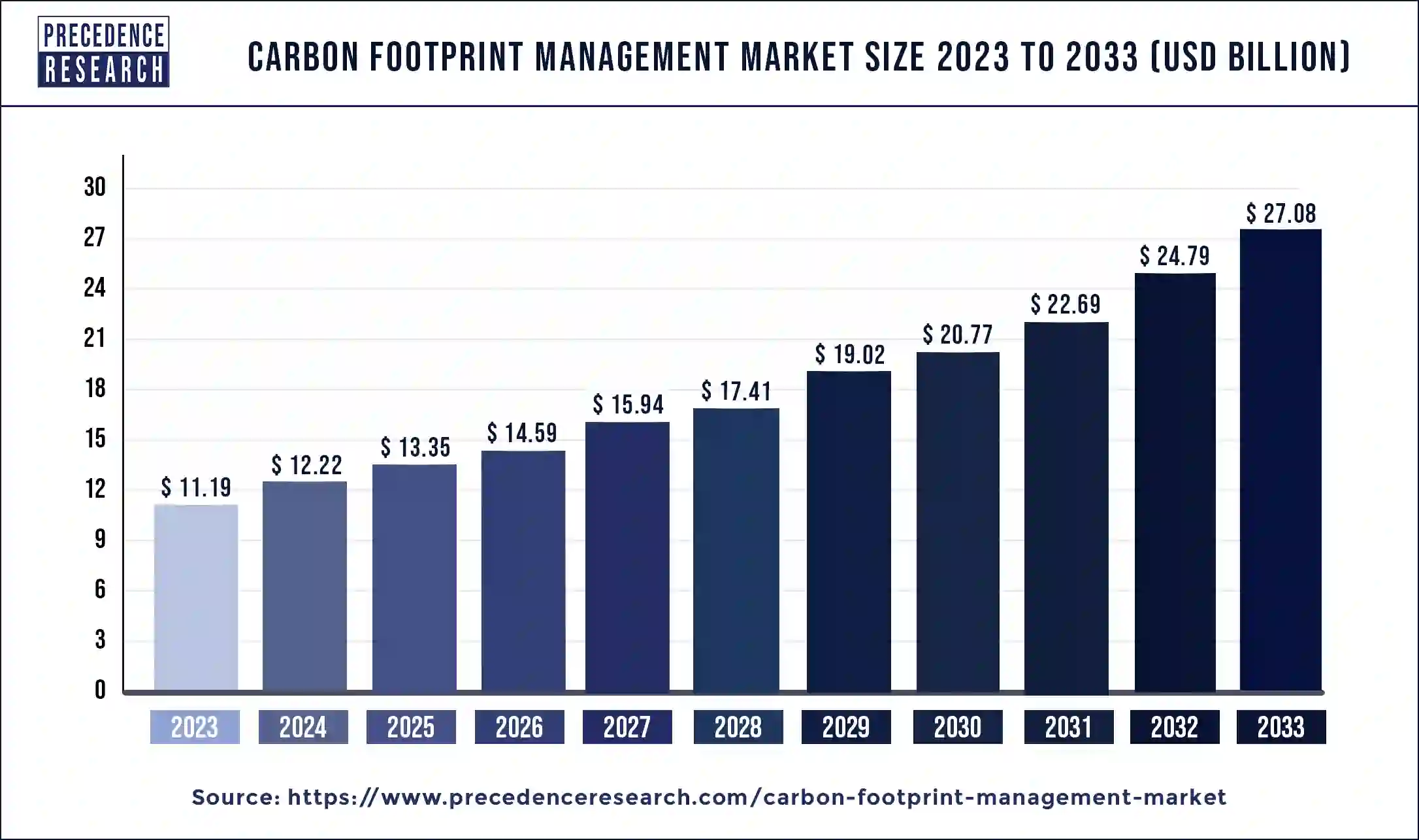

The global carbon footprint management market size was estimated at USD 11.19 billion in 2023, expanding at a CAGR of 9.24% from 2024 to 2033.

The Carbon Footprint Management Market has gained significant traction in recent years due to growing environmental concerns, regulatory pressure, and corporate sustainability initiatives. This market revolves around solutions and services aimed at quantifying, monitoring, managing, and reducing greenhouse gas emissions (GHGs) from various sources, including industrial processes, transportation, energy production, and buildings. With the increasing recognition of climate change risks and the need to transition towards a low-carbon economy, businesses, governments, and organizations across industries are seeking comprehensive carbon footprint management solutions to measure their emissions, set reduction targets, and implement strategies to mitigate their environmental impact. As a result, the Carbon Footprint Management Market is witnessing steady growth and is expected to continue expanding as companies strive to achieve carbon neutrality and meet regulatory requirements.

Key Points

- Asia Pacific led the market with the largest market share of 58% in 2023.

- North America is expected to grow in the market during the forecast period.

- By deployment, the cloud segment has contributed more than 57% of market share in 2023.

- By deployment, the on-premise segment is also growing in the market at a significant rate.

- By type, the enterprise tier segment has recorded over 41% of market share in 2023.

- By type, the mid-tier segment has generated more than 33% of market share in 2023.

- By end-use, the energy and utilities segment dominated the market with the biggest market share of 33% in 2023.

- By end-use, the manufacturing segment is expected to grow in the market during the forecast period.

Growth Factors:

The growth of the Carbon Footprint Management Market is fueled by several factors. Firstly, stringent environmental regulations and carbon pricing mechanisms imposed by governments worldwide are compelling businesses to monitor and reduce their carbon emissions to comply with regulatory requirements and avoid financial penalties. Additionally, corporate sustainability initiatives and investor pressure are driving organizations to adopt carbon footprint management solutions to demonstrate their commitment to environmental stewardship, enhance brand reputation, and attract socially responsible investors. Moreover, advancements in technology, such as the Internet of Things (IoT), artificial intelligence (AI), and big data analytics, are enabling the development of sophisticated carbon footprint management tools that offer real-time monitoring, predictive analytics, and actionable insights, empowering businesses to make informed decisions and optimize their carbon management strategies.

