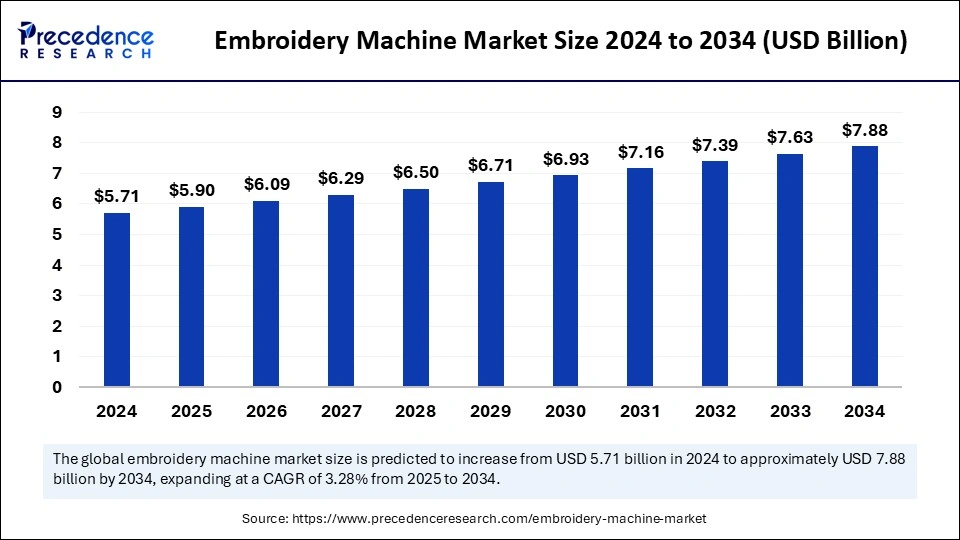

The global embroidery machine market size was estimated at USD 5.71 billion in 2024 and is expected to attain around USD 7.88 billion by 2034, growing at a CAGR of 3.28% from 2025 to 2034.

Embroidery Machine Market Key Points

-

Asia Pacific was the leading region in 2024 with 41% of the market.

-

North America is expected to grow the fastest during the forecast period.

-

Flatbed machines led the market by type in 2024.

-

Multi-needle machines are forecasted to grow the quickest.

-

Computerized technology had the biggest share in 2024.

-

Digital technology is likely to grow at the fastest rate ahead.

-

Textile applications topped the market in 2024.

-

Home decor applications are predicted to grow strongly in the future.

-

Industrial use remained dominant over recent years.

-

Household use is projected to expand rapidly in the near term.

Smart Stitching: The Role of AI in Transforming Embroidery Machines

Artificial Intelligence is transforming the embroidery machine market by bringing automation, precision, and smart design capabilities to the forefront. AI-powered embroidery machines can automatically detect fabric types, adjust stitching parameters in real time, and optimize thread usage for more efficient operation. These machines can learn from patterns and user preferences, reducing manual intervention while improving consistency and design quality.

In addition to design automation, AI enhances predictive maintenance by analyzing machine performance data and identifying potential issues before breakdowns occur. This reduces downtime and improves overall productivity for both industrial users and home-based creators. With AI integration, embroidery machines are evolving into smart systems capable of handling complex, customized designs at high speed and accuracy, reshaping the future of textile manufacturing and personalization.

Embroidery Machine Market Growth Factors

-

Rising Demand for Customized Products: Consumers increasingly seek personalized and unique items, prompting businesses to adopt embroidery machines that efficiently deliver tailored designs.

-

Technological Advancements: Modern embroidery machines offer faster stitching speeds, enhanced precision, and user-friendly interfaces, making them more appealing to both industrial users and hobbyists.

-

Growth in the Textile Industry: The expanding textile sector, particularly in Asia-Pacific countries like China, India, and Japan, plays a significant role in the increased production and consumption of embroidery machines.

-

Popularity of Embroidered Apparel and Accessories: The fashion industry’s embrace of embroidered designs has boosted the demand for embroidery equipment, as consumers favor embellished clothing and accessories.

