The Automated Breast Ultrasound Systems (ABUS) market has witnessed significant growth in recent years, driven by advancements in technology, increasing awareness about breast cancer screening, and rising demand for non-invasive diagnostic solutions. ABUS offers a valuable adjunct to mammography for breast cancer detection, particularly in women with dense breast tissue. In this comprehensive analysis, we will explore the growth factors, trends, regional insights, and competitive landscape of the ABUS market.

Key Takeaways

- North America dominated the automated breast ultrasound systems market with the largest share in 2023.

- Asia Pacific is observed to witness the fastest rate of growth during the forecast period.

- By product, the automated breast ultrasound scanner segment has contributed the largest market share of in 2023.

- By product, the automated breast volume scanner combination therapy segment is observed to witness a notable rate of growth during the forecast period.

- By end user, the radiologists segment dominated the market in 2023.

- By end user, the surgeon segment is projected to witness rapid growth in the upcoming years.

Get a Sample: https://www.precedenceresearch.com/sample/3925

Growth Factors

Several factors contribute to the growth of the ABUS market. Firstly, the rising incidence of breast cancer globally has fueled the demand for advanced diagnostic tools for early detection and improved patient outcomes. ABUS systems offer high-resolution imaging capabilities, allowing healthcare providers to detect breast abnormalities with greater sensitivity, especially in women with dense breast tissue, where mammography may be less effective.

Furthermore, technological advancements in ABUS systems, such as the integration of artificial intelligence (AI) algorithms for image analysis and interpretation, have enhanced the accuracy and efficiency of breast cancer screening. AI-driven ABUS platforms can assist radiologists in detecting and characterizing suspicious lesions, reducing interpretation time and potentially improving diagnostic accuracy.

Moreover, increasing awareness campaigns and initiatives promoting breast cancer screening and early detection have contributed to the adoption of ABUS systems. Healthcare organizations, advocacy groups, and governments worldwide are actively promoting regular screening programs, emphasizing the importance of early diagnosis in improving survival rates and reducing the burden of breast cancer.

Trends

The ABUS market is characterized by several notable trends shaping its growth trajectory. One prominent trend is the integration of ABUS technology into multi-modality breast imaging workflows. Many healthcare facilities are adopting a multi-modal approach to breast cancer screening, combining mammography, ultrasound, and magnetic resonance imaging (MRI) for comprehensive evaluation, particularly in high-risk populations or women with dense breast tissue.

Another emerging trend is the development of handheld and portable ABUS devices, offering greater flexibility and accessibility in various clinical settings. Portable ABUS systems enable point-of-care screening in remote or underserved areas, facilitating early detection and timely intervention for breast cancer patients who may have limited access to traditional imaging facilities.

Additionally, there is a growing emphasis on personalized medicine and risk-stratified screening approaches in breast cancer management. ABUS systems play a crucial role in risk assessment and personalized screening strategies, allowing healthcare providers to tailor screening protocols based on individual patient characteristics, such as breast density, family history, and genetic predisposition.

Automated Breast Ultrasound Systems Market Scope

| Report Coverage | Details |

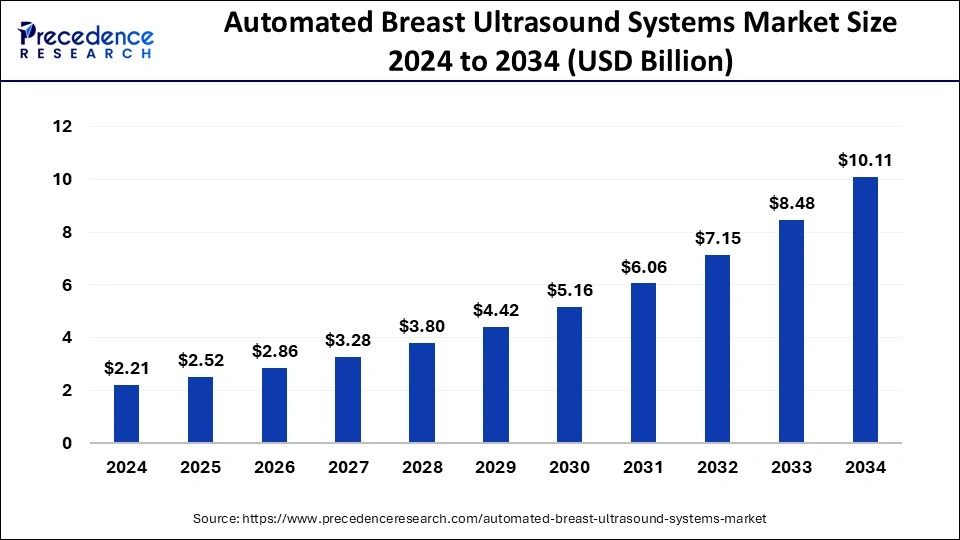

| Growth Rate from 2024 to 2033 | CAGR of 15.59% |

| Global Market Size in 2023 | USD 2.31 Billion |

| Global Market Size by 2033 | USD 9.84 Billion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Product and By End-user |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Region Insights

