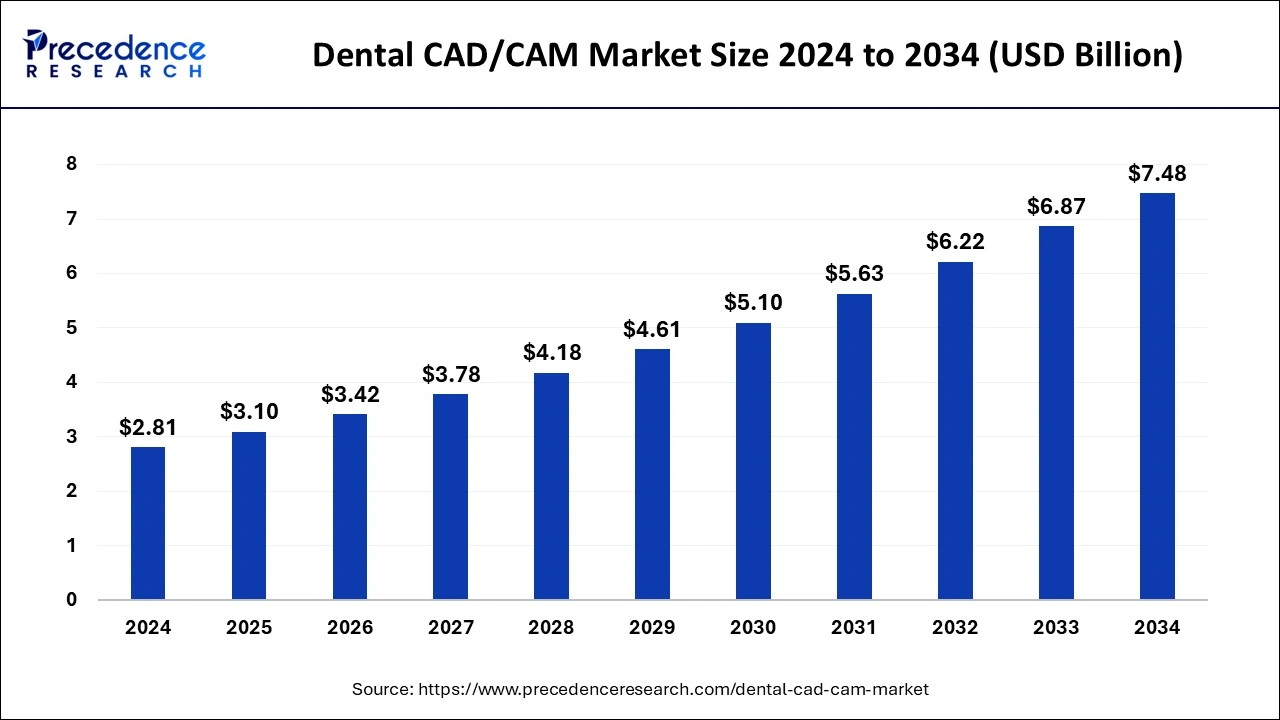

The global dental CAD/CAM market size is estimated to surpass around USD 6.87 billion by 2033 from USD 2.54 billion in 2023, growing at a CAGR of 10.46% from 2024 to 2033.

The Dental CAD/CAM (Computer-Aided Design/Computer-Aided Manufacturing) market has witnessed significant growth in recent years, driven by advancements in technology, rising demand for dental prosthetics, and increasing adoption of digital dentistry practices. Dental CAD/CAM systems enable dentists and dental technicians to design and manufacture dental restorations such as crowns, bridges, veneers, and implants with precision and efficiency. These systems offer numerous advantages over traditional methods, including faster production times, improved accuracy, and customization options tailored to individual patient needs. As a result, the dental CAD/CAM market has become a critical component of modern dental practices worldwide.

Key Points

- North America led the market with the biggest market share of 36% in 2023.

