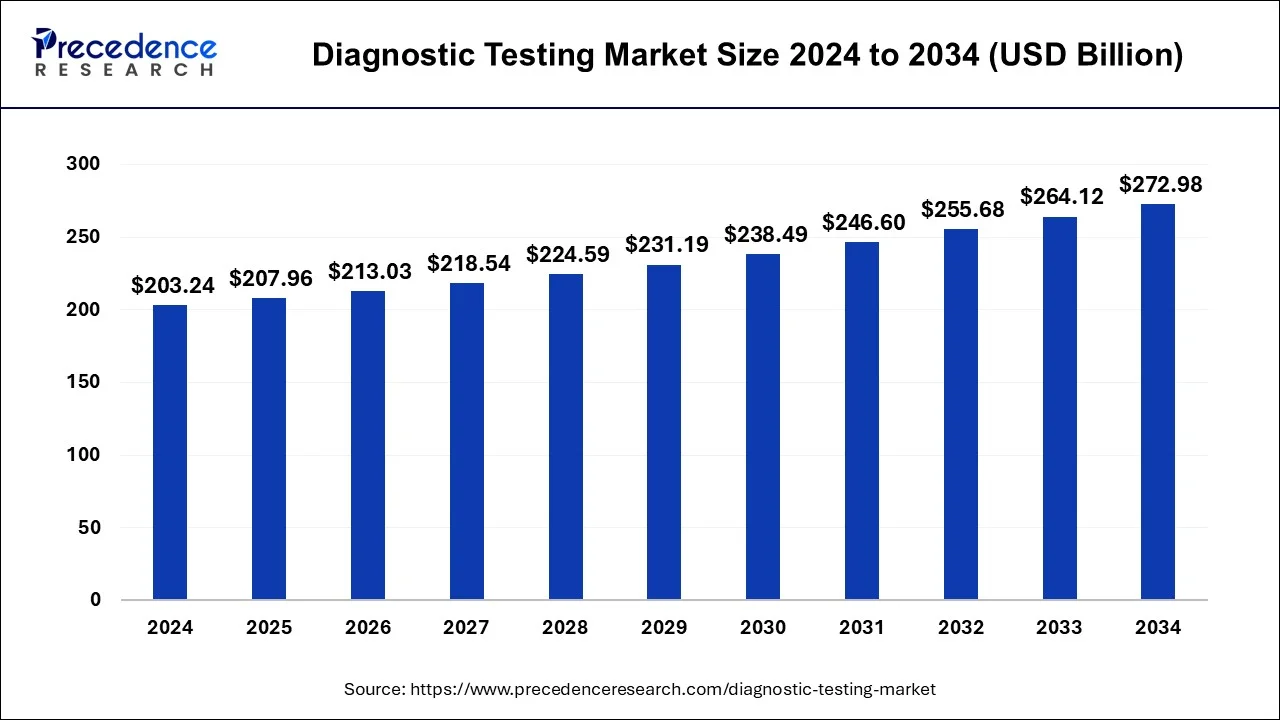

The global diagnostic testing market size was valued at USD 210.55 billion in 2023 and is expected to attain USD 272.98 billion by 2034.

Diagnostic tests are essential in medical investigations to identify individuals’ diseases, conditions, or infections. These tests assist healthcare providers in assessing the overall health of patients by diagnosing and monitoring the progression of the disease, enhancing patient care and safety, and reducing healthcare costs. The market is expected to grow at a significant growth rate in the coming years. This is due to the increasing demand for at-home diagnostic tests due to the growing trend of home healthcare. Moreover, the rising incidence of neurological disorders, cancers, and diabetes boosts the demand for point-of-care testing, thus fueling the market.

Key Insights

- The North America dental diagnostic and surgical equipment market size was valued at USD 4.83 billion in 2023 and is projected to reach around USD 8.99 billion by 2033.

- North America dominated the global dental diagnostic and surgical equipment segment has generated revenue share of 42% in 2023.

- By product, the dental surgical equipment segment has generated revenue share of 53% in 2023.

- By region, the market in Asia Pacific is expected to expand at a substantial growth rate during the forecast period.

- By type, the clinical diagnostic segment dominated the market in 2023.

- By approach, the in-vitro diagnostic instrument segment led the market in 2023.

- By application, the cardiology segment is projected to dominate the market in the coming years.

