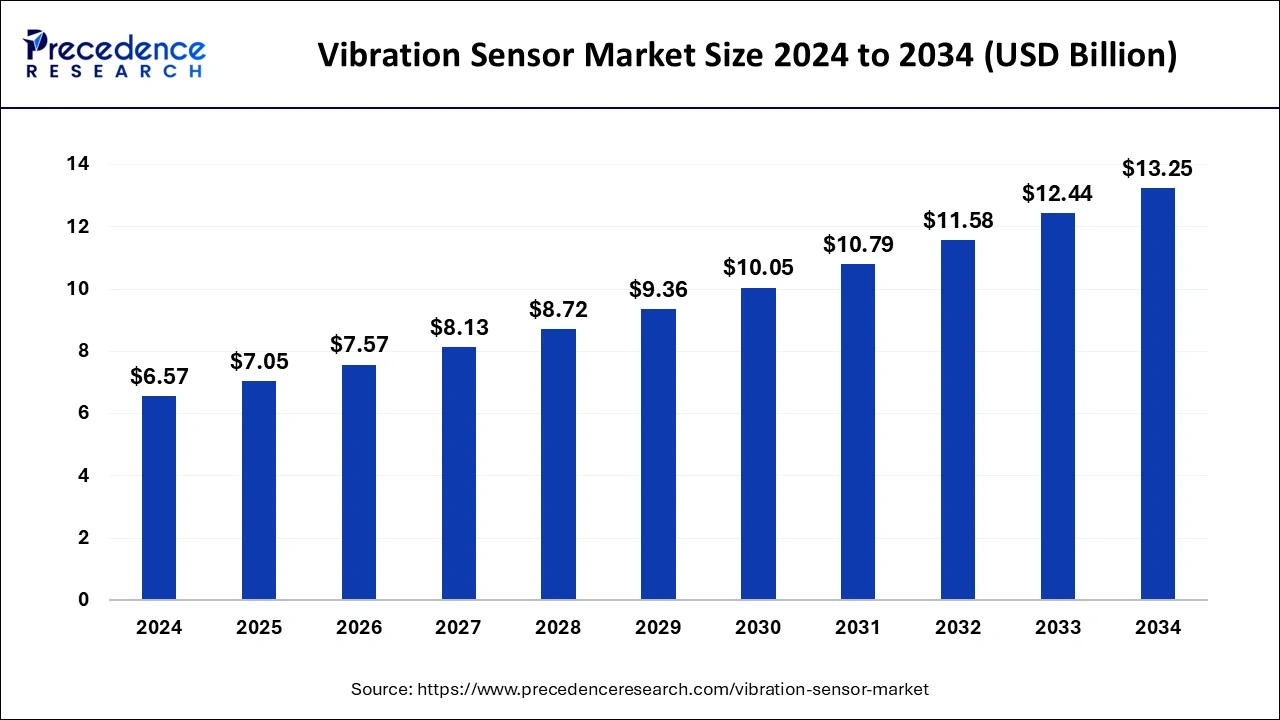

The global vibration sensor market size is anticipated to grow around USD 12.44 billion by 2033 from USD 6.12 billion in 2023, growing at a CAGR of 7.35% from 2024 to 2033.

The vibration sensor market is witnessing substantial growth driven by increasing demand across various industries such as automotive, aerospace, manufacturing, and healthcare. Vibration sensors, also known as accelerometers, are essential components in monitoring and detecting vibrations in machinery, equipment, and structures. They play a critical role in predictive maintenance, condition monitoring, and ensuring the safety and reliability of industrial processes. As industries embrace automation and digitalization, the need for accurate and reliable vibration sensing solutions continues to rise, propelling the growth of the global vibration sensor market.

Key Points

- North America dominated the market with the largest market share of 38% in 2023.

- Asia Pacific is expected to witness the fastest CAGR of 8.62% between 2024 and 2033

- By type, the accelerometers segment has captured more than 45% in 2023.

- By type, the displacement sensors segment is expected to expand at a CAGR of 8.4% between 2024 and 2033.

- By technology, the piezoresistive sensors segment has generated 25% of market share in 2023.

- By technology, the tri-axial sensors segment is projected to grow at the fastest CAGR of 8.92% between 2024 and 2033.

- By end-use, the automobile segment has held the significant market share of 28% in 2023.

- By material, the quartz-based sensors segment has recorded more than 44% of the market share in 2023.