- Asia Pacific is expected to witness notable growth in the market during the forecast period.

- By type, the in-lab system segment dominated the dental CAD/CAM market in 2023.

- By component, the hardware segment had the highest market share in 2023.

- By component, the software segment is expected to grow in the market during the forecast period.

- By end-user, the dental clinics segment dominated the market with the largest share in 2023.

Growth Factors:

Several factors contribute to the growth of the dental CAD/CAM market. One key driver is the growing prevalence of dental disorders and the rising demand for dental restorations. With an aging population and changing lifestyles leading to an increase in dental issues such as cavities, tooth decay, and tooth loss, there is a growing need for effective and durable dental prosthetics. Dental CAD/CAM systems offer a solution by streamlining the design and manufacturing process, enabling dental professionals to provide timely and high-quality restorations to patients.

Another significant growth factor is the continuous innovation and technological advancements in CAD/CAM systems. Manufacturers are constantly improving their software and hardware offerings to enhance performance, accuracy, and ease of use. The integration of artificial intelligence (AI), machine learning, and 3D imaging technologies into dental CAD/CAM systems further enhances their capabilities, allowing for more precise and personalized dental restorations. Additionally, the development of open architecture systems and interoperability standards promotes compatibility and interoperability between different CAD/CAM solutions, driving adoption across dental practices of all sizes.

Get a Sample: https://www.precedenceresearch.com/sample/3946

Dental CAD/CAM Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 10.46% |

| Global Market Size in 2023 | USD 2.54 Billion |

| Global Market Size by 2033 | USD 6.87 Billion |

| U.S. Market Size in 2023 | USD 690 Million |

| U.S. Market Size by 2033 | USD 1,880 Million |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Type, By Component, and By End-user |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Dental CAD/CAM Market Dynamics

Drivers:

Several drivers propel the growth of the dental CAD/CAM market. One of the primary drivers is the increasing awareness and acceptance of digital dentistry among dental professionals and patients. Dentists are recognizing the benefits of CAD/CAM technology in improving clinical outcomes, reducing treatment times, and enhancing patient satisfaction. Moreover, patients are becoming more informed and demanding regarding their dental care, preferring treatments that leverage advanced technology for superior results.

Another driver is the rising demand for cosmetic and aesthetic dental procedures. With a growing emphasis on smile aesthetics and facial harmony, there is a surge in the demand for dental restorations such as veneers, inlays, and onlays. Dental CAD/CAM systems enable precise customization of these restorations, allowing dentists to achieve natural-looking results that meet the aesthetic preferences of patients. Additionally, the ability to digitally simulate and preview the final outcome of dental treatments enhances patient confidence and acceptance of cosmetic procedures.

Restraints:

Despite the significant growth prospects, the dental CAD/CAM market faces certain restraints that may hinder its expansion. One major challenge is the high initial investment required for acquiring and implementing CAD/CAM systems. While the long-term benefits of digital dentistry are undeniable, the upfront costs of purchasing hardware, software, and training personnel can be prohibitive for some dental practices, especially smaller ones with limited financial resources. Additionally, the ongoing maintenance and software updates further add to the total cost of ownership, posing a barrier to adoption for some practitioners.

Another restraint is the limited access to skilled personnel proficient in operating CAD/CAM systems. While the technology continues to evolve and become more user-friendly, there is still a learning curve associated with mastering CAD/CAM software and hardware. Dental professionals require specialized training and education to effectively utilize these systems and maximize their potential. However, the availability of comprehensive training programs and continuing education opportunities can address this challenge by equipping dental professionals with the necessary skills and knowledge to leverage CAD/CAM technology effectively.