Region Insights:

The Carbon Footprint Management Market exhibits regional variations in terms of adoption rates, regulatory frameworks, and market dynamics. Developed economies, such as North America and Europe, have been early adopters of carbon footprint management solutions, driven by stringent environmental regulations, corporate sustainability goals, and the presence of mature carbon markets. In North America, the United States and Canada have implemented various federal and state-level regulations, such as the Clean Power Plan and carbon pricing initiatives, spurring demand for carbon management solutions among businesses and organizations. Similarly, Europe has established ambitious targets under the European Green Deal and the Paris Agreement, driving investment in carbon reduction strategies and stimulating the adoption of carbon footprint management technologies across industries. Emerging economies, including China, India, and Brazil, are also witnessing growing interest in carbon footprint management due to increasing environmental awareness, regulatory developments, and the emergence of sustainability-oriented business practices.

Trends:

Several trends are shaping the Carbon Footprint Management Market. One notable trend is the integration of carbon management solutions with enterprise resource planning (ERP) systems, sustainability reporting platforms, and supply chain management software to streamline data collection, analysis, and reporting processes. This integration enables organizations to gain a holistic view of their carbon emissions across the value chain, identify emission hotspots, and implement targeted mitigation measures. Another trend is the rising demand for carbon offsetting and carbon neutrality solutions, driven by organizations’ commitments to achieve net-zero emissions and carbon-neutral operations. Carbon offset projects, such as reforestation, renewable energy, and energy efficiency initiatives, provide companies with opportunities to compensate for their unavoidable emissions and contribute to global emission reduction efforts while enhancing their sustainability credentials.

Carbon Footprint Management Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 9.24% |

| Global Market Size in 2023 | USD 11.19 Billion |

| Global Market Size in 2024 | USD 12.22 Billion |

| Global Market Size by 2033 | USD 27.08 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Deployment, By Type, and By End-Use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Carbon Footprint Management Market Dynamics

Drivers:

Several drivers are propelling the growth of the Carbon Footprint Management Market. Regulatory mandates, such as emissions trading schemes, carbon taxes, and mandatory reporting requirements, compel businesses to monitor and reduce their carbon emissions to comply with legal obligations and avoid financial penalties. Corporate sustainability initiatives, driven by consumer demand, investor pressure, and reputational considerations, are motivating organizations to adopt carbon footprint management solutions to enhance their environmental performance, differentiate their brands, and gain a competitive edge in the market. Moreover, the growing recognition of climate-related risks, including physical risks from extreme weather events and transition risks from climate policy changes and market disruptions, is prompting businesses to assess and mitigate their carbon footprint as part of their broader risk management strategies.

Opportunities:

The Carbon Footprint Management Market presents significant opportunities for technology providers, consulting firms, and carbon offset project developers. Technology vendors have the opportunity to innovate and develop advanced carbon management software and tools that offer enhanced functionality, usability, and scalability to meet the evolving needs of businesses and organizations. Consulting firms can capitalize on the growing demand for carbon footprint assessment services, sustainability strategy development, and implementation support to help clients navigate regulatory requirements, set emission reduction targets, and implement cost-effective mitigation measures. Carbon offset project developers have the opportunity to leverage the growing demand for carbon offset credits and carbon neutrality solutions by developing high-quality offset projects that deliver measurable emission reductions and environmental co-benefits.

Challenges:

Despite the positive growth prospects, the Carbon Footprint Management Market faces several challenges. One challenge is the complexity of measuring and reporting carbon emissions accurately, especially for multinational corporations with diverse operations and supply chains spanning multiple geographies and industry sectors. Standardizing methodologies, data collection protocols, and emission factors across regions and industries remains a challenge, leading to discrepancies in reported emissions and difficulties in comparing performance across organizations. Moreover, the lack of transparency and integrity in carbon offset markets, including concerns about additionality, leakage, and double counting, undermines confidence in carbon offset projects and raises questions about their environmental integrity and effectiveness in achieving emission reductions. Addressing these challenges will require collaboration among stakeholders, including governments, businesses, standard-setting bodies, and civil society organizations, to develop robust regulatory frameworks, improve data quality and transparency, and foster trust in carbon management practices and carbon offset markets.

Read Also: pH Meter Market Size to Attain USD 1,581.92 Million by 2033

Recent Developments

- In May 2023, SAP launched a green ledger for businesses so that companies can manage to leave systems, carbon entering and balance carbon books, and tackle carbon footprint management challenges.

- In November 2022, the USE-based FRANEK sustainable management startup launched CarbonTek, a carbon footprint tool that manages the business’s measurement and analysis of carbon emissions.

Carbon Footprint Management Market Companies

- ProcessMAP

- Schneider Electric

- SAP

- Ecova

- Wolters Kluwer

- IBM Corporation

- Schneider Electric

- Dakota Software

- ENGINE

- IsoMetrix

Segments Covered in the Report

By Deployment

- On-Premise

- Cloud

By Type

- Basic Tier

- Mid-Tier

- Enterprise Tier

By End-Use

- Energy and Utilities

- Manufacturing

- Transportation

- IT and Telecommunication

- Residential and Commercial Buildings

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/

- Intelligent Traffic Management System Market Size, Trends, Report 2034 - July 17, 2024

- Healthcare Finance Solutions Market Size to Grow USD 293.12 Bn by 2034 - July 17, 2024

- Epoxy Composites Market Size to Grow USD 84.99 Bn by 2034 - July 17, 2024