Key Points

- North America held the largest revenue share of 38% in 2023.

- Asia Pacific is observed to be the fastest-growing region in the market during the forecast period.

- Based on the component, the software segment has garnered 58% revenue share in 2023.

- Based on function, the training segment held the largest share of the market in 2023.

- By application, the non-industrial segment held the largest share of the market in 2023.

- By end user, the consumer electronics segment dominated the AI in computer vision market in 2023 with revenue share of around 37%.

- By end user, the automotive segment is projected to grow fastest in the forecast period.

Get a Sample: https://www.precedenceresearch.com/sample/3913

Growth Factors:

Several factors contribute to the rapid expansion of the AI in Computer Vision market. Firstly, the increasing demand for automation and efficiency across industries has spurred the adoption of computer vision solutions. Businesses seek to enhance productivity, reduce operational costs, and improve decision-making processes through the deployment of AI-powered vision systems. Additionally, the proliferation of digital imaging devices, such as cameras and sensors, has generated vast amounts of visual data, creating opportunities for AI algorithms to extract valuable insights. Moreover, advancements in deep learning techniques have revolutionized image recognition and object detection capabilities, enabling more accurate and reliable computer vision applications.

Region Insights:

The AI in Computer Vision market exhibits regional variations in terms of adoption, investment, and regulatory landscape. North America dominates the market, driven by the presence of major technology companies, robust research and development activities, and early adoption of AI technologies. The region benefits from a mature ecosystem comprising startups, academic institutions, and industry giants collaborating to innovate in computer vision. Meanwhile, Asia Pacific emerges as a key growth region, fueled by rapid industrialization, increasing investments in AI infrastructure, and rising demand for automation solutions. Countries like China, Japan, and South Korea are at the forefront of AI development, driving the expansion of the market in the region.

Trends:

Several trends shape the trajectory of the AI in Computer Vision market. One notable trend is the integration of computer vision with edge computing, enabling real-time analysis and decision-making at the point of data generation. Edge AI solutions leverage compact, energy-efficient hardware to process visual data locally, reducing latency and bandwidth requirements. Another trend is the convergence of computer vision with augmented reality (AR) and virtual reality (VR) technologies, creating immersive experiences and interactive applications. Furthermore, the emergence of explainable AI techniques addresses concerns regarding the transparency and interpretability of computer vision algorithms, facilitating trust and regulatory compliance.

AI in Computer Vision Market Scope

| Report Coverage | Details |

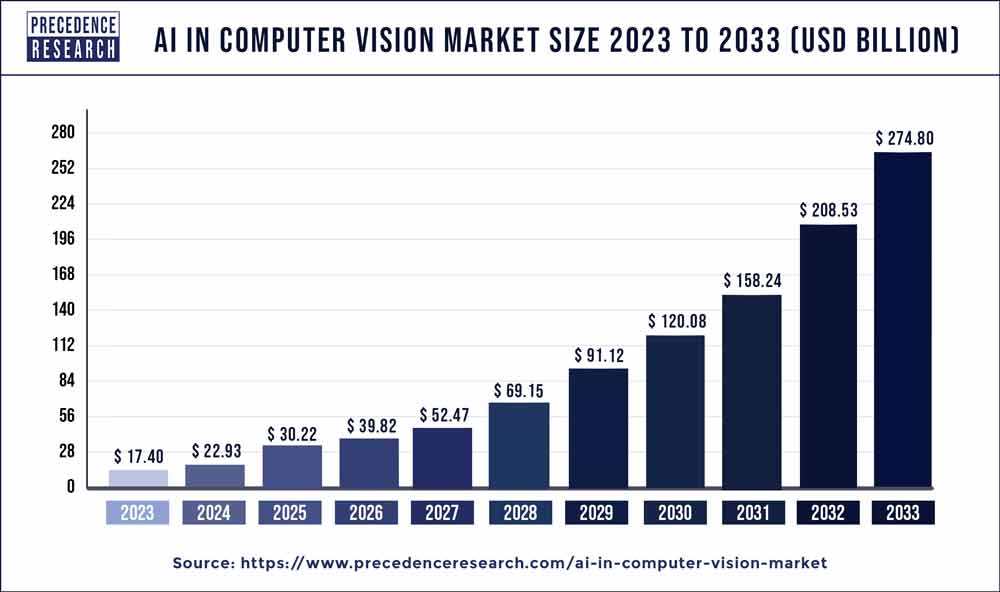

| Growth Rate from 2024 to 2033 | CAGR of 31.77% |

| Global Market Size in 2023 | USD 17.40 Billion |

| Global Market Size by 2033 | USD 274.80 Billion |

| U.S. Market Size in 2023 | USD 5.88 Billion |

| U.S. Market Size by 2033 | USD 92.94 Billion |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Component, By Application, By Function, and By End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

SWOT Analysis

Strengths:

- Advanced algorithms: AI-driven computer vision systems leverage sophisticated algorithms, enabling accurate and efficient visual recognition tasks.

- Diverse applications: Computer vision finds applications across diverse industries, including healthcare, automotive, retail, and surveillance, among others.

