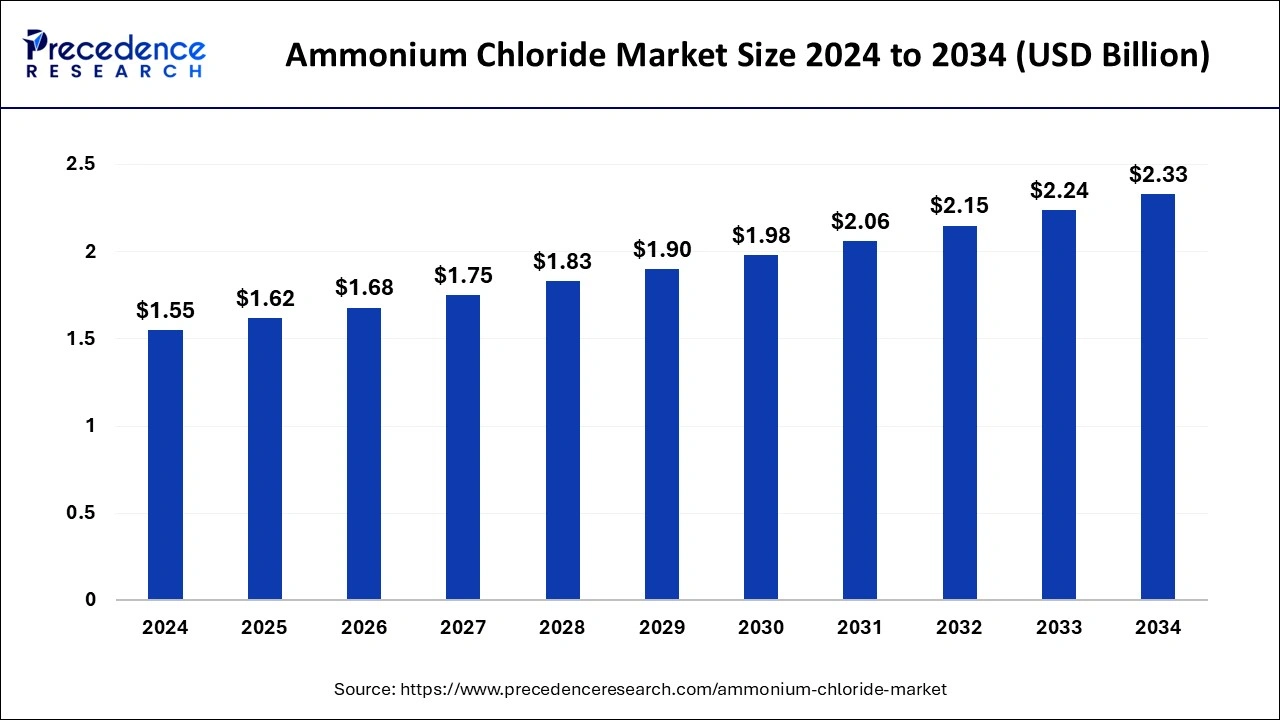

The global ammonium chloride market size is anticipated to surpass around USD 2.24 billion by 2033 from USD 1.49 billion in 2023, growing at a CAGR of 4.14% from 2024 to 2033.

The global ammonium chloride market has experienced steady growth in recent years, driven by its diverse applications across various industries such as agriculture, pharmaceuticals, food and beverages, and textiles. Ammonium chloride, chemically known as NH4Cl, is a white crystalline salt commonly produced through the reaction of ammonia with hydrochloric acid. Its versatile properties make it a valuable ingredient in numerous industrial processes, ranging from fertilizers and metalworking to medicine and food additives. As industries continue to seek cost-effective and efficient solutions, the demand for ammonium chloride is expected to remain strong, presenting lucrative opportunities for market players worldwide.

Key Points

- Asia Pacific held the largest market share of 51% in 2023.

- North America is poised to be the second-largest position holder in the market over the forecast period.

- By grade, in 2023, the agriculture grade segment held the highest market share of 28%.

- By grade, the food grade segment is anticipated to witness rapid growth at a significant CAGR of 4.9% during the projected period.

- By application, the fertilizer segment has held 24% of the market share in 2023.

- By application, the medical/pharmaceutical segment is anticipated to witness rapid growth of 3.5% over the projected period.

