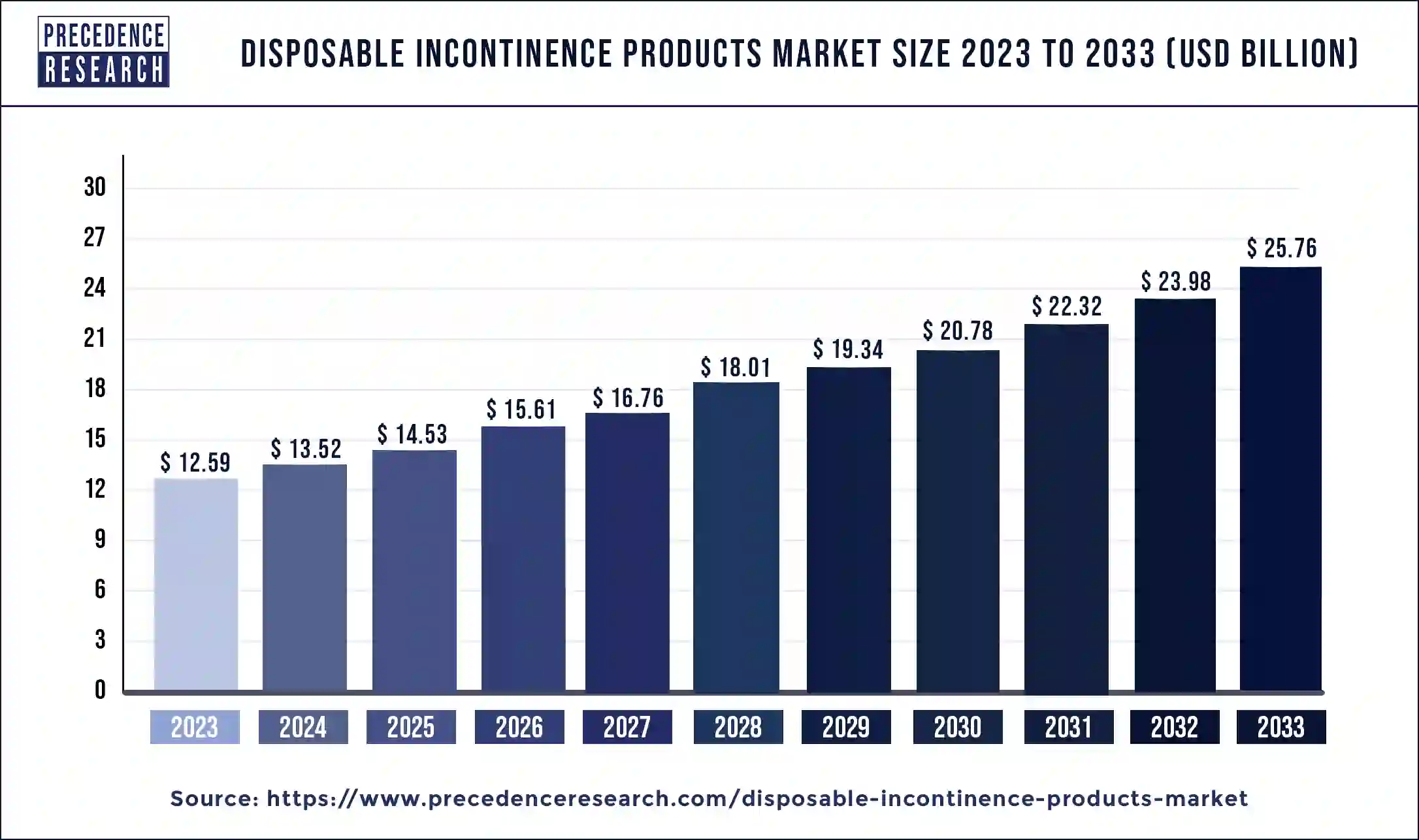

The global disposable incontinence products market size is anticipated to reach USD 25.76 billion by 2033 from USD 12.59 billion in 2023, expanding at a CAGR of 7.42% from 2024 to 2033.

The disposable incontinence products market is experiencing rapid growth globally due to the increasing prevalence of urinary incontinence and fecal incontinence among aging populations, along with the rising awareness about personal hygiene and healthcare standards. Disposable incontinence products, including adult diapers, pads, and protective underwear, offer convenience, comfort, and discretion to individuals managing incontinence-related issues. With the growing emphasis on patient comfort, dignity, and quality of life, the demand for disposable incontinence products is expected to continue rising, driving market expansion across various demographics and geographic regions.

Key Points

- Europe dominated the market with the largest share of 35% in 2023.

- By product, the protective incontinence garments segment has held the largest market share of 85% in 2023.

- By application, the fecal incontinence segment has contributed more than 25% of market share in 2023.

