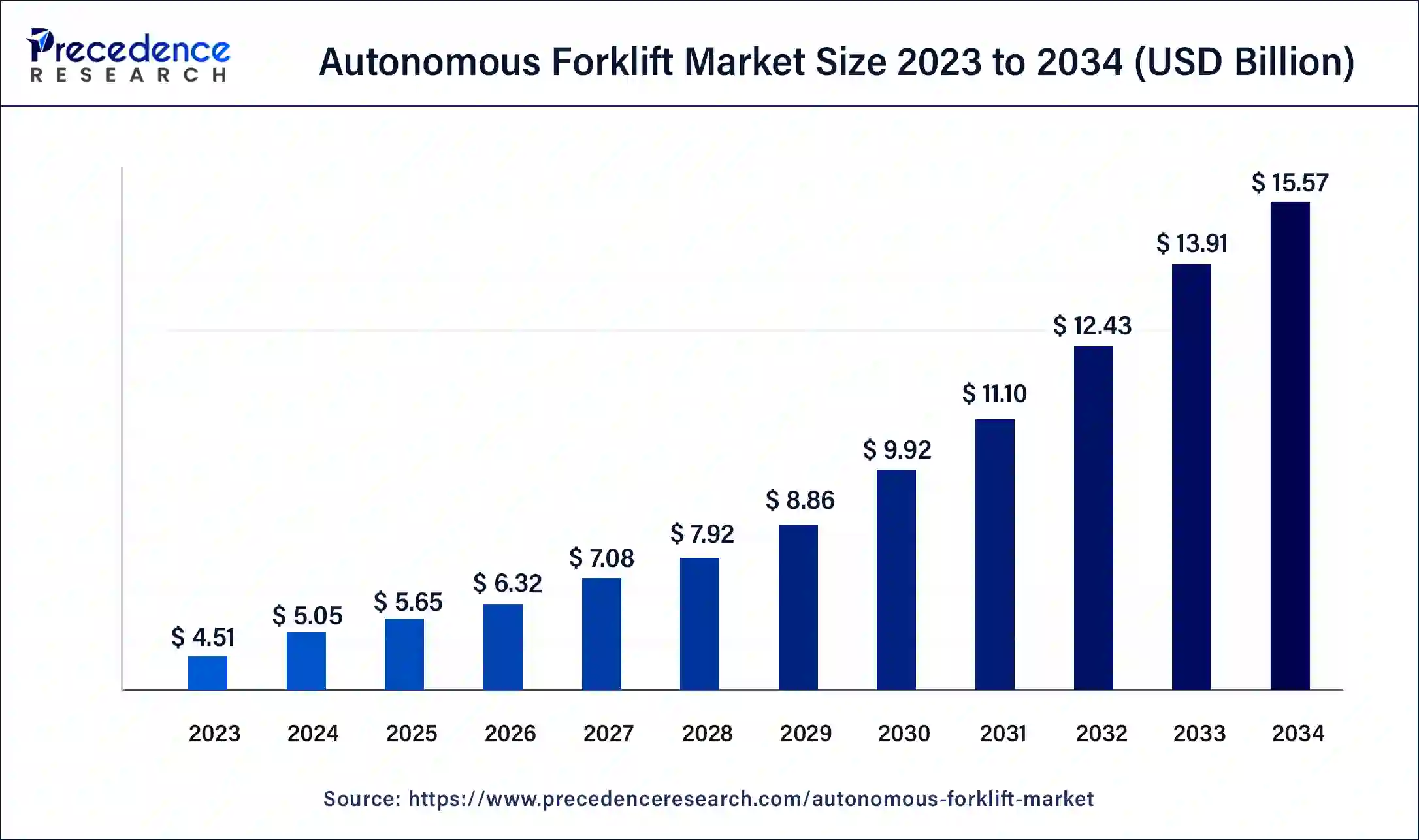

The global autonomous forklift market size was calculated at USD 4.51 billion in 2023 and is expected to expand around USD 13.91 billion by 2033, growing at a CAGR of 11.92% from 2024 to 2033

Autonomous Forklift Market Key Takeaways

- Asia Pacific dominated the autonomous forklift market in 2023.

- North America is expected to show significant growth in the market over the forecast period.

- By tonnage, the above 10 tonnes segment dominated the market in 2023.

- By tonnage, the below 5-10 segment is expected to grow at the fastest rate in the market during the forecast period.

- By navigation technology, the laser segment dominated the market in 2023.

- By navigation technology, the vision segment is expected to grow at a notable rate in the market over the forecast period.

- By end use, the retail & wholesale segments dominated the market in 2023.

- By end use, the logistics segment is expected to grow rapidly in the market over the forecast period.

- By application, the indoor segment dominated the market in 2023.

The Autonomous Forklift Market is experiencing significant growth due to advancements in automation and robotics technologies. Autonomous forklifts, also known as automated guided vehicles (AGVs) or self-driving forklifts, are designed to move and transport materials within warehouses, factories, and distribution centers without the need for human intervention. These forklifts are equipped with sensors, cameras, and advanced software to navigate through complex environments, ensuring efficient and safe operations. The market is driven by the increasing demand for automation in material handling to enhance productivity, reduce labor costs, and minimize human error.

Get a Sample: https://www.precedenceresearch.com/sample/4363

Growth Factors

Several factors are contributing to the growth of the autonomous forklift market. Firstly, the rise in e-commerce and the need for efficient warehousing solutions have accelerated the adoption of automated material handling systems. Secondly, the advancements in artificial intelligence (AI) and machine learning (ML) technologies have enhanced the capabilities of autonomous forklifts, making them more reliable and efficient. Additionally, the increasing labor costs and the shortage of skilled labor in various regions are pushing companies to invest in automation to maintain competitive advantage. Lastly, the emphasis on workplace safety and the reduction of accidents in industrial settings are further propelling the demand for autonomous forklifts.

