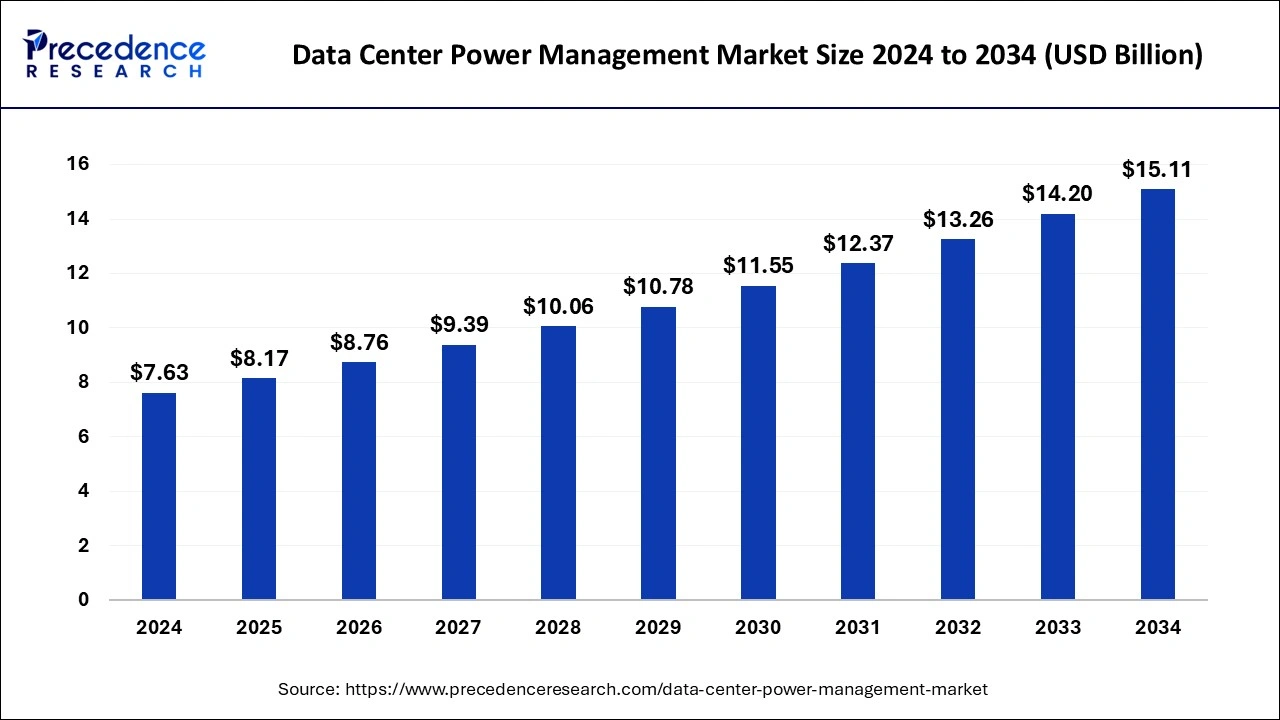

The global data center power management market size was valued at USD 7.12 billion in 2023, growing at a CAGR of 7.15% from 2024 to 2033.

Key Points

- North America contributed 36% of market share in 2023.

- Asia-Pacific is estimated to expand the fastest CAGR between 2024 and 2033.

- By component, the solution segment held the largest market share in 2023.

- By component, the service segment is anticipated to grow at a remarkable CAGR between 2024 and 2033.

- By data center size, the small data center segment generated the largest market share in 2023.

- By data center size, the large data center segment is expected to expand at the fastest CAGR over the projected period.

- By application, the IT & telecom segment has contributed the major market share in 2023.

- By application, the healthcare segment is expected to expand at the fastest CAGR over the projected period.

The Data Center Power Management Market encompasses the technologies and solutions designed to efficiently manage and optimize power consumption within data centers. As data centers continue to proliferate globally, driven by the exponential growth of data generated by businesses and consumers alike, the demand for effective power management solutions becomes increasingly critical. This market segment includes a variety of hardware, software, and services aimed at reducing energy consumption, enhancing operational efficiency, and ensuring reliable power delivery within data center facilities.

Data Center Power Management Market Data and Statistics

- According to the U.S. Department of Energy, data centers account for about 2% of the country’s total electricity consumption, highlighting the need for energy-efficient power management solutions.

- The World Economic Forum predicts that data volume will surge in the upcoming years, projected to hit 463 exabytes by 2025.

- GSMA anticipates a continuous rise in Internet of Things (IoT) connections from 2020 to 2030, with an estimated total of 24 billion enterprise IoT connections by 2030. This growth, coupled with the expansion of social media, is exponentially increasing the global data generation and storage.

- In July 2023, ABB India’s Electrification business introduced groundbreaking UPS solutions tailored for data centers. This innovative UPS, a pioneer in sustainability, forms part of the ABB EcoSolutions portfolio and aligns with ABB’s circularity framework.

Get a Sample: https://www.precedenceresearch.com/sample/4023

Growth Factors: Several factors contribute to the growth of the Data Center Power Management Market. One significant factor is the escalating demand for data storage and processing capabilities, fueled by the rapid digital transformation across various industries. Additionally, the increasing adoption of cloud computing, big data analytics, and IoT technologies drives the expansion of data center infrastructure, thereby driving the need for efficient power management solutions. Moreover, rising concerns regarding environmental sustainability and energy efficiency propel organizations to invest in power management technologies to minimize their carbon footprint and reduce operating costs.