Growth Factors:

Several factors contribute to the growth of the global ammonium chloride market. Firstly, the agricultural sector represents a significant end-user segment for ammonium chloride, where it is widely used as a nitrogen fertilizer to enhance crop yield and improve soil fertility. With the global population on the rise and the increasing demand for food production, the agriculture industry continues to drive the demand for fertilizers, thereby fueling the growth of the ammonium chloride market.

Moreover, the pharmaceutical industry utilizes ammonium chloride in various medications and formulations, such as expectorants, diuretics, and cough suppressants. The growing prevalence of respiratory diseases, coupled with the expanding pharmaceutical sector in developing economies, contributes to the increased demand for ammonium chloride in pharmaceutical applications.

Furthermore, the food and beverage industry employs ammonium chloride as a food additive and flavoring agent in products such as salty licorice, baked goods, and condiments. As consumer preferences shift towards natural and organic ingredients, manufacturers are exploring alternative additives like ammonium chloride to meet regulatory standards and consumer demands, thereby driving market growth.

Additionally, the metalworking industry utilizes ammonium chloride in soldering fluxes and metal surface treatments due to its ability to remove oxide layers and improve solder flow. As industrial activities and construction projects continue to expand globally, the demand for metalworking chemicals, including ammonium chloride, is expected to increase, thereby stimulating market growth.

Moreover, the textile industry utilizes ammonium chloride in dyeing and printing processes as a dyeing assistant and mordant. With the rise in disposable income and fashion consciousness among consumers, the textile industry is experiencing steady growth, leading to an increased demand for chemicals like ammonium chloride.

Get a Sample: https://www.precedenceresearch.com/sample/3967

Region Insights:

The demand for ammonium chloride varies across regions due to differences in industrial activities, agricultural practices, and regulatory environments. In Asia Pacific, countries like China and India dominate the global market, driven by their large agricultural sectors and growing industrialization. China, in particular, is a major producer and consumer of ammonium chloride, owing to its significant fertilizer consumption and expanding chemical industry.

In North America, the United States is a key market for ammonium chloride, supported by its robust agricultural sector and diverse industrial base. The country’s focus on sustainable agriculture practices and technological advancements in fertilizer production further contribute to market growth in the region.

In Europe, countries like Germany, France, and the Netherlands are prominent consumers of ammonium chloride, primarily due to their well-established agricultural sectors and stringent regulations on fertilizer use. Additionally, the pharmaceutical and chemical industries in Europe drive the demand for high-quality ammonium chloride for various applications.

In Latin America, countries such as Brazil and Argentina are emerging markets for ammonium chloride, driven by their expanding agricultural sectors and increasing industrial activities. The region’s favorable climate conditions for agriculture and growing investments in infrastructure development further contribute to market growth.

In the Middle East and Africa, countries like Egypt, South Africa, and Morocco are significant consumers of ammonium chloride, particularly in the agriculture sector. The region’s focus on improving agricultural productivity and food security drives the demand for fertilizers, including ammonium chloride.

Ammonium Chloride Market Scope

| Report Coverage | Details |

| Global Market Size in 2023 | USD 1.49 Billion |

| Global Market Size by 2033 | USD 2.24 Billion |

| Growth Rate from 2024 to 2033 | CAGR of 4.14% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Grade and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Ammonium Chloride Market Dynamics

Drivers:

Several drivers propel the growth of the global ammonium chloride market. One of the primary drivers is the increasing demand for nitrogen fertilizers to support agricultural productivity and food security. With the global population projected to reach over 9 billion by 2050, there is a growing need to enhance crop yields and improve soil fertility, driving the demand for fertilizers like ammonium chloride.

Moreover, the expansion of the pharmaceutical industry, particularly in developing economies, drives the demand for ammonium chloride in medications and healthcare products. As healthcare infrastructure improves and access to medicines increases, the demand for pharmaceutical ingredients like ammonium chloride is expected to rise.

Furthermore, the food and beverage industry’s emphasis on product innovation and quality drives the demand for safe and effective food additives like ammonium chloride. As consumers become more health-conscious and demand transparency in food ingredients, manufacturers seek alternatives to traditional additives, thereby boosting the demand for natural and organic compounds like ammonium chloride.

Additionally, the growth of industrial sectors such as metalworking, textiles, and chemicals contributes to the increasing demand for ammonium chloride in various applications. As manufacturing activities expand globally and technological advancements drive efficiency improvements, the demand for specialty chemicals like ammonium chloride is expected to grow.

