The Antidiabetics Market is a crucial segment within the pharmaceutical industry, driven by the rising prevalence of diabetes globally. Diabetes, a chronic metabolic disorder characterized by high blood sugar levels, has reached epidemic proportions, impacting millions of individuals worldwide. As a result, the demand for antidiabetic drugs continues to surge, creating significant opportunities for pharmaceutical companies to innovate and develop new treatment options. The market encompasses a wide range of medications aimed at managing blood glucose levels and preventing complications associated with diabetes, such as cardiovascular diseases, kidney failure, and neuropathy.

Key Points

- North America has held the largest revenue share of around 39% in 2023.

- Asia Pacific is observed to witness the fastest rate of expansion during the forecast period.

- By product, the insulin segment dominated the antidiabetics market with the highest share in 2023.

- By product, the drug class segment is observed to grow at a significant rate during the forecast period.

- By patient population, the geriatric segment held the dominating share of the market in 2023.

- By route of administration, the oral segment led the market in 2023. The segment is observed to sustain the position.

- By route of administration, the insulin pen/syringe segment is observed to witness the fastest rate of expansion throughout the forecast period.

Get a Sample: https://www.precedenceresearch.com/sample/3914

Growth Factors

Several key factors contribute to the growth of the antidiabetics market. Firstly, the escalating incidence of diabetes, fueled by sedentary lifestyles, unhealthy dietary habits, and increasing obesity rates, drives the demand for antidiabetic drugs. Additionally, advancements in medical technology and drug delivery systems enhance the efficacy and convenience of diabetes management, leading to greater patient adherence. Moreover, growing awareness campaigns and government initiatives aimed at diabetes prevention and management further stimulate market growth. Furthermore, the aging population worldwide, particularly in developed regions, represents a significant demographic factor driving the demand for antidiabetic medications, as the elderly are more susceptible to developing diabetes and its complications.

Region Insights

The antidiabetics market exhibits significant regional variations influenced by factors such as healthcare infrastructure, economic development, cultural norms, and prevalence of diabetes. North America and Europe dominate the market, attributed to their well-established healthcare systems, high per capita healthcare expenditure, and widespread adoption of advanced therapies. In contrast, the Asia-Pacific region, comprising emerging economies like China and India, presents immense growth opportunities due to the expanding diabetic population, improving access to healthcare, and increasing disposable incomes. Additionally, Latin America and the Middle East & Africa region witness steady growth driven by rising awareness, improving healthcare infrastructure, and government initiatives to combat diabetes.

Trends

Several notable trends shape the antidiabetics market landscape. Personalized medicine and precision therapeutics are gaining traction, allowing healthcare providers to tailor treatment regimens based on individual patient characteristics, including genetic predispositions and lifestyle factors. Furthermore, there is a growing emphasis on holistic approaches to diabetes management, incorporating lifestyle modifications, dietary interventions, and complementary therapies alongside pharmacological interventions. Telemedicine and digital health solutions are also emerging trends, facilitating remote monitoring, patient education, and teleconsultations, thereby enhancing access to diabetes care, especially in underserved regions. Moreover, the development of novel drug classes, such as SGLT-2 inhibitors, GLP-1 receptor agonists, and DPP-4 inhibitors, reflects ongoing innovation in the antidiabetics market, offering improved efficacy and safety profiles compared to traditional therapies.

