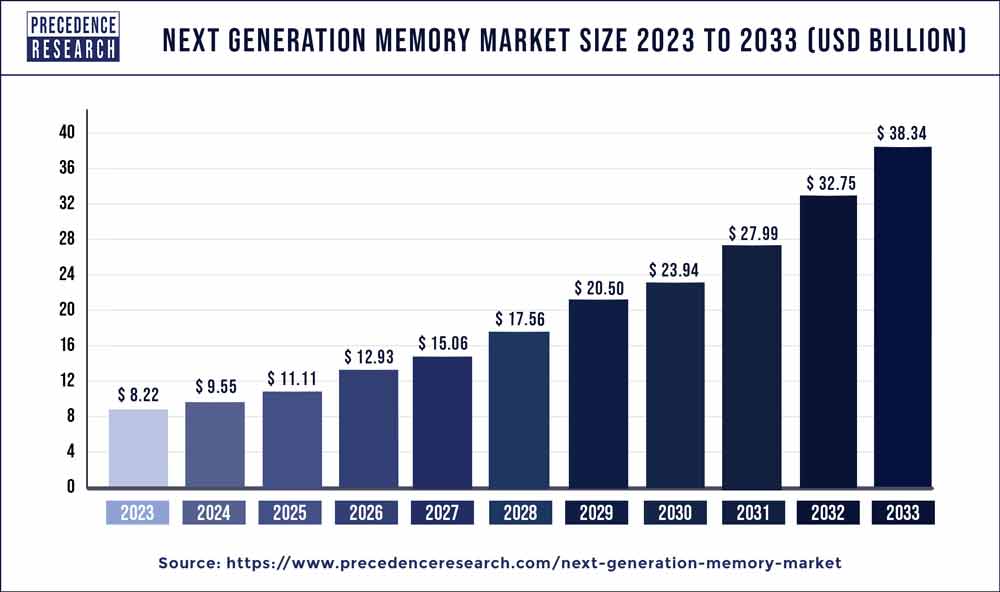

The global next generation memory market size is projected to be worth around USD 38.34 billion by 2033, representing a significant CAGR of 16.70% from 2024 to 2033.

Introduction:

The Next Generation Memory Market has emerged as a pivotal force in the ever-evolving landscape of technology, catering to the insatiable demand for faster, more efficient, and high-capacity memory solutions. As traditional memory technologies face limitations, the next generation of memory solutions promises to redefine the boundaries of computing capabilities. This market is characterized by a dynamic interplay of various factors, including technological advancements, increasing data-centric applications, and the relentless pursuit of enhanced performance across industries.

Key Takeaways

- Asia-Pacific held the largest share of 51% in 2023.

- North America is expected to grow at a CAGR of 25.1% during the forecast period.

- By technology, the non-volatile memory segment held the largest share of 76% in 2023.

- By wafer size, the 300mm segment held the largest share of 61% of the market in 2023.

- By wafer size, the 200mm segment is expected to grow at a significant rate during the forecast period.

- By application, the BFSI segment held the largest share of the market by contributing 32% in 2023.

Growth Factors

The growth of the Next Generation Memory Market is propelled by several key factors. Firstly, the incessant need for higher data transfer speeds and lower latency in applications such as artificial intelligence, big data analytics, and the Internet of Things (IoT) is a significant driver. Additionally, the growing demand for non-volatile memory solutions with lower power consumption and higher endurance has spurred the development of next-generation memory technologies like resistive random-access memory (RRAM) and phase-change memory (PCM).

Get a Sample: https://www.precedenceresearch.com/sample/3747

Next Generation Memory Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 16.70% |

| Global Market Size in 2023 | USD 8.22 Billion |

| Global Market Size by 2033 | USD 38.34 Billion |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Technology, By Wafer Size, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Trends

Trends in the Next Generation Memory Market are shaping the industry’s trajectory. One notable trend is the increasing adoption of 3D NAND technology, offering higher storage capacity in a smaller footprint. Moreover, the integration of advanced technologies like 5G and edge computing is driving the demand for memory solutions capable of handling the massive influx of data generated by these technologies.

