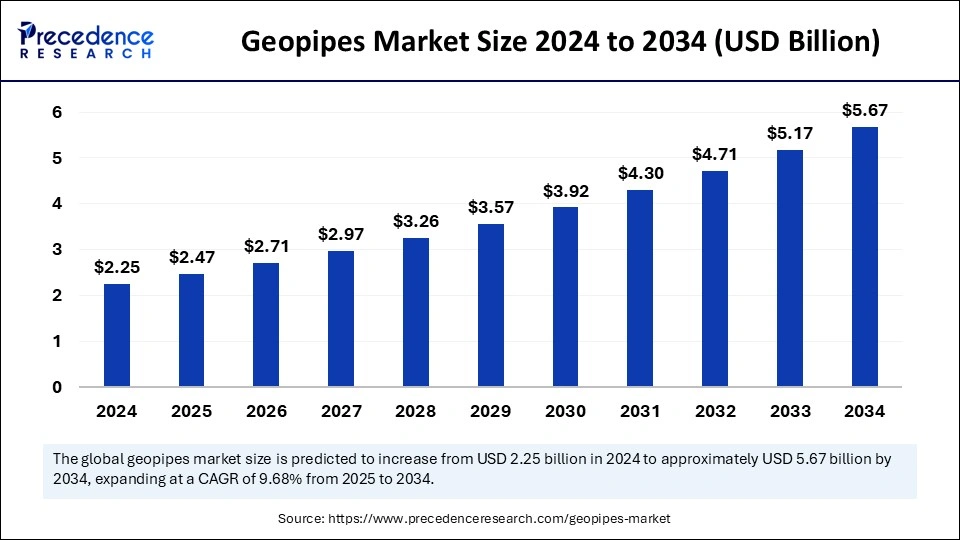

The global geopipes market size is estimated to attain around USD 5.67 billion by 2034, increasing from USD 2.25 billion in 2024, with a CAGR of 9.68%.

Get a Free Sample Copy of the Report@ https://www.precedenceresearch.com/sample/5830

Geopipes Market Key Points

-

In 2024, Asia Pacific was the dominant force in the global market, securing 44% of the total share.

-

North America is on track for the highest growth rate, with a projected CAGR of 9.2%.

-

HDPE remained the top product choice, holding a 61% market share.

-

PP is emerging as a high-growth segment, forecasted to achieve a 10.23% CAGR.

-

Drainage and sewer systems were the primary applications, representing 39% of demand.

-

Irrigation and agriculture applications are poised to grow quickly, with a CAGR of 10.13%.

How is AI Shaping the Geopipes Market?

Artificial Intelligence is playing a transformative role in the geopipes market by enhancing efficiency, reliability, and sustainability across the pipeline lifecycle. AI-driven predictive maintenance systems help detect early signs of damage or stress in geopipes, minimizing failure risks and reducing repair costs. In the design phase, AI-powered simulations enable engineers to model different scenarios, leading to better material utilization and performance optimization. Additionally, AI contributes to smart manufacturing by ensuring consistent quality and reducing waste through real-time monitoring and automation.

Beyond production, AI supports data-driven decision-making by analyzing environmental and geological data, helping companies choose the most suitable materials and installation methods. It also improves supply chain operations by forecasting demand and optimizing logistics, ensuring timely delivery of components. Furthermore, AI enhances sustainability by monitoring environmental impacts and supporting compliance with regulatory standards, making it a critical tool in the advancement of smart infrastructure systems.

Geopipes Market Overview

The geopipes market is witnessing significant growth due to rising infrastructure development and increasing demand for corrosion-resistant piping systems. Geopipes, typically made from high-density polyethylene (HDPE), polypropylene (PP), or other plastic materials, are widely used in drainage, sewage, irrigation, and other underground applications.

Their ability to withstand chemical exposure, environmental stress, and extreme temperatures makes them ideal for long-term infrastructure solutions. As urbanization and industrialization increase globally, the demand for durable, low-maintenance piping systems continues to rise, fueling the growth of the geopipes market.

Geopipes Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 5.67 Billion |

| Market Size in 2025 | USD 2.47 Billion |

| Market Size in 2024 | USD 2.25 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 9.68% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Geopipes Market Dynamics

Market Drivers

One of the primary drivers of the geopipes market is the growing investment in water management and sanitation infrastructure. With increasing awareness of water conservation and efficient water distribution, geopipes are becoming crucial in agricultural and municipal projects.

