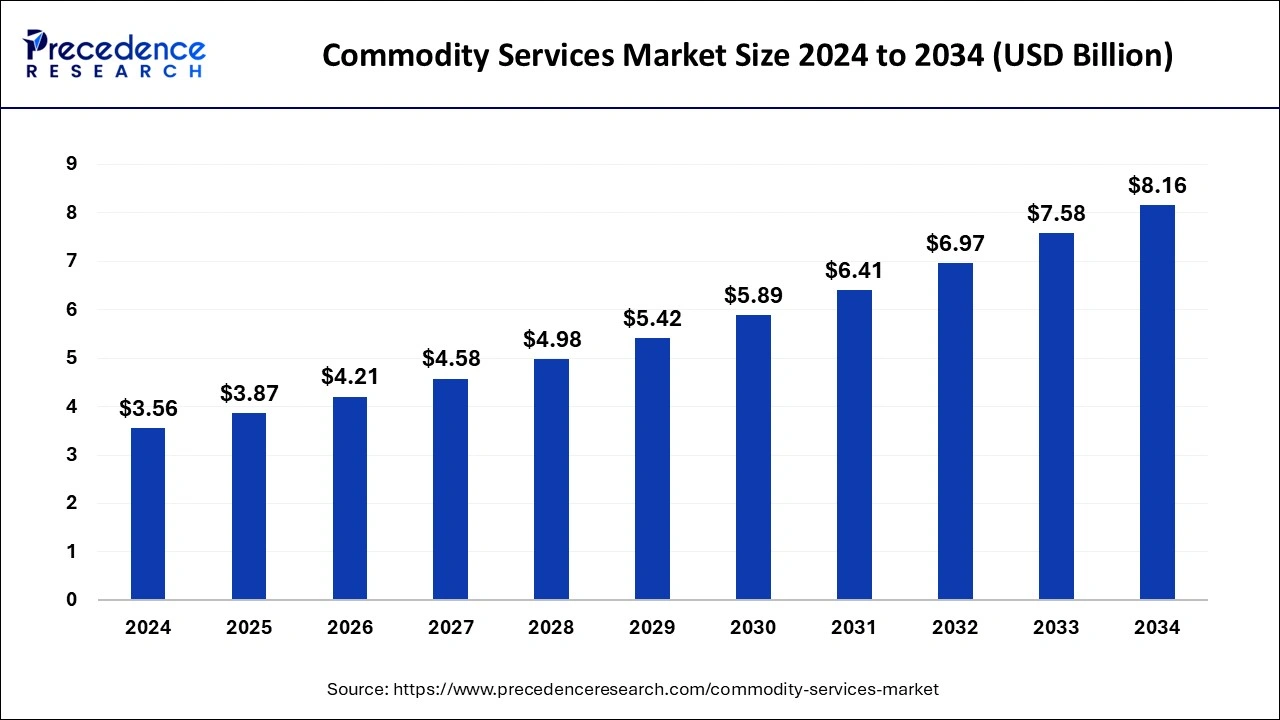

The global commodity services market size was valued at USD 3.27 billion in 2023 and is anticipated to reach around USD 7.58 billion by 2033, growing at a CAGR of 8.76% from 2024 to 2033

Key Points

- North America holds the largest share of the commodity services market.

- Asia Pacific is expected to witness rapid growth in the market.

- By type, the agriculture segment dominated the market in 2023.

- By type, the metal segment is expected to be the fastest growth in the market during the forecast period.

- By entity, the producers segment held the largest share of the market in 2023.

- By entity, the manufacturers segment is expected to grow rapidly in the market during the forecast period.

The commodity services market encompasses a range of activities related to the trading and management of physical commodities such as metals, energy, agriculture, and more. These services include brokerage, trading, risk management, logistics, and consulting. The market plays a crucial role in global supply chains, providing essential support for the buying, selling, and distribution of commodities. Commodity services are vital for stabilizing markets, ensuring liquidity, and enabling companies to hedge against price volatility.

Growth Factors

Several factors drive the growth of the commodity services market. Increasing global demand for raw materials, fueled by industrialization and urbanization, significantly boosts market expansion. Technological advancements, such as blockchain for supply chain transparency and AI for predictive analytics, enhance operational efficiency and attract more participants. Additionally, regulatory changes aimed at promoting transparency and reducing risks in commodity trading contribute to market growth. The rising focus on sustainable and ethical sourcing of commodities also opens new avenues for specialized services.

