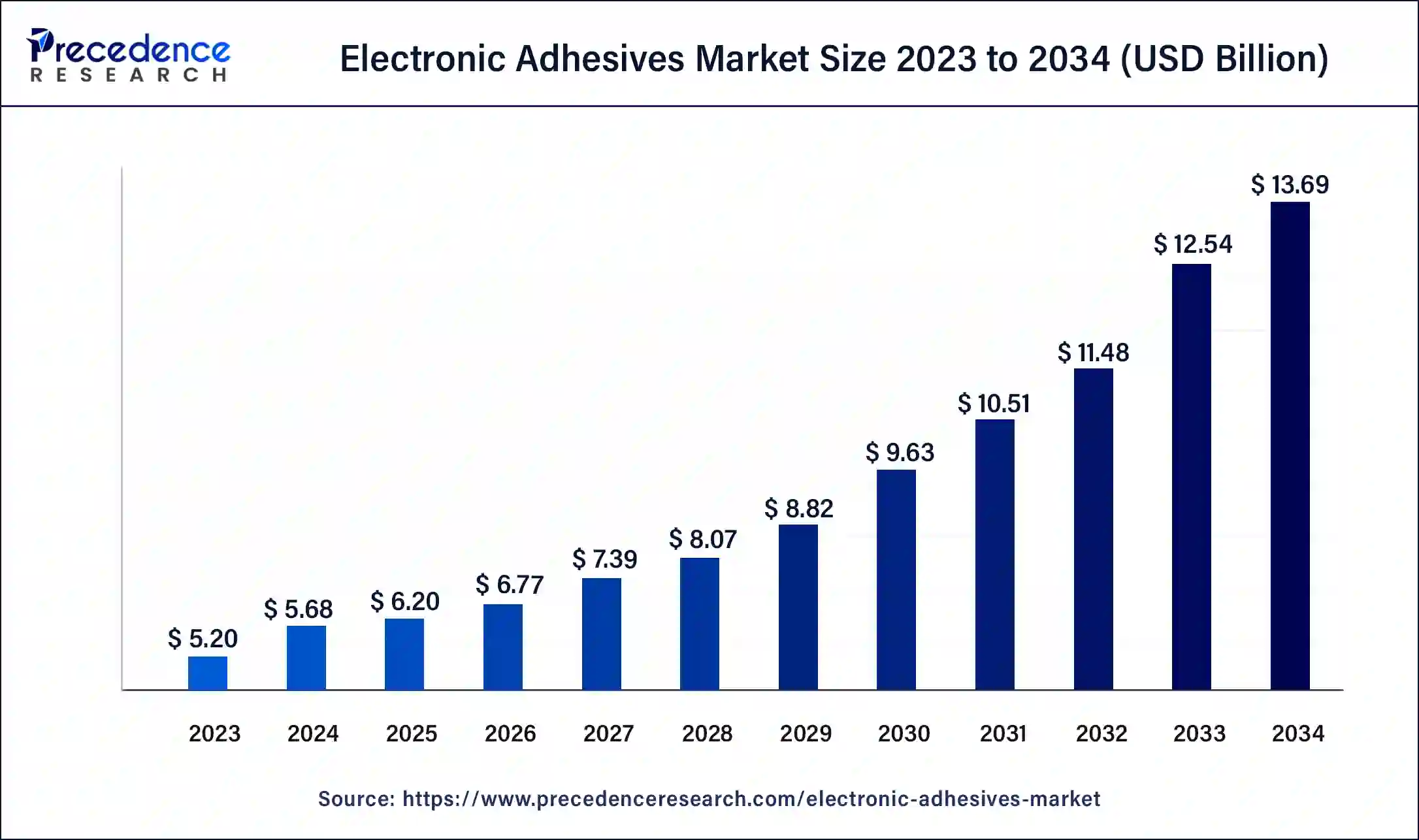

The global electronic adhesives market size was estimated at USD 5.20 billion in 2023, growing at a CAGR of 9.07% from 2024 to 2033.

The electronic adhesives market encompasses materials used to bond components in electronic devices and products. These adhesives play a crucial role in ensuring the durability, efficiency, and performance of electronic devices by providing thermal management, electrical conductivity, and mechanical stability. Applications include surface mounting, wire bonding, and encapsulation, making them essential in the production of smartphones, laptops, and other consumer electronics.