Antidiabetics Market Scope

| Report Coverage | Details |

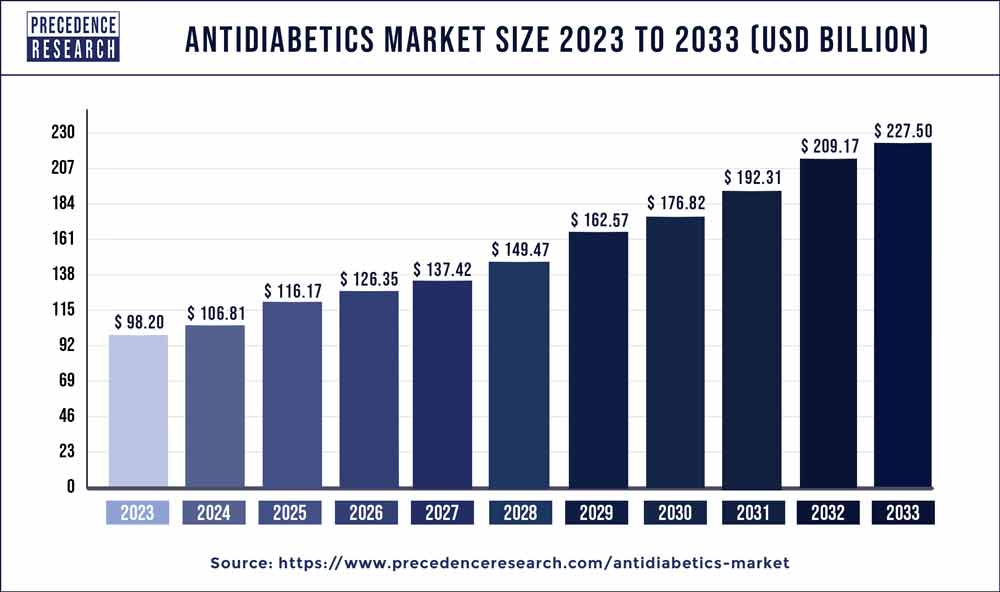

| Growth Rate from 2024 to 2033 | CAGR of 8.76% |

| Global Market Size in 2023 | USD 98.20 Billion |

| Global Market Size by 2033 | USD 227.50 Billion |

| U.S. Market Size in 2023 | USD 30.26 Billion |

| U.S. Market Size by 2033 | USD 70.09 Billion |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Product, By Patient Population, and By Route of Administration |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

SWOT Analysis

The SWOT analysis of the antidiabetics market reveals several strengths, weaknesses, opportunities, and threats shaping its dynamics. Strengths include the increasing prevalence of diabetes, driving robust demand for antidiabetic medications, and advancements in drug development and delivery technologies, enhancing treatment efficacy and patient adherence. Weaknesses encompass challenges related to medication adherence, side effects, and the complexity of managing diabetes, posing barriers to optimal disease management. Opportunities lie in untapped markets, such as emerging economies, where rising disposable incomes, improving healthcare infrastructure, and growing awareness present avenues for market expansion. However, threats include regulatory hurdles, pricing pressures, and competition from generic drugs, impacting market growth and profitability.

Read Also: AI in Computer Vision Market Size to Surpass USD 274.80 Bn by 2033

Recent Development

- In February 2023, IOL Chemicals and Pharmaceuticals Ltd, a leading pharmaceutical company’s share increased 12.1% and noticed the 8.25% higher at Rs 437.3 piece during the intraday session. The price of stock increased after the announcement of the antidiabetic drug ‘Metformin Hydrochloride’ approved by China’s drug supervisor.

- In February 2024, Boehringer Ingelheim launched an antidiabetic drug in India for the treatment of chronic kidney dieases getting approval from the Central Drugs Standard Control Organization (CDSCO).

- In January 2024, Glenmark Pharmaceuticals launched the antidiabetic drug a biosimilar of the Liraglutide a famous antidiabetic drug. The drug gets approval from the Drug Controller General of India (DCGI).

- In January 2022, the Danish Drug Maker, Novo Nordisk introduce the launch of anti-diabetics drug semaglutide in India for the Type 2 diabetes treatment.

Competitive Landscape

The antidiabetics market is characterized by intense competition among pharmaceutical companies vying for market share through product differentiation, strategic alliances, and innovative marketing strategies. Key players in the market include multinational corporations such as Novo Nordisk, Sanofi, Eli Lilly, Merck & Co., and AstraZeneca, which dominate the market with their extensive product portfolios and global presence. Additionally, generic drug manufacturers play a significant role, offering affordable alternatives to branded medications and intensifying competition, particularly in price-sensitive markets. Moreover, the entry of biotechnology companies and startups focused on developing novel therapies, including gene therapies and cell-based treatments, adds further dynamism to the competitive landscape, driving innovation and reshaping industry dynamics.

Antidiabetic Market Companies

- Sanofi-Aventis

- Takeda Pharmaceuticals

- Eli Lilly

- Oramed Pharmaceuticals

- Boehringer Ingelheim

- Merck & Co. Inc.

- Novo Nordisk

- Bristol-Myers Squibb

- Halozyme Therapeutics

- Pfizer

Segments Covered in the Report

By Product

- Insulin

- Rapid Acting

- Long Acting

- Premixed Insulin

- Short Acting

- Drug Class

- Biguanides

- GLP-Agonists

- Thiazolidinediones

- Sulphonylureas

- SGLT-2

- Alpha-Glucosidase Inhibitors

- DPP-4 Inhibitors

- Meglitinides

By Patient Population

- Pediatric

- Adults

- Geriatric

By Route of Administration

- Oral

- Infusion

- Intravenous

- Insulin Pump

- Insulin Pen/Syringe

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

- Intelligent Traffic Management System Market Size, Trends, Report 2034 - July 17, 2024

- Healthcare Finance Solutions Market Size to Grow USD 293.12 Bn by 2034 - July 17, 2024

- Epoxy Composites Market Size to Grow USD 84.99 Bn by 2034 - July 17, 2024