-

User-Friendly Machines: The development of easy-to-use embroidery machines has attracted a broader range of users, including small businesses and home-based entrepreneurs, contributing to market growth.

Market Snapshot

The embroidery machine market has become a lucrative segment within the textile machinery industry, with applications ranging from commercial clothing production to personal hobby use. With increased interest in custom apparel and branding, embroidery is becoming a value-added service across several sectors.

Embroidery Machine Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 7.88 Billion |

| Market Size in 2025 | USD 5.90 Billion |

| Market Size in 2024 | USD 5.71 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 3.28% |

| Dominated Region | Asia Pacific |

| Fastest Growing Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Machine Type, Technology, Application, End user, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Embroidery Machine Market Dynamics

Market Growth Drivers

The proliferation of small fashion startups and online customization platforms has fueled the need for efficient and compact embroidery solutions. Additionally, automation trends in manufacturing are pushing industrial buyers to adopt high-speed, multi-head machines for bulk operations.

Opportunities Ahead

There is growing potential in offering subscription-based embroidery design software and leasing models for expensive machines. The home embroidery segment is particularly promising, driven by content creators and crafters looking for creative outlets or additional income streams.

Challenges to Address

Market barriers include the up-front cost of advanced systems and the fragmented nature of design software compatibility. Long-term maintenance and the need for specialized servicing can also be a deterrent for small business owners.

Regional Overview

Asia Pacific dominates in terms of production and sales, backed by a well-established textile ecosystem. In contrast, North America and Europe lean more toward high-value, niche applications. Africa and the Middle East are still in early adoption stages but show promise as their garment industries mature.

Embroidery Machine Market Companies

- Bernina

- Hasenfratz

- Barudan

- Viking

- ProEmbroiderer

- SWF

- Janome

- Brother Industries

- ZSK

- Tajima

- Sewing Machines Plus

- Ricoma

- Merrylock

- Melco

Latest Announcement

- In December 2024, Lesage Embroidery Machines, a leader in high-end garment and hat embroidery machines under the Promaker group, announced its commitment to innovation in the new year. The company’s statement emphasized, “In the new year, we will continue to deeply root ourselves in the field of intelligent embroidery for garments and hats, standing at the forefront of the industry with continuous technological innovation, leading the wave of change.”

Embroidery Machine Market Recent Developments

- In 2024, Bernina introduced the “Bernina 990” sewing and embroidery machine, equipped with a scanner, camera, touchscreen, and laser. These features facilitate precise design placement by visualizing the hopped fabric within the embroidery hoop. With a focus on innovation, Bernina continues to enhance the user experience by combining traditional craftsmanship with modern technology.

- In 2023, Brother Industries launched a series of high-speed embroidery machines featuring advanced connectivity options, enabling seamless integration with design software and cloud services. These machines cater to both small businesses and large-scale manufacturers, offering greater flexibility and precision.

Segments Covered in the Report

By Machine Type

- Flat-bed embroidery machines

- Multi-Needle Embroidery Machines

- Single-Needle Embroidery Machines

- Commercial Embroidery Machines

By Technology

- Computerized Embroidery Machines

- Manual Embroidery Machines

- Digital Embroidery Machines

By Application

- Textile Industry

- Fashion Industry

- Home Decor

- Promotional Products

By End User

- Industrial

- Household

- Academic

By Geography

- North America

- Europe

- South America

- Asia Pacific

- Middle East and Africa

Also Read: AI-Driven Battery Technology Market

Ready for more? Dive into the full experience on our website@ https://www.precedenceresearch.com/

- Nanodiamonds Market Size to Attain USD 1,143.33 Million by 2034 - April 16, 2025

- Luxury Boxes Market Size to Attain USD 9.01 Bn by 2034 - April 16, 2025

- Landscaping and Gardening Service Market Size to Gain USD 201.9 Bn by 2034 - April 16, 2025