Key Points

- Asia Pacific dominated the electronic adhesives market in 2023 and accounted for 32% revenue share.

- North America is the fastest-growing region in the global market.

- By resin type, the epoxy segment has accounted market share of around 37% in 2023.

- Based on application type, the surface mounting segment dominated the market in 2023.

- Based on end user, the consumer electronics segment dominated the market in 2023 and will continue doing so throughout the forecast period.

Growth Factors

The growth of the electronic adhesives market is driven by the increasing demand for consumer electronics such as smartphones and tablets. The rise in adoption of electric and hybrid vehicles, which require electronic components, also contributes to market growth. Moreover, technological advancements in electronic devices and the miniaturization of components necessitate the use of high-performance adhesives, further boosting the market.

Get a Sample: https://www.precedenceresearch.com/sample/4094

Regional Insights

The Asia-Pacific region leads the electronic adhesives market due to its status as a hub for electronics manufacturing. Countries such as China, Japan, and South Korea have a strong presence in this market, driven by their robust manufacturing industries and the presence of major electronic component manufacturers. North America and Europe also contribute significantly to the market, with strong research and development activities and increasing investments in the electronics industry.

Electronic Adhesives Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 9.07% |

| Global Market Size in 2023 | USD 5.20 Billion |

| Global Market Size in 2024 | USD 5.67 Billion |

| Global Market Size by 2033 | USD 12.40 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Resin Type, By Form, By Application, and By End-user Industry |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Electronic Adhesives Market Dynamics

Drivers

Key drivers of the electronic adhesives market include the rapid growth of the consumer electronics industry, the expansion of the automotive electronics sector, and the trend toward miniaturization and integration of electronic components. The need for reliable, high-performance adhesives to support emerging technologies such as 5G and IoT devices is also propelling market growth.

Opportunities

Opportunities in the electronic adhesives market include the development of eco-friendly and sustainable adhesive solutions. As environmental regulations tighten, manufacturers can gain a competitive edge by offering products that meet these standards. Additionally, advances in nanotechnology and materials science could lead to innovative adhesive solutions with improved performance.

Challenges

Challenges in the electronic adhesives market include maintaining product consistency and quality while keeping costs low. Variability in raw material prices can impact the cost of production, affecting profitability. Furthermore, stringent environmental and safety regulations may pose challenges in terms of compliance and the need for continuous innovation to meet industry standards.

Read Also: Data Center Virtualization Market Size, Share, Report by 2033

Recent Developments

- In May 2023, Arkema acquired Polytec PT, a German company that specializes in manufacturing adhesives for batteries and electronic products. The company has sales worth 15 Euros and has its main production site in Karlsbad, Germany. Arkema assures us that it will strengthen the company further by serving the best in the ever-growing batteries and electronics market.

- In February 2024, Intertronics, a company specializing in adhesive manufacturing, launched a structural adhesive selection guide. It will help the manufacturers find the right optimal adhesive for their application in order to get a strong and highly effective bond. In this guide, one can find a detailed overview of the chemistries of five structural adhesives: Epoxy, polyurethane, cyanoacrylate, UV curing, and methyl methacrylate (MMA). The guide has been designed in a way that will benefit a wide range of industries, including automotive, aerospace, electronics, construction, etc.

Electronic Adhesives Market Companies

- Arkema

- 3M

- Ashland

- AVERY DENNISON CORPORATION

- BASF SE

- Beardow Adams

- CHEMENCE

- Covestro AG

- Dow

- Fuller Company

- Henkel AG & Co. KGaA

- Huntsman International LLC

- Illinois Tool Works Inc. (ITW)

- MAPEI S.P.A.

- Permabond LLC

- Pidilite Industries Ltd.

- Sika AG

Segments Covered in the Report

By Resin Type

- Epoxy

- Acrylics

- Polyurethane

- Silicone

- Others

By Form

- Liquid

- Paste

- Solid

By Application

- Conformal Coatings

- Surface Mounting

- Encapsulation

- Wire Tacking

- Others

By End-user

- Consumer Electronics

- IT Hardware

- Automotive

- Medical

- Aerospace & Defense

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/

- Intelligent Traffic Management System Market Size, Trends, Report 2034 - July 17, 2024

- Healthcare Finance Solutions Market Size to Grow USD 293.12 Bn by 2034 - July 17, 2024

- Epoxy Composites Market Size to Grow USD 84.99 Bn by 2034 - July 17, 2024