Key Points

- Europe has contributed for the largest market share of 34% in 2023.

- Asia-Pacific is estimated to expand at the fastest CAGR of 23.75% during the forecast period of 2024-2033.

- By solution, the safety & security segment held the largest market share of 49% in 2023.

- By solution, the remote diagnostics segment is anticipated to grow at a remarkable CAGR of 22.29% during the forecast period.

- By component, the services segment has generated the largest market share of 52% in 2023.

- By component, the hardware segment is growing at the fastest CAGR of 15.64% over the projected period.

- By application, the passenger cars segment has generated more than 75% of market share in 2023.

- By application, the commercial vehicles segment is expected to grow at a CAGR of 23.70% over the projected period.

The Automotive Embedded Telematics Market has witnessed significant growth in recent years, driven by the increasing demand for connected vehicles and advanced in-vehicle technologies. Embedded telematics systems have become integral components of modern vehicles, offering a wide range of functionalities such as vehicle tracking, remote diagnostics, emergency assistance, and infotainment services. These systems leverage wireless communication technologies and sophisticated software platforms to provide real-time data monitoring and analysis, enhancing vehicle safety, efficiency, and convenience.

Get a Sample: https://www.precedenceresearch.com/sample/3886

Growth Factors

Several key factors contribute to the growth of the automotive embedded telematics market. Firstly, the rising consumer preference for connected features in vehicles, including navigation assistance, remote vehicle management, and entertainment services, fuels the adoption of embedded telematics solutions. Additionally, regulatory mandates promoting vehicle safety and security, such as eCall regulations in Europe and similar initiatives in other regions, drive the integration of telematics systems into automobiles. Moreover, advancements in communication technologies, such as 5G networks and the Internet of Things (IoT), enable seamless connectivity and data exchange between vehicles and external networks, further boosting the demand for embedded telematics solutions.

Automotive Embedded Telematics Market Scope

| Report Coverage | Details |

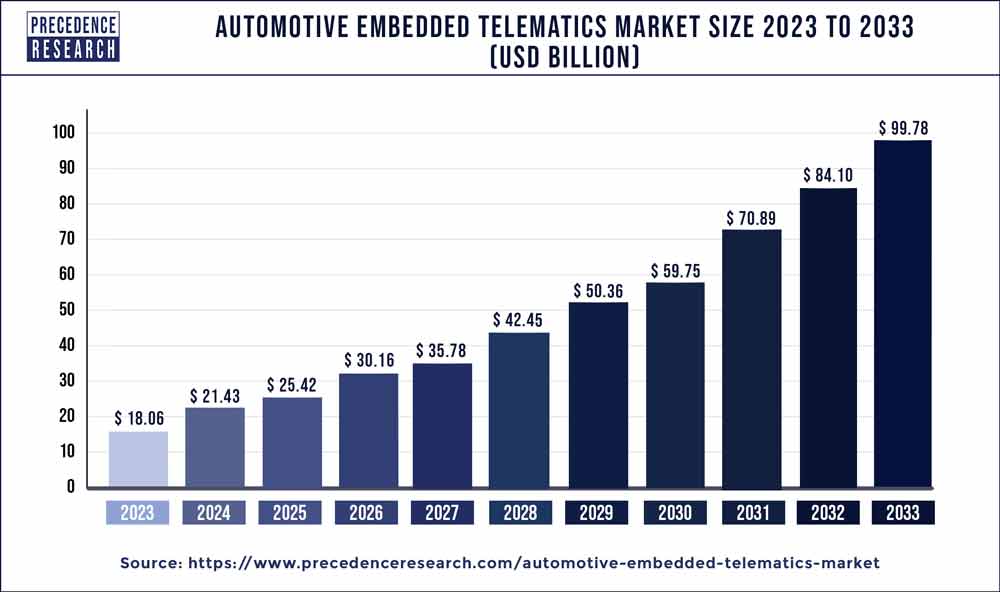

| Growth Rate from 2024 to 2033 | CAGR of 18.64% |

| Global Market Size in 2023 | USD 18.06 Billion |

| Global Market Size by 2033 | USD 99.78 Billion |

| Largest Market | Europe |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Solution, By Component, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Automotive Embedded Telematics Market Dynamics

Drivers:

Several drivers propel the growth of the automotive embedded telematics market. Firstly, the increasing focus on vehicle safety and security among consumers and regulatory authorities accelerates the adoption of embedded telematics systems, which offer features like automatic crash notification, stolen vehicle tracking, and remote vehicle immobilization. Additionally, the growing trend of connected and autonomous vehicles requires robust telematics infrastructure to support communication between vehicles, infrastructure, and other connected devices, thereby driving the demand for embedded telematics solutions. Furthermore, the integration of artificial intelligence (AI) and machine learning algorithms into telematics platforms enhances their capabilities for predictive maintenance, driver behavior analysis, and personalized services, contributing to market growth.

