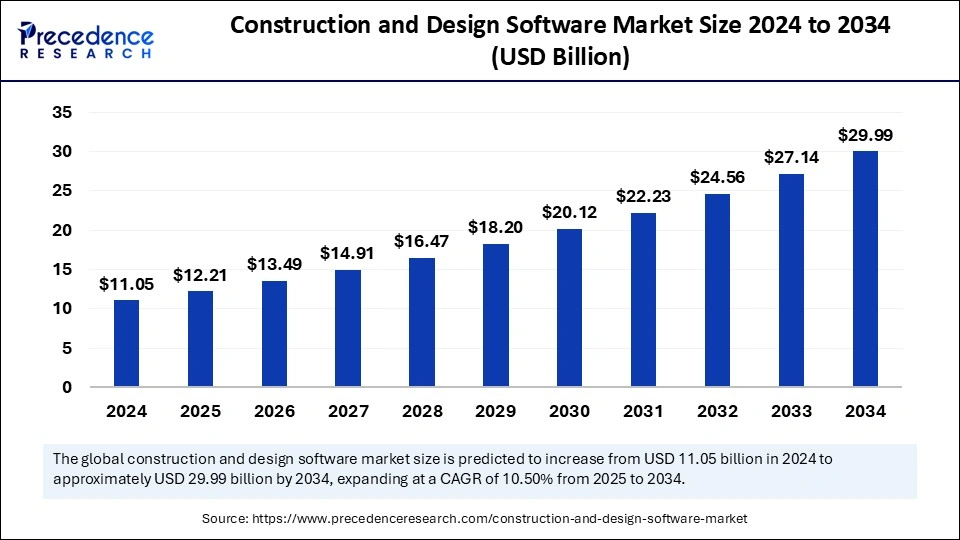

The global construction and design software market size was valued at USD 11.05 billion in 2024 and is expected to attain around USD 29.99 billion by 2034, growing at a CAGR of 10.50%.

Get a Free Sample Copy of the Report@ https://www.precedenceresearch.com/sample/5798

Construction and Design Software Market Key Points

-

North America led the market in 2024 with a 33% share.

-

Asia Pacific is expected to see the strongest CAGR of 11.5%.

-

Project management & scheduling was the top function, holding 19% market share.

-

Bid management is expected to grow notably in the years ahead.

-

On-premise solutions dominated deployment types with 55% market share.

-

Cloud-based deployment is poised for accelerated adoption.

-

Architects and builders comprised the largest end-use group at 40%.

-

Designers will likely contribute significantly to market expansion moving forward.

Role of Artificial Intelligence (AI) in the Construction and Design Software Market

Artificial Intelligence (AI) is playing a transformative role in the construction and design software market, introducing smarter, faster, and more efficient solutions across all stages of project development.

One of the most valuable contributions of AI is in predictive analytics. By analyzing historical data, AI can forecast potential risks, cost overruns, and project delays, enabling construction managers and designers to make informed decisions early in the planning process. This not only improves budgeting accuracy but also enhances timeline management and reduces unexpected challenges.

AI is also revolutionizing design workflows through generative design. This technology allows professionals to input specific goals, such as spatial requirements, materials, and budget constraints, and automatically generate multiple optimized design options. This speeds up the creative process, promotes innovation, and often leads to more efficient use of space and materials.

In terms of project execution, AI supports real-time monitoring by integrating with sensors, drones, and IoT devices. This ensures continuous oversight of construction progress, helps maintain safety standards, and allows for real-time adjustments that keep projects on track.

Construction and Design Software Market Growth Factors

1. Rapid Urbanization and Infrastructure Development

The increasing need for residential, commercial, and industrial infrastructure—especially in emerging economies—is propelling demand for advanced design and construction tools that can streamline planning and execution.

2. Rising Adoption of Building Information Modeling (BIM)

BIM is becoming a standard in the construction industry due to its ability to improve collaboration, reduce errors, and increase efficiency. Governments in many regions are mandating its use for public infrastructure projects, further boosting market growth.

