use, the pipeline operators segment is expected to grow at the fastest rate in the market over the projected period.

The oil and gas security market plays a critical role in safeguarding assets and infrastructure across the upstream, midstream, and downstream sectors. This market encompasses a wide range of solutions, including physical security, network security, and risk management systems, aimed at protecting facilities, pipelines, and data from cyber and physical threats. As the oil and gas industry becomes more digitized and interconnected, the need for robust security measures has intensified. In recent years, high-profile cyberattacks and geopolitical tensions have underscored the vulnerabilities within this sector, driving investment in advanced security technologies.

Sample:https://www.precedenceresearch.com/sample/5220

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 47.82 Billion |

| Market Size in 2024 | USD 27.94 Billion |

| Market Size in 2025 | USD 29.48 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 5.52% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Component, End user, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East, & Africa |

Market Drivers

Several factors drive the growth of the oil and gas security market. Chief among them is the increasing frequency and sophistication of cyberattacks targeting critical energy infrastructure. The adoption of Industrial Internet of Things (IIoT) technologies has expanded the attack surface, making real-time monitoring and cybersecurity a necessity. Additionally, stringent regulatory requirements and industry standards compel companies to implement comprehensive security measures. Geopolitical instability and terrorism threats further necessitate enhanced security for critical oil and gas infrastructure, boosting demand for integrated security solutions.

Opportunities

The market offers significant growth opportunities, particularly with the advent of advanced technologies such as artificial intelligence (AI), machine learning (ML), and blockchain. These technologies enhance threat detection, response times, and predictive analytics, providing a more proactive approach to security. The rise of smart oil fields and digital twins also presents opportunities for security vendors to integrate their solutions into new digital ecosystems. Moreover, emerging markets in Asia-Pacific, Africa, and Latin America are increasingly investing in oil and gas infrastructure, creating demand for localized security solutions tailored to specific regional risks.

Challenges

Despite the growth potential, the oil and gas security market faces several challenges. High implementation costs and the complexity of integrating new security solutions with existing legacy systems can be a barrier for many organizations. Additionally, the sector suffers from a shortage of skilled cybersecurity professionals, which hampers the effective deployment and management of advanced security systems. Resistance to change and low awareness about the importance of cybersecurity in certain regions or segments of the industry further compound these challenges.

Regional Insights

North America leads the market, driven by extensive oil and gas operations, advanced technological adoption, and a strong regulatory framework. The Middle East follows closely, given its status as a major hub for oil and gas production, coupled with heightened geopolitical risks. Europe is also a significant market, driven by stringent regulations and investments in renewable and traditional energy sectors. Meanwhile, the Asia-Pacific region is expected to witness the fastest growth, fueled by rapid industrialization, urbanization, and increasing energy demand. Africa and Latin America, although smaller markets, offer untapped potential due to ongoing infrastructure development and exploration activities.

Read Also: Stationery Products Market Size to hit USD 180.65 Bn By 2034

Oil And Gas Security Market Companies

- ABB Ltd.

- Cisco Systems Inc.

- Honeywell International Inc.

- Schneider Electric SE

- Siemens AG

- Waterfall Security Solutions Ltd.

- Parsons Corporation

- P2 Energy Solutions

- KBR, Inc.

- DuPont de Nemours, Inc.

- Huawei Technologies Co., Ltd.

- Shell Catalysts & Technology

- Baker Hughes Company

- Halliburton Company

- Symantec Corporation

Recent News

- In August 2024, SLB and Palo Alto Networks declared an expansion of their partnership aimed at improving cybersecurity within the energy sector. The partnership seeks to boost SLB’s security infrastructure and develop innovative solutions to address emerging cyber threats.

- In July 2024, Accenture acquired True North Solutions, a U.S.-based provider of industrial engineering solutions, to improve its capabilities in helping clients in the oil, gas, and mining sectors produce and transport energy more safely and efficiently.

Segments Covered in the Report

By Component

- Hardware

- Software

- Services

By End user

- Oil and Gas Companies

- Pipeline Operators

- Drilling Contractors

- Energy Infrastructure Providers

- Third-party Security Providers

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

Web:https://www.precedenceresearch.com/

- Perishable Prepared Food Market Size to Attain USD 157.77 Bn by 2034 - April 24, 2025

- Fabric Filter Market Size to Attain USD 7.50 Billion by 2034 - April 24, 2025

- Pilot Training Market Size to Attain USD 31.38 Bn by 2034 - April 24, 2025