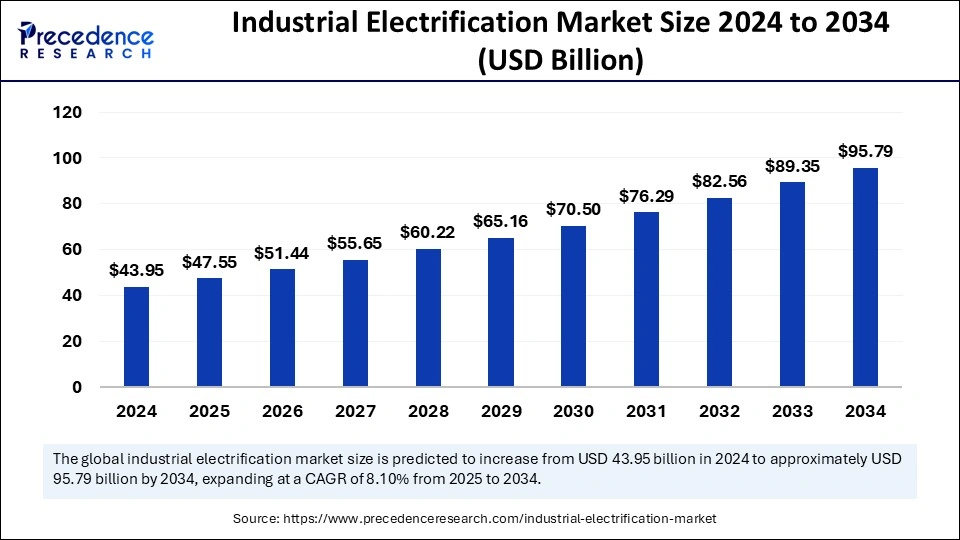

The global industrial electrification market size is expected to cross around USD 95.79 billion by 2034, increasing from USD 43.95 billion in 2024, with a CAGR of 8.10%.

Get a Free Sample Copy of the Report@ https://www.precedenceresearch.com/sample/5783

Industrial Electrification Market Key Takeaways

-

Asia Pacific secured the top position in 2024, dominating with 37% market share.

-

Europe is forecasted to grow at a healthy CAGR of 8.2% in the coming years.

-

Renewable energy led all sources with a commanding 59% share in 2024.

-

The nuclear power segment is expected to rise steadily with an 8.7% CAGR from 2025–2034.

-

Heat pumps captured 35% of the technology market in 2024.

-

The electric resistance heating segment is projected to experience the highest CAGR at 8.7%.

-

The manufacturing industry was the largest consumer in 2025, representing 27% of the end-use market.

-

The construction sector is forecasted to grow robustly at a CAGR of 8.6%.

Role of AI in the Industrial Electrification Market

Artificial Intelligence (AI) plays a transformative role in the industrial electrification market by enabling smart energy management, predictive maintenance, and optimized grid operations. Through real-time data analysis and machine learning, AI helps industries monitor energy usage, forecast demand, and reduce energy waste. It enhances system efficiency by balancing loads, integrating renewable energy sources, and preventing equipment failures before they occur—leading to reduced operational costs and increased productivity.

Additionally, AI supports sustainability by tracking carbon emissions and identifying opportunities to reduce energy consumption. It enables advanced process automation, improves logistics in electrified supply chains, and enhances decision-making through digital twin simulations. As industries shift toward cleaner and smarter operations, AI becomes a critical tool in accelerating electrification and achieving long-term energy and environmental goals.

Growth Factors Driving the Industrial Electrification Market

The industrial electrification market is experiencing robust growth, largely propelled by the global transition toward cleaner and more sustainable energy sources. As industries aim to reduce carbon emissions and meet regulatory requirements, electrification presents a reliable solution by replacing fossil fuel-based systems with electric alternatives.

Governments worldwide are implementing supportive regulations and offering incentives to accelerate the shift, especially in heavy industries and manufacturing. Additionally, the integration of renewable energy sources such as solar and wind into industrial processes has significantly increased, enhancing the overall appeal and feasibility of electrification.

Technological advancements are another key growth driver, as innovations in automation, power electronics, and smart grid systems improve the efficiency and affordability of electrified industrial operations. The rise of Industry 4.0 and the adoption of AI and IoT are enabling real-time energy monitoring, predictive maintenance, and intelligent energy management, making electrification more practical and cost-effective.

Moreover, as electric mobility infrastructure expands, related industries such as battery manufacturing and component production are also seeing increased electrification, further boosting market demand. These combined factors are shaping a dynamic and rapidly evolving industrial electrification landscape.

Industrial Electrification Market Trends

- In 2023, renewable energy capacity additions reached a record high of 507 gigawatts (GW), which represents a 50% increase compared to 2022.

- Solar photovoltaic (PV) technology accounted for three-quarters of these global additions. This information comes from the IEA’s Renewables 2023 report, which highlights significant growth in the adoption of clean energy.