Region Insights: The Data Center Power Management Market exhibits significant regional variations influenced by factors such as economic development, technological advancements, regulatory frameworks, and infrastructure investments. North America dominates the market due to the presence of a large number of established data center facilities, particularly in the United States. Europe follows closely, driven by stringent energy regulations and the adoption of green initiatives. Meanwhile, Asia Pacific emerges as a rapidly growing market fueled by increasing investments in data center infrastructure across emerging economies like China and India.

Data Center Power Management Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 7.15% |

| Global Market Size in 2023 | USD 7.12 Billion |

| Global Market Size by 2033 | USD 14.20 Billion |

| U.S. Market Size in 2023 | USD 1.92 Billion |

| U.S. Market Size by 2033 | USD 3.83 Billion |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Component, By Data Center Size, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Data Center Power Management Market Dynamics

Drivers:

Several drivers fuel the growth of the Data Center Power Management Market. One key driver is the escalating demand for energy-efficient solutions driven by rising electricity costs and environmental concerns. Additionally, the growing complexity of data center architectures and the need to optimize power usage amid dynamic workloads stimulate the adoption of advanced power management technologies. Furthermore, regulatory mandates and government initiatives promoting energy efficiency and renewable energy sources encourage organizations to invest in power management solutions to comply with regulations and achieve sustainability goals.

Opportunities

The Data Center Power Management Market presents numerous opportunities for innovation and growth. With the increasing integration of renewable energy sources such as solar and wind power into data center operations, there is a growing demand for hybrid power management solutions that effectively harness and manage diverse energy sources. Moreover, the emergence of edge computing and distributed data centers creates opportunities for specialized power management solutions tailored to the unique requirements of edge deployments. Furthermore, advancements in artificial intelligence (AI) and machine learning (ML) enable predictive analytics and automation capabilities, enhancing the efficiency and reliability of power management systems.

Challenges

Despite the promising growth prospects, the Data Center Power Management Market faces several challenges. One major challenge is the complexity of integrating power management solutions into existing data center infrastructure without disrupting operations. Additionally, interoperability issues between heterogeneous hardware and software components pose obstacles to seamless integration and interoperability. Moreover, the upfront costs associated with deploying advanced power management technologies may deter organizations, particularly small and medium-sized enterprises (SMEs), from investing in comprehensive solutions. Furthermore, concerns regarding data security and privacy present challenges in adopting cloud-based power management solutions, especially in highly regulated industries. Addressing these challenges requires collaborative efforts from industry stakeholders to develop standardized protocols, enhance interoperability, and increase awareness of the benefits of efficient power management practices.

Read Also: Call and Contact Center Outsourcing Market Size, Share, Report 2033

Recent Developments

- In October 2023, ABB Ltd disclosed its collaboration with ZincFive, welcoming them as an authorized supplier for its UPS systems. ZincFive’s nickel-zinc battery option joins the existing lithium-ion and lead-acid offerings, now integrated and supported within ABB’s uninterruptible power supply system.

- Also in October 2023, Vertiv initiated a partnership with American Electric Power (AEP) and inaugurated the Vertiv Customer Experience Center. This center showcases a microgrid power solution aimed at aiding data centers in tackling challenges related to electrical grid capacity. The Vertiv microgrid, with a capacity of 1.0 megawatt (MW), comprises an Uninterruptible Power Supply (UPS) system, lithium-ion battery, system controls, and other crucial components, catering to customers exploring the potential of microgrids and energy storage systems for their mission-critical power systems.

- In November 2023, Vertiv introduced the Vertiv SmartMod Max CW, a prefabricated modular data center tailored to meet escalating demands. This solution accommodates up to 200kW of total IT load in a single system, offering a variety of customization options including power capacities, rack quantities and sizes, and module dimensions. The Vertiv SmartMod Max CW integrates the Vertiv Liebert EXM uninterruptible power supply (UPS) system in power ratings of 100 kW, 150 kW, and 200 kW, along with thermal management units equipped with intelligent controls, empowering small-scale operations such as edge data centers to fulfill their specific needs.

- In October 2023, ABB unveiled the ABB TruFit power distribution unit, an all-in-one solution designed to address the mounting demands of rapidly approaching data center project timelines. With flexibility ranging from 50 to 800 kVA, TruFit offers outstanding configurability, reliability, and safety features at the system level.

Data Center Power Management Market Companies

- Schneider Electric SE

- ABB Ltd

- Eaton Corporation

- Vertiv Group Corp

- Delta Electronics, Inc.

- Huawei Technologies Co., Ltd.

- General Electric Company

- Legrand SA

- Raritan Inc.

- Cyber Power Systems (USA), Inc.

- Tripp Lite

- Socomec Group

- Vertiv Co.

- Emerson Electric Co.

- Mitsubishi Electric Corporation

Segments Covered in the Report

By Component

- Solution

- Service

By Data Center Size

- Small Data Center

- Medium Data Center

- Large Data Center

By Application

- BFSI

- Colocation

- Energy

- Government

- Healthcare

- Manufacturing

- IT & telecom

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/

- Intelligent Traffic Management System Market Size, Trends, Report 2034 - July 17, 2024

- Healthcare Finance Solutions Market Size to Grow USD 293.12 Bn by 2034 - July 17, 2024

- Epoxy Composites Market Size to Grow USD 84.99 Bn by 2034 - July 17, 2024