Regional Insights

The autonomous forklift market is witnessing varied growth patterns across different regions. North America and Europe are leading the market due to the early adoption of advanced technologies and the presence of major industry players. The robust industrial infrastructure and the high labor costs in these regions are also driving the market. In the Asia-Pacific region, countries like China, Japan, and South Korea are rapidly embracing automation in manufacturing and warehousing, contributing to significant market growth. The expansion of the e-commerce sector and the increasing investments in smart factory solutions are further boosting the market in this region. Meanwhile, regions like Latin America and the Middle East & Africa are gradually adopting autonomous forklifts as industries modernize and the benefits of automation become more apparent.

Autonomous Forklift Market Scope

| Report Coverage | Details |

| Autonomous Forklift Market Size in 2023 | USD 4.51 Billion |

| Autonomous Forklift Market Size in 2024 | USD 5.05 Billion |

| Autonomous Forklift Market Size by 2033 | USD 13.91 Billion |

| Autonomous Forklift Market Growth Rate | CAGR of 11.92% from 2024 to 2033 |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Tonnes, Navigation Technology, End-use, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Autonomous Forklift Market Dynamics

Drivers

The primary drivers of the autonomous forklift market include the growing need for efficiency and productivity in material handling operations. The reduction in operational costs due to decreased reliance on human labor and the enhanced safety features of autonomous forklifts are major incentives for adoption. The technological advancements in sensors, navigation systems, and AI have significantly improved the performance and reliability of these forklifts, making them a viable option for various industries. Additionally, the increasing prevalence of smart warehouses and the integration of Internet of Things (IoT) technologies are driving the demand for autonomous forklifts to streamline operations and improve inventory management.

Opportunities

The autonomous forklift market presents several opportunities for growth and innovation. The continuous advancements in AI and machine learning algorithms provide opportunities to further enhance the capabilities of autonomous forklifts, making them more adaptive and intelligent. The growing trend of Industry 4.0 and the integration of IoT in industrial operations offer opportunities for developing more connected and efficient automated systems. Furthermore, the expansion of the e-commerce sector and the increasing demand for rapid and efficient order fulfillment present significant opportunities for autonomous forklift manufacturers to cater to the logistics and warehousing needs of this booming industry. Additionally, the emerging markets in Asia-Pacific, Latin America, and Africa offer untapped potential for growth as industries in these regions modernize and adopt automation.

Challenges

Despite the promising growth, the autonomous forklift market faces several challenges. High initial investment costs and the complexity of integrating autonomous forklifts into existing operations can be a barrier for some companies. Additionally, the need for skilled personnel to manage and maintain these advanced systems can pose a challenge, especially in regions with a shortage of technical expertise. Concerns related to cybersecurity and the potential vulnerability of connected systems to cyber attacks also present a challenge to the widespread adoption of autonomous forklifts. Moreover, navigating regulatory and compliance issues in different regions can be complex and may hinder the market growth. Lastly, the resistance to change and the reluctance of some industries to replace traditional forklifts with autonomous alternatives can slow down the adoption rate.

Read Also: Wireless Connectivity Market Size to Grow USD 335.38 Bn by 2033

Autonomous Forklift Market Recent Developments

- In February 2024, Seegrid Corporation announced the launch of an autonomous lift truck, the Palion Lift CR1 model, to address evolving challenges in autonomous material handling for warehousing, manufacturing, and logistics customers. The Palion Lift CR1 boasts an impressive 15’ lift height and a robust 4,000lb payload capacity. Further, the company stated that the new model is equipped with its own proprietary state-of-the-art navigation technology.

- In August 2023, Cyngn Inc., a developer of AI-powered autonomous driving solutions for industrial applications, announced a paid pre-order agreement with Arauco, a global company of sustainable forestry products, pulp, and engineered wood that is a supplier to the furniture and construction industries, to supply 100 autonomous electric DriveMod-enabled forklifts. The agreement aims to enhance Arauco’s operations and drive efficiency in its material handling processes.

- In September 2022, Toyota Material Handling Japan (“TMHJ”), a branch of Toyota Industries Corporation, developed an autonomous lift truck with world-first*1AI-based technology that automatically recognizes truck and load location and position and produces automated travel paths to complete loading operations.

Autonomous Forklift Market Companies

- Toyota Industries Corporation

- Kion Group AG

- Mitsubishi Logisnext Co Ltd

- Jungheinrich AG

- Hyster-Yale Materials Handling

- Hangcha Group Co, Ltd

- Agilox Services GMBH

- Komatsu Ltd.

- Doosan Corporation

- Anhui Yufeng Equipment Co., Ltd.

- Anhui Heli Co., Ltd.

- Crown Equipment Corporation

- MLE B.V.

Segments Covered in the Report

By Tonnes

- Below 5 Tons

- 5 to 10 Tons

- Above 10 Tons

By Navigation Technology

- Laser

- Vision

- Optical Tape

- Magnetic

- Inductive Guidance

By End-use

- Retail and Wholesale

- Logistics

- Automotive

- Food Industry

- Others

By Application

- Indoor

- Outdoor

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/

- Intelligent Traffic Management System Market Size, Trends, Report 2034 - July 17, 2024

- Healthcare Finance Solutions Market Size to Grow USD 293.12 Bn by 2034 - July 17, 2024

- Epoxy Composites Market Size to Grow USD 84.99 Bn by 2034 - July 17, 2024