3. Digital Transformation Across the AEC Industry

Construction firms are increasingly investing in digital solutions to improve productivity, accuracy, and cost-efficiency. The shift from manual processes to software-based systems is creating a favorable environment for market expansion.

4. Integration of Emerging Technologies

Technologies such as artificial intelligence, machine learning, virtual/augmented reality, and IoT are being integrated into design and construction platforms. These enhance decision-making, project visualization, predictive analytics, and real-time monitoring.

5. Growing Demand for Cloud-Based Solutions

Cloud-based construction and design software is gaining popularity due to its scalability, flexibility, and accessibility. It supports real-time collaboration among stakeholders across different locations and simplifies software updates and maintenance.

6. Increased Focus on Sustainability and Green Construction

There’s a growing emphasis on designing energy-efficient and environmentally friendly buildings. Software tools help architects and engineers analyze energy performance, simulate sustainable designs, and meet regulatory compliance.

7. Improved Project Management and Cost Control

The need to manage complex construction projects, reduce delays, and control costs is driving the use of software solutions for scheduling, budgeting, and resource planning. These tools enhance transparency and efficiency throughout the project lifecycle.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 29.99 Billion |

| Market Size in 2025 | USD 12.21 Billion |

| Market Size in 2024 | USD 11.05 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 10.50% |

| Dominated Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Function, Deployment, End Use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Major growth factors include the need for faster project delivery, increased focus on reducing waste and rework, and the widespread use of BIM and 3D modeling. The construction industry’s shift to digital solutions is also being propelled by labor shortages and higher material costs.

Opportunities

AI and machine learning offer major growth avenues, especially in automating repetitive design tasks and improving design quality. The surge in cloud computing adoption allows for greater scalability, remote access, and improved data management for construction professionals.

Challenges

Key challenges involve high software costs, cybersecurity threats, and a general lack of standardization in construction practices across regions. Training staff and transitioning from manual to digital processes also remains a hurdle for many organizations.

Regional Insights

North America is a mature market with wide-scale implementation of digital tools and advanced technologies. Asia Pacific is the fastest-growing region, driven by large-scale construction projects and favorable government policies. Europe is also progressing steadily, led by its push for environmentally friendly and digitally optimized construction solutions.

Recent Developments

- In July 2024, TestFit, a Dallas-based real estate development feasibility platform, announced the launch of a new tool called Generative Design. This tool enables architects and developers to optimize building and site layout designs effortlessly.

- In February 2025, Hover, a leader in 3D property data, released Instant Design, an AI-powered design product. This product enables construction pros and homeowners to instantly visualize any home remodeling or new construction project.

- In March 2025, Trimble unveiled the 2025 versions of Tekla Structural Designer, its structural analysis and 3D design software for multimaterial buildings, and Tekla Tedds, its automated civil and structural analysis calculation software. With several significant updates, both products offer enhanced user experience and expanded design capabilities for an optimized design collaboration experience.

- In September 2024, Zenerate launched an AI-powered design automation tool, Zenerate App, to quickly generate and identify optimal design schemes, and eliminate the need to redraw floor plans to fit a unit mix. Zenerate App generates building and site plan options in real time to meet specific project objectives.

Construction and Design Software Market Companies

- Trimble Inc.

- Constellation Software Inc.

- Autodesk Inc.

- Oracle Corporation

- Microsoft Corporation

- SAP SE

- Vectorworks, Inc.

- Sage Group plc

- BENTLEY SYSTEMS

- RIB Software SE

Segments Covered in the Report

By Function

- Safety & Reporting

- Project Management & Scheduling

- Project Design

- Field Service Management

- Cost Accounting

- Construction Estimation

- On across Bid Management

- Others

By Deployment

- On-premise

- Cloud

By End-use

- Architects & Builders

- Remodelers

- Designers

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)

Also Read: Circular Economy Consulting Services Market

Ready for more? Dive into the full experience on our website@ https://www.precedenceresearch.com/