The non-alcoholic beverages market has experienced significant growth and transformation in recent years, driven by shifting consumer preferences towards healthier lifestyles, increased awareness about the harmful effects of excessive alcohol consumption, and the growing demand for innovative and flavorful beverage options. Non-alcoholic beverages encompass a wide range of products, including carbonated soft drinks, fruit juices, energy drinks, ready-to-drink tea and coffee, functional beverages, and non-alcoholic beer and wine alternatives. This market segment continues to evolve rapidly, with companies continually introducing new products, flavors, and formulations to meet the diverse preferences of consumers globally.

Key Points

- North America held the largest share of the market in 2023.

- Asia Pacific is projected to expand at the fastest rate during the forecast period of 2024-2033.

- By product, the functional beverages segment held the largest share of the market in 2023.

- By product, the sparkling water and seltzers segment is expected to show the fastest growth.

- By distribution, the online platforms segment held the dominating share of the market in 2023.

- By distribution, the direct-to-consumer channels segment represents another highly influential segment for the forecast period.

- By end-user, the health-conscious consumer segment held the dominating share of the market in 2023.

- By end-user, the fitness enthusiasts segment is expected to witness a significant rate of expansion during the forecast period.

Get a Sample: https://www.precedenceresearch.com/sample/3858

Growth Factors

Several key factors have contributed to the growth of the non-alcoholic beverages market. One of the primary drivers is the rising health consciousness among consumers, leading to a shift away from sugary and alcoholic beverages towards healthier alternatives. Increasing awareness about the detrimental effects of excessive sugar and alcohol consumption on health has prompted consumers to seek out beverages that offer nutritional benefits, such as natural fruit juices, herbal teas, and functional beverages fortified with vitamins, minerals, and botanical extracts.

Moreover, changing demographics and lifestyles, particularly among younger consumers, have fueled the demand for convenient and on-the-go beverage options. Busy lifestyles, urbanization, and a growing preference for healthier refreshments have boosted the sales of ready-to-drink beverages, bottled water, and low-calorie soft drinks. Additionally, the rise of e-commerce platforms and online grocery delivery services has made it easier for consumers to access a wide variety of non-alcoholic beverages, further driving market growth.

Furthermore, the increasing focus on sustainability and environmental responsibility has led to a surge in demand for eco-friendly packaging materials and manufacturing practices within the non-alcoholic beverages industry. Companies are investing in recyclable packaging, reducing their carbon footprint, and adopting sustainable sourcing methods to appeal to environmentally conscious consumers and comply with regulatory standards.

Trends:

Several notable trends are shaping the non-alcoholic beverages market landscape. One prominent trend is the growing popularity of plant-based and functional beverages. Consumers are seeking out beverages made from natural ingredients, such as plant-based milk alternatives (e.g., almond milk, oat milk) and functional drinks infused with herbs, spices, and adaptogens known for their health benefits. This trend is driven by the desire for cleaner labels and products that align with specific dietary preferences, such as vegan, gluten-free, and paleo diets.

Another trend is the increasing demand for premium and artisanal beverages. Consumers are willing to pay a premium for high-quality, artisan-crafted beverages that offer unique flavors, superior ingredients, and authentic production methods. This trend reflects a shift towards experiential consumption, where consumers value the story behind the product and seek out elevated drinking experiences that go beyond basic hydration.

Additionally, the rise of “better-for-you” beverages, which prioritize health and wellness without compromising on taste, is gaining momentum in the market. These beverages may be low in sugar, fortified with vitamins and antioxidants, or formulated with functional ingredients like probiotics and collagen to support digestive health and skincare.