Growth Factors:

Several factors contribute to the growth of the vibration sensor market. Firstly, the rising adoption of predictive maintenance practices by industries to minimize downtime and optimize asset performance is driving the demand for vibration sensors. These sensors enable early detection of equipment faults, mechanical failures, and abnormal vibrations, allowing maintenance teams to take proactive measures to prevent costly breakdowns and unplanned downtime.

Moreover, stringent regulations and safety standards imposed by regulatory authorities to ensure worker safety and environmental protection are driving the implementation of vibration monitoring systems in industrial settings. Vibration sensors play a crucial role in monitoring equipment health, detecting potential hazards, and preventing accidents in hazardous work environments.

Additionally, advancements in sensor technologies, such as microelectromechanical systems (MEMS) and wireless sensor networks, have expanded the capabilities and applications of vibration sensors. MEMS-based vibration sensors offer compact size, low power consumption, and high sensitivity, making them ideal for integration into portable devices, wearable gadgets, and Internet of Things (IoT) devices.

Furthermore, the increasing integration of vibration sensors into smart machines, industrial robots, and automation systems is fueling market growth. These sensors provide real-time feedback on equipment performance, enabling intelligent decision-making, process optimization, and predictive analytics in smart manufacturing environments.

Moreover, the growing demand for vibration sensors in automotive applications, including vehicle health monitoring, engine diagnostics, and structural health monitoring, is driving market growth. With the rise of electric vehicles (EVs) and autonomous vehicles (AVs), there is a growing need for vibration sensors to ensure the safety, reliability, and performance of automotive systems.

Get a Sample: https://www.precedenceresearch.com/sample/3969

Region Insights:

The vibration sensor market is geographically diverse, with significant growth observed across regions. In North America, the presence of key players, technological advancements, and the widespread adoption of industrial automation drive market growth. The region’s strong focus on innovation and investments in research and development contribute to the development of advanced vibration sensing solutions for various industries.

In Europe, stringent regulations regarding worker safety and environmental protection drive the demand for vibration monitoring systems in industrial sectors such as manufacturing, automotive, and aerospace. Additionally, the region’s emphasis on sustainability and energy efficiency fosters the adoption of predictive maintenance practices, further driving market growth.

Asia Pacific is a key growth market for vibration sensors, fueled by rapid industrialization, urbanization, and infrastructure development in countries such as China, India, and Japan. The region’s expanding manufacturing sector, growing automotive industry, and increasing investments in smart infrastructure drive the demand for vibration sensing solutions for condition monitoring and predictive maintenance.

Latin America and the Middle East & Africa regions are also witnessing growth in the vibration sensor market, driven by infrastructure development projects, investments in industrial automation, and the expansion of key industries such as oil & gas, mining, and construction. These regions offer untapped opportunities for vibration sensor manufacturers seeking to expand their presence in emerging markets.

Vibration Sensor Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 7.35% |

| Global Market Size in 2023 | USD 6.12 Billion |

| Global Market Size by 2033 | USD 12.44 Billion |

| U.S. Market Size in 2023 | USD 1.74 Billion |

| U.S. Market Size by 2033 | USD 3.55 Billion |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Type, By Technology, By End-use, and By Material |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Vibration Sensor Market Dynamics

Drivers:

Several drivers propel the growth of the vibration sensor market. Firstly, the increasing emphasis on equipment reliability, operational efficiency, and safety in industrial environments drives the adoption of vibration monitoring solutions. Industries such as manufacturing, oil & gas, and power generation rely on vibration sensors to detect equipment faults, prevent catastrophic failures, and optimize asset performance.

Moreover, the growing trend towards predictive maintenance strategies, enabled by advancements in sensor technologies and data analytics, is a significant driver of market growth. Vibration sensors provide real-time insights into equipment health, enabling maintenance teams to schedule repairs proactively, reduce downtime, and extend the lifespan of critical assets.

Additionally, the rise of industrial automation and smart manufacturing initiatives drives the integration of vibration sensors into machinery, equipment, and production lines. These sensors enable real-time monitoring, feedback control, and condition-based maintenance, enhancing process efficiency, productivity, and quality in manufacturing operations.

Furthermore, the increasing adoption of vibration sensors in automotive applications, such as vehicle health monitoring, engine diagnostics, and active safety systems, is driving market growth. As vehicles become more complex and technologically advanced, there is a growing demand for sensors capable of detecting and analyzing vibrations to ensure vehicle performance, comfort, and safety.

Moreover, the proliferation of IoT-enabled devices and smart sensors in various industries creates opportunities for vibration sensor manufacturers to develop innovative solutions for remote monitoring, predictive analytics, and asset management. By leveraging IoT connectivity and cloud-based platforms, vibration sensors can deliver actionable insights and predictive maintenance capabilities to end-users, further driving market growth.