Opportunity:

The dental CAD/CAM market presents significant opportunities for growth and innovation in the coming years. One promising opportunity lies in the expansion of CAD/CAM applications beyond traditional restorative dentistry. As technology advances, CAD/CAM systems are increasingly being utilized for other dental applications such as orthodontics, implantology, and smile design. For example, CAD/CAM technology enables the fabrication of custom orthodontic appliances, surgical guides for implant placement, and digital smile design solutions that enhance treatment planning and outcomes. By diversifying their offerings and expanding into new market segments, manufacturers can capitalize on emerging opportunities and broaden their customer base.

Another opportunity lies in the integration of CAD/CAM systems with digital workflows and practice management software. As dental practices transition towards fully digital workflows, there is a growing demand for seamless integration between CAD/CAM systems, electronic health records (EHR), and other software platforms. Integrated solutions enable efficient data exchange, streamlined communication between dental teams, and automated workflows that enhance productivity and patient care. By developing interoperable software solutions and partnering with EHR providers, CAD/CAM manufacturers can position themselves as leaders in the digital dentistry ecosystem and create value for their customers.

Read Also: Vascular Closure Devices Market Size to Worth USD 3.30 Bn by 2033

Region Insights:

The dental CAD/CAM market exhibits regional variations in terms of adoption rates, market dynamics, and regulatory environment. North America and Europe are the leading regions in terms of market share, driven by the presence of advanced healthcare infrastructure, high healthcare expenditure, and early adoption of digital dentistry practices. These regions are characterized by a large number of dental laboratories and clinics equipped with CAD/CAM systems, as well as a strong focus on research and development in dental technology.

In contrast, emerging economies in Asia Pacific, Latin America, and the Middle East are experiencing rapid growth in the dental CAD/CAM market. Factors such as rising disposable income, increasing healthcare expenditure, and expanding access to dental care contribute to the growth of these regions. Additionally, government initiatives aimed at promoting oral health awareness and improving dental infrastructure further stimulate market growth. However, challenges such as limited reimbursement policies, regulatory barriers, and uneven distribution of skilled dental professionals pose challenges to market expansion in these regions.

Recent Developments

- In February 2024, Carbon announced the launch of automated 3D printing tools for the advancements in print preparation, post-processing, and print production for dental users of their 3D printing technology. The organization also collaborates with Desktop Health.

- In February 2024, Halo Dental Technologies announced the launch of its “Digital Dental Mirror.” The launch is the advancement in dentistry that transformed and enhanced the patient’s care.

- In February 2024, Kerr Dental, a leading manufacturer of quality dental and restorative products, launched the new SimpliCut™ rotary products. The latest launch is the pre-sterilized single patient-use diamond burs line, manufactured to enhance efficiencies and reduce the requirement for sterilization, cleaning, and processing.

- In February 2024, Havant MP Alan Mak launched the mobile dental service, allowing NHS care for the residencies of Hampshire and the Isle of Wight with the risk of social exclusion.

- In February 2024, Nexa3D announced its collaboration with North American dental partners Harris Discount Dental Supply and CAD-Ray. Additionally, it launched the three resins from dental market juggernaut Pac-Dent, Inc., allowing efficiency in the workflow of the restorative and surgical applications for labs for the practices using Nexa3D’s XiP desktop printer by LSPc technology.

Dental CAD/CAM Market Companies

- 3M Company

- Amann Girbach AG

- Danaher Corporation

- Dental wings Inc.

- Dentsply Sirona Inc.

- Institut Straumann AG

- Ivoclar vivadent AG

- Planmeca OY

- Roland DAG

- Zirkonzahn GMBH

Segments Covered in the Report

By Type

- In-lab System

- In-office System

By Component

- Hardware

- Software

By End-user

- Dental Clinics

- Dental Laboratories

- Dental Milling Centers

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/

- Intelligent Traffic Management System Market Size, Trends, Report 2034 - July 17, 2024

- Healthcare Finance Solutions Market Size to Grow USD 293.12 Bn by 2034 - July 17, 2024

- Epoxy Composites Market Size to Grow USD 84.99 Bn by 2034 - July 17, 2024