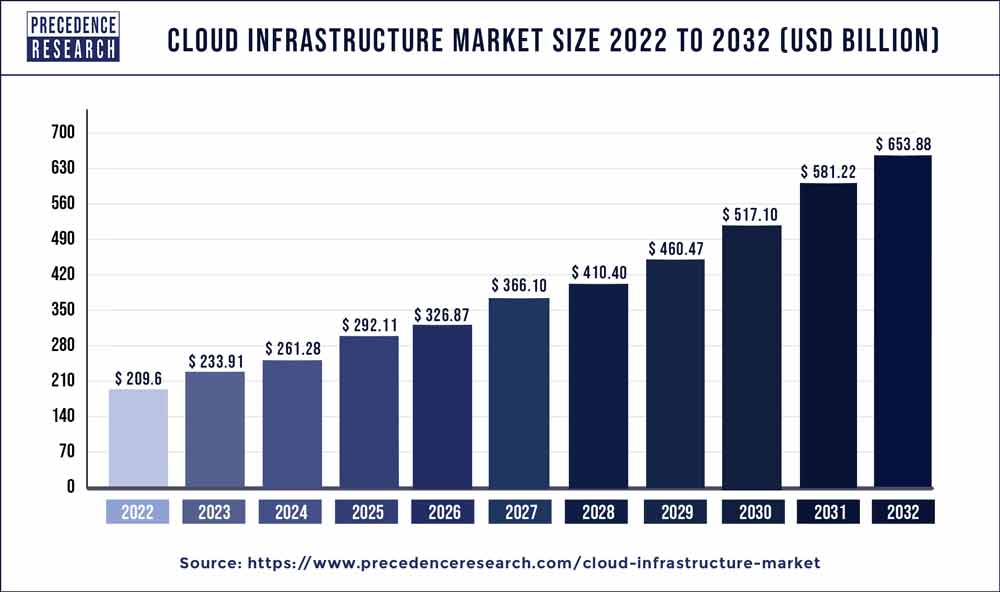

The global cloud infrastructure market size is expected to hit around USD 653.88 billion by 2032, expanding at a CAGR of 12.10% during the forecast period from 2023 to 2032.

Key Takeaways

- North America contributed more than 42% of revenue share in 2022.

- Asia-Pacific is estimated to expand the fastest CAGR between 2023 and 2032.

- By type, the hardware segment has held the largest market share of 56% in 2022.

- By type, the services segment is anticipated to grow at a remarkable CAGR of 13.4% between 2023 and 2032.

- By end use, the IT & telecom segment generated over 28% of revenue share in 2022.

- By end use, the healthcare segment is expected to expand at the fastest CAGR over the projected period.

The Cloud Infrastructure Market is experiencing robust growth driven by the escalating demand for scalable and flexible computing resources. As businesses increasingly migrate towards cloud-based solutions, the market has become a pivotal enabler for digital transformation initiatives. Cloud infrastructure, encompassing services such as Infrastructure as a Service (IaaS) and Platform as a Service (PaaS), provides organizations with the agility and cost-effectiveness required to meet evolving business needs. The rising trend of remote work, coupled with the continuous evolution of technologies like artificial intelligence and IoT, further propels the demand for scalable and reliable cloud infrastructure solutions.

Get a Sample: https://www.precedenceresearch.com/sample/3660

Growth Factors:

Several factors contribute to the flourishing Cloud Infrastructure Market. Firstly, the continual expansion of data-intensive applications and the need for storage and processing capabilities drive the demand for scalable cloud infrastructure. Additionally, the cost-effectiveness of cloud services compared to traditional on-premises solutions attracts businesses seeking efficient resource utilization. The increasing awareness of the benefits of cloud computing, such as enhanced flexibility, scalability, and accessibility, among enterprises of all sizes, acts as a catalyst for market growth. Moreover, advancements in cloud security solutions address concerns related to data protection, fostering trust among businesses to embrace cloud infrastructure for their operations.

Region Snapshot

The Cloud Infrastructure Market exhibits a global footprint with significant regional variations. North America stands out as a major player, driven by the strong presence of key cloud service providers and early adoption by enterprises. Europe follows suit, with an increasing focus on digital transformation initiatives. Asia-Pacific showcases substantial growth potential, fueled by the burgeoning IT landscape in countries like China and India. The Middle East and Africa are witnessing a gradual but steady adoption of cloud infrastructure, while Latin America is experiencing accelerated growth as businesses leverage cloud services to enhance their operational efficiency.

