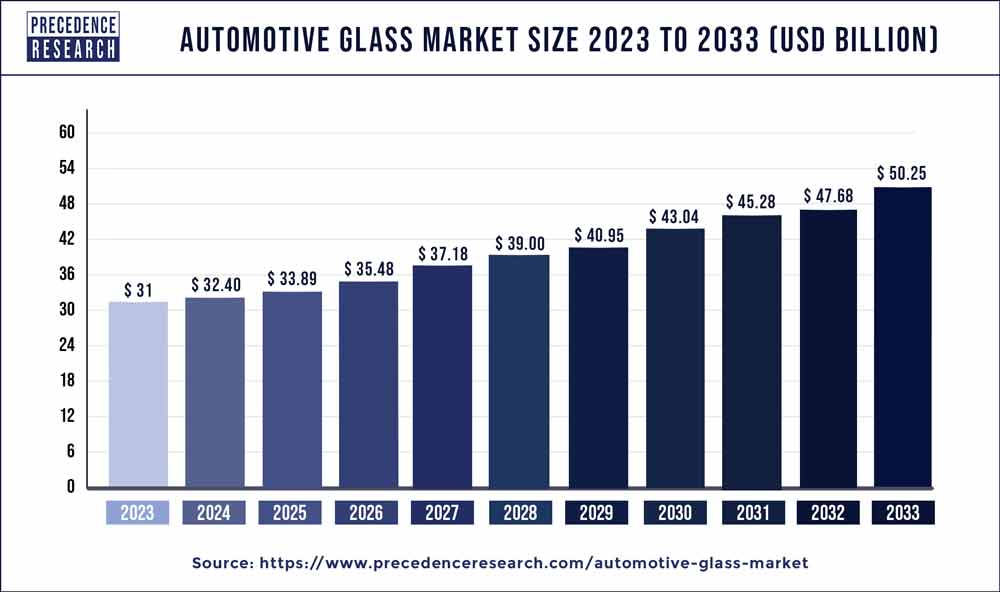

The global automotive glass market size is projected to be worth around USD 50.25 billion by 2033 from USD 31 billion in 2023 poised to grow at a CAGR of 5% from 2024 to 2033.

Key Takeaways

- Asia-Pacific contributed 55% of market share in 2023.

- North America is estimated to expand the fastest CAGR between 2024 and 2033.

- By product, the tempered glass segment held the largest market share of 60% in 2023.

- By product, the laminated glass segment is anticipated to grow at a remarkable CAGR of 7.3% between 2024 and 2033.

- By vehicle type, the passenger cars segment generated over 59% of the market share in 2023.

- By vehicle type, the light commercial vehicles segment is expected to expand at the fastest CAGR over the projected period.

- By end-use, the original equipment manufacturer (OEM) segment generated over 92% of the market share in 2023.

- By end-use, the aftermarket segment is expected to expand at the fastest CAGR over the projected period.

Introduction:

The automotive glass market plays a crucial role in the automotive industry, providing essential components for vehicles’ structural integrity and safety. Automotive glass encompasses various types, including windshields, side windows, rear windows, and sunroofs, each serving distinct functions in ensuring driver visibility, passenger comfort, and vehicle aesthetics. As advancements in vehicle design, safety regulations, and consumer preferences continue to evolve, the automotive glass market experiences dynamic shifts and opportunities for innovation.

Get a Sample: https://www.precedenceresearch.com/sample/3732

Growth Factors:

Several key factors drive the growth of the automotive glass market. Firstly, the rising demand for passenger and commercial vehicles, fueled by population growth, urbanization, and increasing disposable incomes in emerging economies, drives the need for automotive glass components. Additionally, stringent safety standards and regulations worldwide mandate the use of high-quality, shatter-resistant glass in vehicles, contributing to market growth. Moreover, technological advancements, such as the integration of smart glass solutions offering enhanced visibility, UV protection, and energy efficiency, further propel market expansion. Furthermore, the growing trend towards electric and autonomous vehicles presents new opportunities for specialized automotive glass products tailored to the unique requirements of these vehicles.

Trends

Several notable trends are shaping the automotive glass market landscape. One prominent trend is the increasing adoption of lightweight and energy-efficient glass materials to improve vehicle fuel efficiency and reduce carbon emissions. Additionally, there is a growing emphasis on incorporating advanced features into automotive glass, such as heads-up displays (HUDs), augmented reality (AR) overlays, and embedded sensors for enhanced driver assistance and connectivity. Moreover, the demand for customizable and aesthetically appealing glass solutions to differentiate vehicle models and enhance brand identity is on the rise. Furthermore, the integration of innovative manufacturing techniques, such as advanced molding processes and automated production systems, is streamlining production processes and reducing manufacturing costs.

