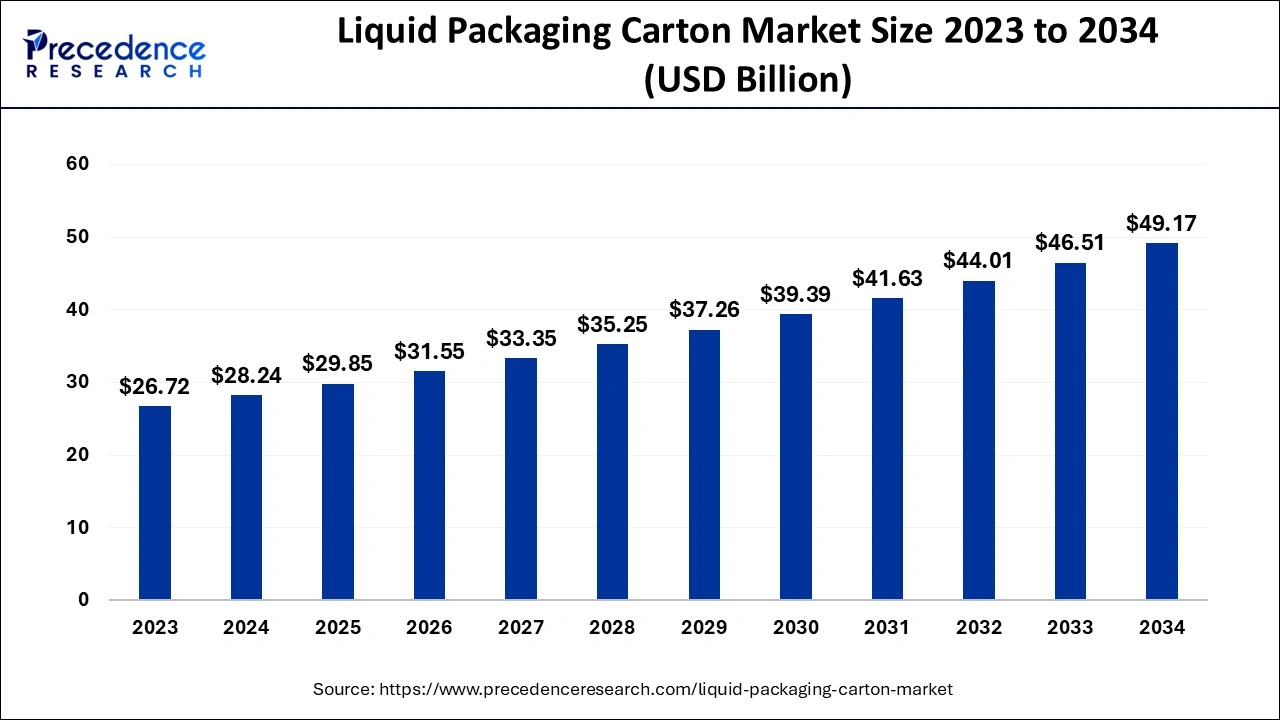

The global liquid packaging carton market size reached USD 28.24 billion in 2024 and is predicted to be Cross around USD 49.17 billion by 2034, growing at a CAGR of 5.70% from 2024 to 2034.

Key Points

- Asia Pacific dominated the liquid packaging carton market with the largest market share of 39% in 2023.

- North America is expected to grow at the fastest rate in the market during the forecast period.

- By type, the brick liquid cartons segment held the largest market share in 2023.

- By type, the gable top segment is expected to grow at the fastest rate in the market during the forecast period.

- By shelf life, the liquid cartons segment dominated the global market in 2023.

- By shelf life, the short-term shelf life segment is expected to grow rapidly in the market during the forecast period.

- By application, the dairy products segment accounted for the biggest market share of 50% in 2023.

- By application, the juice & drinks segment is expected to grow significantly in the market during the forecast period.

The liquid packaging carton market is a rapidly growing sector within the broader packaging industry. It encompasses a variety of carton types, including brick cartons, gable tops, and shaped cartons, which are used for packaging liquids such as milk, juice, wine, and liquid food products. These cartons offer advantages like lightweight, convenience, recyclability, and an extended shelf life for perishable goods. The market is driven by the increasing demand for sustainable and eco-friendly packaging solutions, along with the growing consumer preference for packaged beverages and foods.

