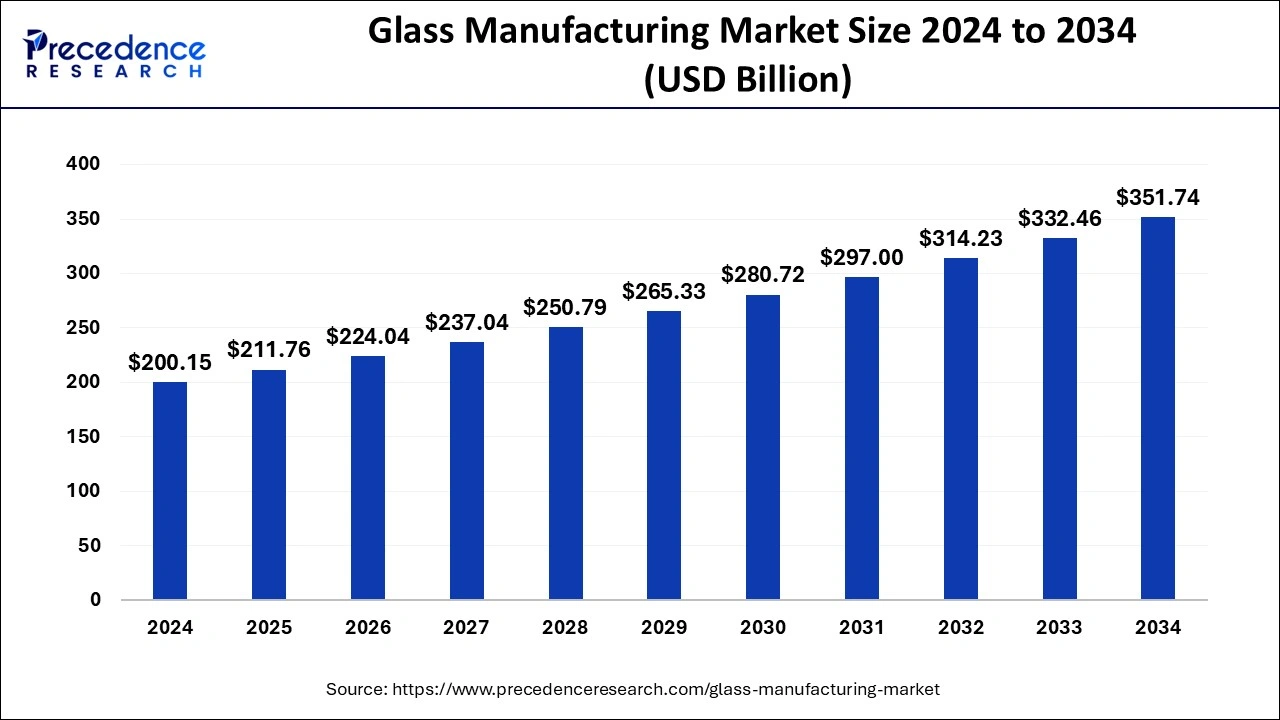

The glass manufacturing market size accounted for USD 200.15 billion in 2024 and is expected to be surpass around USD 351.74 billion by 2034, with a CAGR of 5.8%.

Key Points

- Asia Pacific led the market in 2024, holding a dominant 40% share of the global industry.

- The container glass segment achieved the largest market share of 50% in the product category in 2024.

- The automatic segment saw the highest share in applications, reaching 45% in 2024.

Also Read@ https://www.precedenceresearch.com/artificial-intelligence-market

Market Dynamics

Market Drivers

The increasing demand for glass across diverse industries, such as packaging, electronics, and construction, is a key driver of market growth. The shift towards sustainable packaging solutions has boosted the demand for glass bottles and containers, particularly in the beverage and pharmaceutical industries.

Additionally, the rising adoption of smart glass in automotive and electronic applications is fueling market expansion. Government initiatives promoting energy-efficient construction materials, including insulated and solar control glass, further contribute to market growth.

Opportunities

The glass manufacturing industry is benefiting from the rising adoption of advanced glass technologies, including tempered glass, laminated glass, and self-cleaning glass. The increasing preference for energy-efficient buildings has led to higher demand for Low-E and double-glazed glass, creating opportunities for manufacturers.

The growing popularity of glass in electronics, including display screens and touch panels, is another significant market driver. Moreover, the rapid urbanization in emerging economies presents new opportunities for glass manufacturers in infrastructure development and smart city projects.

Challenges

One of the major challenges in the glass manufacturing industry is the high energy consumption required in the production process. The dependence on fossil fuels for melting and refining raw materials leads to high operational costs and environmental concerns.

Regulatory pressure to reduce carbon emissions and adopt sustainable manufacturing practices adds to the complexity. Additionally, glass is prone to breakage and requires careful handling and transportation, leading to logistical challenges. Market fluctuations and disruptions in the supply chain also pose risks to manufacturers.

Regional Insights

Asia Pacific remains the largest market for glass manufacturing, with China being the leading producer due to its vast industrial base and high demand in construction and packaging. North America is witnessing steady growth, with advancements in smart glass technologies and increasing investments in green buildings.

Europe, driven by strict environmental policies, is focusing on sustainable glass production and recycling initiatives. Meanwhile, the Middle East and Africa are emerging markets, with rising demand for glass in infrastructure and luxury real estate projects.

- Customer Self-service Software Market Size to Attain USD 128.36 Bn by 2034 - April 11, 2025

- Converted Flexible Packaging Market Size to Attain USD 374.06 Bn by 2034 - April 11, 2025

- Scleral Lens Market Size to Soar USD 982.68 Bn by 2034 - April 11, 2025