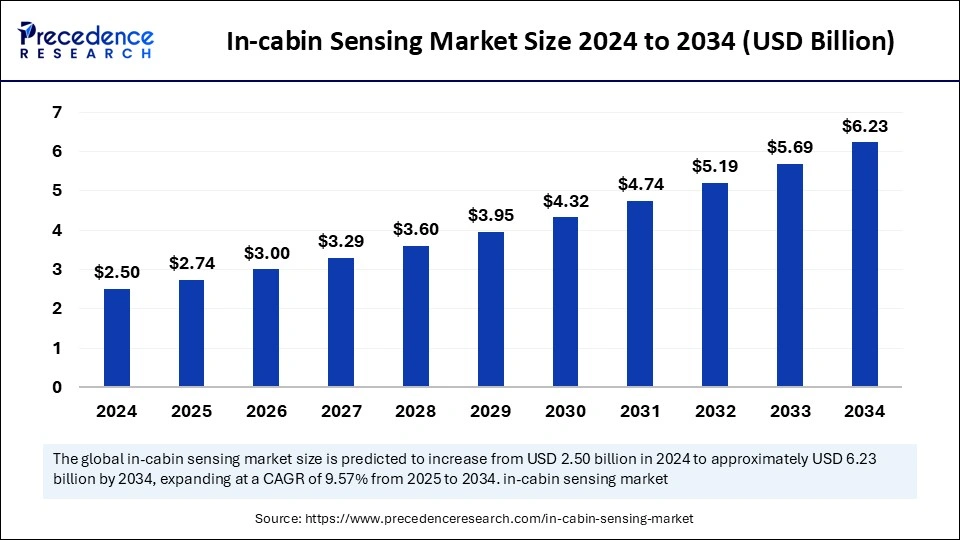

The global in-cabin sensing market size was estimated at USD 2.50 billion in 2024 and is expected to attain around USD 6.23 billion by 2034, growing at a CAGR of 9.57% from 2025 to 2034.

Get a Free Sample Copy of the Report@ https://www.precedenceresearch.com/sample/5788

In-cabin Sensing Market Key Points

-

North America maintained a dominant market share position in 2024.

-

Asia Pacific is forecast to grow at the fastest pace in the upcoming years.

-

Capacitive steering sensors led the sensor type segment in terms of market size in 2024.

-

Torque steering sensors are projected to experience notable market growth.

-

Driver monitoring systems represented the leading monitoring system segment in 2024.

-

Cabin monitoring systems are gaining traction and expected to grow rapidly.

-

The automotive segment remained the largest end-user in 2024.

Role of Artificial Intelligence (AI) in the In-Cabin Sensing Market

Enhancing Passenger Safety and Comfort

Artificial Intelligence plays a vital role in the in-cabin sensing market by enabling real-time monitoring of occupants and driver behavior. AI algorithms power systems that detect driver drowsiness, distraction, or unsafe behavior, triggering alerts to prevent accidents. For passengers, AI helps adjust settings like climate control, lighting, and seat positioning by recognizing gestures, facial expressions, and voice commands—creating a safer and more personalized in-vehicle experience.

Powering Smart, Adaptive Interiors

With the help of AI, in-cabin systems can continuously learn from user preferences and adapt to different driving conditions. AI-driven sensor fusion combines data from cameras, infrared sensors, and microphones to interpret in-cabin activity with high accuracy. This technology supports functions such as child presence detection, emotion recognition, and seamless infotainment control, driving innovation in connected and autonomous vehicle interiors.

Growth Drivers Accelerating the In-Cabin Sensing Market

The in-cabin sensing market is experiencing rapid expansion due to the rising emphasis on vehicle safety, driver monitoring, and occupant comfort. One of the key growth factors is the increasing regulatory push for advanced driver-assistance systems (ADAS) and mandatory driver monitoring features in several regions, especially in Europe and North America. As automotive safety standards become stricter, manufacturers are integrating in-cabin sensing technologies to comply with new regulations and enhance crash prevention systems.

Additionally, the surge in demand for connected and autonomous vehicles is fueling innovation in interior sensing capabilities. Automakers are increasingly adopting technologies such as facial recognition, gesture control, and emotion detection to create smart cabin environments. The growing consumer demand for personalized and intuitive in-vehicle experiences is further driving the adoption of AI-powered in-cabin solutions.