Moreover, government initiatives aimed at promoting sustainable agriculture practices and environmental conservation drive the adoption of nitrogen fertilizers like ammonium chloride. Subsidies, incentives, and regulations promoting the use of fertilizers that minimize environmental impact further stimulate market growth.

Opportunities:

The global ammonium chloride market presents several opportunities for industry players to capitalize on emerging trends and market dynamics. One significant opportunity lies in the development of innovative formulations and applications for ammonium chloride across diverse industries. By leveraging advances in chemical engineering and materials science, companies can create new products and solutions that address evolving customer needs and market demands.

Furthermore, expanding into untapped markets and regions presents opportunities for market expansion and growth. Emerging economies in Asia, Africa, and Latin America offer significant potential for increased fertilizer consumption and industrial development, providing opportunities for ammonium chloride producers to establish a presence and capture market share.

Moreover, strategic partnerships and collaborations with key stakeholders, such as agricultural associations, research institutions, and government agencies, can enhance market visibility and access to new opportunities. By collaborating on research and development initiatives, market players can drive innovation, improve product quality, and explore new applications for ammonium chloride.

Additionally, investments in sustainable manufacturing processes and environmentally friendly production technologies can differentiate companies in the competitive market landscape. By adopting cleaner production methods, reducing carbon emissions, and minimizing waste generation, companies can enhance their reputation, attract environmentally conscious customers, and comply with stringent regulatory requirements.

Furthermore, diversification of product portfolios and expansion into adjacent markets offer avenues for revenue growth and risk mitigation. By offering a range of complementary products and services, companies can cater to diverse customer needs and market segments, reducing dependency on any single product or industry sector.

Challenges:

Despite the promising growth prospects, the global ammonium chloride market faces several challenges that may impact its trajectory. One of the primary challenges is the volatility of raw material prices, particularly ammonia and hydrochloric acid, which are key ingredients in ammonium chloride production. Fluctuations in commodity prices can affect production costs, profit margins, and overall competitiveness, posing challenges for market players.

Moreover, regulatory compliance and environmental concerns regarding fertilizer use and chemical manufacturing present challenges for industry participants. Stringent regulations on fertilizer labeling, application rates, and environmental impact assessments require companies to invest in compliance measures and sustainable practices, increasing operational costs and complexity.

Read Also: Nanosensors Market Size to Touch USD 1,712.89 Million by 2033

Recent Developments

- In March 2023, Yara Clean Ammonia and Enbridge Inc. penned a letter of intent to collaboratively develop and build a low-carbon blue ammonia production plant in Texas, USA. The facility, anticipated to have a capacity ranging from 1.2 to 1.4 million tons per annum, will employ auto-thermal reforming coupled with carbon capture technology. Its objective is to address the increasing global demand for low-carbon ammonia. Subject to approval, the project entails an investment ranging between $2.6 and $2.9 billion.

- In May 2022, BASF unveiled the expansion of its Automotive Coatings Application Center in Mangalore, India. The facility has been meticulously designed to facilitate customer-centric R&D operations and provide an authentic simulation of OEM paint shops.

Ammonium Chloride Market Companies

- BASF SE (Germany)

- The Dallas Group of America (U.S.)

- Central Glass Co., Ltd (Japan)

- Tuticorin Alkali Chemicals And Fertilizers Limited (India)

- Tinco Chemicals Private Limited (India)

- Hubei Yihua Chemical Industry Co Ltd (China)

- Jinshan Chemical (China)

- CNSG (China)

- HEBANG (China)

- Tianjin Bohua YongLi Chemical (China)

- Shannxi Xinghua (China)

- Shijiazhuang Shuanglian Chemical (China)

- Liuzhou Chemical (China)

- Hangzhou Longshan Chemical (China)

- Sichuan Guangzhou (China)

- Guangyu Chemical Co Ltd (China)

- Shanxi Yangmei Fengxi Fertilizer Industry (Group) Co., Ltd (China)

- YNCC (South Korea)

Segments Covered in the Report

By Grade

- Food Grade

- Industrial Grade

- Agriculture Grade

- Metal Works Grade

By Application

- Agrochemical

- Medical/Pharmaceutical

- Food Additives

- Leather & Textiles

- Batteries

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/

- Intelligent Traffic Management System Market Size, Trends, Report 2034 - July 17, 2024

- Healthcare Finance Solutions Market Size to Grow USD 293.12 Bn by 2034 - July 17, 2024

- Epoxy Composites Market Size to Grow USD 84.99 Bn by 2034 - July 17, 2024