Get a Sample: https://www.precedenceresearch.com/sample/4364

Region Insights

The commodity services market is highly dynamic, with regional variations reflecting local economic activities and resource availability. North America, led by the United States, is a significant player due to its advanced financial markets and robust energy and agricultural sectors. Europe follows closely, with major trading hubs in London and Geneva. The Asia-Pacific region, particularly China and India, is experiencing rapid growth due to increased industrial activity and demand for raw materials. Latin America and Africa, rich in natural resources, are emerging markets with substantial potential, although they face challenges such as political instability and infrastructure deficits.

Commodity Services Market Scope

| Report Coverage | Details |

| Commodity Services Market Size in 2023 | USD 3.27 Billion |

| Commodity Services Market Size in 2024 | USD 3.56 Billion |

| Commodity Services Market Size by 2033 | USD 7.58 Billion |

| Commodity Services Market Growth Rate | CAGR of 8.76% from 2024 to 2033 |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Type, Entity, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Commodity Services Market Dynamic

Drivers

Key drivers of the commodity services market include the growing need for risk management solutions amid volatile commodity prices. The globalization of trade and the increasing complexity of supply chains necessitate sophisticated services to manage logistics and compliance. Financialization of commodities, where commodities are traded like financial assets, also propels market growth. Additionally, the integration of digital technologies and data analytics in trading and logistics optimizes operations and enhances decision-making processes, driving further adoption of commodity services.

Opportunities

The commodity services market offers numerous opportunities, especially with the advent of digital transformation. Innovations like blockchain can provide greater transparency and traceability in commodity supply chains, appealing to companies and consumers alike. The shift towards renewable energy sources and sustainable practices presents opportunities for services specializing in green commodities. Emerging markets in Asia, Africa, and Latin America offer untapped potential for expansion. Furthermore, developing tailored financial products and services for small and medium enterprises (SMEs) in the commodity sector can drive market growth.

Challenges

Despite its growth prospects, the commodity services market faces several challenges. Price volatility and market unpredictability can pose significant risks to service providers and their clients. Regulatory changes and compliance requirements vary widely across regions, complicating international operations. Technological advancements, while beneficial, require substantial investment and continuous adaptation, posing a barrier for smaller firms. Additionally, geopolitical tensions and trade disputes can disrupt commodity flows and market stability. Environmental and social governance (ESG) concerns are increasingly critical, necessitating services that adhere to ethical and sustainable practices.

Read Also: Autonomous Forklift Market Size to Grow USD 13.91 Billion by 2033

Commodity Services Market Recent Developments

- In February 2024, First-of-its-kind daily, spot market U.S. lithium carbonate price assessments have been made available by Platts, a division of S&P Global Commodity Insights, the premier independent source of information, data, analysis, benchmark prices, and workflow solutions for the commodities, energy, battery metals, and energy transition markets.

- In February 2024, With the introduction of the DoubleLine Commodity Strategy ETF and the Fortune 500 Equal Weight ETF, there are now six DoubleLine ETFs available. The DoubleLine Opportunistic Bond ETF, DoubleLine Mortgage ETF, DoubleLine Commercial Real Estate ETF, and DoubleLine Shiller CAPE U.S. Equities ETF1 are the other four exchange-traded funds.

Commodity Services Market Companies

- Cargill

- Gunvor

- Louis Dreyfus Company

- Mercuria energy group

- Trafigura

- Archer Daniels Midland

- Bunge limited

- Mabanaft

- Wilmar International

- COFCO Group

- Koch industries

- Hedgers

- Glencore

- Vitol

- Arbitrageurs

Segment Covered in the Report

By Type

- Metal

- Energy

- Agricultural

- Livestock

- Meat

- Others

By Entity

- Investors

- Consumers

- Manufacturers

- Traders

- Business Entities

- Producers

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/

- Intelligent Traffic Management System Market Size, Trends, Report 2034 - July 17, 2024

- Healthcare Finance Solutions Market Size to Grow USD 293.12 Bn by 2034 - July 17, 2024

- Epoxy Composites Market Size to Grow USD 84.99 Bn by 2034 - July 17, 2024