Restraints:

Despite its rapid expansion, the automotive embedded telematics market faces certain restraints that could impede its growth trajectory. One significant challenge is the high initial cost associated with implementing embedded telematics systems in vehicles, which can deter price-sensitive consumers and manufacturers, particularly in emerging markets. Moreover, concerns regarding data privacy and cybersecurity pose obstacles to widespread adoption, as consumers and regulatory bodies demand robust security measures to protect sensitive information transmitted and stored by telematics platforms. Additionally, interoperability issues arising from the proliferation of disparate telematics standards and protocols may hinder seamless integration and compatibility between different vehicle models and telematics service providers.

Opportunity:

Amidst the challenges, the automotive embedded telematics market presents promising opportunities for innovation and growth. The increasing integration of advanced driver assistance systems (ADAS) and vehicle-to-everything (V2X) communication technologies with embedded telematics platforms opens up new avenues for enhancing vehicle safety, efficiency, and autonomy. Furthermore, the emergence of subscription-based business models and value-added services, such as predictive maintenance, usage-based insurance, and in-vehicle commerce, offers opportunities for revenue diversification and enhanced customer engagement for automotive OEMs and telematics service providers. Moreover, the growing adoption of electric vehicles (EVs) and the transition towards smart and sustainable mobility solutions create a conducive environment for the expansion of embedded telematics applications in the automotive sector.

Read Also: US Ultraviolet Disinfection Equipment Market Size, Report By 2033

Recent Developments

- In December 2022, CerebrumX Labs Inc. joined forces with Toyota to offer real-time insights for enhancing the safety and cost-effectiveness of connected fleet operations. The primary aim of this partnership is to reduce the Total Cost of Ownership (TCO) for fleets by utilizing telematics data obtained from Toyota vehicles within the network. The collaboration promotes data-driven decision-making, striving to elevate overall performance.

- In November 2022, CerebrumX Labs Inc. unveiled the integration of data from Ford connected vehicles. This integration seeks to enhance its data-centric Usage-Based Insurance (UBI)-as-a-Service model for insurance companies. CerebrumX aims to offer insurers a quicker, more cost-effective method to launch UBI programs by utilizing integrated telematics tailored for eligible Ford and Lincoln connected vehicles.

- In April 2022, Hitachi Solutions partnered with BitBrew, aiming to combine BitBrew’s connected vehicle platform with Hitachi Solutions America’s expertise in the insurance industry, enterprise integration, and deployment. This collaboration aims to deliver cutting-edge solutions for analyzing vehicle health and driver behavior in the insurance industry, leveraging real-time telematics data streams. By leveraging each other’s strengths, Hitachi Solutions America can provide reliable data-driven models and valuable connected services that meet the evolving needs of the insurance sector.

- In March 2022, Geotab Inc. collaborated with Free2move, a subsidiary of Stellantis. Through this partnership, Geotab seeks to equip Stellantis brand vehicles, including Ram, Jeep, Dodge, and Chrysler, with a Geotab Integrated Solution. This collaborative solution utilizes embedded telematics in Stellantis cars, enabling seamless integration of vehicle information from Free2move servers into the MyGeotab platform. Fleet executives can access a user-friendly telematics dashboard to generate reports and monitor crucial parameters, enhancing mobility and optimizing fleet performance.

Competitive Landscape

The automotive embedded telematics market is characterized by intense competition among key players, including automotive OEMs, telematics solution providers, software developers, and telecommunications companies. Established players such as Bosch, Continental AG, Verizon Communications, and Harman International Industries dominate the market with their extensive product portfolios, technological expertise, and global reach. However, the market also presents opportunities for new entrants and startups to innovate and differentiate themselves through disruptive technologies, strategic partnerships, and customer-centric solutions. Collaborations between automotive manufacturers and technology companies, as well as mergers and acquisitions within the industry, are likely to reshape the competitive landscape and drive consolidation in the automotive embedded telematics market.

Automotive Embedded Telematics Market Companies

- Verizon Connect

- Geotab

- TomTom Telematics

- AT&T

- Bosch Connected Devices and Solutions

- MiX Telematics

- CalAmp

- Teletrac Navman

- Harman International (a Samsung company)

- Continental AG

- Vodafone Automotive

- Telit

- Airbiquity

- Sierra Wireless

- WirelessCar

Segments Covered in the Report

By Solution

- Safety & Security

- Information & Navigation

- Entertainment

- Remote Diagnostics

By Component

- Hardware

- Services

- Connectivity

By Application

- Passenger Cars

- Commercial Vehicles

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

- Intelligent Traffic Management System Market Size, Trends, Report 2034 - July 17, 2024

- Healthcare Finance Solutions Market Size to Grow USD 293.12 Bn by 2034 - July 17, 2024

- Epoxy Composites Market Size to Grow USD 84.99 Bn by 2034 - July 17, 2024