- Growing ecosystem: The market benefits from a growing ecosystem of startups, research institutions, and technology vendors collaborating to innovate and commercialize AI solutions.

Weaknesses:

- Data privacy concerns: The proliferation of visual data raises concerns regarding data privacy and security, necessitating robust measures to protect sensitive information.

- Integration challenges: Integrating computer vision solutions with existing infrastructure and workflows may pose challenges related to compatibility, scalability, and interoperability.

- Ethical considerations: The use of AI in computer vision raises ethical questions regarding bias, fairness, and accountability in decision-making processes, requiring careful regulation and oversight.

Opportunities:

- Market expansion: The increasing adoption of AI technologies and the proliferation of digital imaging devices create opportunities for market expansion across industries and regions.

- Innovation potential: Ongoing research and development efforts in AI algorithms, hardware optimization, and application domains drive innovation and unlock new possibilities in computer vision.

- Emerging use cases: The exploration of emerging use cases such as autonomous vehicles, smart cities, and precision agriculture presents untapped opportunities for AI in computer vision.

Threats:

- Regulatory challenges: Rapid advancements in AI technology outpace regulatory frameworks, leading to uncertainty and regulatory scrutiny regarding data privacy, algorithmic accountability, and safety standards.

- Competition: The AI in Computer Vision market is highly competitive, with numerous players vying for market share, leading to price pressures and margin erosion.

- Technological limitations: Despite advancements, computer vision systems still face challenges such as occlusion, lighting variations, and domain-specific adaptation, limiting their effectiveness in certain scenarios.

Read Also: Light Therapy Market Size to Worth USD 1.52 Billion by 2033

Recent Developments

- In March 2023, Red Cat Holdings, a military technology company that integrates robotic software and hardware, partnered with Athena Artificial Intelligence Pvt Ltd, a technology company specializing in AI and computer vision. The partnership aims to enhance the capabilities of Red Cat’s latest military drone, by integrating advanced AI and computer vision technologies developed by Athena AI.

- In August 2022, TachyHealth, Inc, a Dubai-based artificial intelligence solution provider for medical centers and hospitals, collaborated with Medical Refill, which provides remote medical consultation for their patients. The collaboration aims to provide technology solutions such as computer vision, artificial intelligence, and big data analytics to the clinical team.

- In July 2022, IDEMIA, a multinational technology company that offers facial recognition and other computer vision software & products to government and private companies, partnered with the U.S. Department of Homeland Security which takes care of public security in the U.S. The partnership is expected to improve U.S. Department of Homeland Security activities, such as identifying suspects during criminal investigations & travelers at the airports and streamlining security at the checkpoints after deploying facial recognition tools.

- In June 2022, Visionary.ai, a software provider of image signal processors (ISP), partnered with Innovize Technologies Ltd, a manufacturer of LIDAR sensors. The partnership aims to provide a combined service of ISP software and LiDAR sensors to improve the performance of 3D computer vision for various applications, including drones, robotics, and smart cities.

- In January 2022, Drishti Technologies, Inc., an AI-driven video traceability and video analytics provider, incorporated computer vision and deep learning to automate the analysis of manufacturing units with the videos.

Competitive Landscape:

The AI in Computer Vision market is characterized by intense competition, with key players competing on innovation, product differentiation, and market presence. Major companies such as Google LLC, Microsoft Corporation, and Amazon Web Services, Inc. dominate the market, leveraging their technological expertise and vast resources to develop cutting-edge computer vision solutions. These companies offer comprehensive AI platforms, tools, and services tailored to various industries and use cases. Additionally, a thriving ecosystem of startups and research institutions contributes to innovation and diversity in the market. Startups specializing in niche applications, algorithm development, or hardware optimization compete alongside established players, driving forward the evolution of AI in computer vision. Strategic partnerships, mergers, and acquisitions are common strategies adopted by market players to expand their capabilities, enter new markets, and gain a competitive edge.

AI in Computer Vision Market Companies

- Baummer

- Cognex Corporation

- Intel Corporation

- KEYENCE CORPORATION

- Matterport, Inc.

- NATIONAL INSTRUMENTS CORP

- Omron Corporation

- Sony Semiconductor Solutions Corporation

- Teledyne Technologies Incorporated

- Texas Instruments Incorporated

- Amazon Web Services, Inc.

- Alphabet, Inc.

- Microsoft Corporation

- Nvidia Corporation

- IBM Corporation

- Facebook, Inc.

- Qualcomm Technologies, Inc.

- Apple, Inc.

- Baidu, Inc.

Segments Covered in the Report

By Component

- Hardware

- Processor

- CPU

- GPU

- ASIC

- FPGA

- Memory

- Storage

- Processor

- Software

By Application

- Industrial

- Non-industrial

By Function

- Training

- Interference

By End-use

- Automotive

- Healthcare

- Retail

- Security And Surveillance

- Robotics And Machines

- Consumer Electronics

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

- Intelligent Traffic Management System Market Size, Trends, Report 2034 - July 17, 2024

- Healthcare Finance Solutions Market Size to Grow USD 293.12 Bn by 2034 - July 17, 2024

- Epoxy Composites Market Size to Grow USD 84.99 Bn by 2034 - July 17, 2024