The global electric construction equipment market size was estimated at USD 10.32 billion in 2023, growing at a CAGR of 23.62% from 2024 to 2033.

The global electric construction equipment market is experiencing a notable shift towards electrification driven by environmental concerns, stringent emissions regulations, technological advancements, and the increasing focus on sustainability in the construction industry. Electric construction equipment, including excavators, loaders, cranes, and forklifts, offers several advantages over traditional diesel-powered machinery, such as reduced emissions, lower operating costs, improved efficiency, and quieter operation. As governments worldwide implement policies to curb carbon emissions and promote the adoption of cleaner technologies, the electric construction equipment market is poised for substantial growth in the coming years.

Key Points

- Asia Pacific contributed 34% of market share in 2023.

- North America is estimated to expand the fastest CAGR between 2024 and 2033.

- By vehicles, the excavators segment held the largest market share of 30% in 2023.

- By vehicles, the cranes segment is anticipated to grow at a remarkable CAGR of 25.2% between 2024 and 2033.

- By source, the lithium-ion segment generated over 44% of market share in 2023.

- By source, the lead acid segment is expected to expand at the fastest CAGR over the projected period.

- By end use, the construction segment generated over 32% of market share in 2023.

- By end use, the industrial segment is expected to expand at the fastest CAGR over the projected period.

Growth Factors:

Several key factors are driving the growth of the global electric construction equipment market. Firstly, environmental regulations aimed at reducing greenhouse gas emissions and noise pollution are compelling construction companies to transition towards electric construction equipment to comply with stricter emission standards. Additionally, technological advancements in battery technology, such as higher energy density, faster charging capabilities, and longer battery life, have made electric construction equipment more viable and cost-effective alternatives to diesel-powered machinery. Moreover, the lower operating costs associated with electric construction equipment, including reduced fuel consumption and maintenance expenses, are driving adoption among construction companies seeking to improve profitability and sustainability.

Get a Sample: https://www.precedenceresearch.com/sample/4046

Region Insights:

The adoption of electric construction equipment varies significantly across regions, influenced by factors such as regulatory frameworks, infrastructure development, market maturity, and consumer preferences. Developed regions such as North America and Europe are leading the transition towards electric construction equipment, driven by stringent emissions regulations, government incentives, and growing environmental awareness. In North America, initiatives such as California’s Zero-Emission Vehicle (ZEV) mandate and federal tax credits for electric equipment purchases are accelerating the adoption of electric construction machinery. Europe, with its ambitious targets for reducing carbon emissions and promoting sustainable development, has witnessed increasing investments in electric construction equipment and charging infrastructure. Emerging markets in Asia-Pacific, including China and India, are also embracing electric construction equipment to address urban pollution, improve air quality, and meet sustainability goals.

Trends:

Several trends are shaping the electric construction equipment market landscape. One notable trend is the development of compact electric construction machinery suited for urban construction projects and confined workspaces. These compact electric equipment offer maneuverability, reduced emissions, and quieter operation, making them ideal for construction projects in densely populated areas. Another trend is the integration of telematics and connectivity features in electric construction equipment, enabling real-time monitoring of machine performance, predictive maintenance, and fleet management optimization. Additionally, advancements in autonomous and semi-autonomous technologies are driving the development of electric construction equipment with enhanced safety, productivity, and efficiency, reducing the need for manual operation and labor-intensive tasks.