- By end-user, the hospitals segment is expected to lead the market throughout the forecast period.

Regional Stance

North America dominated the diagnostic testing market in 2023. This is due to the region’s strong emphasis on early disease detection and prevention. Diagnostic tests play a crucial role in disease detection and prevention. Moreover, the region is at the forefront of advanced healthcare technologies, leading to the development of cutting-edge diagnostic tools. Recently, Canada has made regulatory amendments aimed at improving patient safety. Moreover, the high prevalence of chronic diseases and the well-established healthcare system in the region further contributed to the regional market growth.

The market in Asia Pacific is expected to expand at a substantial growth rate in the near future, owing to the availability of diagnostics tests at low costs. With the rising prevalence of communicable diseases, there is increasing demand for diagnostic testing within the region. Moreover, the rising government initiatives to advance healthcare infrastructure and improve access to healthcare technologies further boost the market in Asia Pacific.

Type Insights

The clinical diagnostic segment dominated the global diagnostic testing market in 2023. Clinical diagnostic includes all medical tests carried out in a medical institution. These tests are important in the early identification of risk factors along with diseases so that treatment plans can be started. The increase in lifestyle-related ailments, such as diabetes, cardiovascular disease, and hypertension, often require clinical diagnostic tests to make informed decisions. Benefits associated with these tests include fast test results, simple procedures, and less discomfort. With the rising burden of diseases, the number of clinical trials is increasing, further contributing to segmental growth.

Approach Insights

The in-vitro diagnostic instrument segment led the market in 2023. This is primarily due to the growing use of in-vitro diagnostics (IVDs) to identify diseases or disorders. In-vitro diagnostic instruments are used to perform a range of disease-related tests using various samples, such as blood, tissues, and urine. Their high sensitivity and accuracy lead to precise diagnostics. Moreover, IVDs can be performed on various tools, from simple portable tests to complex laboratory instruments. These tests can be done at home, a lab, or a healthcare facility. The rising occurrences of chronic and infectious diseases are expected to spur the segment’s growth.

Application Insights

The cardiology segment is projected to dominate the market in the coming years due to the increasing instances of cardiovascular diseases worldwide. Cardiovascular diseases, such as stroke and heart disease, are the leading cause of death. Thus, diagnostic testing is crucial in diagnosing and managing various cardiovascular diseases. This testing provides detailed insights into the heart’s activity, rhythm, blood flow, and anatomic anomalies. Additionally, laboratory tests help identify risk factors associated with heart disease, including blood lipids and fats. In addition, cardiologists use cardiac imaging, testing, and diagnostics as indispensable tools in the timely identification, precise diagnosis, and competent treatment of cardiac disorders. The growing focus on early detection further propels the segment.

End-user Insights

The hospitals segment is expected to lead the market throughout the forecast period. This is mainly due to the availability of various diagnostic tests in hospitals, such as cytology, CBC, and blood cultures used for detecting syphilis, urease, C-reactive protein, and HBA1C antigen. Multispecialty hospitals also offer digital X-ray services, ultrasound scans (sonography), stress test procedures, and 2D echo tests. Hospitals often have their pathology lab or diagnostic centers, which help in early disease screening, monitoring, and prevention, ensuring that accurate and timely medical care is always given to patients. The rising patient pool in hospitals further contributes to segmental growth.

Market Dynamics

Driver

Rising prevalence of noncommunicable diseases

According to the WHO, noncommunicable diseases (NCDs) are responsible for 74% of all deaths, causing 41 million deaths every year. Diabetes, cancer, chronic respiratory disorders, and cardiovascular diseases are the leading causes of death, causing more than 80% of premature NCD deaths. With the growing aging population, the instances of chronic diseases are rising as chronic diseases develop with age. Moreover, there is a significant increase in the rate of ailments worldwide. Thus, the need for accurate, rapid, and personalized diagnostics to effectively manage various conditions has increased, thus driving the market.

Restraint

Stringent guidelines for the approval of diagnostic test kits

The U.S. FDA regulates DNA test kits to ensure their efficacy and safety. Following these guidelines is a major challenge for manufacturers of diagnostic test kits. These kits are required to be stored at -180 C to -800 C. The FDA has the authority to ban these test kits are not adhere to guidelines. Moreover, lengthy product approval processes can delay product launches, thus restraining market growth.

