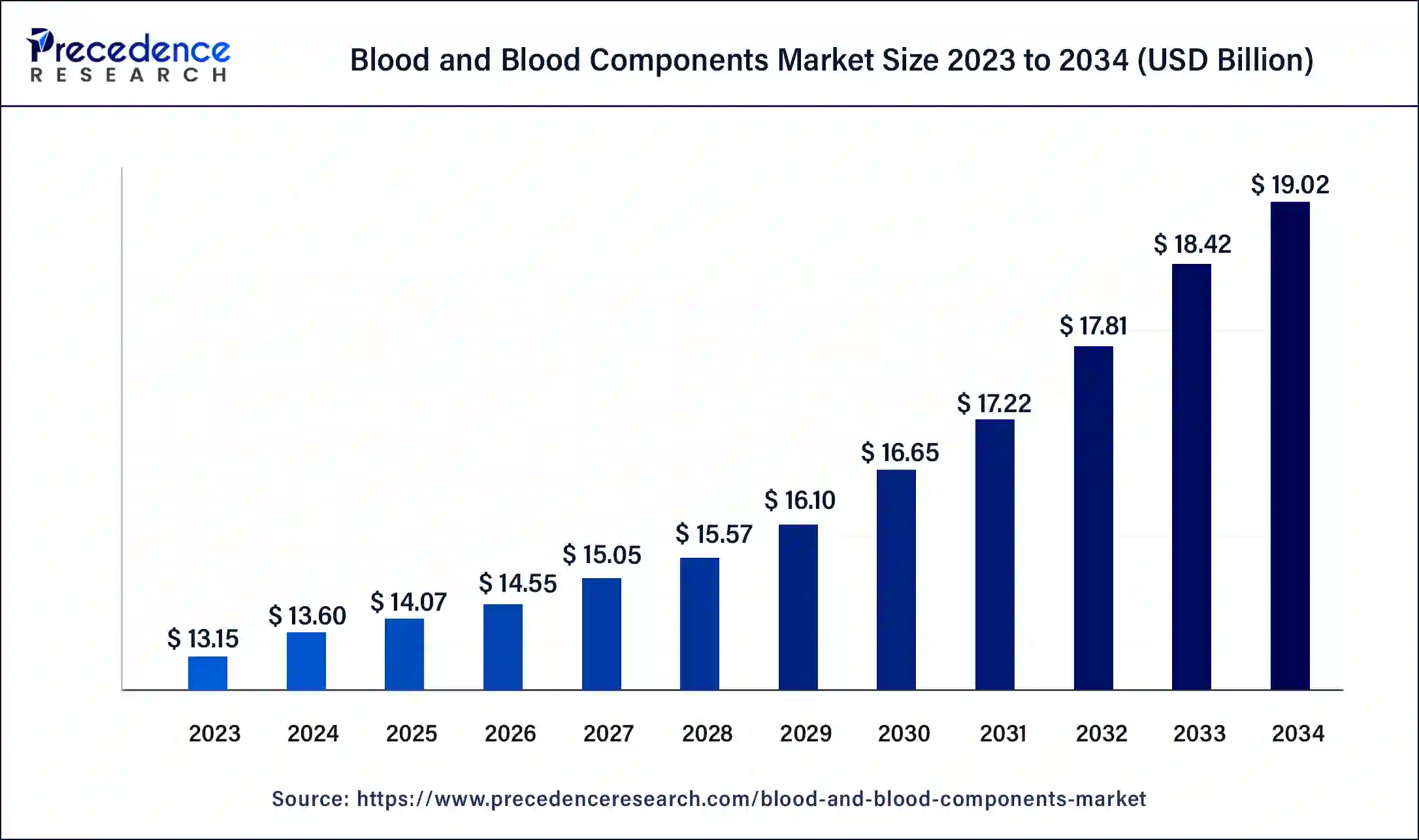

The global blood and blood components market size was calculated at USD 13.15 billion in 2023 and is expected to reach around USD 18.42 billion by 2033, growing at a CAGR of 3.43% from 2024 to 2033.

Key Points

- Europe dominated the market with the largest revenue share of 35% in 2023.

- North America is expected to gain a significant share of the market during the forecast period.

- By product, the blood components segment held the largest revenue share in 2023.

