Key Points

- North America dominated the market in 2023.

- By product, the reagents & kits segment dominated the market in 2023.

- By test, the disease diagnostic testing segment dominated the largest share in 2023.

- By technology, the real-time PCR system segment dominated the genetic analysis market in 2023.

- By application, the infectious diseases segment dominated the market in 2023.

- By end-use, the research & development laboratories segment dominated the market in 2023.

Get a Sample: https://www.precedenceresearch.com/sample/3922

Growth Factors

Several factors are driving the expansion of the genetic analysis market. Firstly, the declining cost of sequencing technologies, such as next-generation sequencing (NGS), has made genetic analysis more accessible and affordable. This cost reduction has spurred widespread adoption across research institutions, healthcare facilities, and pharmaceutical companies, driving market growth.

Additionally, increasing demand for personalized medicine and targeted therapies has fueled the need for genetic analysis tools and services. Genetic testing enables healthcare providers to tailor treatment plans based on an individual’s genetic makeup, improving treatment efficacy and patient outcomes. Moreover, growing awareness of genetic predispositions to certain diseases, such as cancer and inherited disorders, has led to a surge in demand for genetic testing services, further driving market expansion.

Furthermore, advancements in bioinformatics and data analytics have enhanced the interpretation of genetic data, enabling researchers and clinicians to extract valuable insights from complex genomic datasets. These technological innovations have accelerated research efforts in genomics, biomarker discovery, and drug development, driving demand for genetic analysis tools and services in both academic and commercial settings.

Trends:

The genetic analysis market is witnessing several trends that are shaping the future of the industry. One notable trend is the integration of artificial intelligence (AI) and machine learning algorithms into genetic analysis platforms. AI-driven analytics enable more accurate interpretation of genetic data, identification of disease-causing mutations, and prediction of treatment responses, thereby enhancing the utility of genetic analysis in clinical decision-making.

Moreover, there is a growing emphasis on multi-omics approaches, which combine genomic, transcriptomic, proteomic, and metabolomic data to gain a comprehensive understanding of biological systems. Integrating multiple layers of omics data enables researchers to unravel complex disease mechanisms, identify biomarkers, and develop targeted therapies, driving demand for advanced genetic analysis solutions that support multi-omics integration.

Additionally, there is increasing interest in direct-to-consumer (DTC) genetic testing services, driven by consumer curiosity about their ancestry, traits, and health risks. DTC genetic testing companies offer affordable and convenient testing kits that allow individuals to explore their genetic heritage and receive personalized health insights without involving healthcare providers. However, concerns about data privacy, accuracy of results, and interpretation of findings have prompted regulatory scrutiny and industry self-regulation in the DTC genetic testing market.