Opportunities:

The vibration sensor market offers numerous opportunities for stakeholders across industries. Firstly, there is a growing demand for wireless vibration sensors capable of remote monitoring, data transmission, and integration with IoT platforms. These sensors enable real-time condition monitoring, predictive maintenance, and asset management, offering convenience, flexibility, and cost savings to end-users.

Moreover, the adoption of Industry 4.0 technologies, such as big data analytics, artificial intelligence, and machine learning, presents opportunities for vibration sensor manufacturers to develop advanced predictive maintenance solutions. By analyzing vast amounts of sensor data, predictive analytics algorithms can identify equipment failures, predict maintenance needs, and optimize maintenance schedules, maximizing equipment uptime and reliability.

Additionally, there is a growing need for vibration sensors in emerging applications such as structural health monitoring, smart infrastructure, and wearable devices. Vibration sensors play a crucial role in detecting structural defects, monitoring building integrity, and ensuring the safety and resilience of critical infrastructure assets such as bridges, dams, and pipelines.

Furthermore, the expansion of the automotive industry, particularly the electric vehicle (EV) and autonomous vehicle (AV) segments, presents opportunities for vibration sensor manufacturers to supply sensors for vehicle health monitoring, predictive maintenance, and autonomous driving systems. As EVs and AVs become more prevalent, there is a growing demand for sensors capable of monitoring vehicle dynamics, detecting anomalies, and ensuring passenger safety.

Moreover, the increasing focus on environmental sustainability and energy efficiency drives the demand for vibration sensors in renewable energy applications such as wind turbines, solar panels, and hydroelectric power plants. These sensors enable condition monitoring, fault detection, and performance optimization, maximizing energy production and minimizing downtime in renewable energy systems.

Challenges:

Despite the growth opportunities, the vibration sensor market faces several challenges. Firstly, interoperability issues and compatibility concerns arise due to the diverse range of sensor technologies, communication protocols, and data formats used in industrial environments. Standardization efforts and collaboration among stakeholders are needed to ensure seamless integration and interoperability of vibration sensors with existing systems and platforms.

Moreover, data privacy and cybersecurity threats pose risks to sensitive information collected by vibration sensors, particularly in IoT-enabled applications. Ensuring data security, encryption, and access control measures are essential to protect against unauthorized access, data breaches, and cyber-attacks on connected devices and networks.

Additionally, the complexity of predictive maintenance implementation, including data collection, analysis, and decision-making processes, can be a barrier to adoption for some organizations. Effective predictive maintenance requires expertise in sensor deployment, data analytics, and maintenance strategies, as well as investments in training, infrastructure, and software tools.

Read Also: Cardiac Rhythm Management Devices Market Size, Report by 2033

Recent Developments

- In January 2023, HARMAN International unveiled its sound and vibration sensor and external microphone products, designed to enhance the auditory experience in and around vehicles for various applications, including identifying emergency vehicle sirens and detecting glass breakage or collisions.

- In March 2022, SAMSUNG released the Galaxy A53 5G smartphone, which features an octa-core processor, a 120 Hz refresh rate display, and a sharp resolution of 1080 x 2400 pixels.

- In May 2022, Sensoteq announced the Kappa X Wireless Vibration Sensor. This compact sensor has a replaceable battery and can detect faults, making it suitable for various industrial applications.

Vibration Sensor Market Companies

- Dytran Instruments, Inc.

- PCB Piezotronics, Inc. (IMI Sensors division)

- Hansford Sensors Ltd.

- TE Connectivity Ltd. (formerly Measurement Specialties, Inc.)

- Honeywell International Inc.

- Robert Bosch GmbH

- National Instruments Corporation

- Analog Devices, Inc.

- Meggitt PLC

Segment Covered in the Report

By Type

- Accelerometers

- Velocity Sensors

- Displacement Sensors

By Technology

- Piezoresistive Sensors

- Tri-Axial Sensors

By End-use

- Automotive Sector

- Aerospace And Defense

- Consumer Electronics

By Material

- Quartz-based Sensors

- Doped Silicon Sensors

- Piezoelectric Ceramics

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/

- Intelligent Traffic Management System Market Size, Trends, Report 2034 - July 17, 2024

- Healthcare Finance Solutions Market Size to Grow USD 293.12 Bn by 2034 - July 17, 2024

- Epoxy Composites Market Size to Grow USD 84.99 Bn by 2034 - July 17, 2024