Electric Construction Equipment Market Scope

| Report Coverage | Details |

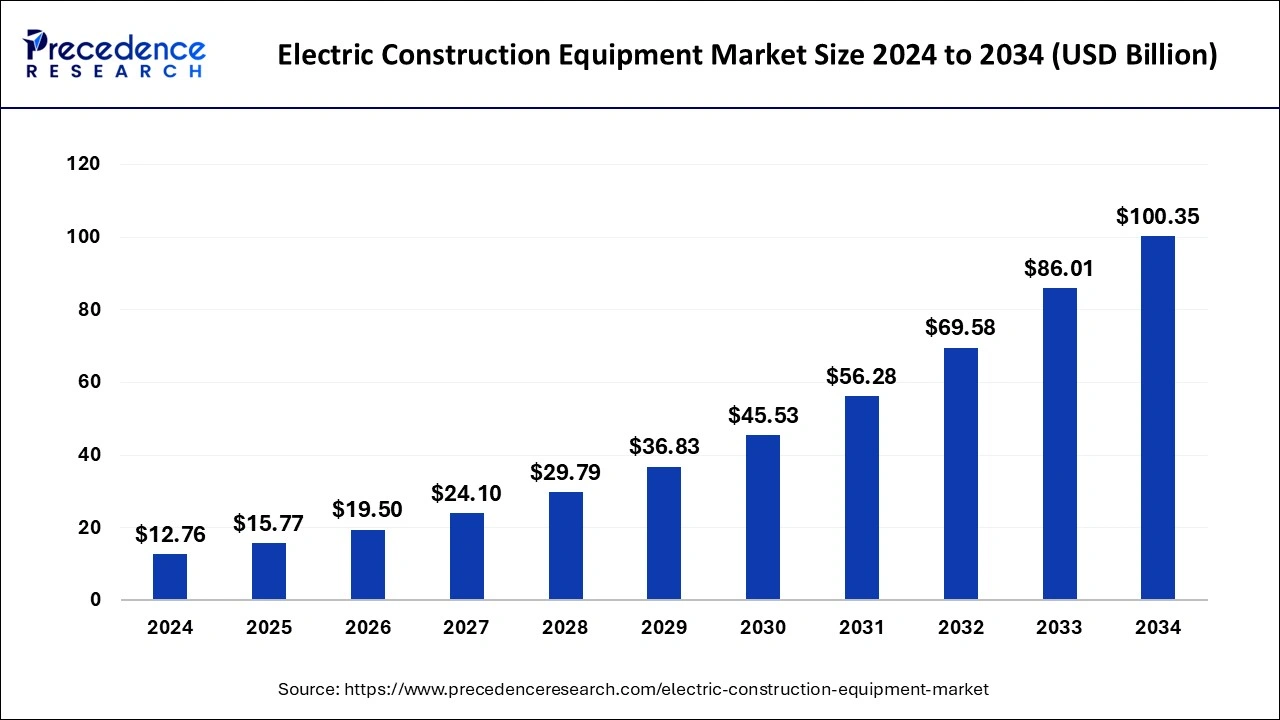

| Growth Rate from 2024 to 2033 | CAGR of 23.62% |

| Global Market Size in 2023 | USD 10.32 Billion |

| Global Market Size in 2024 | USD 12.76 Billion |

| Global Market Size by 2033 | USD 86.01 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Vehicles, By Source, and By End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Electric Construction Equipment Market Dynamics

Drivers

Several factors are driving the adoption of electric construction equipment globally. Firstly, the environmental benefits of electric construction machinery, including reduced emissions, noise pollution, and environmental impact, are compelling construction companies to transition towards cleaner and more sustainable equipment options. Additionally, the lower operating costs of electric construction equipment, attributed to lower fuel consumption, reduced maintenance requirements, and longer equipment lifespan, are driving cost-conscious construction firms to invest in electrified fleets. Government incentives, such as tax credits, grants, and subsidies for electric equipment purchases, are further incentivizing the adoption of electric construction machinery, especially in regions with stringent emissions regulations and sustainability targets.

Opportunities

The electric construction equipment market presents significant opportunities for manufacturers, suppliers, and other stakeholders across the value chain. Manufacturers have the opportunity to innovate and develop a wide range of electric construction equipment tailored to diverse construction applications, including excavators, loaders, dump trucks, and cranes. Investing in research and development to improve battery technology, charging infrastructure, and equipment efficiency can enhance the competitiveness and attractiveness of electric construction machinery. Moreover, suppliers of components and systems for electric construction equipment, such as batteries, electric motors, and power electronics, can capitalize on the growing demand for electrified solutions by offering innovative and cost-effective technologies to OEMs. Furthermore, government agencies and policymakers can play a pivotal role in supporting the transition towards electric construction equipment through incentives, infrastructure investments, and regulatory frameworks that promote sustainability and emission reductions in the construction industry.

