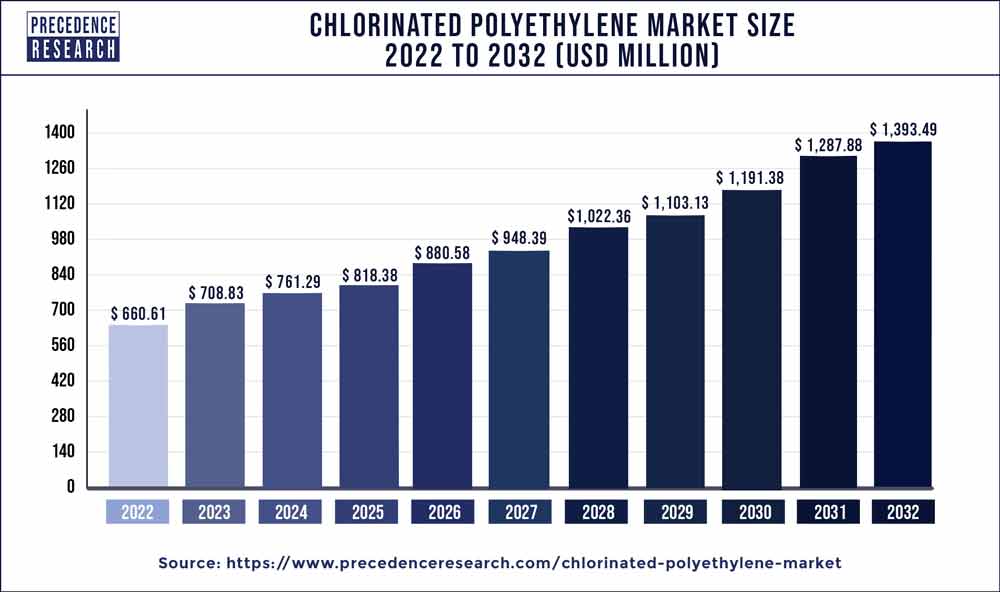

The global chlorinated polyethylene market size was valued at USD 708.83 million in 2023 and is expected to hit around USD 1,393.49 million by 2032, expanding at a CAGR of 7.80% from 2023 to 2032.

Key Takeaways

- North America contributed more than 41% of market share in 2022.

- Asia-Pacific is estimated to expand the fastest CAGR between 2023 and 2032.

- By product, the CPE 135A segment has held the largest market share of 45% in 2022.

- By product, the CPE 135B segment is anticipated to grow at a remarkable CAGR of 8.1% between 2023 and 2032.

- By application, the wire and cable jacketing segment generated over 27% of market share in 2022.

- By application, the adhesives segment is expected to expand at the fastest CAGR over the projected period.

The Chlorinated Polyethylene (CPE) market is a dynamic sector within the chemical industry, characterized by the production and utilization of a versatile synthetic rubber-like material. CPE is widely employed for its exceptional resistance to heat, chemicals, and flame, making it a valuable component in various applications. As a thermoplastic elastomer, it combines the flexibility of rubber with the processability of thermoplastics, contributing to its widespread adoption in diverse industries.

Growth Factors:

The growth of the Chlorinated Polyethylene market is propelled by several key factors. Increased demand in the automotive sector for manufacturing robust, weather-resistant components such as hoses, belts, and automotive seals has been a significant growth driver. Additionally, the expanding construction industry has augmented the use of CPE in applications like roofing membranes and insulation materials. The market also benefits from the rising awareness of the material’s advantages, including its cost-effectiveness and durability, further driving its adoption across different sectors.

Get a Sample: https://www.precedenceresearch.com/sample/3655

Drivers:

Several drivers fuel the Chlorinated Polyethylene market’s expansion. Technological advancements in the production processes, enhancing the quality and performance of CPE, play a crucial role. Moreover, the material’s eco-friendly characteristics, such as recyclability, align with the growing global emphasis on sustainable practices, fostering its demand. Regulatory support for the use of CPE in various industries, coupled with its adaptability to diverse manufacturing methods, contributes significantly to market growth.

Trends:

Key trends in the Chlorinated Polyethylene market include innovations in formulations to meet specific industry requirements. There is a noticeable shift towards the development of high-performance CPE grades tailored for specialized applications. Additionally, the market is witnessing a surge in research and development activities to explore new applications and improve existing products, aligning with the evolving needs of end-users. The trend towards customization and niche applications is expected to shape the market landscape in the coming years.

