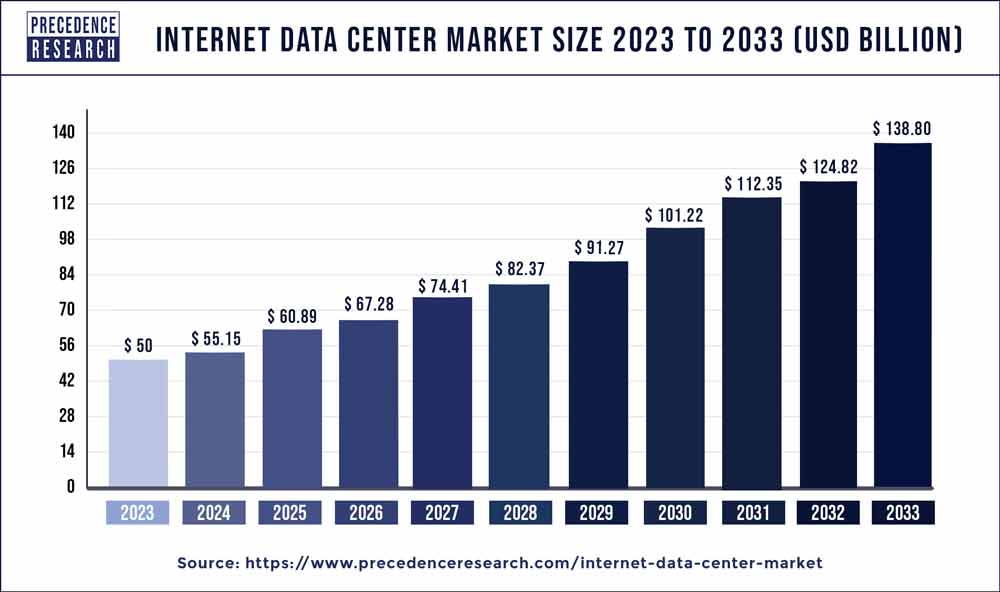

The global internet data center market size is projected to be worth around USD 138.80 billion by 2033, representing at a CAGR of 10.80% from 2024 to 2033.

Introduction:

The Internet Data Center (IDC) market is undergoing rapid evolution and expansion, driven by the ever-increasing demand for digital services and the growing volume of data generated globally. As businesses and consumers alike embrace cloud computing, big data analytics, and emerging technologies like the Internet of Things (IoT), the need for robust and efficient data center infrastructure has become paramount. This article explores the key growth factors, trends, opportunities, restraints, regional insights, and the competitive landscape within the Internet Data Center market.

Key Takeaways

- North America dominated the market with a 43% market share in 2023.

- Asia-Pacific is expected to witness the fastest rate with a CAGR of 14.2% during the forecast period of 2024-2033.

- By end-use, the cloud service Provider (CSP) segment held the largest segment of 38% in the internet data center market in 2023.

- On the other hand, the e-commerce & retail segment is expected to grow at a significant rate of 15.2% during the forecast period.

- By service, the colocation segment held the largest share of 43% in 2023.

- By service, the content delivery network (CDN) segment is expected to grow at a notable rate of 10.3% during the forecast period.

- By deployment, the public segment held the largest share of 56% in 2023.

- By deployment, the hybrid segment is expected to grow at a significant CAGR of 16.2% during the forecast period.

- By enterprise size, the large enterprises segment held the dominating share of 86% in 2023.

- Whereas the small and medium-sized enterprises (SME) segment is expected to grow at a notable CAGR of 18.3% during the forecast period.

Growth Factors

Several factors contribute to the remarkable growth of the Internet Data Center market. Firstly, the exponential rise in data generation and consumption across various industries fuels the demand for data storage and processing capabilities. Additionally, the increasing adoption of cloud-based services and the transition towards edge computing to reduce latency are significant growth drivers. Moreover, the surge in digital transformation initiatives by businesses to stay competitive and the rising prevalence of remote working further amplify the demand for advanced data center solutions.