The adoption and utilization of ABUS systems vary across different regions, influenced by factors such as healthcare infrastructure, reimbursement policies, and regulatory frameworks. In developed markets such as North America and Europe, ABUS adoption is relatively high, driven by well-established breast cancer screening programs, favorable reimbursement policies, and a strong emphasis on early detection and prevention.

In contrast, emerging markets in Asia-Pacific, Latin America, and the Middle East are witnessing growing demand for ABUS technology, fueled by increasing healthcare expenditures, improving infrastructure, and rising awareness about breast cancer screening. However, challenges such as limited access to healthcare facilities, uneven distribution of resources, and cultural barriers may hinder the widespread adoption of ABUS in some regions.

Competitive Landscape: The ABUS market is characterized by intense competition among leading players, as well as new entrants seeking to capitalize on the growing demand for breast cancer screening solutions. Key players in the market include GE Healthcare, Siemens Healthineers, Hitachi Healthcare, and SonoCine Inc., among others. These companies are investing in research and development initiatives to enhance the performance, functionality, and usability of their ABUS systems, aiming to gain a competitive edge in the market.

Moreover, partnerships, collaborations, and strategic alliances are common strategies employed by ABUS manufacturers to expand their market presence and distribution networks. Many companies are collaborating with healthcare providers, research institutions, and advocacy groups to promote awareness, education, and adoption of ABUS technology in breast cancer screening programs.

Furthermore, mergers and acquisitions are prevalent in the ABUS market, as companies seek to strengthen their product portfolios, expand their geographic footprint, and leverage synergies to drive growth and profitability. Consolidation within the industry may lead to increased market consolidation and competitive pressures, as larger players seek to dominate key market segments and gain market share.

Read Also: Acne Medication Market Size to Attain USD 19.17 Bn by 2033

Recent Developments

- In February 2024, Butterfly Network introduced the iQ3TM handheld ultrasound system, incorporating advanced image processing, artificial intelligence (AI) capabilities, and enhanced 3D imaging technology. This innovative device marks a significant milestone in ultrasound technology, offering healthcare professionals a portable and powerful tool for diagnostic imaging with improved accuracy and efficiency.

- In October 2023, Philips Healthcare unveiled a groundbreaking solution for breast ultrasound imaging, combining hardware and software into a cohesive package. Available on the company’s Epiq and Affiniti ultrasound scanners, this innovative offering integrates Philips’ PureWave eL18-4 ultra-broadband linear-array transducer with advanced ‘anatomical intelligence’ automated software.

Automated Breast Ultrasound Systems Market Companies

- ALPINION Medical Systems Co., Ltd.

- BK Medical Holding Company, Inc.

- Canon Medical Systems Corporation

- Delphinus Medical Technologies, Inc.

- Fukuda Denshi Co., Ltd.

- GE Healthcare

- Hitachi, Ltd.

- Hologic, Inc.

- Konica Minolta, Inc.

- Koninklijke Philips N.V.

- QT Imaging, Inc.

- Samsung Group

- Seno Medical Instruments, Inc.

- Siemens Healthineers AG

- SonoCine, Inc.

Segments Covered in the Report

By Product

- Automated Breast Ultrasound System

- Automated Breast Volume Scanner

- Automated Breast Ultrasound Device

- Automated Breast Imaging System

- Automated Breast Ultrasound Scanner

- Automated Breast Ultrasound Equipment

- Automated Breast Ultrasound Machine

- Automated Breast Ultrasound Technology

By End-user

- Radiologists

- Oncologists

- Breast Surgeons

- Gynecologists

- Breast Imaging Technologists

- Healthcare Providers

- Patients

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

- Intelligent Traffic Management System Market Size, Trends, Report 2034 - July 17, 2024

- Healthcare Finance Solutions Market Size to Grow USD 293.12 Bn by 2034 - July 17, 2024

- Epoxy Composites Market Size to Grow USD 84.99 Bn by 2034 - July 17, 2024