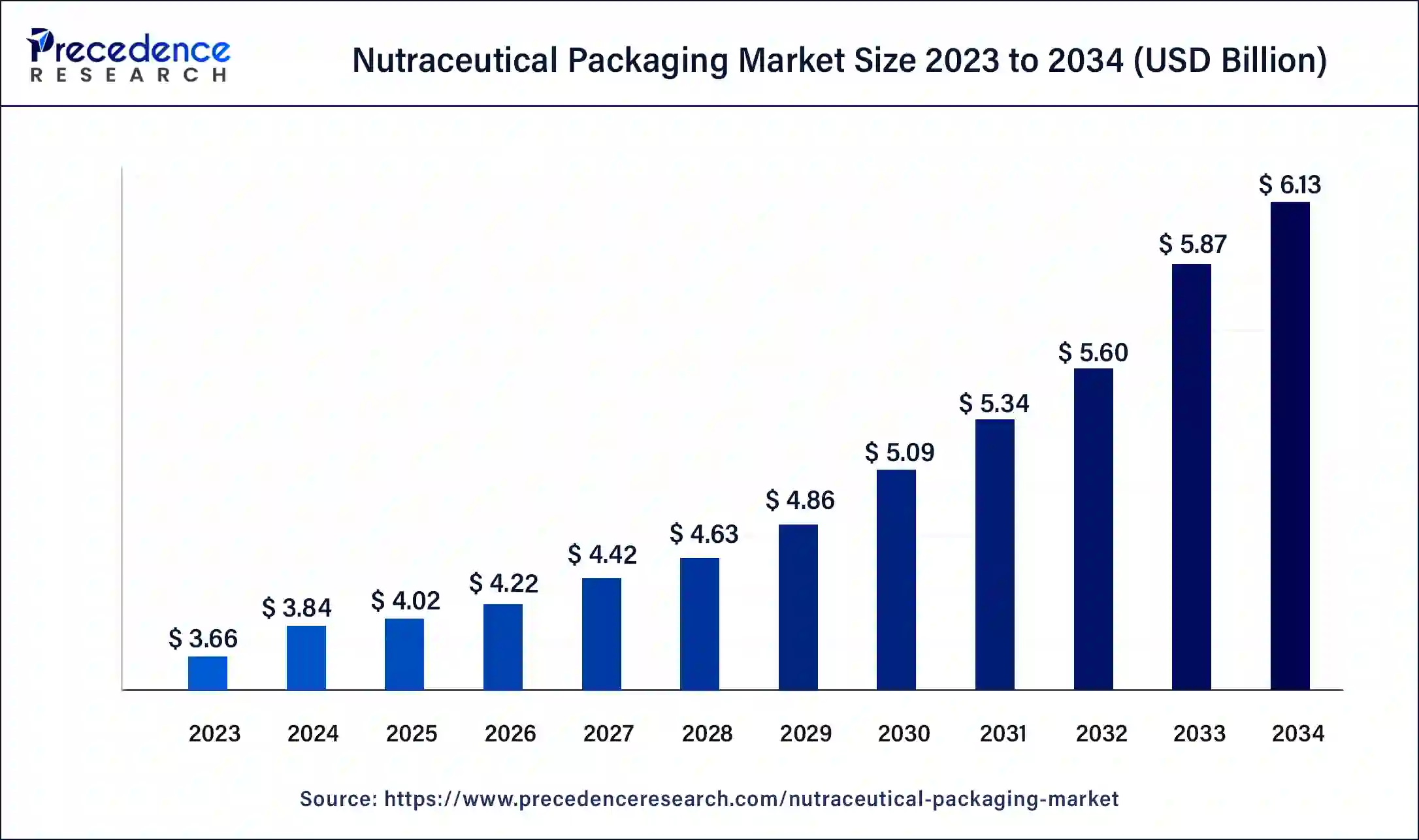

The global nutraceutical packaging market size was estimated at USD 3.66 billion in 2023, growing at a CAGR of 4.83% from 2024 to 2033.

The nutraceutical packaging market is experiencing robust growth driven by the increasing demand for functional foods and dietary supplements worldwide. Nutraceuticals encompass a broad spectrum of products including vitamins, minerals, herbal extracts, probiotics, and other bioactive compounds that offer health benefits beyond basic nutrition. The packaging of these products plays a crucial role in maintaining their efficacy, freshness, and safety, thereby driving the demand for innovative and sustainable packaging solutions. With the rising consumer awareness regarding health and wellness, coupled with lifestyle changes and aging populations, the nutraceutical packaging market is poised for significant expansion in the coming years.

Key Points

- North America dominated the market with the largest market share of 53% in 2023.

- Europe is expected to grow with the highest CAGR in the market during the forecast period.

- By packaging type, the bottles and jars segment has generated more than 36% of market share in 2023.

- By packaging type, the bags & pouches segment is expected to grow to the highest CAGR in the market during the forecast period.

- By Product, the dietary supplement segment has contributed more than 41% of market share in 2023.

- By Product, the functional foods segment is expected to grow to the highest CAGR in the market by product during the forecast period.

- By material, the glass segment is expected to grow to the highest CAGR in the market during the forecast period.

Growth Factors:

Several factors contribute to the growth of the nutraceutical packaging market. Firstly, the growing emphasis on preventive healthcare and wellness among consumers is driving the demand for nutraceutical products, thereby propelling the need for specialized packaging solutions. Additionally, technological advancements in packaging materials and manufacturing processes are enabling the development of innovative packaging formats such as blister packs, sachets, pouches, and bottles that enhance product shelf life and convenience for consumers. Moreover, stringent regulatory requirements regarding product safety and labeling are prompting manufacturers to invest in high-quality packaging materials and compliance measures, further fueling market growth.