Opportunities

The market presents promising opportunities as it continues to evolve. The proliferation of connected devices and the rising trend of edge computing create a fertile ground for the deployment of next-generation memory solutions. Moreover, the advent of neuromorphic computing and in-memory computing architectures opens up new avenues for innovative memory technologies to address the unique requirements of these emerging computing paradigms.

Restraints

Despite the immense potential, the Next Generation Memory Market faces certain restraints. Challenges in terms of manufacturing complexities and high initial costs hinder widespread adoption. Compatibility issues with existing infrastructure and the need for standardization pose additional challenges, limiting the seamless integration of next-generation memory technologies into existing systems.

Region Insights:

The market’s landscape varies across regions due to factors such as technological advancements, infrastructure development, and economic conditions. In developed regions like North America and Europe, the focus is on research and development, fostering innovation in next-generation memory technologies. Meanwhile, in emerging economies of Asia-Pacific, the market is driven by the rapid expansion of the electronics and IT industries, coupled with increasing investments in advanced technologies.

Read Also: Internet Data Center Market Size to Reach USD 138.80 Bn by 2033

Competitive Landscape:

The competitive landscape of the Next Generation Memory Market is marked by intense rivalry among key players striving to gain a competitive edge. Established companies and new entrants alike are investing heavily in research and development to introduce cutting-edge memory solutions. Collaboration and strategic partnerships are becoming commonplace as companies aim to leverage each other’s strengths in this dynamic market. Notable players in the market include industry giants like Samsung Electronics, Micron Technology, and SK Hynix, among others.

Next Generation Memory Market Companies

- Micron Technology, Inc. (United States)

- Samsung Electronics Co., Ltd. (South Korea)

- SK Hynix Inc. (South Korea)

- Intel Corporation (United States)

- Western Digital Corporation (United States)

- Toshiba Memory Corporation (Japan)

- Fujitsu Ltd. (Japan)

- Adesto Technologies Corporation (United States)

- Crossbar Inc. (United States)

- Everspin Technologies Inc. (United States)

- Viking Technology (United States)

- Avalanche Technology Inc. (United States)

- Spin Memory Inc. (United States)

- Nantero Inc. (United States)

- Cypress Semiconductor Corporation (United States

Recent Developments

- In April 2023, SK Hynix Inc. of South Korea achieved a significant industry milestone by developing a 12-layer HBM31 product with a memory capacity of 24 gigabytes (GB), marking the largest capacity in the industry. This achievement represented a 50% increase in memory capacity compared to the previous product, following the company’s mass production of the world’s first HBM3 in June 2022.

- In May 2022, Everspin Technologies Inc. based in the United States introduced the STT-MRAM EMxxLX xSPI Family, featuring densities ranging from 8 Mbit up to 64 Mbit.

- In March 2022, Fujitsu Semiconductor Memory Solution Limited in Japan launched a 12Mbit ReRAM (Resistive Random Access Memory) known as MB85AS12MT, representing the highest density in Fujitsu’s ReRAM product family. The MB85AS12MT is a non-volatile memory with a 12Mbit memory density and operates within a wide power supply voltage range from 1.6V to 3.6V.

Segments Covered in the Report

By Technology

- Non-volatile Memory

- Volatile Memory

By Wafer Size

- 200 mm

- 300 mm

By Application

- Consumer Electronics

- Enterprise Storage

- Automotive & Transportation

- Military & Aerospace

- Industrial

- Telecommunications

- Energy & Power

- Healthcare

- Agricultural

- Retail

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/

- Intelligent Traffic Management System Market Size, Trends, Report 2034 - July 17, 2024

- Healthcare Finance Solutions Market Size to Grow USD 293.12 Bn by 2034 - July 17, 2024

- Epoxy Composites Market Size to Grow USD 84.99 Bn by 2034 - July 17, 2024