Chlorinated Polyethylene Market Scope

| Report Coverage | Details |

| Growth Rate from 2023 to 2032 | CAGR of 7.80% |

| Market Size in 2023 | USD 708.83 Million |

| Market Size by 2032 | USD 1,393.49 Million |

| Largest Market | North America |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Segments Covered | By Product and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

By Product:

- CPE 135A

- CPE 135B

- Others

The Chlorinated Polyethylene market is segmented based on product variations, with different grades and formulations catering to specific industrial requirements. One notable product classification is the varying degrees of chlorination, influencing the polymer’s properties. High molecular weight CPE, for instance, is characterized by enhanced flexibility and impact resistance, making it suitable for applications requiring durability, such as cable jackets and automotive components. Conversely, low molecular weight CPE may find utility in specific applications where a balance between flexibility and processability is crucial. The diverse product landscape allows manufacturers and end-users to select CPE formulations tailored to their specific needs.

Application

- Impact Modifier

- Wire and Cable Jacketing

- Hose and Tubing

- Adhesives

- Infrared Absorption

- Others

- Impact Modification in PVC: A significant application of CPE is as an impact modifier for PVC. This involves blending CPE with PVC to improve the toughness and impact resistance of the final product. This application is particularly vital in the production of pipes, fittings, and profiles in the construction industry, where durability is a key requirement.

- Wire and Cable Jacketing: CPE’s resistance to heat, flame, and chemicals makes it a preferred material for wire and cable insulation and jacketing. This application is crucial in the electrical and telecommunication industries, where reliable and durable insulation materials are essential for ensuring the integrity of electrical systems.

- Automotive Components: In the automotive sector, CPE is used in the manufacturing of thermoplastic elastomer (TPE) compounds. These compounds find applications in weatherseals, gaskets, and other components where resistance to harsh environmental conditions and chemicals is necessary. The automotive industry’s increasing demand for reliable and weather-resistant materials has contributed to the growth of this application segment.

Recent Developments

- In August 2022, Continental announced its collaboration with INOVYN to incorporate BIOVYN, a bio-attributed PVC, into its automotive surface materials. This strategic partnership aims to diminish the carbon footprint of Continental’s products while meeting the increasing market demand for sustainable, bio-based solutions.

- In January 2021, Shintech disclosed a significant capital investment of USD 1.25 billion to fortify its integrated PVC business under Shin-Etsu Chemical Co. Ltd. This investment is expected to substantially augment Shintech Inc.’s PVC production capacity in the United States, reaching an impressive 3.62 million metric tons annually.

- In January 2021, Orbia announced plans to divest its PVC Unit due to demand constraints. However, the final decision on this divestment is pending an official revelation.

Competitive Landscape:

The Chlorinated Polyethylene market features a competitive landscape with several established players and continuous entry of new participants. Leading companies focus on research and development to introduce novel products and maintain a competitive edge. Strategic partnerships and collaborations are common, aiming to expand market reach and strengthen the product portfolio. The competitive environment is characterized by a balance between large, global players and regional manufacturers catering to specific market segments. As the demand for CPE continues to rise, the competitive landscape is anticipated to witness further dynamism and innovation.

Chlorinated Polyethylene Market Companies

- Showa Denko K.K.

- Weifang Yaxing Chemical Co., Ltd.

- Novista Group Co., Ltd.

- Hangzhou Keli Chemical Co., Ltd.

- S&E Specialty Polymers

- Nippon Paper Crecia Co., Ltd.

- Sundow Polymers Co., Ltd.

- Jiangsu Tianteng Chemical Industry Co., Ltd.

- Jiangsu Changqing Agrochemical Co., Ltd.

- Shandong Gaoxin Chemical Co., Ltd.

- Xuyi Xinyuan Technology Co., Ltd.

- Dow Inc.

- Xiamen Xingyan Chemicals Co., Ltd.

- Xianju Furuixiang Special Chemical Co., Ltd.

- Hangzhou Electrochemical Group Co., Ltd.

Segments Covered in the Report

By Product

- CPE 135A

- CPE 135B

- Others

By Application

- Impact Modifier

- Wire and Cable Jacketing

- Hose and Tubing

- Adhesives

- Infrared Absorption

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/

- Photodynamic Therapy Market Size to Rake USD 8.42 Bn by 2033 - February 5, 2024

- Image Recognition Market Size to Attain USD 166.01 Bn by 2033 - February 5, 2024

- Hydrogen Storage Tanks and Transportation Market Report 2033 - February 5, 2024