Key Points

- North America dominated the market with a major market share of 34% in 2023.

- By type, the monoclonal antibody segment held the largest market share in 2023.

- By end user, the hospital segment has captured the largest market share of 48% in 2023.

Get a Sample: https://www.precedenceresearch.com/sample/3891

Growth Factors

Several key factors drive the growth of the antibody therapy market. One of the primary drivers is the increasing prevalence of chronic and autoimmune diseases, such as cancer, rheumatoid arthritis, and inflammatory bowel disease, which necessitate the development of novel treatment modalities. Additionally, advancements in biotechnology and antibody engineering techniques have enhanced the efficiency and specificity of therapeutic antibodies, expanding their therapeutic potential and widening the scope of target indications.

Moreover, growing investment in healthcare research and development, along with favorable regulatory frameworks supporting biologics development and approval, has facilitated the rapid expansion of the antibody therapy market. The rising demand for personalized medicine and targeted therapies, coupled with the growing adoption of monoclonal antibody-based treatments, further fuels market growth. Additionally, the emergence of biosimilars and biobetters offers opportunities for market expansion and increased accessibility of antibody-based therapies to patients worldwide.

Antibody Therapy Market Scope

| Report Coverage | Details |

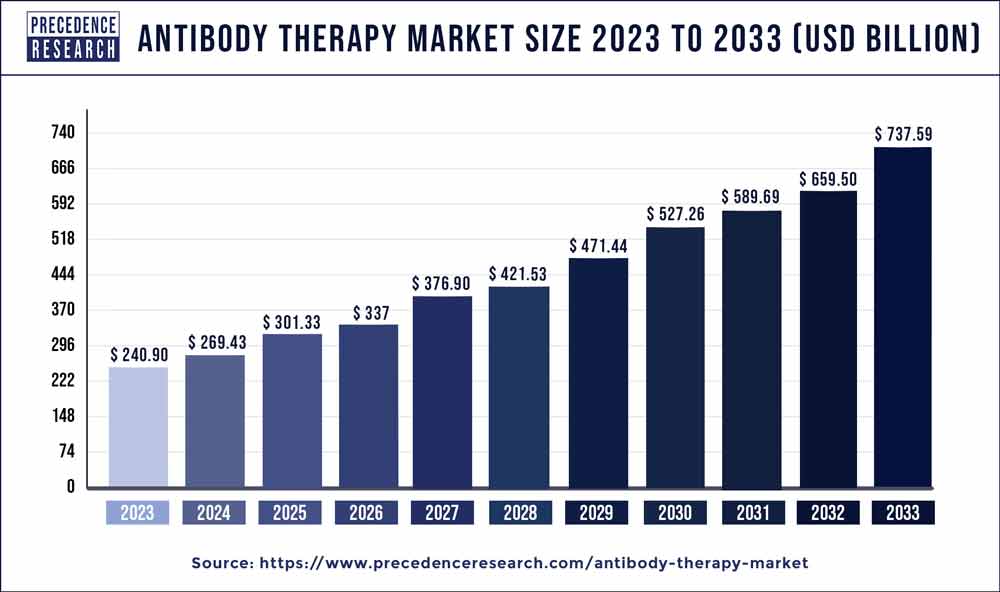

| Growth Rate from 2024 to 2033 | CAGR of 11.84% |

| Global Market Size in 2023 | USD 240.90 Billion |

| Global Market Size by 2033 | USD 737.59 Billion |

| U.S. Market Size in 2023 | USD 57.33 Billion |

| U.S. Market Size by 2033 | USD 175.55 Billion |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Type and By End User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Antibody Therapy Market Dynamics

Drivers

Several drivers contribute to the growth and development of the antibody therapy market. Firstly, the increasing prevalence of chronic and complex diseases, such as cancer, autoimmune disorders, and infectious diseases, creates a significant demand for innovative therapeutic approaches, including antibody-based treatments. The specificity and efficacy of antibodies make them attractive options for targeted therapy, reducing off-target effects and enhancing patient outcomes.

Furthermore, advancements in antibody engineering technologies, such as phage display, hybridoma technology, and recombinant DNA techniques, enable the development of antibodies with improved binding affinity, specificity, and pharmacokinetic properties. This allows for the generation of next-generation antibody therapeutics capable of addressing previously unmet medical needs and targeting specific disease pathways. Additionally, the growing understanding of disease biology and immunology has led to the identification of novel targets for antibody-based intervention, further driving research and development efforts in this field.