- By incontinence type, the mixed segment dominated the market with the largest share in 2023.

- By disease, the chronic disease segment has accounted for more than 26% of the market share in 2023.

- By material, the cotton fabrics segment dominated the market’s largest revenue share in 2023.

- By gender, the female segment dominated the disposable incontinence products market in 2023.

- By age, the 60 to 79 years segment dominated the market in 2023.

- By distribution channel, the retail stores segment dominated the market in 2023.

- By end-use, the ambulatory surgical centers segment held the largest share of the market in 2023.

Growth Factors:

Several factors contribute to the robust growth of the disposable incontinence products market. One key driver is the demographic shift towards an aging population, particularly in developed regions such as North America, Europe, and Asia-Pacific. Aging populations are more prone to urinary incontinence and fecal incontinence due to age-related changes in bladder and bowel function, leading to increased demand for effective and discreet incontinence management solutions.

Moreover, the growing prevalence of chronic health conditions such as obesity, diabetes, and neurological disorders contributes to the rise in incontinence cases globally. Individuals with these comorbidities are at higher risk of developing urinary and fecal incontinence, necessitating the use of disposable incontinence products for effective management and improved quality of life. Additionally, advancements in healthcare infrastructure and awareness campaigns about incontinence-related issues drive market growth by encouraging early diagnosis and intervention.

Furthermore, the expansion of e-commerce platforms and online retail channels enhances market accessibility and convenience for consumers seeking disposable incontinence products. Online retailers offer a wide range of product options, discreet packaging, and home delivery services, catering to the needs of individuals who prefer privacy and convenience when purchasing incontinence supplies. This shift towards online purchasing behavior expands market reach and accelerates product adoption among diverse consumer demographics.

Get a Sample: https://www.precedenceresearch.com/sample/3980

Region Insights:

The disposable incontinence products market exhibits a global presence, with North America, Europe, Asia-Pacific, and other regions representing significant growth opportunities. North America dominates the market due to the high prevalence of urinary incontinence and fecal incontinence, coupled with the presence of well-established healthcare infrastructure and reimbursement policies. The region’s aging population, along with favorable regulatory initiatives and public awareness campaigns, drives market growth and innovation in disposable incontinence products.

In Europe, increasing healthcare expenditures and aging demographics contribute to market expansion. The European Union’s focus on improving healthcare standards and promoting patient-centered care drives the adoption of disposable incontinence products across healthcare facilities and home care settings. Additionally, initiatives aimed at destigmatizing incontinence-related issues and promoting open discussions about bladder and bowel health support market growth and product acceptance.

Asia-Pacific emerges as a rapidly growing market for disposable incontinence products, fueled by the region’s aging population, urbanization, and rising disposable incomes. Countries such as China, Japan, and South Korea witness increasing demand for incontinence management solutions due to changing lifestyles, higher awareness about personal hygiene, and improving healthcare infrastructure. Moreover, government initiatives to address aging-related healthcare challenges and improve access to healthcare services drive market expansion across the Asia-Pacific region.

Disposable Incontinence Products Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 7.42% |

| Global Market Size in 2023 | USD 12.59 Billion |

| Global Market Size by 2033 | USD 25.76 Billion |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Application, By Incontinence Type, By Disease, By Material, By Gender, By Distribution Channel, and By End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Disposable Incontinence Products Market Dynamics

Drivers:

Several factors drive the adoption of disposable incontinence products among consumers and healthcare providers. One primary driver is the increasing focus on maintaining quality of life and dignity for individuals managing incontinence-related issues. Disposable incontinence products offer discretion, comfort, and absorbency, allowing individuals to maintain active lifestyles and participate in daily activities without fear of embarrassment or discomfort.

Additionally, advancements in product design and technology contribute to market growth by improving product performance, comfort, and skin health. Innovations such as superabsorbent polymers, odor control features, and breathable materials enhance the efficacy and user experience of disposable incontinence products, driving consumer preference and loyalty. Moreover, eco-friendly and sustainable product options address growing environmental concerns and consumer preferences for environmentally responsible purchasing choices.

Furthermore, the increasing adoption of disposable incontinence products in healthcare facilities and home care settings drives market expansion. Healthcare providers recognize the importance of effective incontinence management in preventing skin breakdown, infections, and psychosocial issues associated with untreated incontinence. Disposable products offer cost-effective, hygienic, and convenient solutions for managing incontinence across diverse patient populations, driving market demand and adoption.

Opportunities:

The disposable incontinence products market presents numerous opportunities for innovation and expansion. One significant opportunity lies in the development of tailored product solutions for specific user demographics and clinical needs. Customized product designs, sizes, and absorbency levels cater to the diverse preferences and requirements of individuals managing incontinence, enhancing product acceptance and satisfaction. Moreover, specialty products for unique user populations, such as pediatric incontinence products and bariatric incontinence products, address unmet needs and expand market reach.