Automotive Glass Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 5% |

| Global Market Size in 2023 | USD 31 Billion |

| Global Market Size by 2033 | USD 50.25 Billion |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Product, By Vehicle Type, and By End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

By Product:

- Laminated Glass: This type of automotive glass consists of two or more layers of glass bonded together with a layer of polyvinyl butyral (PVB) or other adhesive material. Laminated glass is commonly used for windshields due to its strength and ability to prevent shattering upon impact.

- Tempered Glass: Tempered glass undergoes a heating and rapid cooling process, which increases its strength compared to regular glass. It is often used for side and rear windows in vehicles because it shatters into small, blunt pieces upon impact, reducing the risk of injury.

- Others: This category may include specialty or niche types of automotive glass, such as acoustic glass for reducing noise inside the vehicle, heated glass for defrosting, or smart glass with adjustable tint levels.

By Vehicle Type:

- Passenger Cars: This segment includes sedans, hatchbacks, coupes, convertibles, and other vehicles designed primarily for transporting passengers. Automotive glass for passenger cars typically varies in size and shape to fit different models and designs.

- Commercial Vehicles: This category encompasses trucks, vans, buses, and other vehicles used for commercial purposes. The automotive glass for commercial vehicles may need to withstand heavier loads and more rugged conditions compared to passenger cars.

- Others: This segment may include specialty vehicles such as off-road vehicles, sports cars, electric vehicles, and luxury vehicles, each with specific requirements for automotive glass.

By End-use:

- OEM (Original Equipment Manufacturer): Automotive glass supplied to vehicle manufacturers for installation during the production process. OEM automotive glass often undergoes rigorous testing to meet industry standards and vehicle specifications.

- Aftermarket: Replacement automotive glass sold separately from the vehicle manufacturer. Aftermarket glass may be used to replace damaged or worn-out glass in vehicles, offering consumers options beyond what was originally installed by the OEM.

- Others: This category could include specialty or custom applications of automotive glass, such as for racing cars, vintage vehicles, or specialized industrial vehicles.

Recent Developments

- In May 2022, NSG Group revealed plans to integrate its automotive glass business in China with SYP Kangqiao Autoglass Co., Ltd., a leading Chinese automotive glass manufacturer. This strategic partnership with SYP Automotive is designed to bolster NSG Group’s capacity to meet the growing demands of car manufacturers in the Chinese market.

- In March 2022, LKQ Corporation finalized an agreement to divest PGW Auto Glass to One Equity Partners (OEP), a private equity firm. According to its website, PGW boasts an extensive network with over 100 distribution branches and a customer base exceeding 27,000 in both Canada and the United States.

- In February 2019, Vitro, a North American automotive glass manufacturer, committed a significant investment of USD 60 million toward the development and implementation of cutting-edge technologies. These investments were strategically directed at the North American market, with the goal of reinforcing Vitro’s prominent position in the automotive glass sector. The company aimed to strengthen its role as a premier supplier to original equipment manufacturers (OEMs) and aftermarket customers in the region.

Read Also: U.S. In Vitro Diagnostics Market Size to Increase USD 41.62 Bn By 2033

Competitive Landscape:

The automotive glass market is characterized by intense competition among key players striving to innovate, differentiate, and capture market share. Major players in the industry include Saint-Gobain, Asahi Glass Co., Ltd., Fuyao Glass Industry Group Co., Ltd., Nippon Sheet Glass Co., Ltd., and Guardian Industries, among others. These companies compete based on factors such as product quality, technological innovation, pricing strategies, and geographical presence. Moreover, partnerships, mergers, and acquisitions are common strategies employed by key players to strengthen their market position, expand their product portfolios, and enhance their global reach. Additionally, investments in research and development (R&D) to develop advanced glass solutions tailored to evolving consumer preferences and regulatory requirements are key drivers of competitiveness in the automotive glass market.

Automotive Glass Market Companies

- Asahi Glass Co., Ltd.

- Saint-Gobain S.A.

- Fuyao Glass Industry Group Co., Ltd.

- Nippon Sheet Glass Co., Ltd. (NSG Group)

- Guardian Industries

- AGC Inc.

- Vitro S.A.B. de C.V.

- Xinyi Glass Holdings Limited

- Central Glass Co., Ltd.

- Shenzhen Benson Automobile Glass Co., Ltd.

- Pittsburgh Glass Works (PGW)

- Webasto SE

- Corning Incorporated

- SYP Kangqiao Autoglass Co., Ltd.

- Pilkington Group Limited

Segments Covered in the Report

By Product

- Tempered Glass

- Laminated Glass

- Others

By Vehicle Type

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

By End-use

- Original Equipment Manufacturer (OEM)

- Aftermarket

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

- Photodynamic Therapy Market Size to Rake USD 8.42 Bn by 2033 - February 5, 2024

- Image Recognition Market Size to Attain USD 166.01 Bn by 2033 - February 5, 2024

- Hydrogen Storage Tanks and Transportation Market Report 2033 - February 5, 2024