Internet Data Center Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 10.80% |

| Global Market Size in 2023 | USD 50 Billion |

| Global Market Size by 2033 | USD 138.80 Billion |

| U.S. Market Size in 2023 | USD 15.05 Billion |

| U.S. Market Size by 2033 | USD 42.16 Billion |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Service, By Deployment, By Enterprise Size, and By End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Trends:

Several trends are shaping the trajectory of the IDC market. One notable trend is the adoption of modular and scalable data center designs, allowing organizations to expand their infrastructure in a flexible and cost-effective manner. Another trend is the focus on sustainability, with data centers incorporating energy-efficient technologies and renewable energy sources to mitigate environmental impact. Additionally, the rise of 5G technology is influencing data center architecture to support low-latency, high-bandwidth applications.

Opportunities

The IDC market presents numerous opportunities for stakeholders. With the increasing complexity of IT environments, there is a growing demand for managed services and colocation solutions. Moreover, the emergence of emerging markets and the proliferation of smart devices open doors for data center providers to establish a strong presence in untapped regions. Furthermore, partnerships and collaborations in the industry create opportunities for innovation and enhanced service offerings.

Restraints:

Despite the promising growth, the IDC market faces certain challenges and restraints. One significant factor is the high initial cost of building and maintaining data centers, deterring some organizations from investing in their infrastructure. Additionally, concerns about data security and privacy, especially in the wake of evolving regulations, pose challenges for data center operators. Moreover, the shortage of skilled professionals in the field exacerbates operational challenges.

Region Insights

Regional dynamics play a crucial role in shaping the IDC market. North America, with its early adoption of advanced technologies, remains a key player in the market. The Asia-Pacific region is experiencing rapid growth, driven by the increasing digitalization in countries like China and India. Europe emphasizes sustainability, influencing data center practices. The Middle East and Africa present untapped potential, with growing investments in digital infrastructure.

Read Also: AI in Food Market Size, Trends, Share, Report by 2033

Competitive Landscape:

The competitive landscape of the IDC market is characterized by intense rivalry among key players. Major companies are continually investing in research and development to stay ahead in terms of technology and service offerings. Mergers and acquisitions are common strategies for market consolidation, enabling companies to broaden their portfolios and expand their global footprint. Notable players in the industry include market leaders such as Amazon Web Services (AWS), Microsoft Corporation, and Google Cloud, among others.

Internet Data Center Market Companies

- Alibaba Cloud (China)

- Amazon Web Services, Inc. (United States)

- AT&T Intellectual Property (United States)

- Lumen Technologies (CenturyLink) (United States)

- China Telecom Americas, Inc. (United States)

- CoreSite (United States)

- CyrusOne (United States)

- Digital Realty (United States)

- Equinix, Inc. (United States)

- Google Cloud (United States)

- IBM (United States)

- Microsoft (United States)

- NTT Communications Corporation (Japan)

- Oracle (United States)

- Tencent Cloud (China)

Recent Developments

- In September 2023, Google, Microsoft, Schneider Electric, and Danfoss jointly unveiled a collaborative initiative known as the Net Zero Innovation Hub for Data Center. This groundbreaking project is developed in partnership with the Danish Data Center Industry. The proposed location for this innovative center is Fredericia, Denmark.

- In November 2020, the United States Immigration & Customs Enforcement Agency invested over USD 100 million in cloud services, utilizing the Amazon Web Services and Microsoft Azure cloud environments.

- In January 2020, Vapor IO announced its ambitious plans to establish 36 edge data center sites across the United States by 2021.

Segments Covered in the Report

By Service

- Hosting

- Colocation

- CDN

- Others

By Deployment

- Public

- Private

- Hybrid

By Enterprise Size

- Large Enterprises

- SMEs

By End-use

- CSP

- Telecom

- Government/Public Sector

- BFSI

- Media & Entertainment

- E-commerce & Retail

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/

- Intelligent Traffic Management System Market Size, Trends, Report 2034 - July 17, 2024

- Healthcare Finance Solutions Market Size to Grow USD 293.12 Bn by 2034 - July 17, 2024

- Epoxy Composites Market Size to Grow USD 84.99 Bn by 2034 - July 17, 2024