Non-Alcoholic Beverages Market Scope

| Report Coverage | Details |

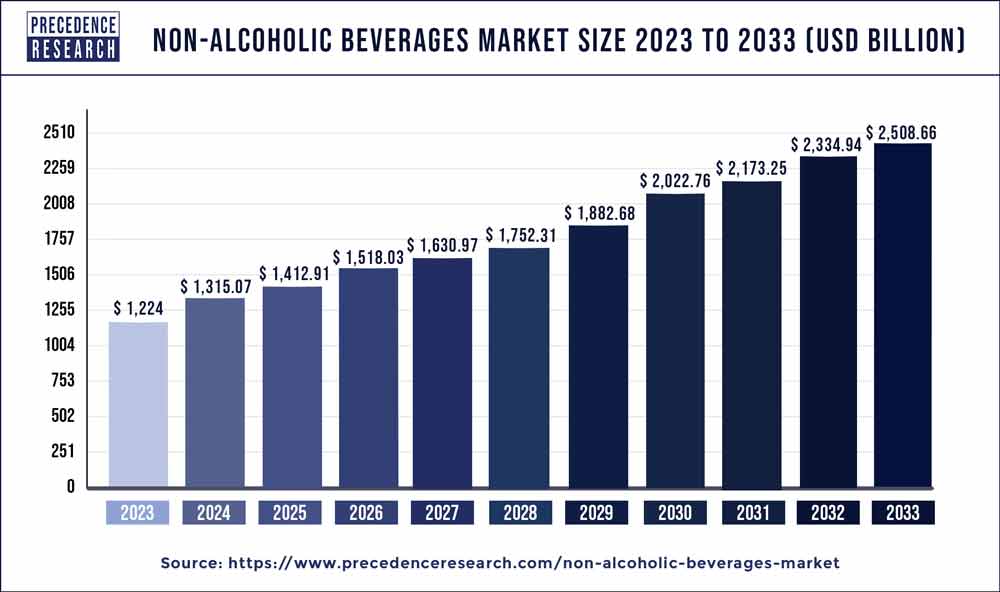

| Growth Rate from 2024 to 2033 | CAGR of 7.44% |

| Global Market Size in 2023 | USD 1,224 Billion |

| Global Market Size by 2033 | USD 2,508.66 Billion |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Product, By Distribution, and By End-user |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

SWOT Analysis

Strengths:

- Wide variety of product offerings catering to diverse consumer preferences

- Strong brand recognition and marketing efforts by leading beverage companies

- Increasing consumer awareness about the health benefits of non-alcoholic beverages

- Growing availability of non-alcoholic options in restaurants, cafes, and retail outlets

Weaknesses:

- Potential health concerns associated with artificial sweeteners and additives in some beverages

- Competition from other beverage categories, such as alcoholic beverages and water

- Price sensitivity among certain consumer segments, limiting the adoption of premium products

- Regulatory challenges related to labeling, marketing, and ingredient sourcing

Opportunities:

- Expansion into emerging markets with growing middle-class populations and rising disposable incomes

- Innovation in product development, including new flavors, formulations, and packaging solutions

- Strategic partnerships with retailers, restaurants, and hospitality chains to expand distribution channels

- Leveraging digital marketing and e-commerce platforms to reach a broader audience of consumers

Threats:

- Intense competition from both traditional beverage companies and new entrants into the market

- Fluctuations in raw material prices, supply chain disruptions, and geopolitical uncertainties

- Health and wellness trends shifting consumer preferences away from certain beverage categories

- Increased scrutiny and regulation of sugar content, labeling claims, and marketing practices

Recent Developments

- In January 2024, Svami unveiled two new non-alcoholic beverages. 2 Cal Cola offers a sugar-free, keto-friendly option, while Svami Salted Lemonade provides a refreshing twist with low sugar and natural lemons.

- In January 2023, AB InBev Brands reported double-digit growth in their no-alcohol beverage range, targeting diverse consumer needs. Fusion, an energy drink, seamlessly integrates into lifestyles, offering refreshment, energy, and hydration.

Competitive Landscape:

The non-alcoholic beverages market is highly competitive, with numerous global and regional players vying for market share. Leading multinational companies, such as The Coca-Cola Company, PepsiCo, and Nestlé, dominate the market with extensive product portfolios, strong brand equity, and widespread distribution networks. These companies continually invest in research and development to innovate new products, enhance existing formulations, and stay ahead of changing consumer preferences.

In addition to the major players, there is a growing presence of niche and specialty beverage brands catering to specific consumer segments and preferences. These smaller companies often focus on artisanal, organic, or locally sourced ingredients to differentiate themselves in the market and appeal to discerning consumers seeking unique flavor experiences and healthier options.

Furthermore, the non-alcoholic beverages market is witnessing increased competition from non-traditional players, including startups and disruptors leveraging technology and novel business models to enter the industry. These companies often prioritize sustainability, transparency, and ethical sourcing practices to attract environmentally conscious consumers and differentiate themselves in a crowded market landscape.

Non-Alcoholic Beverages Market Companies

- PepsiCo, Inc.

- The Coca-Cola Company

- Danone S.A.

- Nestlé S.A.

- Red Bull GmbH

Segments Covered by the Report

By Product

- Carbonated soft drinks

- Bottled water

- Fruit juices and nectars

- Functional beverages

- Sports and energy drinks

- Ready-to-drink (RTD) tea and coffee

- Dairy and dairy alternatives

- Non-alcoholic beers and wines

- Sparkling water and seltzers

- Mixers and syrups

By Distribution

- Retail Stores

- Online Platforms

- Convenience Stores

- Supermarkets

- Specialty Stores

- Food Service Outlets

- Hospitality Industry

- Direct-to-Consumer Channels

- Beverage Vending Machines

- Institutional Sales (Schools, Offices, etc.)

By End-user

- General Consumers

- Fitness Enthusiasts

- Health-conscious Individuals

- Athletes and Sports Professionals

- Children and Teens

- Pregnant Women

- Designated Drivers

- Individuals in Recovery

- Seniors

- Professionals (e.g., at work, during meetings)

- Social Gatherings and Events

- Religious and Cultural Communities

- Individuals with Dietary Restrictions

- Wellness Retreats and Spas

- Hospitality and Catering Industry

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

- Intelligent Traffic Management System Market Size, Trends, Report 2034 - July 17, 2024

- Healthcare Finance Solutions Market Size to Grow USD 293.12 Bn by 2034 - July 17, 2024

- Epoxy Composites Market Size to Grow USD 84.99 Bn by 2034 - July 17, 2024