Additionally, the rising focus on sustainable construction practices and the need for lightweight, easy-to-install piping solutions further boosts demand. Their long service life and low maintenance requirements make them cost-effective compared to traditional materials, driving adoption in both developed and developing regions.

Market Opportunities

The market presents numerous opportunities driven by technological advancements and innovation in pipe manufacturing. The integration of smart sensors into geopipes for monitoring flow, pressure, and damage detection is opening up new possibilities in smart infrastructure development.

Emerging markets in Asia, Africa, and Latin America also offer significant growth potential, as these regions invest heavily in urban infrastructure, irrigation systems, and waste management. Additionally, the growing adoption of eco-friendly and recyclable materials in pipe production aligns well with global sustainability goals.

Market Challenges:

Despite the promising outlook, the geopipes market faces several challenges. High initial installation costs and limited awareness about advanced plastic piping systems in some regions can restrict market penetration. Furthermore, fluctuations in raw material prices, especially for petroleum-based plastics, can impact production costs and pricing strategies.

Regulatory compliance and environmental concerns over plastic use also pose challenges, prompting manufacturers to invest in greener alternatives and recycling technologies.

Regional Insights:

Regionally, Asia Pacific dominated the geopipes market in 2024, accounting for the largest market share due to rapid infrastructure development in countries like China and India. The region’s focus on improving water distribution, sanitation, and agricultural efficiency continues to drive demand.

North America is projected to experience the fastest CAGR, supported by investments in smart infrastructure and water conservation initiatives. Europe also holds a substantial market share, with stringent environmental regulations pushing the adoption of high-performance, sustainable piping systems.

Geopipes Market Companies

- Geosynthetics Limited

- GSE Environmental

- TenCate Geosynthetics

- SKAPS Industries

- HUESKER

- Officine Maccaferri

- ABG Ltd.

- Terram

- Thrace Group

- Ocean Global

Latest Announcements by Industry Leaders

In March 2025, REHAU launched the first 100% climate-neutral plastic sewer system. This innovative sewage pipe system is designed with a focus on the circular economy, contributing to significant emissions savings. Constructed from 100% recycled polymer and high-quality polypropylene, it allows for measurable CO2 reduction by utilizing sustainable and recyclable materials. “Our new polymer sewage system uniquely combines performance and sustainability,” said Steve. “With nevoPP, we offer the wastewater industry a reliable option on their path toward net zero, while maintaining the high standards.” He added, “At REHAU, we are dedicated to driving the transition to sustainable materials for businesses. Our latest innovation, nevoPP, exemplifies this commitment. By modernizing our production facilities, we continuously improve efficiency and ensure that sustainability remains at the core of our manufacturing processes.”

Recent Developments

- In March 2025, Nippon Steel obtained five “SuMPO EPD” certifications for its pipes and tubes used in the chemical industry and for boilers. To support its customers’ efforts to promote carbon neutrality, Nippon Steel Corporation has achieved these certifications under the SuMPO Environmental Labeling Program by the Sustainable Management Promotion Organization (SuMPO), a general incorporated association.

- In July 2024, the Van Leeuwen Pipe and Tube Group unveiled its own brand of CO2-reduced steel pipe and tube products, named Van Leeuwen Impact. This new line supports the sustainability goals of its partners and customers in the steel pipe and tube industry. As customers increasingly seek sustainable solutions, Van Leeuwen Impact offers a way for businesses to reduce their carbon footprint without compromising product quality or performance.

- In November 2023, Baker Hughes, an energy technology company, announced the launch of its new PythonPipe portfolio. This latest development in reinforced thermoplastic pipe (RTP) technology facilitates faster installations, reduces the time to first production, and lowers lifecycle emissions.

Segments covered in the report

By Product

- High-density Polyethylene (HDPE)

- Polypropylene (PP)

- Polyvinyl Chloride (PVC)

- Other

By Application

- Drainage & Sewer Systems

- Irrigation & Agriculture

- Mining & Industrial

- Oil & Gas Pipelines

- Road & Highway Construction

- Other

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Also Read: Laminated Steel Market

Ready for more? Dive into the full experience on our website@ https://www.precedenceresearch.com/

- Fabric Filter Market Size to Attain USD 7.50 Billion by 2034 - April 24, 2025

- Pilot Training Market Size to Attain USD 31.38 Bn by 2034 - April 24, 2025

- Wearable Smart Baby Monitor Market Size to Gain USD 4.34 Billion by 2034 - April 24, 2025