Get a Sample:https://www.precedenceresearch.com/sample/4042

Region Insights:

The nutraceutical packaging market exhibits regional variations influenced by factors such as economic development, consumer preferences, regulatory frameworks, and market maturity. North America and Europe dominate the market due to the high adoption of nutraceutical products, particularly in the United States, Canada, Germany, and the United Kingdom. These regions have well-established healthcare infrastructures and stringent quality standards, driving the demand for premium packaging solutions. In Asia-Pacific, rapid urbanization, changing lifestyles, and increasing disposable incomes are driving the growth of the nutraceutical market, consequently boosting the demand for innovative packaging solutions. Emerging markets in Latin America and the Middle East & Africa are also witnessing growth opportunities fueled by rising health consciousness and expanding distribution channels.

Nutraceutical Packaging Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 4.83% |

| Global Market Size in 2023 | USD 3.66 Billion |

| Global Market Size by 2024 | USD 3.84 Billion |

| Global Market Size by 2033 | USD 5.86 Billion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Packaging Type, By Product, and By Material |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Nutraceutical Packaging Market Dynamics

Drivers:

Several drivers are propelling the growth of the nutraceutical packaging market. Firstly, the increasing prevalence of chronic diseases and lifestyle-related disorders such as obesity, diabetes, and cardiovascular diseases has spurred the demand for functional foods and dietary supplements, driving market growth. Additionally, the aging population worldwide is seeking nutritional supplements to address age-related health concerns, further fueling market demand. Moreover, the growing popularity of e-commerce platforms for purchasing nutraceutical products is driving the need for robust and protective packaging solutions to ensure product integrity during transit and storage. Furthermore, advancements in packaging technologies such as smart packaging, active packaging, and sustainable materials are driving innovation in the nutraceutical packaging market.

Opportunities:

The nutraceutical packaging market offers several opportunities for manufacturers and stakeholders. Firstly, there is immense potential for the development of sustainable packaging solutions to address environmental concerns and meet consumer preferences for eco-friendly packaging. Biodegradable materials, recyclable packaging, and compostable options are gaining traction in the market, presenting opportunities for companies to capitalize on sustainability initiatives. Moreover, the expansion of online retail channels and direct-to-consumer sales presents opportunities for packaging manufacturers to develop customized and user-friendly packaging formats tailored to e-commerce requirements. Additionally, the growing trend towards personalized nutrition and dietary supplements offers opportunities for packaging customization and product differentiation to cater to individual consumer needs and preferences.

Challenges:

Despite the favorable growth prospects, the nutraceutical packaging market faces certain challenges that need to be addressed. One of the primary challenges is the complex regulatory landscape governing nutraceutical products and packaging materials, which varies across regions and requires compliance with multiple standards and certifications. This can pose barriers to market entry and expansion for manufacturers, particularly in international markets. Moreover, the rapid pace of technological advancements in packaging materials and formats necessitates continuous investment in research and development to stay competitive and meet evolving consumer demands. Additionally, cost considerations and pricing pressures in the nutraceutical industry may constrain the adoption of premium packaging solutions, particularly in price-sensitive markets.

Read Also: Flywheel Energy Storage Market Size Will be USD 1.77 Bn by 2033

Recent Developments

- In February 2024, NBi FlexPack launched its flexible packaging manufacturer, producing custom solutions. Its products are made in the U.S. to allow for quick turnaround times for shipping in the U.S.

- In February 2024, Innovia Films, a leading material science pioneer that manufactures polyolefin film materials for labels and packaging, announced the extension of its product range for floatable polyolefin shrink films. The new film is a low-density white film made from polyolefin (WAPO) that maintains floatability when printed.

- In November 2023, SIG, a leading systems and solutions provider for aseptic packaging, announced the introduction of state-of-the-art filling machines for F&B leaders and startups in the India, Middle East, and Africa region.

- In September 2023, Amcor released the blog on ‘How Regulations and Needs Differentiate OTC and Dietary Supplement Packaging Selection Processes.’ This blog includes OTC packaging regulations and recommendations, drivers behind dietary supplement packaging, and compliant packaging solutions for dietary supplements and OTC drugs from Amcor.

Nutraceutical Packaging Market Companies

- Alpha Packaging

- Amcor Limited

- Gerresheimer AG

- Mondi Plc.

- RPC Group

- Graham Packaging Company

- Sonoco Products Company

- Constantia Flexible Group GmbH

- ALPLA Werke Alwin Lehner GmbH & Co KG

- Flex-pack

- Innovia Film

- Law Print & Packaging Management Ltd.

- American Nutritional Corporation

- Wasdell Packaging Group

- PontEurope

- Arizona Nutritional Supplements LLC

- Comar

- Medifilm AG

- Origin Pharma Packaging

- CSB Nutrition Corporation

- Nutra Solutions

Segments Covered in the Reports

By Packaging Type

- Bottles and Jars

- Bags and Pouches

- Cartons

- Stick Packs

- Blister Packs

- Other

By Product

- Dietary Supplements

- Functional Foods

- Herbal Products

- Isolated Nutrient Supplements

- Other

By Material

- Plastic

- Glass

- Metal

- Paper and paperboard

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/

- Intelligent Traffic Management System Market Size, Trends, Report 2034 - July 17, 2024

- Healthcare Finance Solutions Market Size to Grow USD 293.12 Bn by 2034 - July 17, 2024

- Epoxy Composites Market Size to Grow USD 84.99 Bn by 2034 - July 17, 2024