- Global entities signed agreements at the COP28 UN Climate Change Conference in December 2024 to develop renewable power capacity threefold through 2030 while demonstrating worldwide support for sustainable energy initiatives according to stated agreements.

- The power transmission market attracted approximately USD 140 billion in 2023 as investments rose by 10% while Europe, the United States, China, India, and Latin American components became members of this expansion, as per the IRENA 2023 report.

- According to the IEA 2024 report, recent findings of new construction projects are predicted to reach high levels of electrification in their systems, leading to decreased environmental impact by 2024.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 95.79 Billion |

| Market Size in 2025 | USD 47.55 Billion |

| Market Size in 2024 | USD 43.95 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 8.10% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | Europe |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Source, Technology, End-Use Industry, and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Industrial Electrification Market Dynamics

Growth Drivers

Growing environmental concerns and rising energy efficiency goals are driving industrial electrification forward. Industries are attracted to the cost-saving potential of electric systems, along with their lower emissions. Supportive policies and funding for clean energy projects are reinforcing the trend.

Annual Investment in Clean Energy by Countries and Regions for 2024

| Country/Region | Investment (USD billion) |

| China | 359 |

| United States | 85 |

| European Union | 106 |

| India | 37 |

| Latin America | 41 |

| Southeast Asia | 15 |

| Africa | 22 |

Opportunities for Expansion

Advancements in electric equipment design, combined with digitalization and automation, are unlocking new use cases for industrial electrification. There’s increasing interest in hybrid systems and electrified process heating. Innovations in battery storage and AI-enabled controls are making energy usage smarter and more efficient.

Barriers and Challenges

Despite strong market interest, challenges such as upfront equipment costs, system integration issues, and limited infrastructure in rural areas can slow adoption. Some industries face difficulties in fully electrifying due to high power demands or unique technical requirements.

Regional Perspective

Asia Pacific remains at the forefront of industrial electrification thanks to its massive industrial sector and supportive government policies. Europe is also advancing quickly, driven by strict emissions targets. North America shows steady growth, especially in sectors like electric transportation and electrified logistics hubs.

Industrial Electrification Market Companies

- ABB

- AISIN CORPORATION

- Bharat Bijlee Limited

- Bonfiglioli Transmissions Private Limited

- BorgWarner Inc.

- Continental AG

- DENSO CORPORATION

- General Electric

- Johnson Electric Holdings Limited

- Kirloskar Electric Company

Latest Announcements by Industry Leaders

- February 2025 – Baker Hughes

- Executive Vice President – Baker Hughes

- Announcement – Baker Hughes announced three new electrification technologies that aim to enhance reliability, increase efficiency, and reduce emissions for both onshore and offshore operations. “Hydrocarbons will continue to be key sources of global energy for decades, and it is crucial that we produce these resources with a minimal carbon footprint,” said Amerino Gatti, Executive Vice President of Oilfield Services and Equipment at Baker Hughes. “By electrifying the production value chain, we can make our operations cleaner, safer, and more efficient while still meeting the world’s energy demands.”

Industrial Electrification Market Recent Developments

- In June 2024, Schneider Electric, a global leader in the digital transformation of energy management and automation, released a report projecting that the electrification of the U.S. industry will increase from 30% to 45% by 2030. This represents a 50% growth.

- In April 2024, Siemens Smart Infrastructure launched Electrification X, a new suite of applications within their SaaS and IoT portfolio. This offering is designed to help renewable generators, transmission system operators (TSOs), distribution system operators (DSOs), industries, and infrastructure customers enhance productivity, reliability, asset utilization, energy efficiency, and sustainable innovation.

- In May 2024, the National Energy Transition Task Force formally introduced the Energy Efficiency and Electrification Working Group (E3WG) as part of the Just Energy Transition Partnership (JETP).

Segments Covered in the Report

By Source

- Renewable Energy

- Solar Energy

- Wind Energy

- Hydropower

- Geothermal

- Nuclear Power

- Nuclear Fission

- Nuclear Fusion

- Fossil Fuel-based

- Others

By Technology

- Heat Pumps

- Electric Resistance Heating

- Electric Arc Heating

- Electric Boilers

- Energy Storage

- Others

By End-Use Industry

- Manufacturing

- Steel and Cement

- Mining

- Chemicals

- Construction

- Oil and Gas

- Pulp and Paper

- Others

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Also Read: Microgrid Controller Software Market

Ready for more? Dive into the full experience on our website@ https://www.precedenceresearch.com/

- Freeze-dried food market expected to grow to USD 56.27 billion by 2034 - April 28, 2025

- Aerospace Foam Market Expected to Grow to USD 12.78 Billion by 2034 - April 28, 2025

- Football equipment Market Forecasted to Grow to USD 21.21 Billion by 2034 - April 28, 2025