Challenges

Despite the promising growth prospects, the electric construction equipment market faces several challenges that could hinder its widespread adoption. One of the primary challenges is the upfront cost of electric construction equipment, which tends to be higher than diesel-powered alternatives due to the cost of battery technology and electrification components. Construction companies may be reluctant to invest in electric equipment without clear cost savings and return on investment, particularly in regions where electricity prices are high or government incentives are limited. Moreover, the availability of charging infrastructure for electric construction equipment remains limited in many regions, posing logistical challenges for construction firms operating in remote or off-grid locations. Additionally, concerns related to battery performance, durability, and reliability in harsh construction environments could impact the adoption of electric construction machinery, necessitating further advancements in battery technology and equipment design to address these challenges effectively.

Read Also: Carbon Footprint Management Market Size Report by 2033

Recent Developments

- In 2023, Komatsu achieved significant strides in the electric construction equipment sector. Key releases included the PC05E-1 Electric Micro Excavator, offering zero emissions in Europe for their 3-ton mini excavator range. Additionally, Komatsu introduced the PC200LCE-11 and PC210LCE-11 Electric Excavators, their initial large electric models, promising performance comparable to diesel equivalents but with zero emissions. At CONEXPO 2023, they unveiled the HB365LC-3 Hybrid Excavator, enhancing fuel efficiency and reducing emissions by integrating a diesel engine with an electric motor and battery.

- In June 2022, Cummins and Komatsu signed a memorandum of understanding to collaborate on zero-emission haulage equipment development. Komatsu had previously announced a power-agnostic truck concept in 2021, capable of utilizing various power sources such as diesel-electric, trolley, battery power, and hydrogen fuel cells.

- In the same month of June 2022, John Deere announced a global partnership with Wacker Neuson to develop excavators ranging from 0 to 9 metric tons. Wacker Neuson will manufacture excavators under five metric tons, while John Deere will oversee design, manufacturing, and technology innovation for models between 5 to 9 metric tons.

- In May 2022, Volvo Construction Equipment (Volvo CE) made an investment in Dutch firm Limach, specializing in electric excavators for the domestic market. This investment supports Volvo CE’s long-term electrification strategy and expands its electromobility product range.

- March 2022 saw the joint development showcase of the PC01E-1 by Honda and Komatsu. This electric micro excavator, powered by portable and interchangeable mobile batteries, represents Komatsu’s first foray into electric micro excavators, developed in collaboration with Honda.

- In December 2021, Volvo Construction Equipment (Volvo CE) collaborated with partners across the electric ecosystem to deliver a comprehensive site solution for real urban applications. This project involved machine demonstrations in Gothenburg, supported by entities such as Gothenburg City, NCC, Gothenburg Energy, Lindholmen Science Park, Chalmers University of Technology, and ABB Electrification Sweden, with funding from the Swedish Energy Agency.

- In October 2021, Caterpillar Venture Capital Inc. (Caterpillar) and another venture invested USD 16 million in BrightVolt, Inc. BrightVolt Inc. is renowned for designing, developing, and manufacturing safe, high-energy, low-cost solid-state lithium-ion batteries. This funding aims to advance larger form-factor products catering to industrial electrification and e-mobility markets.

Electric Construction Equipment Market Companies

- Volvo Construction Equipment

- Komatsu

- Caterpillar

- John Deere

- Honda

- Cummins

- Wacker Neuson

- XCMG

- Hitachi Construction Machinery

- Liebherr

- JCB

- Doosan Infracore

- Hyundai Construction Equipment

- Kobelco Construction Machinery

- Sany Group

Segments Covered in the Report

By Vehicles

- Excavators

- Loaders

- Cranes

- Others

By Source

- Lithium-Ion

- Lead Acid

- Others

By End-use

- Residential

- Construction

- Industrial

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/

- Intelligent Traffic Management System Market Size, Trends, Report 2034 - July 17, 2024

- Healthcare Finance Solutions Market Size to Grow USD 293.12 Bn by 2034 - July 17, 2024

- Epoxy Composites Market Size to Grow USD 84.99 Bn by 2034 - July 17, 2024