Opportunity

Adoption of groundbreaking technologies

Advanced technologies are transforming every aspect of the healthcare industry, from traditional patient care to diagnostics. Digitization, automation, and robotics are leading to the emergence of smart laboratories and imaging systems. The upcoming trend includes the revolution of pathology and radiology using biosensors, liquid biopsies, and AI-driven technologies. Additionally, strategic initiatives by key players to enhance diagnostics for quality performance and health management fuel the market.

Recent Developments

- In September 2024, a collaboration between the University of Chicago Pritzker School of Molecular Engineering and UCLA Samueli School of Engineering developed a cheap paper-based test and sensitive transistor-based diagnostic test system to develop this test for diagnosing diseases in humans.

- In Setember 2024, ARCpoint Inc. has integrated with MD Care Group’s API to enable telehealth doctors and practitioners to order diagnostic tests through physical locations, enhancing the MyARCpointLabs technology platform.

- In August 2024, Qiagen and AstraZeneca are expanding their diagnostics partnership to explore genomic profiling for chronic diseases beyond cancer.

- In June 2024, BioAI, a biotech company, has partnered with Genomic Testing Cooperative, a leading molecular diagnostics provider, to develop and develop novel biomarker diagnostics.

- In June 2024, WHO collaborates with partners at the ASEAN regional meeting to enhance access to quality diagnostic testing.

Diagnostic Testing Market Players

- F-Hoffman La-Rcohe Ltd. (Switzerland)

- ACON Laboratories Inc. (US)

- Danaher (US)

- BD (US)

- MicroGen Diagnostics (US)

- Thermo Fisher Scientific Inc. (US)

- Hemosure, Inc. (US)

- Grifols, S.A (Spain)

- BODITECH MED INC. (South Korea)

- Nanoentek (South Korea)

- Chembio Diagnostic Systems, Inc. (US)

- Siemens Healthcare GmbH (Germany)

- DiaSorin S.p.A. (Italy)

- Bio-Rad Laboratories, Inc. (US)

- BIOMEDOMICS INC (US)

- EKF Diagnostics Holdings plc (UK)

- Biohit Oyj (Finland)

- PerkinElmer Inc. (US)

- bioMérieux SA (France)

- ARKRAY USA, Inc. (US)

- Lamdagen Corporation (US)

- Quidel Corporation (US)

- Illumina, Inc. (US)

- LifeSign LLC. (US)

- Nova Biomedical (US)

- Medixbiochemica (Finaland)

- Ortho Clinical Diagnostics (US)

- Sannuo Biosensing Co., Ltd. (US)

- STRECK (US)

- Sysmex Corporation (Japan)

Segments covered in the report

By Type

- Clinical Diagnostic

- Home Diagnostic

By Application

- Cardiology

- Oncology

- Neurology

- Orthopedics

- Gastroenterology

- Gynecology

- Odontology

- Others

By Approach

- Molecular Diagnostic Instrument

- In-Vitro Diagnostic Instrument

- Point Of Care Testing Instrument

By Solution

- Services

- Products

By Technology

- Immunoassay-Based

- PCR-Based

- Next-generation Sequencing

- Spectroscopy-Based

- Chromatography-Based

- Microfluidics

- Substrate Technology

- Others

By Mode of Testing

- Prescription Based Testing

- OTC Testing

By Sample Type

- Urine

- Saliva

- Blood

- Hair

- Sweat

- Others

By Testing Type

- Biochemistry

- Hematology

- Microbiology

- Histopathology

- Others

By Age

- Pediatric

- Adult & Geriatric

By Distribution Channel

- Direct Tenders

- Retail Sales

- Online Sales

By End User

- Hospitals, Diagnostic Center

- Research Labs and Institutes

- Research Institute

- Homecare

- Blood Banks

- Specialty Clinics

- Ambulatory Surgical Centers

- Others

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Immediate Delivery Available | Buy This Premium Research Report@https://www.precedenceresearch.com/checkout/1984

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 804 441 9344

- Customer Self-service Software Market Size to Attain USD 128.36 Bn by 2034 - April 11, 2025

- Converted Flexible Packaging Market Size to Attain USD 374.06 Bn by 2034 - April 11, 2025

- Scleral Lens Market Size to Soar USD 982.68 Bn by 2034 - April 11, 2025