Additionally, technological advancements in smart incontinence wearables and sensor-based monitoring systems present opportunities for enhancing product functionality and user experience. Smart incontinence products equipped with sensors, connectivity features, and mobile applications enable real-time monitoring of fluid loss, urinary frequency, and skin health, empowering users and caregivers with actionable insights for proactive management and intervention. Furthermore, integration with telehealth platforms and electronic health records (EHR) enhances care coordination and facilitates remote patient monitoring, driving market adoption and value proposition.

Moreover, expanding market penetration in emerging economies and underserved regions presents growth opportunities for disposable incontinence product manufacturers. As healthcare infrastructure improves and awareness about incontinence-related issues increases in developing countries, the demand for affordable and accessible incontinence management solutions rises. Strategic partnerships, distribution agreements, and market expansion initiatives can facilitate market entry and address the unique needs of diverse consumer demographics in emerging markets.

Challenges:

Despite the promising growth prospects, the disposable incontinence products market faces several challenges that could impact its trajectory. One such challenge is the stigma and taboo surrounding incontinence-related issues, which often deter individuals from seeking timely diagnosis and treatment. Cultural barriers, misinformation, and social norms contribute to the reluctance to discuss incontinence openly, leading to underreporting and undertreatment of incontinence cases. Public awareness campaigns and education initiatives are needed to destigmatize incontinence and promote open dialogue about bladder and bowel health.

Additionally, cost considerations and reimbursement limitations pose challenges to market adoption and access to disposable incontinence products, particularly for economically disadvantaged individuals and underserved populations. Limited insurance coverage and out-of-pocket expenses may deter individuals from purchasing high-quality disposable products or seeking appropriate medical care for incontinence management. Addressing affordability barriers and expanding reimbursement coverage for incontinence supplies are essential for improving access to care and reducing disparities in healthcare access.

Furthermore, environmental sustainability concerns related to disposable incontinence products present challenges to market growth and product innovation. Single-use disposable products contribute to plastic waste generation and environmental pollution, raising questions about the long-term sustainability of current consumption patterns. Manufacturers and policymakers are exploring eco-friendly materials, recycling initiatives, and circular economy models to minimize the environmental footprint of disposable incontinence products and promote sustainable consumption practices. Balancing environmental sustainability with product performance and affordability remains a key challenge for the industry.

Read Also: Cold Chain Monitoring Market Size to Cross USD 229.61 Bn by 2033

Recent Developments

- In September 2022, Attindas Hygiene Partners proudly presents its cutting-edge, new adults disposable incontinence underwear line in North America. The latest product, which is invisible beneath clothes and offers 100% leak-free protection, uses Maxi Comfort ultrasonic bonding tech to create a more elastic material that can fit a variety of body shapes. The product comes in three skin-friendly, cottony-soft colors for both men and women.

Disposable Incontinence Products Market Companies

- Essity AB

- Kimberly-Clark Corporation

- Coloplast Ltd.

- Unicharm Corporation

- Paul Hartmann AG

- Ontex

- First Quality Enterprises

- Medline Industries Inc.

Segments Covered in the Report

By Product

- Protective Incontinence Garments

- Disposable Adult Diaper

- Disposable Protective Underwear

- Cloth Adult Diaper

- Disposable Pads and Liners

- Male Guards

- Bladder Control Pads

- Incontinence Liners

- Belted and Beltless Under Garments

- Disposable Under Pads

- Urine Bag

- Leg Urine Bag

- Bedside Urine Bag

- Urinary Catheter

- Indwelling (Foley) Catheter

- Intermittent Catheter

- External Catheter

By Application

- Urine Incontinence

- Fecal Incontinence

- Dual Incontinence

By Incontinence Type

- Stress

- Urge

- Mixed

- Others

By Disease

- Feminine Health

- Pregnancy and Childbirth

- Menopause

- Hysterectomy

- Others

- Chronic Disease

- Benign Prostatic Hyperplasia

- Bladder Cancer

- Mental Disorders

- Others

By Material

- Plastic

- Cotton Fabrics

- Super Absorbents

- Latex

- Others

By Gender

- Male

- Female

By Age

- Below 20 years

- 20 to 39 years

- 40 to 59 years

- 60 to 79 years

- 80+ years

By Distribution Channel

- Retail Stores

- E-commerce

By End-use

- Hospital

- Ambulatory Surgical Centers

- Nursing Facilities

- Long term Care Centers

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/

- Intelligent Traffic Management System Market Size, Trends, Report 2034 - July 17, 2024

- Healthcare Finance Solutions Market Size to Grow USD 293.12 Bn by 2034 - July 17, 2024

- Epoxy Composites Market Size to Grow USD 84.99 Bn by 2034 - July 17, 2024