Genetic Analysis Market Scope

| Report Coverage | Details |

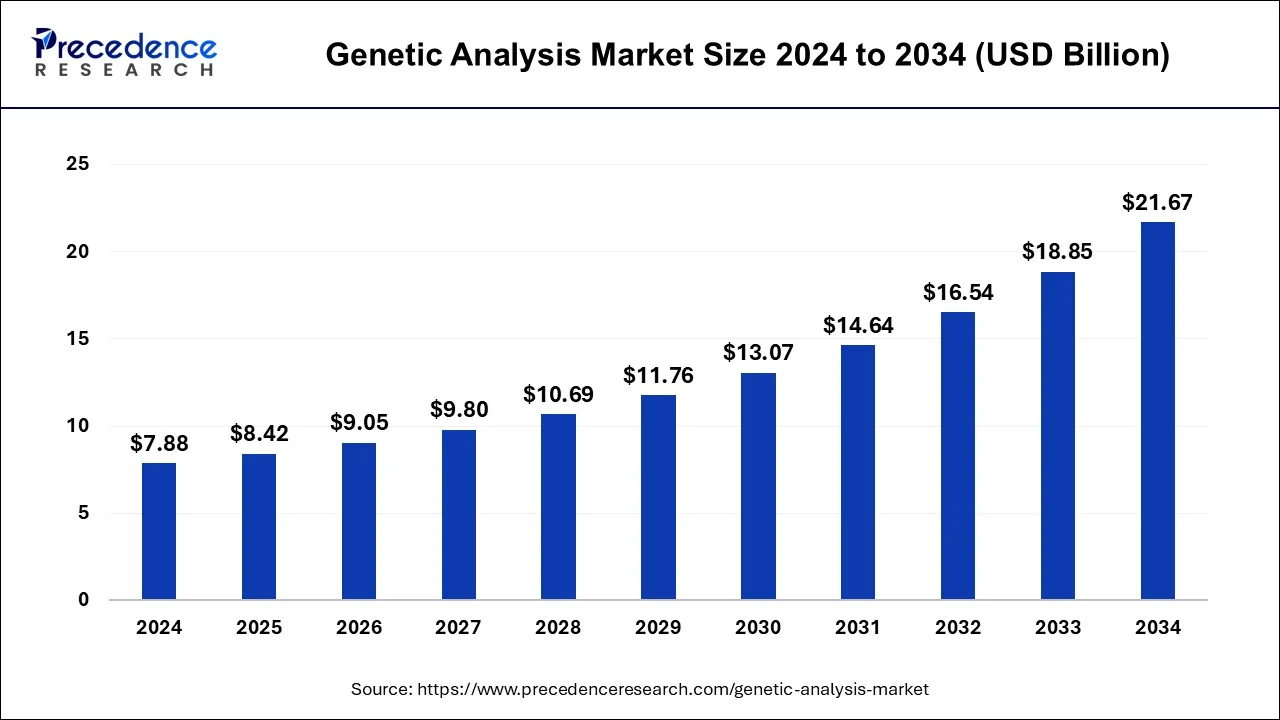

| Growth Rate from 2024 to 2033 | CAGR of 8.39% |

| Global Market Size in 2023 | USD 10.55 Billion |

| Global Market Size by 2033 | USD 23.60 Billion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Product, By Test, By Technology, By Application, and By End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Region Insights:

The genetic analysis market exhibits regional variations influenced by factors such as healthcare infrastructure, regulatory environment, and research funding. North America, particularly the United States, dominates the global genetic analysis market due to a robust biotechnology industry, significant investment in research and development, and supportive regulatory policies. The presence of leading biotech companies, academic research institutions, and healthcare facilities drives market growth in the region.

In Europe, countries like the United Kingdom, Germany, and France are key markets for genetic analysis, fueled by government initiatives to promote genomics research, healthcare innovation, and precision medicine. The European Union’s focus on data privacy and regulatory harmonization has facilitated market expansion while ensuring patient safety and data security in genetic analysis.

Asia-Pacific is emerging as a rapidly growing market for genetic analysis, driven by increasing healthcare expenditure, rising prevalence of genetic disorders, and growing research collaborations with international partners. Countries like China, Japan, and India are investing heavily in genomics research, biotechnology infrastructure, and precision medicine initiatives, driving demand for genetic analysis tools and services in the region.

Read Also: Behavioral and Mental Health Software Market Size, Share, Report by 2033

Recent Developments

- In December 2023, SNP Therapeutics Inc. will introduce a range of prenatal nutrition items in addition to its GenateTM Test, a prenatal genetic screening tool. With the help of Generate Prenatal Nutrition, women can tailor their diet to their unique gene variations related to food metabolism.

- In July 2023, US-based Quest Diagnostics, a supplier of diagnostic information services, introduced Genetic Insights, its first consumer-focused genetic test. Due to the new service, People will better understand their risk of inheriting illness disorders. Personalized health reports and access to genetic counseling, a feature not often provided with comparable services, will be included in the program.

Competitive Landscape:

The genetic analysis market is highly competitive, with a diverse range of companies competing across various segments, including sequencing instruments, reagents, software, and services. Illumina, Inc., the market leader in sequencing technology, commands a dominant position with its portfolio of NGS platforms and consumables, catering to research, clinical, and applied markets worldwide.

Other notable players in the genetic analysis market include Agilent Technologies, Qiagen N.V., and BGI Genomics, among others. These companies compete on the basis of product quality, technological innovation, pricing, and customer service, driving continuous advancements in genetic analysis technology and expanding market opportunities.

Genetic Analysis Market Companies

- Thermo Fisher Scientific

- Abbott Laboratories

- PerkinElmer, Inc.

- BioRad Laboratories

- AutoGenomics Inc.

- ELITech Group

- IntegraGen

- Quest Diagnostics Inc.

- Hoffmann-La Roche AG

- Celera Group

- Qiagen

- Danaher (Cepheid)

Segments Covered in the Report

By Product

- Reagents & Kits

- Instruments

- Software

By Test

- Predictive Genetic Testing

- Carrier Testing

- Prenatal and Newborn Testing

- Disease Diagnostic Testing

- Pharmacogenomic Testing

- Others

By Technology

- Next-Generation Sequencing (NGS)

- Real-Time PCR System

- Others

By Application

- Cancer

- Genetic Diseases

- Cardiovascular Diseases

- Rare Diseases

- Infectious Diseases

- Others

By End-use

- Hospitals

- Research & Development Laboratories

- Diagnostic Centers

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

- Intelligent Traffic Management System Market Size, Trends, Report 2034 - July 17, 2024

- Healthcare Finance Solutions Market Size to Grow USD 293.12 Bn by 2034 - July 17, 2024

- Epoxy Composites Market Size to Grow USD 84.99 Bn by 2034 - July 17, 2024