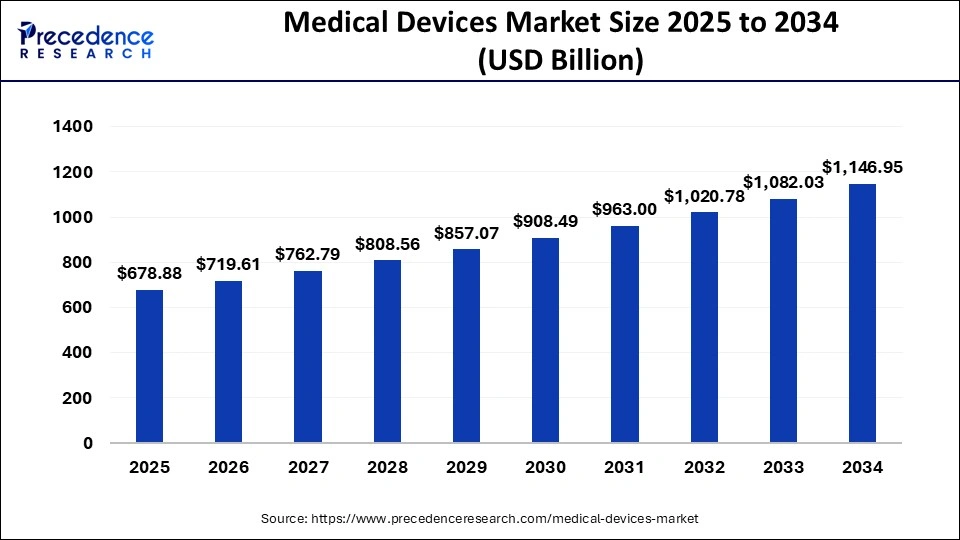

The global medical devices market size accounted for USD 640.45 billion in 2024 and is expected to worth around USD 1,146.95 billion by 2034, at a CAGR of 6%.

Get Sample Copy of Report@ https://www.precedenceresearch.com/sample/1129

Key Points

- In 2024, North America secured the largest market share, contributing 40% of total revenue.

- The hospitals and clinics segment dominated the end-user category with the highest revenue share.

- From 2025 to 2034, diagnostics centers are expected to grow at the fastest compound annual growth rate (CAGR).

Market Scope

| Report Highlights | Details |

| Market Size in 2024 | USD 640.45 Billion |

| Market Size in 2025 | USD 678.88 Billion |

| Market Size by 2034 | USD 1,146.95 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 6% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Therapeutic Application, End User, Region |

| Regional Scope | Asia Pacific, North America, Europe, Latin America, Middle East and Africa |

Also Read: https://www.reportsgazette.com/digital-therapeutics-market/

Market Trends and Opportunities

Market Drivers

The rising demand for early disease detection and effective treatment solutions is a key driver of the medical devices market. Increasing investments in research and development are leading to the launch of innovative and technologically advanced medical equipment.

The growing preference for minimally invasive surgeries and robotic-assisted procedures is fueling market growth. Additionally, favorable healthcare policies and increased government funding are accelerating the adoption of modern medical technologies.

Opportunities

The expansion of personalized medicine and precision healthcare is creating new growth opportunities for medical device manufacturers. The increasing use of wearable health monitors and remote diagnostic tools is transforming patient care. The growing focus on value-based healthcare models is encouraging hospitals and clinics to invest in smart medical devices.

Additionally, the rising trend of partnerships between medical device companies and technology firms is driving innovation in the industry

Challenges

One of the significant challenges in the medical devices market is the high cost of advanced equipment, making it inaccessible to many healthcare facilities in developing countries. Strict regulatory frameworks and the need for continuous compliance with safety standards create barriers for new entrants.

The risk of device malfunctions and recalls also poses challenges for manufacturers. Moreover, the ongoing supply chain disruptions and raw material shortages impact the production and distribution of medical devices.

Regional Insights

North America remains the leading market for medical devices, driven by technological advancements, high healthcare spending, and strong regulatory frameworks. Europe continues to see steady growth, with increased investments in healthcare infrastructure and digital health solutions.

The Asia-Pacific region is emerging as a lucrative market due to rapid urbanization, an aging population, and expanding healthcare facilities. Latin America and the Middle East & Africa are slowly gaining traction, but factors such as economic instability and lower healthcare spending impact their market potential.

Medical Devices Market Companies

- DePuy Synthes

- Medtronics Plc

- Fesenius Medical Care

- GE Healthcare

- Philips Healthcare

- Ethicon LLC

- Siemens Healthineers

- Stryker

- Cardinal Health

- Baxter International Inc.

- BD

Companies Share Insights

The global medical devices market is highly fragmented owing to the presence of large number of market players on global as well as regional level. Among these companies, Medtronic capture the largest market share with diverse product portfolio and strong brand name in the global market. Apart from this, most of the industry players invest prominently in the Research & Development (R&D) activity to develop new products and upgrade the existing product list. Furthermore, these market players largely focus on expanding their distributors across the globe that allows companies to expand their product offerings.

Recent Developments

- In November 2024, Beurer India Pvt. Ltd. introduced the GL 22 Blood Glucose Monitor. This innovative and user-friendly glucose monitoring solution manufactured under Beurer’s “Make in India” initiative. The device features comprehensive monitoring capabilities, offering crucial insights into blood glucose levels.

- In May 2024, OMRON Healthcare India collaborated with AliveCor India to launch AI-driven handheld ECG monitoring devices. These devices instantly detect various arrhythmias, including atrial fibrillation (Afib), bradycardia, and tachycardia.

Segments Covered in the Report

By Type

- Diagnostic Imaging

- Orthopedic Devices

- Cardiovascular Devices

- Minimally Invasive Surgical (MIS)

- Wound Management

- Diabetes Care

- Ophthalmic Devices

- General Surgery

- Dental Devicess

- In Vitro Diagnostics (IVD)

- Others

By End-user

- Hospitals & Ambulatory Surgery Centers (ASCs)

- Clinics

- Others

By Geography

- North America

- Asia Pacific

- Latin America

- Europe

- Middle East and Africa (MEA)

Ready for more? Dive into the full experience on our website@ https://www.precedenceresearch.com/

- Singapore Interactive Kiosk Market Size to Attain USD 1,835.92 Billion by 2034 - April 17, 2025

- Robotic Sensors Market Size to Attain USD 1,716.86 Million by 2034 - April 17, 2025

- Laminated Steel Market Size to Reach USD 2.63 Billion by 2034 - April 17, 2025