Sample: https://www.precedenceresearch.com/sample/5219

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 49.17 Billion |

| Market Size in 2024 | USD 28.24 Billion |

| Market Size in 2025 | USD 29.85 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 5.70% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Shelf Life,Application and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East, & Africa |

Drivers

Several factors are propelling the growth of the liquid packaging carton market. Rising environmental concerns and stringent regulations regarding plastic usage have boosted the demand for recyclable and biodegradable packaging solutions. Additionally, the surge in urbanization and changes in consumer lifestyles, including a preference for ready-to-drink beverages, have led to increased adoption of liquid cartons. The expanding food and beverage industry, especially in emerging economies, further supports market growth.

Opportunities

The market offers significant opportunities, particularly in developing regions where the demand for packaged and processed foods is on the rise. Innovations in packaging technology, such as smart and interactive packaging, provide opportunities for brands to differentiate their products. Moreover, the push towards circular economy practices is driving investments in recycling infrastructure, which could enhance the sustainability credentials of liquid packaging cartons.

Challenges

Despite its growth potential, the market faces several challenges. One of the primary hurdles is the high cost of raw materials and production compared to alternative packaging solutions. Additionally, the recycling infrastructure for liquid cartons is still underdeveloped in many regions, limiting the potential for widespread adoption. Competition from other packaging formats like plastic bottles and flexible pouches also poses a significant challenge.

Regional Insights

Regionally, Europe dominates the liquid packaging carton market, driven by stringent environmental regulations and a strong emphasis on sustainability. North America follows closely, supported by high consumption of packaged beverages and robust recycling infrastructure. The Asia-Pacific region is expected to witness the fastest growth, fueled by rising urbanization, expanding middle-class populations, and increasing health awareness among consumers. Meanwhile, markets in Latin America and the Middle East & Africa are gradually expanding, with opportunities arising from growing investments in the food and beverage sectors.

Read Also: Oil and Gas Security Market Size to Cross USD 47.82 Bn By 2034

Liquid Packaging Carton Market Companies

- Tetra Pak International S.A.

- Elopak AS

- SIG Combibloc Group AG

- Oji Holdings Corporation

- Nippon Paper Industries Co. Ltd.

- Adam Pack S.A.

- Stora Enso Oyj

- H.B. Fuller Company

- LAMI PACKAGING CO., LTD

- Weyerhaeuser Company

- Smurfit Kappa Group plc

- Greatview Aseptic Packaging Co. Ltd.

- TidePak Aseptic Packaging Material Co. Ltd.

- Lami Packaging (Kunshan) Co. Ltd.

Recent News

- In February 2024, family-owned natural soap maker, Dr. Bronner’s launched its soap refill carton package of 32 oz. for its pure-castile liquid soap. This soap refill carton can be used to refill existing containers or bottles for home cleaning use and personal care.

- In May 2023, Dulce Vida, a U.S.-based tequila brand, launched three new ready-to-drink cocktails in sustainable carton packaging offered by Tetra Pak, a liquid packaging solutions company.

- In January 2022, SIG launched the world’s first aluminum-free full barrier packaging materials, Signature EVO, for aseptic carton packs. Signature EVO extends SIG’s lower-carbon aluminum-free packaging materials – for plain white milk – for wider use with oxygen-sensitive products such as plant-based beverages, flavored milk, nectars, or fruit juices.

Segments Covered in the Report

By Type

- Brick Liquid Cartons

- Gable top Liquid Cartons

- Shaped Liquid Cartons

By Shelf Life

- Short-term Shelf Life

- Long-term Shelf Life

By Application

- Dairy Products

- Wine and Spirits

- Juices and Drinks

- Others

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)

Web: https://www.precedenceresearch.com/

- Perishable Prepared Food Market Size to Attain USD 157.77 Bn by 2034 - April 24, 2025

- Fabric Filter Market Size to Attain USD 7.50 Billion by 2034 - April 24, 2025

- Pilot Training Market Size to Attain USD 31.38 Bn by 2034 - April 24, 2025