Opportunities

The antibody therapy market presents numerous opportunities for growth and innovation. Expansion into new therapeutic areas and indications, such as neurodegenerative diseases, cardiovascular disorders, and infectious diseases, represents a promising avenue for market expansion. Additionally, the development of combination therapies involving antibodies, small molecules, and other biologics offers synergistic benefits and potential for improved treatment outcomes.

Moreover, the increasing adoption of immuno-oncology therapies, including immune checkpoint inhibitors and chimeric antigen receptor (CAR) T-cell therapies, presents significant opportunities for the development of novel antibody-based treatments. Collaborations and partnerships between pharmaceutical companies, biotechnology firms, and academic institutions further accelerate innovation and drug discovery efforts in the antibody therapy space. Furthermore, the growing demand for biosimilars and biobetters, driven by the need for cost-effective treatment options and enhanced patient access, opens up new avenues for market expansion and revenue growth.

Restraints

Despite the promising growth prospects, the antibody therapy market faces several challenges and restraints. One of the primary concerns is the high cost of antibody-based treatments, which can limit patient access and affordability, particularly in emerging markets and underprivileged populations. Moreover, the complex manufacturing processes involved in antibody production, along with stringent regulatory requirements for biologics development and approval, contribute to lengthy timelines and high development costs.

Additionally, intellectual property issues, including patent expirations and legal challenges, pose risks to market exclusivity and profitability for innovator companies. The emergence of biosimilars and the potential for market saturation further intensify competition and pricing pressures, impacting revenue margins for established products. Furthermore, safety concerns, such as immunogenicity and adverse drug reactions, necessitate rigorous preclinical and clinical evaluation of antibody therapeutics, adding to development costs and regulatory hurdles.

Read Also: Atherectomy Devices Market Size to Worth USD 1,512.89 Mn by 2033

Regional Insights

The antibody therapy market exhibits regional variations influenced by factors such as healthcare infrastructure, regulatory frameworks, and economic conditions. North America dominates the market, driven by robust research and development activities, strong biotechnology sector, and favorable reimbursement policies. The presence of key market players and academic research institutions further contributes to the region’s leadership in antibody therapy innovation and commercialization.

Europe represents another significant market for antibody therapies, characterized by a supportive regulatory environment, well-established biopharmaceutical industry, and increasing investment in biologics research and development. Asia-Pacific is poised for rapid growth, fueled by expanding healthcare infrastructure, rising prevalence of chronic diseases, and increasing government initiatives to promote biotechnology and innovation. Moreover, partnerships and collaborations between Western and Asian companies facilitate technology transfer and market access, driving regional market expansion.

Recent Developments

- In July 2022, AstraZeneca acquired TeneoTwo, strengthening its hematological cancer pipeline with a clinical-stage T-cell engager.

- In December 2023, Bristol Myers Squibb augmented its radiopharmaceutical platform with the acquisition of RayzeBio.

- In June 2022, Galapagos acquired CellPoint and AboundBio to accelerate access to next-generation cell therapies.

- In June 2023, Lilly acquired cancer antibody drug startup Emergence.

- In September 2021, Boehringer Ingelheim acquired Abexxa Biologics to expand its research efforts in cancer immunology and novel immunotherapeutic approaches further.

- In June 2023, Lonza announced the acquisition of Synaffix, strengthening its antibody-drug conjugates offering.

Antibody Therapy Market Companies

- Bristol-Myers Squibb

- GlaxoSmithKline plc

- Takeda Pharmaceuticals

- Eli Lilly and Company

- Merck & Co, Inc.

- Seagen, Johnson & Johnson

- Novartis AG

- Regeneron Pharmaceuticals

- F. Hoffmann-La Roche Ltd.

- Merck & Co, IncSeagen

Segments Covered in the Report

By Type

- Monoclonal Antibodies

- Oncology, Autoimmune Disease

- Infectious Disease

- Other

- Antibody Drug Conjugates

By End User

- Hospitals

- Specialty Centers

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

- Intelligent Traffic Management System Market Size, Trends, Report 2034 - July 17, 2024

- Healthcare Finance Solutions Market Size to Grow USD 293.12 Bn by 2034 - July 17, 2024

- Epoxy Composites Market Size to Grow USD 84.99 Bn by 2034 - July 17, 2024