Cloud Infrastructure Market Scope

| Report Coverage | Details |

| Growth Rate from 2023 to 2032 | CAGR of 12.10% |

| Market Size in 2023 | USD 233.91 Billion |

| Market Size by 2032 | USD 653.88 Billion |

| Largest Market | North America |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Segments Covered | By Type and By End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

By Type:

Cloud infrastructure is broadly categorized based on its types, primarily consisting of Infrastructure as a Service (IaaS), Platform as a Service (PaaS), and Software as a Service (SaaS). IaaS provides virtualized computing resources over the internet, including servers, storage, and networking components. PaaS offers a platform that allows developers to build, deploy, and manage applications without dealing with the complexities of infrastructure. SaaS delivers software applications over the internet on a subscription basis, eliminating the need for users to install, maintain, and update software locally.

Within these categories, there is a continuous evolution of specialized services, such as Containers as a Service (CaaS) and Functions as a Service (FaaS), which cater to specific application and development requirements.

By End-use:

Cloud infrastructure is utilized across various industries and sectors, showcasing its adaptability to diverse end-use scenarios. Businesses across finance, healthcare, manufacturing, retail, and more leverage cloud services to enhance agility, scalability, and efficiency. In the financial sector, for example, organizations often employ cloud infrastructure for data storage, analytics, and compliance. In healthcare, cloud solutions facilitate secure storage and access to patient data, while manufacturing industries use cloud platforms for process optimization and supply chain management.

Read Also: Electrophoresis Market Size To Rise USD 3.94 Billion By 2032

Recent Developments

- In April 2023, Alibaba Cloud introduced cost-effective alternatives for its Elastic Compute Service (ECS) and Object Storage Service (OSS), aligning with the escalating demand for cloud services. The newly unveiled ECS Universal ensures comparable stability to ECS while offering up to a 40% reduction in costs. Tailored for applications like web hosting, enterprise office tools, and offline data analysis, ECS Universal addresses diverse computing needs. Additionally, Alibaba Cloud introduced the OSS Reserved Capacity (OSS-RC), enabling customers to reserve storage capacity in a specific cloud region for a year, resulting in potential savings of up to 50%.

- In November 2022, Amazon Web Services (AWS) inaugurated India’s Second Infrastructure Region, enhancing options for Indian customers in workload execution, resilience, and data storage. This expansion aims to provide heightened resilience, secure data storage, and lower latency for end-users. AWS’s investment of over USD 4.4 billion in the new AWS Asia Pacific (Hyderabad) region by 2030 is expected to generate more than 48,000 full-time employment opportunities annually, contributing significantly to India’s economic landscape.

Competitive Landscape:

The competitive landscape of the Cloud Infrastructure Market is dynamic, marked by intense rivalry among key players striving to expand their market share. Major global cloud service providers, including Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform, dominate the market. These companies compete not only in terms of infrastructure offerings but also in providing a comprehensive suite of cloud services. Additionally, niche players and regional providers contribute to the competitive mix by catering to specific market segments or offering specialized services. Partnerships, acquisitions, and continuous innovation are common strategies employed by companies to maintain their competitive edge and meet the evolving needs of businesses relying on cloud infrastructure solutions. The market is characterized by ongoing technological advancements, ensuring a landscape that remains dynamic and responsive to the ever-changing demands of the digital era.

Cloud Infrastructure Market Companies

- Amazon Web Services (AWS)

- Microsoft Azure

- Google Cloud Platform (GCP)

- IBM Cloud

- Alibaba Cloud

- Oracle Cloud

- VMware

- Cisco Systems

- Hewlett Packard Enterprise (HPE)

- Dell Technologies

- Red Hat

- Salesforce

- SAP

- Intel Corporation

- NetApp

Segments Covered in the Report

By Type

- Hardware

- Services

By End-use

- IT & Telecom

- BFSI

- Retail & Consumer Goods

- Manufacturing

- Healthcare

- Media & Entertainment

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/

- Photodynamic Therapy Market Size to Rake USD 8.42 Bn by 2033 - February 5, 2024

- Image Recognition Market Size to Attain USD 166.01 Bn by 2033 - February 5, 2024

- Hydrogen Storage Tanks and Transportation Market Report 2033 - February 5, 2024