Moreover, the integration of advanced sensor fusion, including infrared, ultrasonic, and radar sensors, is improving the accuracy and functionality of these systems, creating more value for both premium and mass-market vehicles. The emergence of electric vehicles (EVs), with their focus on advanced features and tech-enabled interiors, is also contributing significantly to the growth of the market.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 6.23 Billion |

| Market Size in 2025 | USD 2.74 Billion |

| Market Size in 2024 | USD 2.50 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 9.57% |

| Dominated Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Sensor Type, Monitoring System, End-user, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Market Drivers

Stricter safety norms, growing public awareness, and technological advancements are driving market adoption. Automotive companies are also leveraging these systems to comply with Euro NCAP and other safety ratings, increasing their market competitiveness.

Market Opportunities

There is significant opportunity for in-cabin sensing in autonomous vehicles, where passenger monitoring will be critical. Partnerships between automotive OEMs and tech firms to build AI-enabled sensing platforms are expanding, and the use of infrared and radar technologies opens new doors for innovation.

Market Challenges

High system costs and concerns regarding cybersecurity and user privacy pose considerable challenges. Additionally, developing accurate and reliable sensing technologies that perform under varying lighting and environmental conditions is technically demanding.

Regional Insights

Europe is emerging as a strong contender, with investments in automotive safety and green mobility. Meanwhile, Asia Pacific, led by China and India, is rapidly expanding due to the increase in consumer spending and smart city initiatives. North America maintains strong momentum due to established infrastructure and tech-forward consumers.

- In December 2024, a South Korean multinational conglomerate, LG Electronics (LG) announced a strategic collaboration with Ambarella and develop its latest in-cabin solution. Ambarella worked closely with LG to integrate its CV25 AI system-on-chip (SoC) into LG’s Driver Monitoring System (DMS), allowing automotive OEMs to deliver safer vehicles.

Europe is expected to witness notable growth during the forecast period. The growth of the European in-cabin sensing market is attributed to government regulations and safety standards, increasing adoption of advanced technologies with high sensing capabilities, increasing demand for autonomous vehicles, and increasing adoption of Driver Monitoring Systems (DMS). The increasing demand for advanced safety features in vehicles supports market expansion. European automotive manufacturers are focusing on the development of advanced driver assistance systems (ADAS) to enhance automation and improve vehicle safety. Moreover, stringent regulations to promote ADAS contribute to market growth.

- For instance, in July 2024, the EU’s New Vehicle General Safety Regulation (GSR2) or Regulation (EU) 2019/2144 mandates the addition of advanced driver assistance systems (ADAS), which rely on in-cabin sensing solutions.

In-cabin Sensing Market Companies

- Continental Engineering Services

- Rheinmetall AG

- Cipia

- LG Electronics (LG)

- Infineon technologies

- Lumentum Operations

- Anyverse SL

- Robert Bosch GmbH

- HARMAN International

Recent Developments

- In January 2025, MulticoreWare, Inc. and Cipia teamed up to showcase a cutting-edge demonstration of in-cabin monitoring sensor fusion at CES 2025. This demonstration fuses 60GHz radar and IR camera technologies, combining their strengths to present precise tracking of driver and occupant vital signs, even in complex conditions. By collaborating with Cipia, a leader in computer vision and AI in-cabin monitoring solutions, MulticoreWare aims to push the boundaries of innovation and deliver advanced safety solutions for the automotive industry.

- In June 2023, Cipia announced a new solution from its continuing collaboration with Ambarella, Inc., an edge AI semiconductor company. This latest solution offers automotive manufacturers higher flexibility regarding the location of in-cabin sensing systems, including the rear-view mirror, as well as the ability to use a single camera.

- In May 2023, Smart Eye announced a collaboration with Texas Instruments to provide automakers with an innovative interior sensing solution that improves driver safety and enables in-cabin experiences that enhance comfort, wellness, and entertainment. Fully compliant with the new General Safety Regulations (GSR) and European New Car Assessment Program (Euro NCAP), the solution enables higher performance and more cost-effective implementations in vehicles.

Segments Covered in the Report

By Sensor Type

- Capacitive Steering Sensors

- Torque Steering Sensors

- Printed Sensors

By Monitoring System

- Driver Monitoring Systems

- Cabin Monitoring Systems

- Thermal Monitoring Systems

By End-user

- Automotive

- Electrical & Electronics

- Aerospace & Defence

By Region

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

Also Read: Automotive Overhead Console Market

Ready for more? Dive into the full experience on our website@ https://www.precedenceresearch.com/

- Football equipment Market Forecasted to Grow to USD 21.21 Billion by 2034 - April 28, 2025

- Metal 3D Printing Market Size to Attain USD 87.33 Billion by 2034 - April 25, 2025

- Duty-Free And Travel Retail Market Size to Attain USD 667.61 Bn by 2034 - April 25, 2025