- By product, the whole blood segment is expected to witness the fastest growth in the market during the forecast period.

- By end use, the hospitals segment dominated the market in 2023.

- By end use, the ambulatory surgical centers segment is expected to grow rapidly in the market during the forecast period.

- By application, the cancer treatment segment held a significant share of the market in 2023.

- By application, the anemia segment is expected to grow rapidly during the forecast period.

The blood and blood components market encompasses a broad spectrum of products and services related to blood collection, processing, storage, and transfusion. This market plays a critical role in healthcare systems worldwide, supplying vital blood components such as red blood cells, platelets, plasma, and white blood cells for various medical procedures, including surgeries, trauma care, and treatments for chronic conditions.

Get a Sample: https://www.precedenceresearch.com/sample/4355′

Growth Factors

Several factors contribute to the growth of the blood and blood components market. One significant factor is the increasing demand for blood transfusions due to rising surgical procedures, trauma cases, and chronic diseases such as cancer and blood disorders. Technological advancements in blood processing and storage techniques also drive market growth by enhancing the safety and efficacy of blood products.

Region Insights:

The blood and blood components market exhibit regional variations influenced by factors such as healthcare infrastructure, regulatory environment, and prevalence of diseases. Developed regions like North America and Europe have well-established blood banking systems and stringent regulatory standards, whereas emerging economies in Asia-Pacific and Latin America are witnessing rapid growth driven by improving healthcare infrastructure and increasing awareness about blood donation.

Blood and Blood Components Market Scope

| Report Coverage | Details |

| Blood and Blood Components Market Size in 2023 | USD 13.15 Billion |

| Blood and Blood Components Market Size in 2024 | USD 13.60 Billion |

| Blood and Blood Components Market Size by 2033 | USD 18.42 Billion |

| Blood and Blood Components Market Growth Rate | CAGR of 3.43% from 2024 to 2033 |

| Largest Market | Europe |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Product, End-use, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Blood and Blood Components Market Dynamics

Drivers:

Several drivers propel the growth of the blood and blood components market. Population aging leads to a higher prevalence of chronic diseases requiring blood transfusions, driving demand. Additionally, advancements in medical technologies, such as automation in blood processing and screening for infectious diseases, improve the efficiency and safety of blood products, further boosting market growth.

Opportunities

The blood and blood components market presents various opportunities for market players to expand their presence and offerings. Collaborations between blood banks, hospitals, and research institutions can enhance blood collection, storage, and distribution networks. Moreover, expanding into emerging markets offers opportunities for growth due to increasing healthcare spending and rising demand for blood products.

Challenges

Despite its growth prospects, the blood and blood components market faces several challenges. Ensuring an adequate and safe blood supply remains a significant challenge, particularly in regions with limited access to healthcare infrastructure and blood donation facilities. Moreover, concerns about bloodborne diseases, transfusion reactions, and compatibility issues necessitate stringent regulatory oversight and quality control measures.

Read Also: Remote Cardiac Monitoring Market Size to Touch USD 9.75 Bn by 2033

Blood and Blood Components Market Recent Developments

- In January 2024, Today, Inspira Technologies OXY B.H.N Ltd., a leader in life support technology with the goal of replacing conventional mechanical ventilators, announced its intention to provide a single-use, disposable blood oxygenation kit (the “Kit”) for its INSPIRA ART medical device series.

- In January 2024, in a race with Apple Inc. and other electronic behemoths, Samsung Electronics Co. is pursuing the development of continuous blood pressure monitoring and noninvasive glucose monitoring. The company has high aspirations for the healthcare industry.

Blood and Blood Components Market Companies

- European Blood Alliance

- Australian Red Cross

- Indian Red Cross

- American Association of Blood Banks

- South African National Blood Service

Segment Covered in the Report

By Product

- Whole Blood

- Blood Components

By End-use

- Hospitals

- Ambulatory Surgical Centers

By Application

- Anemia

- Trauma & Surgery

- Cancer Treatment

- Bleeding Disorders

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/

- Intelligent Traffic Management System Market Size, Trends, Report 2034 - July 17, 2024

- Healthcare Finance Solutions Market Size to Grow USD 293.12 Bn by 2034 - July 17, 2024

- Epoxy Composites Market Size to Grow USD 84.99 Bn by 2034 - July 17, 2024