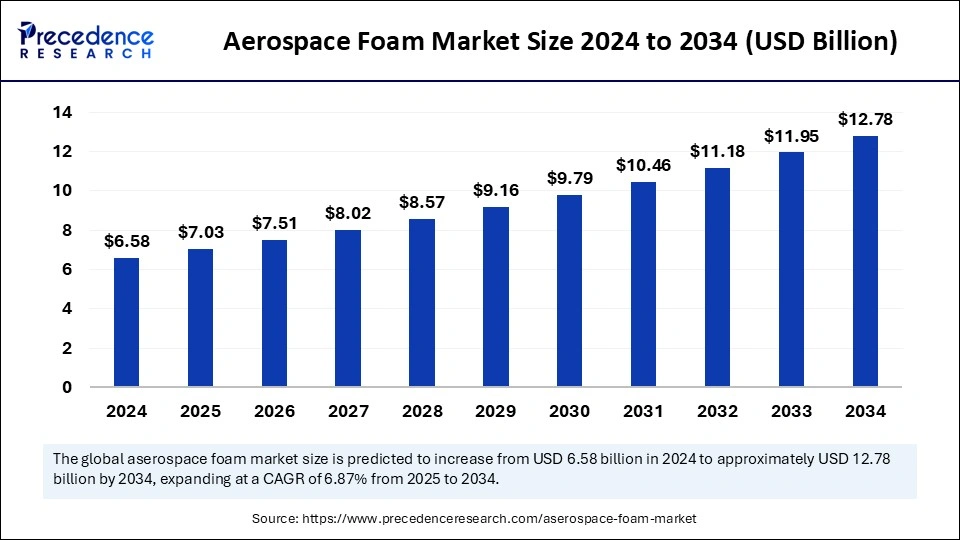

The aerospace foam market, estimated at USD 6.58 billion in 2024, is forecasted to expand to USD 12.78 billion by 2034, driven by a CAGR of 6.87%.

Aerospace Foam Market Key Points

-

North America captured 36% of the global aerospace foam market share in 2024.

-

The Asia Pacific region is anticipated to lead the market in terms of growth during the forecast period.

-

The polyurethane foam segment accounted for the largest market share in 2024.

-

The EPE foam segment is projected to experience notable growth over the forecast years.

-

The largest application segment in 2024 was carbon walls and ceilings.

-

Aircraft seats are expected to drive considerable growth in the application segment during the forecast period.

-

The commercial aviation segment led the end-use market share in 2024.

-

The military aircraft end-use segment is expected to grow at a strong CAGR over the next decade.

Impact of AI on the Aerospace Foam Market

AI is playing a crucial role in the aerospace foam market by enhancing both production and performance. With AI-driven automation and machine learning, manufacturers can optimize the design and production processes of aerospace foams. AI algorithms help identify the best material combinations, ensuring that foams have the right balance of strength, flexibility, and weight, which are essential for aircraft applications.

By analyzing large datasets, AI systems can predict the behavior of different foam materials under various conditions, such as temperature changes and mechanical stresses, contributing to the development of more durable and efficient materials.

Furthermore, AI is enabling predictive maintenance for foam-based products used in aerospace applications. By integrating AI with smart sensors, manufacturers can monitor the performance of foam components, like insulation and cushioning materials in aircraft, and predict when maintenance or replacements will be needed. This leads to reduced downtime and improved operational efficiency.

AI also assists in optimizing supply chains by forecasting demand for aerospace foams, ensuring that manufacturers can meet production schedules and reduce waste. As a result, AI is significantly improving product quality, reducing costs, and enhancing the overall efficiency of the aerospace foam market.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 12.78 Billion |

| Market Size in 2025 | USD 7.03 Billion |

| Market Size in 2024 | USD 6.58 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.87% |

| Dominated Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Application, End-Use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Market Drivers

Several factors are driving the growth of the aerospace foam market. The increasing air travel demand and the need for fuel-efficient aircraft are key drivers, as aerospace foams help reduce the weight of aircraft, leading to lower fuel consumption and carbon emissions. Additionally, the growing focus on improving passenger comfort, including better noise insulation and cushioning, is fostering demand for acoustic foams and advanced seating materials.

The continuous innovation in aircraft design, along with a push toward energy-efficient and environmentally sustainable solutions, also propels the market forward.

Opportunities

Opportunities in the aerospace foam market are abundant. The rise of electric and hybrid-electric aircraft, which demand lightweight materials for enhanced efficiency, presents new growth prospects. Additionally, as the industry focuses on sustainability, there is a rising demand for eco-friendly foams made from renewable sources or that can be easily recycled.

Manufacturers are also working on creating new foam types that offer enhanced fire resistance, durability, and insulation properties, opening up further avenues for market expansion.

Challenges

Despite its growth, the aerospace foam market faces challenges. The high cost of raw materials and the need to meet rigorous environmental and safety standards for foam products pose significant hurdles. The development of advanced foam materials is complex and expensive, and the market also grapples with the volatility of raw material prices.

Meeting these challenges while maintaining cost-effectiveness and safety remains a key concern for manufacturers.

Regional Insights

North America leads the global aerospace foam market, driven by major aerospace manufacturers and a strong military aviation sector, particularly in the United States. The continuous investment in aerospace innovation and the demand for advanced materials contribute to the region’s dominance.

The Asia Pacific region, led by China and India, is expected to witness the fastest growth due to rising infrastructure development, increasing air travel demand, and military aviation investments. Europe also holds a significant market share, with demand driven by commercial aviation and manufacturers focused on developing lightweight and fuel-efficient materials.

Recent Developments

- In September 2024, L&L Products released InsituCore foam materials, which serve as the basis for lightweight composite manufacturing processes. The InsituCore technology directs parts to generate their form by producing internal pressure when creating affordable and sustainable aerospace foam solutions.

- In March 2024, Boeing invested USD 110 million in the Espace Aéro Innovation Zone, which led to the creation of an Aerospace Development Centre. The company shows its commitment to aerospace materials technology advancement by investing strategically in aerospace foam together with other advanced aerospace components that improve aerospace performance.

- In March 2024, the collaboration between 3DEO and IHI Aerospace Co., Ltd. started to promote additive manufacturing (AM) technologies in the aerospace sector. Together, they enable IA to enhance its operational capability through the implementation of DfAM design processes.

Aerospace Foam Market Companies

- Boyd Corp.

- Evonik Industries AG

- ERG Aerospace Corp.

- SABIC

- BASF SE

- ZOTEFOAMS PLC

- General Plastics Manufacturing Company

- Solvay

- UFP Technologies, Inc.

- Recticel NV/SA

- NCFI Polyurethanes

- DuPont

- Rogers Corp.

- ARMACELL

Segments Covered in the Report

By Type

- Polyurethane foam

- Polyethylene foam

- Melamine foam

- Metal foam

- Polyimide foam

- Polyethylene terephthalate foam

- Polyvinyl chloride foam

- Specialty high-performance foam

By Application

- Flight deck pads

- Carbon walls and ceilings

- Aircraft seats

- Aircraft floor

- Others

By End-Use

- General aviation

- Commercial aviation

- Military aircraft

- Rotary aircraft

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

Also Read: Fabric Filter Market

Ready for more? Dive into the full experience on our website@ https://www.precedenceresearch.com/

- Freeze-dried food market expected to grow to USD 56.27 billion by 2034 - April 28, 2025

- Aerospace Foam Market Expected to Grow to USD 12.78 Billion by 2034 - April 28, 2025

- Football equipment Market Forecasted to Grow to USD 21.21 Billion by 2034 - April 28, 2025